Michigan Job Sharing Policy

Description

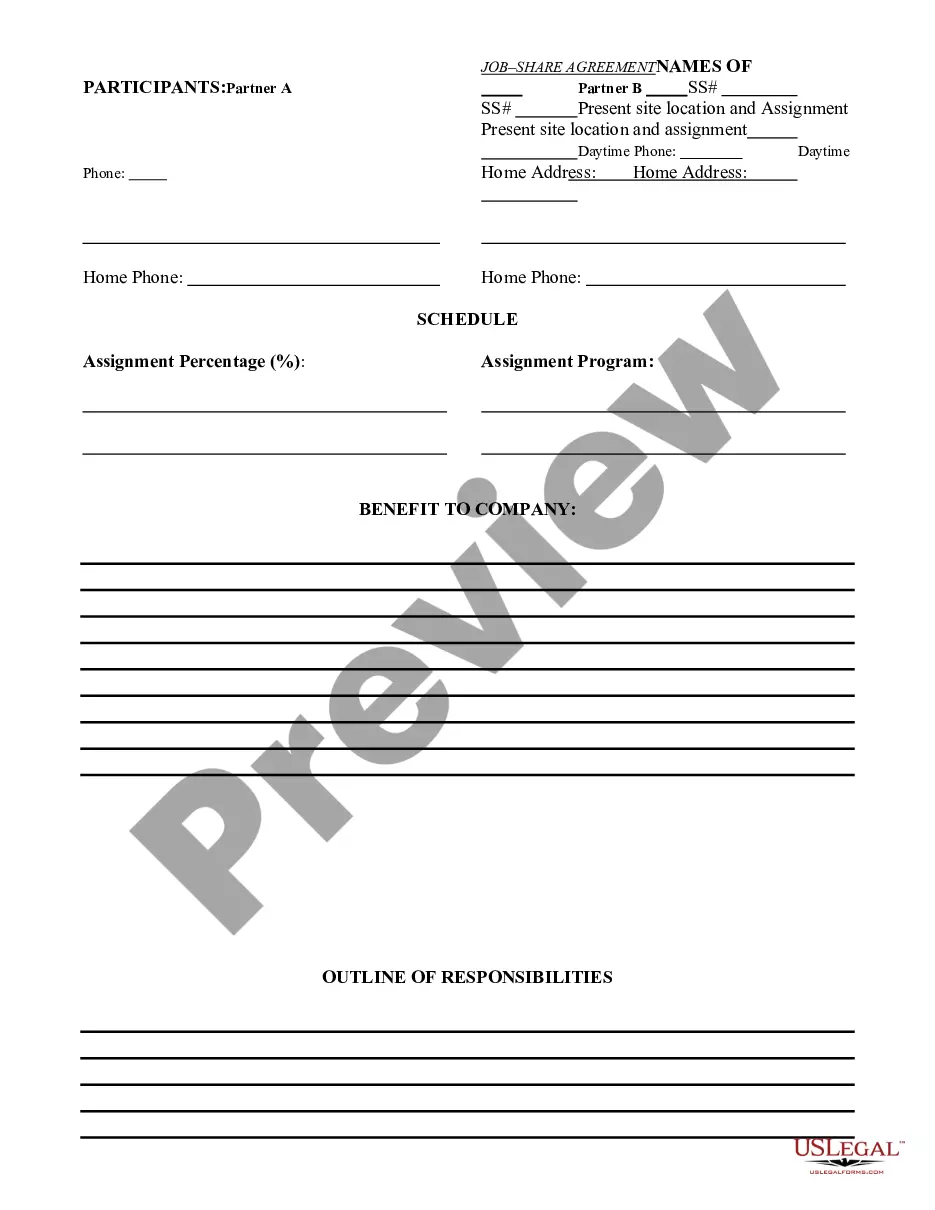

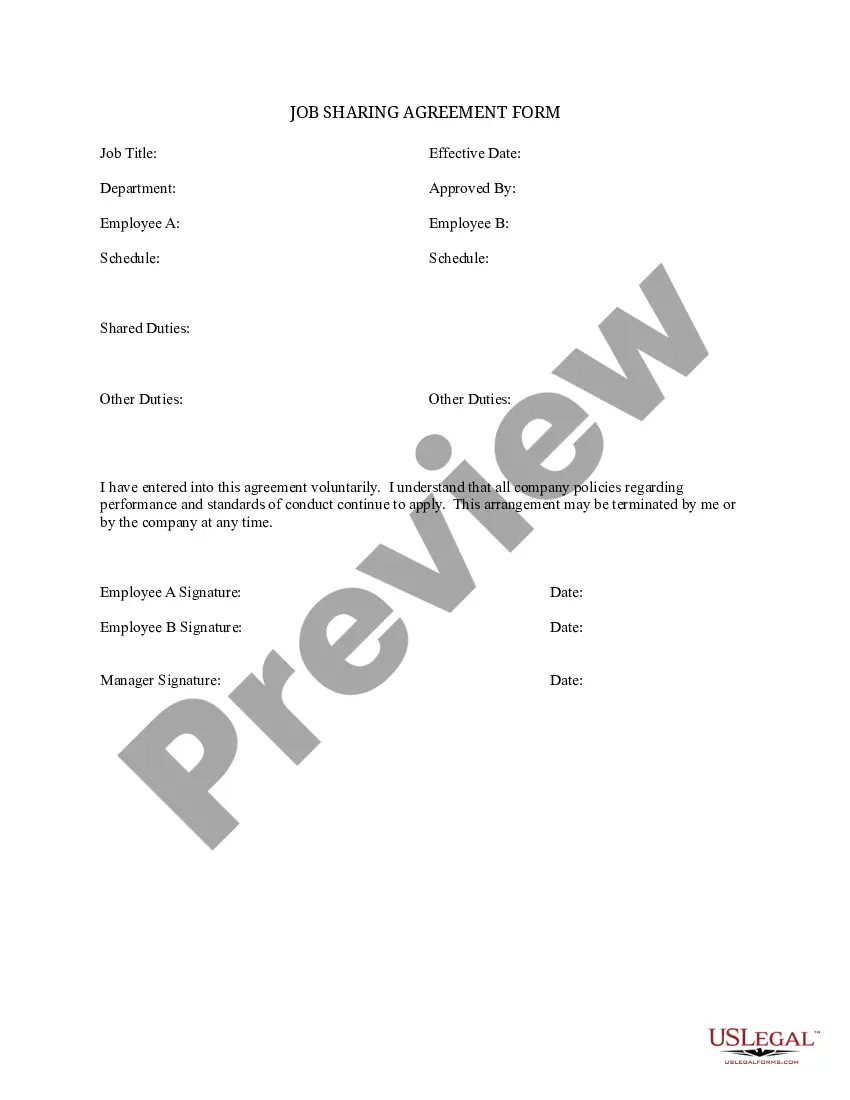

How to fill out Job Sharing Policy?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad array of legal document templates that you can download or print.

While using the website, you can find thousands of forms for business and personal uses, categorized by type, state, or keywords. You can find the latest versions of forms such as the Michigan Job Sharing Policy in moments.

If you have an account, Log In to download the Michigan Job Sharing Policy from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your profile.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Confirm you have selected the correct form for your city/county.

- Click the Preview button to review the contents of the form.

- Read the form description to ensure that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Select your preferred payment plan and provide your information to register for the account.

Form popularity

FAQ

If you earned $1,000 a week, your weekly unemployment benefit in Michigan may range from about half of your weekly earnings. The exact amount depends on various factors, including your employment history and how long you have contributed to the unemployment insurance fund. By understanding the Michigan Job Sharing Policy, you can better estimate your benefits and make informed financial decisions.

Employers may file an application online through the Michigan Web Account Manager (MiWAM) at michigan.gov/uia. For more information about Work Share, visit Michigan.gov/workshare or call the Office of Employer Ombudsman at 1-855-484-2636 or call 1-844-WORKSHR (967-5747).

