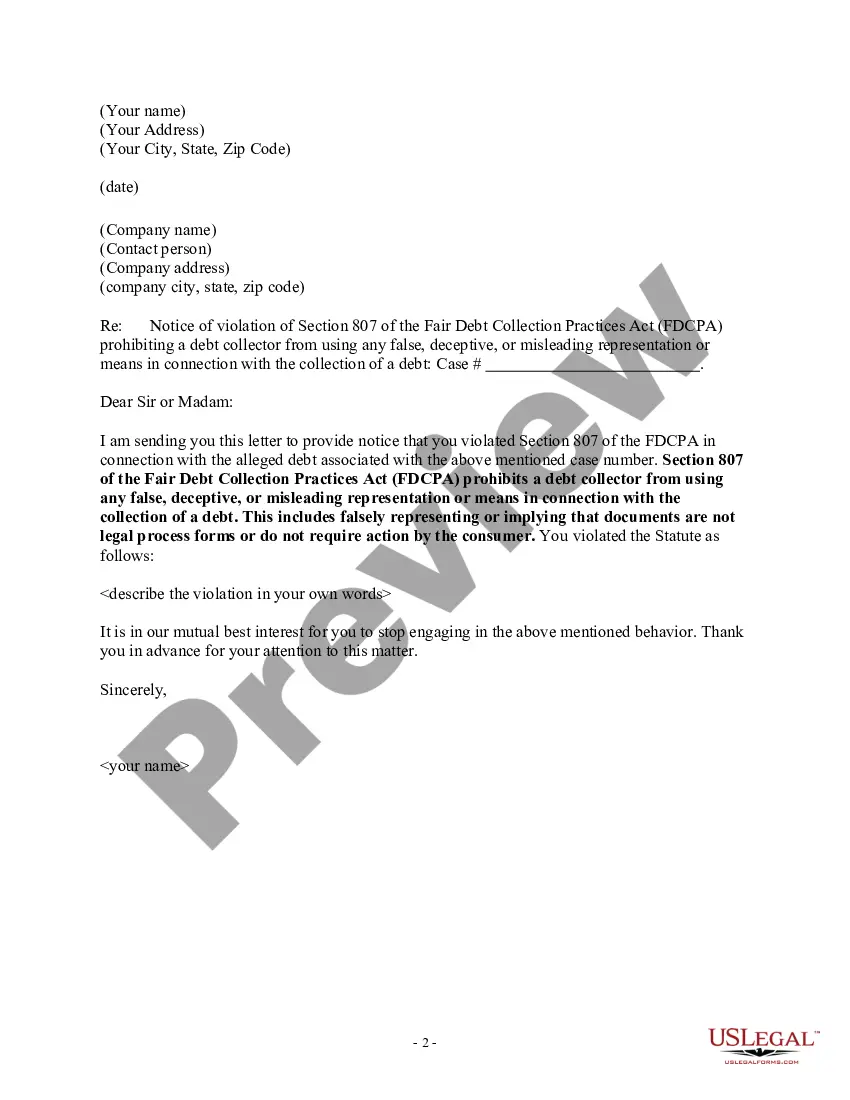

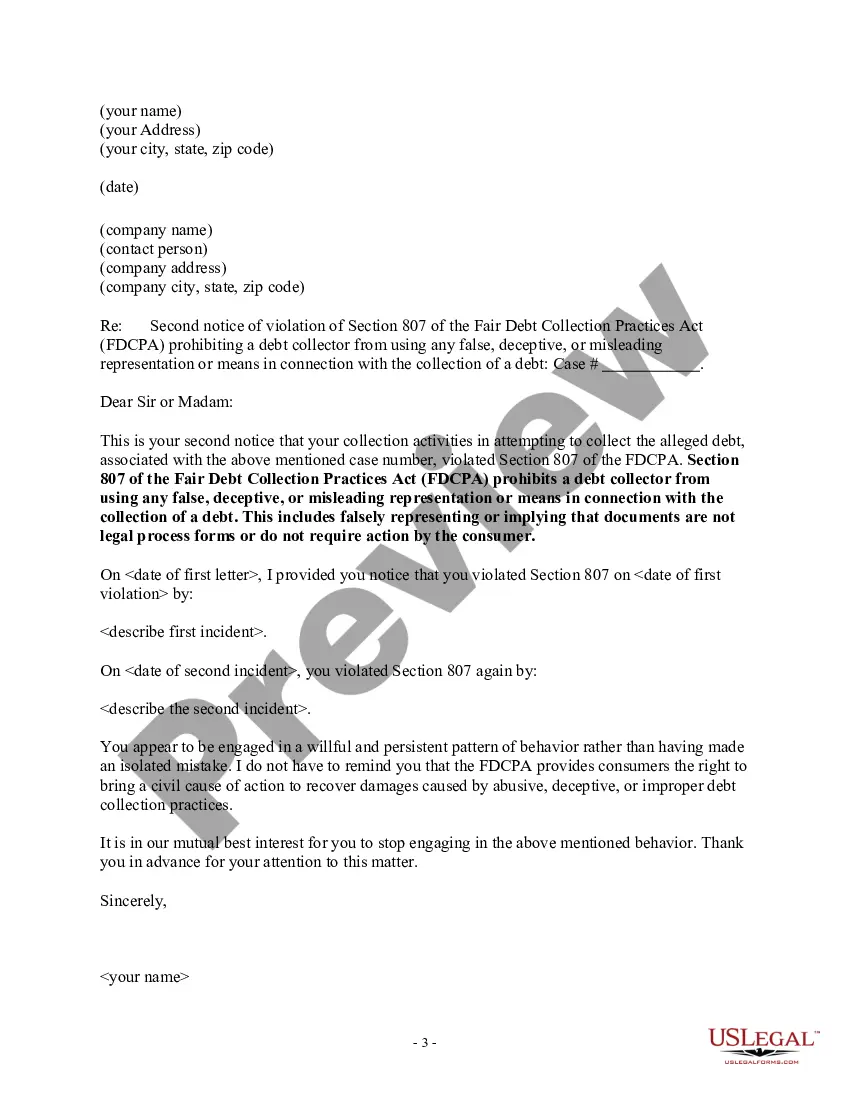

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Michigan Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

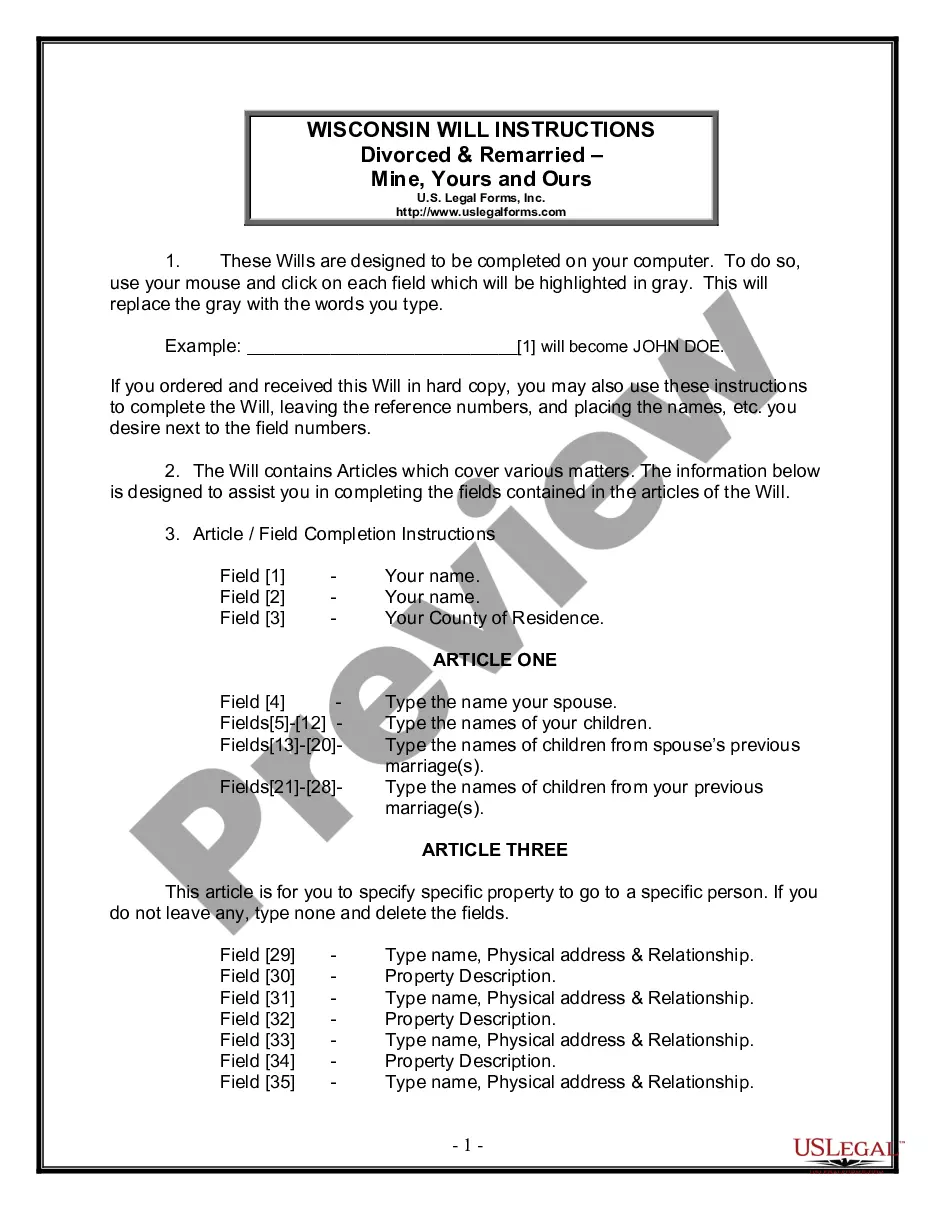

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

It is feasible to spend hours online searching for the legal document template that meets your federal and state requirements.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can easily download or print the Michigan Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action from their service.

