Michigan Eligible Directors' Stock Option Plan of Wyle Electronics

Description

How to fill out Eligible Directors' Stock Option Plan Of Wyle Electronics?

US Legal Forms - one of several biggest libraries of legal varieties in the USA - offers an array of legal document layouts you are able to acquire or produce. Utilizing the internet site, you may get thousands of varieties for business and specific reasons, sorted by types, states, or search phrases.You will discover the latest models of varieties such as the Michigan Eligible Directors' Stock Option Plan of Wyle Electronics within minutes.

If you already have a monthly subscription, log in and acquire Michigan Eligible Directors' Stock Option Plan of Wyle Electronics from your US Legal Forms collection. The Download key will appear on each and every develop you see. You gain access to all in the past delivered electronically varieties within the My Forms tab of your respective accounts.

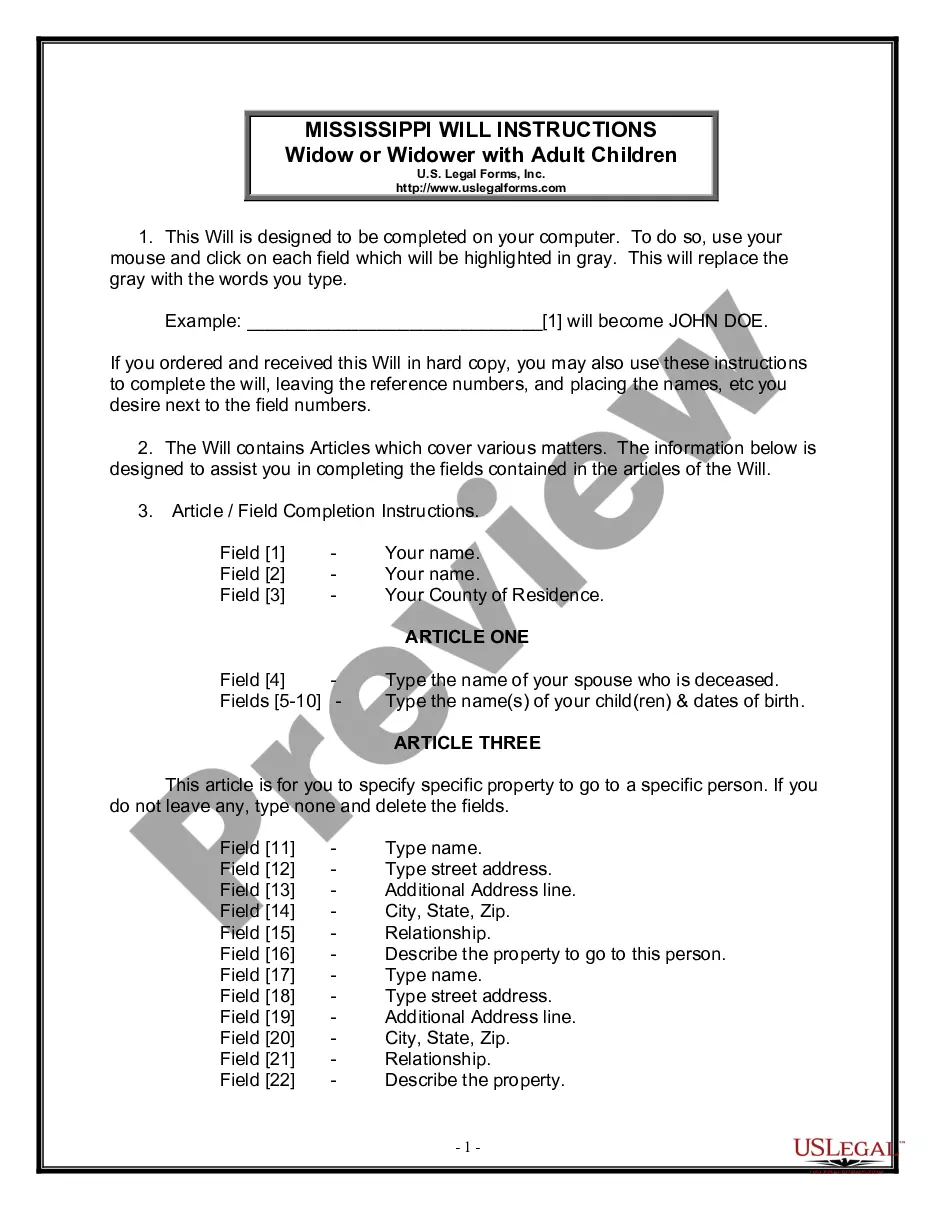

If you would like use US Legal Forms for the first time, listed here are basic directions to get you started off:

- Ensure you have chosen the best develop for your area/county. Select the Review key to examine the form`s information. Look at the develop description to ensure that you have selected the correct develop.

- In the event the develop does not match your specifications, make use of the Lookup field towards the top of the screen to find the the one that does.

- In case you are satisfied with the form, verify your decision by clicking the Buy now key. Then, pick the prices strategy you like and provide your references to sign up for the accounts.

- Process the purchase. Use your charge card or PayPal accounts to perform the purchase.

- Select the formatting and acquire the form on the gadget.

- Make modifications. Complete, change and produce and indicator the delivered electronically Michigan Eligible Directors' Stock Option Plan of Wyle Electronics.

Every template you added to your money lacks an expiration particular date which is the one you have permanently. So, if you want to acquire or produce one more version, just check out the My Forms portion and click in the develop you need.

Get access to the Michigan Eligible Directors' Stock Option Plan of Wyle Electronics with US Legal Forms, the most extensive collection of legal document layouts. Use thousands of skilled and state-specific layouts that meet up with your small business or specific requirements and specifications.