Michigan's Work Share program provides employers with an alternative to layoffs when the work available to employees decreases. Instead of the employer laying off some employees, all employees share the available work by working reduced hours and collecting a portion of unemployment benefits.

States with workshare programs include Arizona, Arkansas, California, Colorado, Connecticut, Florida, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Washington, and Wisconsin.

Amount of unemployment benefits: The weekly benefit amount is capped at $362. To determine how many weeks of benefits you may receive, BW&UC multiplies your total base period wages by 43%, and then divides that answer by your weekly benefit amount. The claim, however, cannot be less than 14 weeks or more than 26 weeks.

Can I have federal taxes withheld from my Work Sharing benefits? Yes. You have the option to withhold 15 percent federal taxes.

Michigan's Work Share program provides employers with an alternative to layoffs when the work available to employees decreases. Instead of the employer laying off some employees, all employees share the available work by working reduced hours and collecting a portion of unemployment benefits.

Employers may file an application online through the Michigan Web Account Manager (MiWAM) at michigan.gov/uia. For more information about Work Share, visit Michigan.gov/workshare or call the Office of Employer Ombudsman at 1-855-484-2636 or call 1-844-WORKSHR (967-5747).

Michigan's Work Share program allows employers to restart their business and bring employees back from unemployment. Employers can bring employees back with reduced hours - while employees collect partial unemployment benefits to make up a portion of the lost wages.

(WLUC) - The Michigan State House of Representatives have voted to end federal extended unemployment benefits. Under current legislation, those collecting unemployment received an extra $300 a week on top of state unemployment.