If you want to find another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Michigan Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your preference.

- Examine the form summary to confirm you have chosen the appropriate template.

Form popularity

FAQ

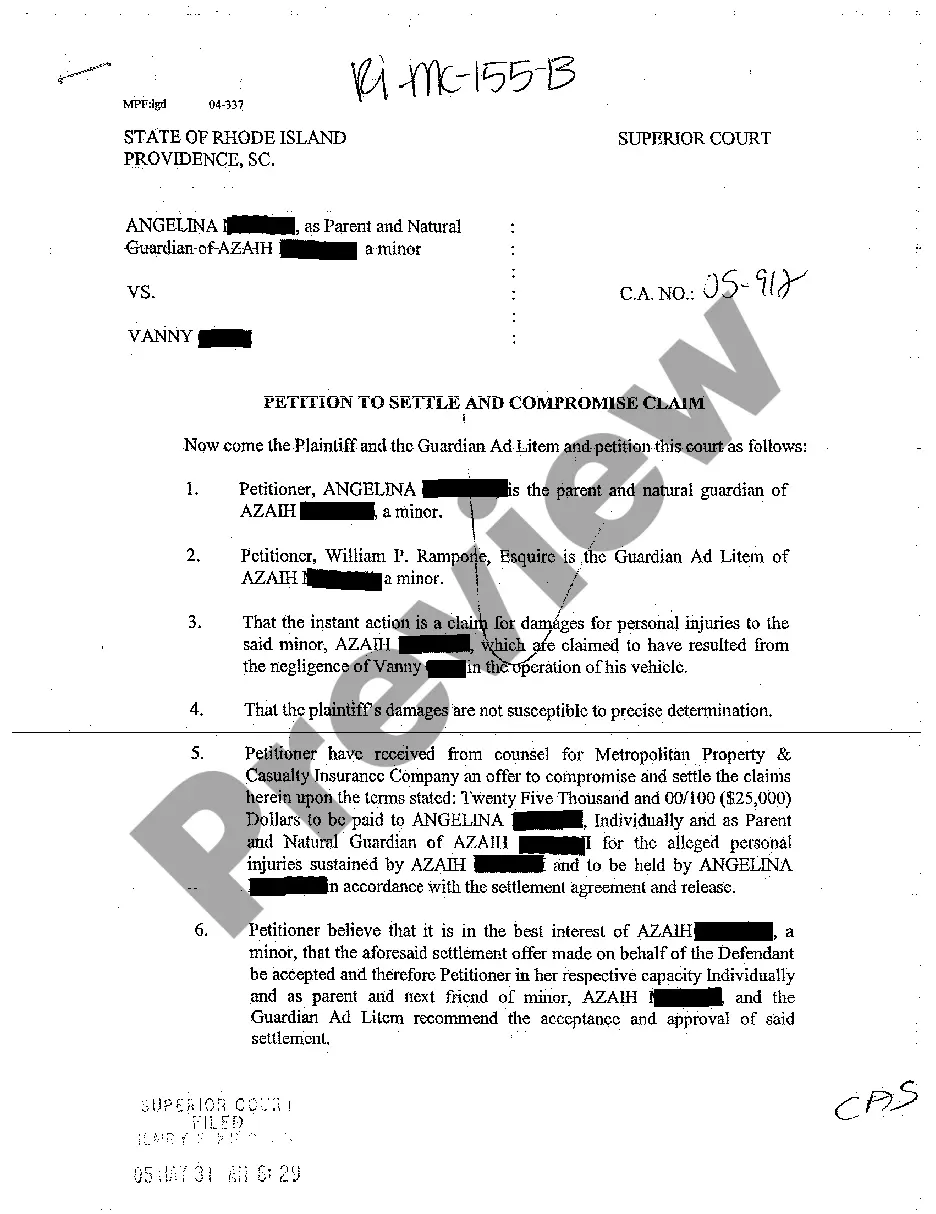

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

Banned debt collection practices making threats - this includes exposing or threatening to expose you or a family member to ridicule or acts of intimidation. deception - for example, impersonating a government employee or agent, or using a document that looks like an official document but is not.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

A solid debt collection strategy helps you stabilize your cash flow and receive money from your clients without irritating them. Debt collection strategies include reviewing your invoicing and billing processes, hiring accountants, and understanding your clients' payment processes.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).