Michigan Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

US Legal Forms - one of the biggest libraries of legitimate varieties in the USA - gives an array of legitimate document layouts you can acquire or printing. Making use of the site, you can find thousands of varieties for enterprise and person purposes, categorized by types, states, or key phrases.You will discover the newest models of varieties much like the Michigan Deferred Compensation Investment Account Plan within minutes.

If you have a registration, log in and acquire Michigan Deferred Compensation Investment Account Plan from your US Legal Forms collection. The Download switch will show up on every kind you perspective. You get access to all earlier downloaded varieties within the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, allow me to share basic directions to get you started:

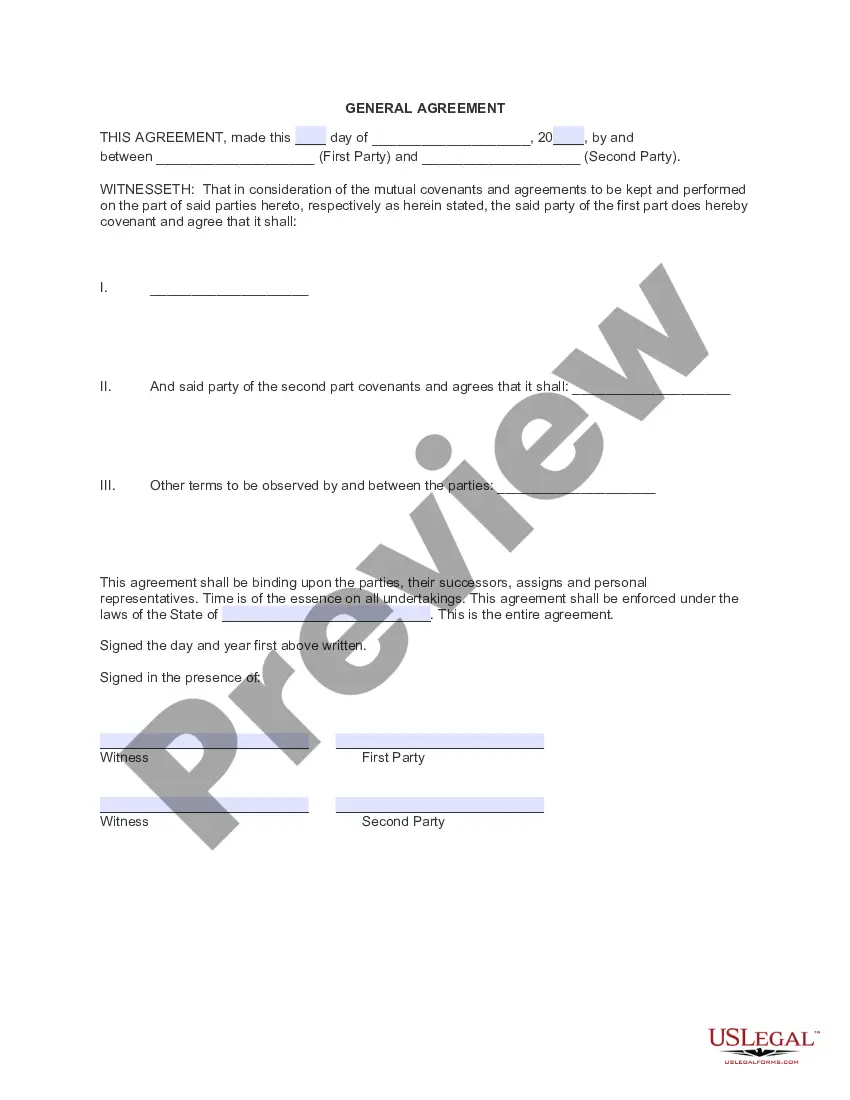

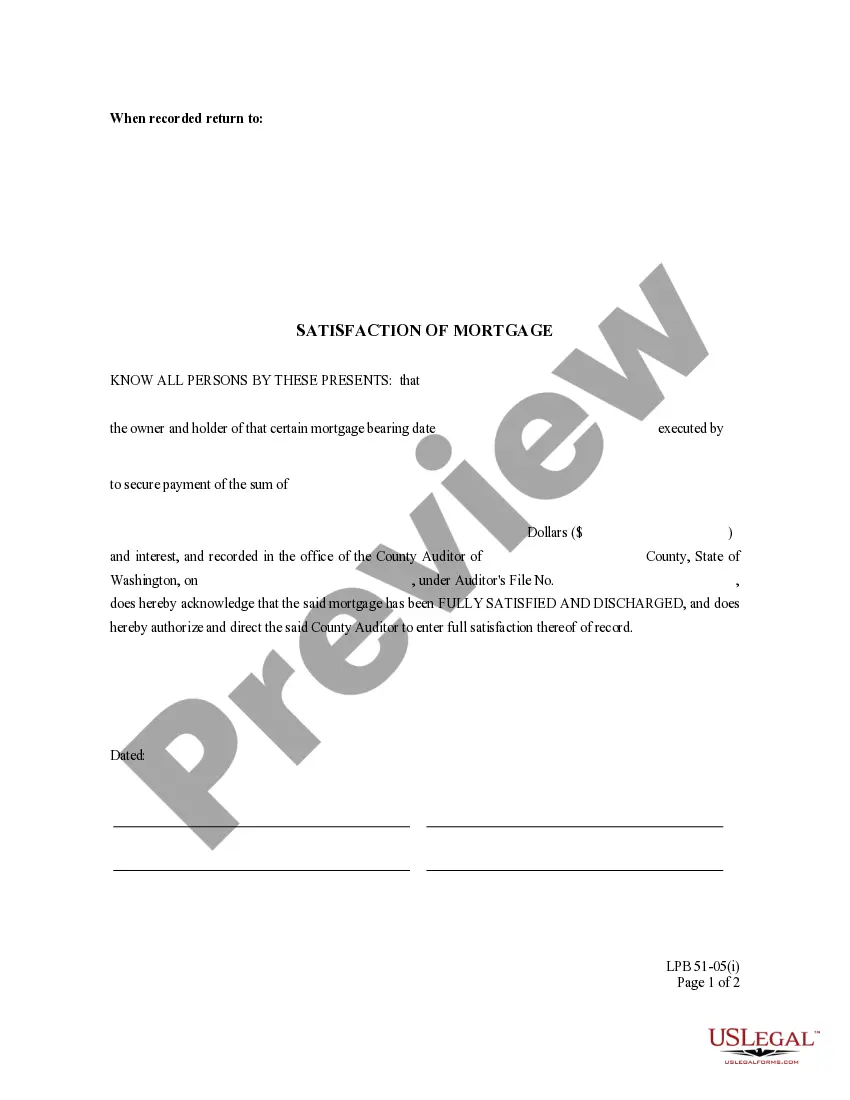

- Make sure you have picked out the proper kind for your town/state. Click the Review switch to examine the form`s articles. Browse the kind explanation to ensure that you have chosen the proper kind.

- If the kind doesn`t fit your requirements, make use of the Lookup discipline at the top of the screen to discover the one which does.

- If you are satisfied with the shape, confirm your option by visiting the Buy now switch. Then, choose the rates prepare you want and supply your references to register to have an profile.

- Procedure the financial transaction. Utilize your bank card or PayPal profile to finish the financial transaction.

- Choose the file format and acquire the shape in your device.

- Make modifications. Complete, revise and printing and indicator the downloaded Michigan Deferred Compensation Investment Account Plan.

Every template you included with your account does not have an expiration time which is your own property for a long time. So, if you want to acquire or printing an additional copy, just go to the My Forms area and click on about the kind you need.

