Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

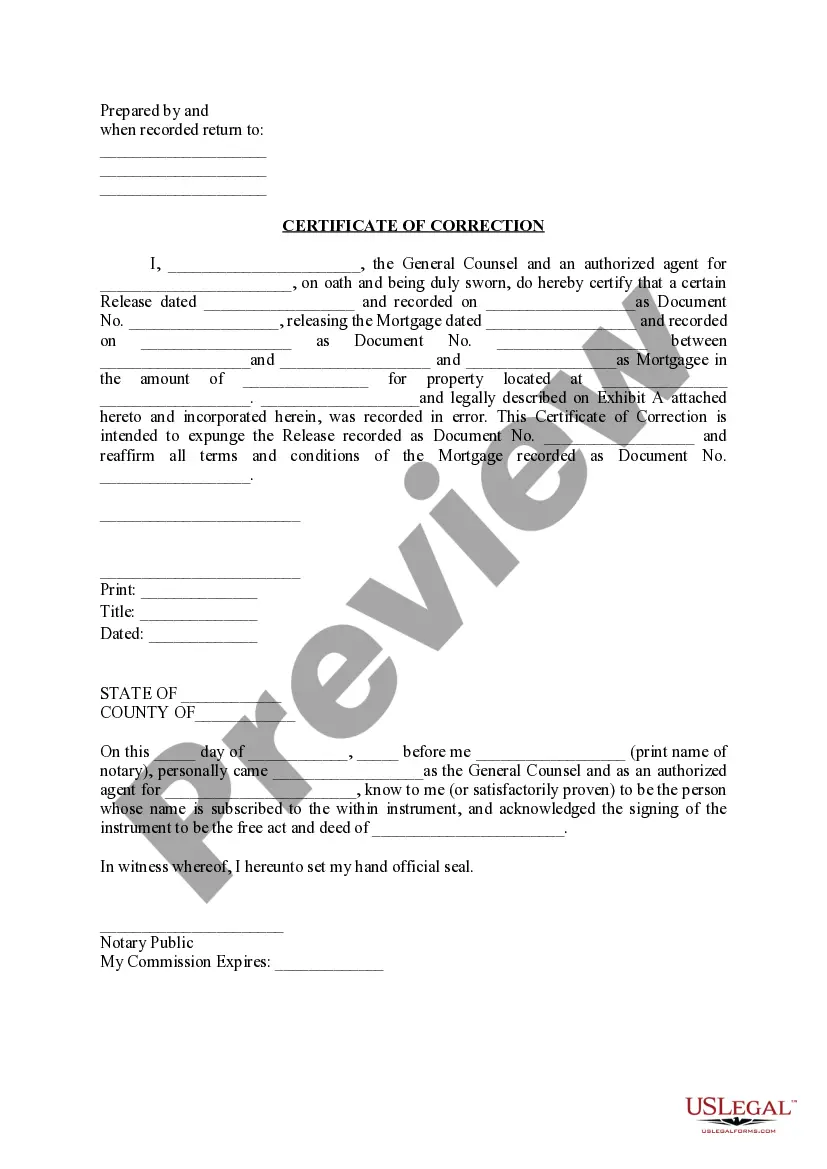

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the most recent versions of forms like the Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors in just moments.

If the form does not satisfy your requirements, use the Search field at the top of the screen to find one that does.

Once satisfied with the form, confirm your choice by clicking the Purchase now button.

- If you have a monthly subscription, Log In and retrieve the Michigan Acknowledgment Form for Consultants or Self-Employed Independent Contractors from the US Legal Forms collection.

- The Download button will be visible on every form you view.

- You can access all previously saved forms from the My documents section of your account.

- If you are a new user of US Legal Forms, here are some basic steps to help you begin.

- Verify you have selected the correct form for your area.

- Click the Review button to examine the contents of the form.

Form popularity

FAQ

How to become an independent consultantCommit to your specialty.Pursue education or training.Gain relevant experience.Find clients.Create a website and increase social media presence.Ask for recommendations.Be patient.Meet new people.More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent consultant is a unique option for those looking for a role with a bit more flexibility than a traditional nine-to-five job. Independent consultants provide services to a variety of clients, rather than working for one establishment.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

When you work as a consultant, you are considered a self-employed individual. Most companies treat consultants as independent contractors.

At that point the Consultant may be said to become a Contractor. The terms have also become blurred as industry has incorporated them into employee job titles. Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.