Michigan Ratification of Sale of Stock

Description

How to fill out Ratification Of Sale Of Stock?

Are you presently within a place where you need paperwork for sometimes company or person uses almost every working day? There are tons of legitimate record layouts accessible on the Internet, but getting kinds you can depend on isn`t effortless. US Legal Forms gives a large number of develop layouts, much like the Michigan Ratification of Sale of Stock, that happen to be published to fulfill state and federal specifications.

Should you be presently acquainted with US Legal Forms internet site and have an account, simply log in. Afterward, you are able to down load the Michigan Ratification of Sale of Stock design.

If you do not provide an accounts and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is for that correct city/county.

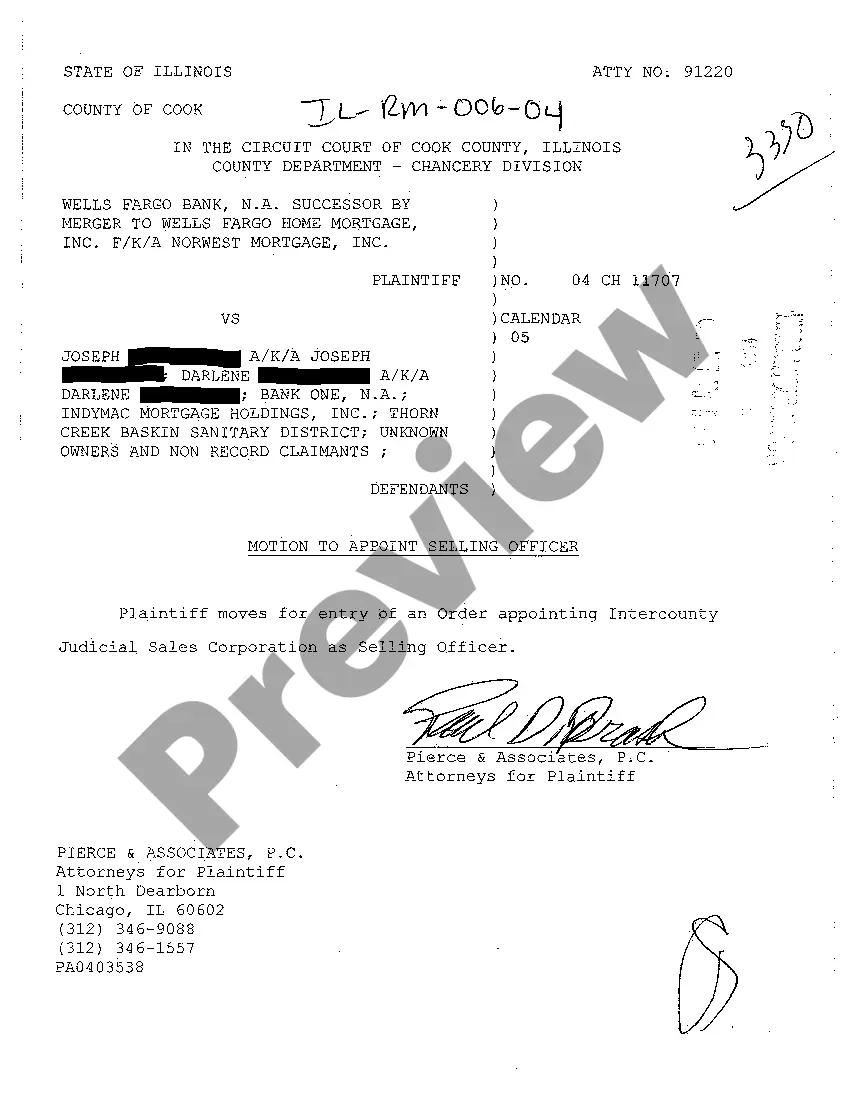

- Make use of the Preview key to analyze the shape.

- Look at the outline to actually have chosen the appropriate develop.

- In the event the develop isn`t what you are searching for, utilize the Look for field to get the develop that suits you and specifications.

- If you get the correct develop, click on Purchase now.

- Pick the pricing program you would like, complete the specified details to create your account, and purchase the order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file format and down load your backup.

Discover all the record layouts you might have bought in the My Forms menus. You can get a extra backup of Michigan Ratification of Sale of Stock anytime, if necessary. Just click the needed develop to down load or produce the record design.

Use US Legal Forms, one of the most extensive collection of legitimate forms, in order to save efforts and steer clear of mistakes. The service gives expertly made legitimate record layouts that you can use for a variety of uses. Produce an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Right to Redeem After a Judicial Foreclosure Under California Law. If the foreclosure is judicial, you may generally redeem the home within: three months after the foreclosure sale, if the proceeds from the sale satisfy the indebtedness, or. one year if the sale resulted in a deficiency.

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

Under the new Michigan Foreclosure laws, lenders are forced to pursue a Judicial Foreclosure if they fail to execute a loan modification for an eligible borrower during the 90 day pre-foreclosure period.

Redemption Period ? starts day of Sheriff Sale -Six (6) months is most common. -If the amount claimed to be due on the mortgage at the date of foreclosure is less than 2/3 of the original indebtedness, the redemption period is 12 months. -Farming property can be up to twelve (12) months.

MCL 600.3201. A power of sale provision gives the lender the power to sell the property when the borrower defaults. There must be a default under the terms of the mortgage that triggers the ?power of sale? clause.

Notice of foreclosure recorded at local courthouse. Sheriff's sale date is scheduled, and then published in the county newspaper for four (4) consecutive weeks ? including details of the debt. Notice of the sale date gets posted on the property within two (2) weeks of the first publication.

446.58 Cappers, boosters, shillers or false bids prohibited. At any such sale by auction, no person shall act as "bidder," or what is commonly known as a "capper,""booster" or "shiller," or offer or make any false bid, or offer any false bid or pretend to buy any article sold or offered for sale at any sale by auction.

The longer the bank has held the property, the greater the odds that it will seriously consider low offers. You could make an initial bid at a price that's at least 20% below the current market price, or even more if the property is located in an area with a high incidence of foreclosures.