Get access to the Michigan Deferred Compensation Investment Account Plan with US Legal Forms, probably the most comprehensive collection of legitimate document layouts. Use thousands of expert and state-distinct layouts that satisfy your organization or person needs and requirements.

Form popularity

FAQ

The two plans are also different in that 401(k) plans do not offer a three-year Pre-Retirement Catch-Up; and 457(b) plans do. Another difference is that a 401(k) distribution prior to age 59½ may be subject to a 10% early withdrawal penalty and 457(b) plans generally do not have the same early withdrawal penalty.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

457(b) plans are generally available for state and local government employees, as well as certain tax-exempt nonprofits. These plans are very similar to other types of employer-offered retirement accounts. Employees can make contributions up to the annual limit, invest these funds, and grow their retirement nest egg.

The money in a 457(b) grows, tax-deferred over time. When the participant retires and starts to take distributions from their account, those distributions come with regular income taxes. A 457(b) is an example of a defined contribution plan.

Like the better-known 401(k) plan in the private sector, the 457 plan allows employees to deposit a portion of their pre-tax earnings in an account, reducing their income taxes for the year while postponing the taxes due until the money is withdrawn after they retire.

As mentioned above, contributions to 457(b) plans are discretionary: Employees, and sometimes employers, make contributions to a 457(b) plan as they choose and can vary their contribution amounts. With a 401(a) plan, the employer can make contributions, and may require employees to contribute to the plan as well.

The Deferred Compensation Option is an opportunity for your employees to supplement the pension and healthcare benefits they're already earning.