Michigan Employment Firm Audit

Description

How to fill out Employment Firm Audit?

You are capable of spending several hours online searching for the legal document template that meets the federal and state regulations you need. US Legal Forms offers a vast collection of legal forms that have been vetted by experts.

You can easily download or create the Michigan Employment Firm Audit through our service.

If you currently possess a US Legal Forms account, you can sign in and then click the Download button. After that, you can complete, modify, print, or endorse the Michigan Employment Firm Audit. Each legal document template you obtain is yours indefinitely. To obtain another copy of any purchased form, visit the My documents section and select the appropriate option.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make edits to the document if necessary. You can complete, modify, endorse, and print the Michigan Employment Firm Audit. Download and print a vast range of document templates using the US Legal Forms website, which provides the largest assortment of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your specific region/city of choice.

- Read the form description to confirm you've selected the right form.

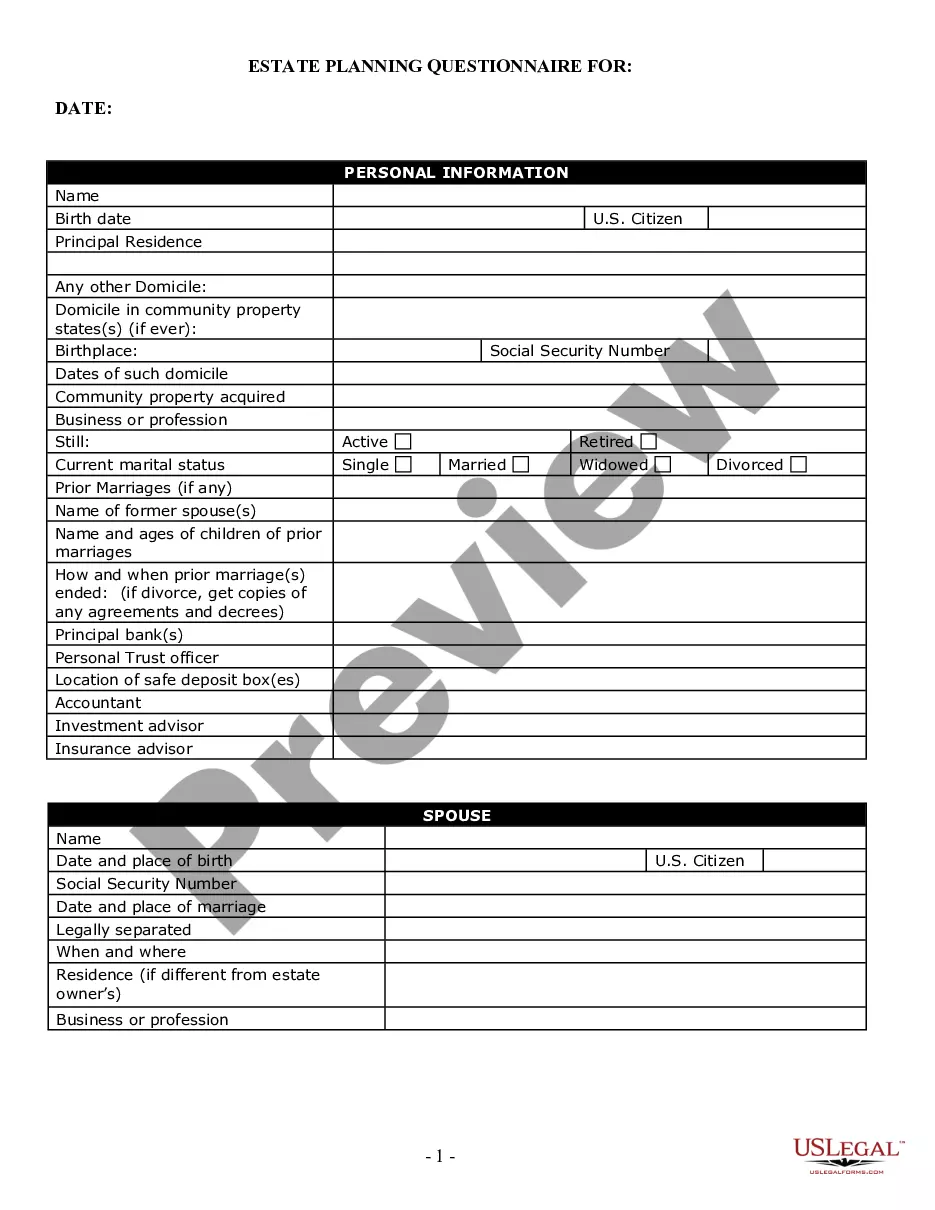

- If available, utilize the Preview option to review the document template as well.

- If you wish to find another version of the form, use the Search area to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for your account on US Legal Forms.

Form popularity

FAQ

The person committing fraud could be a claimant who is intentionally misrepresenting information being provided to the Unemployment Insurance Agency (UIA) when filing and/or certifying for unemployment benefits or could be a traditional fraud matter whereby a criminal is impersonating or representing themselves as a

It is an audit of the records of a random sample of claimants who are either approved for benefits or denied for benefits.

Discrepancies in reported wageIf a former worker files for unemployment benefits, and wages reported to MDES do not match the records for the worker, an audit may be initiated.

A California payroll tax audit is a lot like what it sounds like. The Employment Development Department (EDD) assigns a tax auditor to review your business's payroll tax records to make sure that payroll has been properly reported and that California payroll tax has been properly paid.

Respond to UIA Requests Top If the UIA asks you for information, respond within 10 days. If you do not respond within 10 days, you may lose your benefits and be charged with fraud.

The Texas Workforce Commission is charged with auditing businesses to ensure that employee wages are properly reported and appropriate taxes paid on such wages. If TWC rules that an employer has failed to properly report all wages and pay taxes, it will assess back taxes and interest.

An IRS audit is a review/examination of an organization's or individual's accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

What is required for a work search? Claimants receiving unemployment benefits are required to actively search for work and report at least one work search activity for each week they claim benefits.

UIA Audits / Investigations. 25cf The U.S. Department of Labor requires UIA. to conduct tax audits/investigations. 25cf Section 9 of the Michigan Employment. Security (MES) Act gives the agency the authority to audit/review the books and records of employers to ensure compliance with the law.