Michigan Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

Are you presently in a situation where you require documents for either business or personal needs almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Michigan Purchase Order for Non-Inventory Items, designed to comply with both federal and state regulations.

After you find the appropriate form, click Buy now.

Select your desired pricing plan, provide the required information to set up your account, and complete your purchase using PayPal or a credit card. Choose a suitable document format and download your copy. You can access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the Michigan Purchase Order for Non-Inventory Items whenever necessary. Simply navigate to the relevant form to obtain or print the document template. Utilize US Legal Forms, which boasts one of the largest collections of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Michigan Purchase Order for Non-Inventory Items template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific city/state.

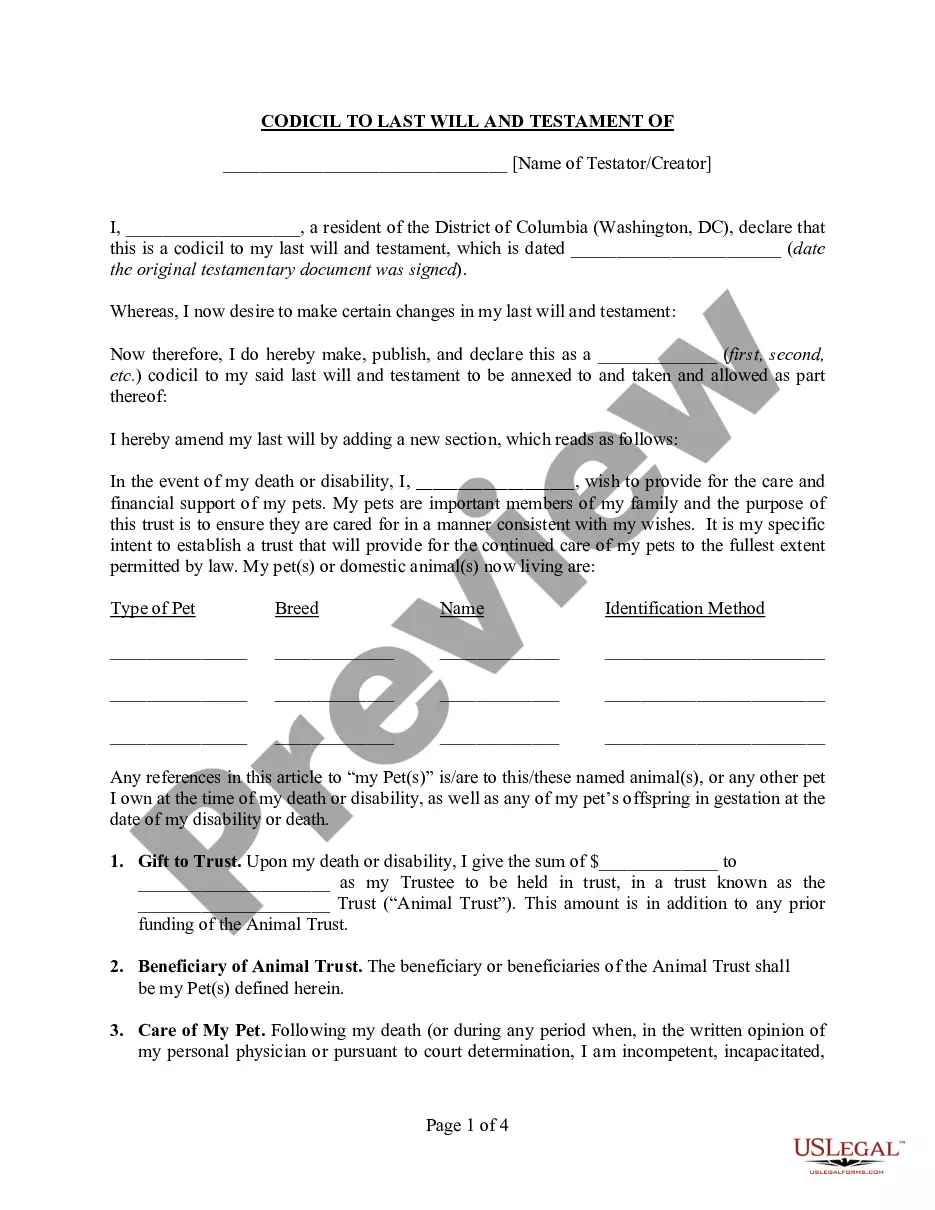

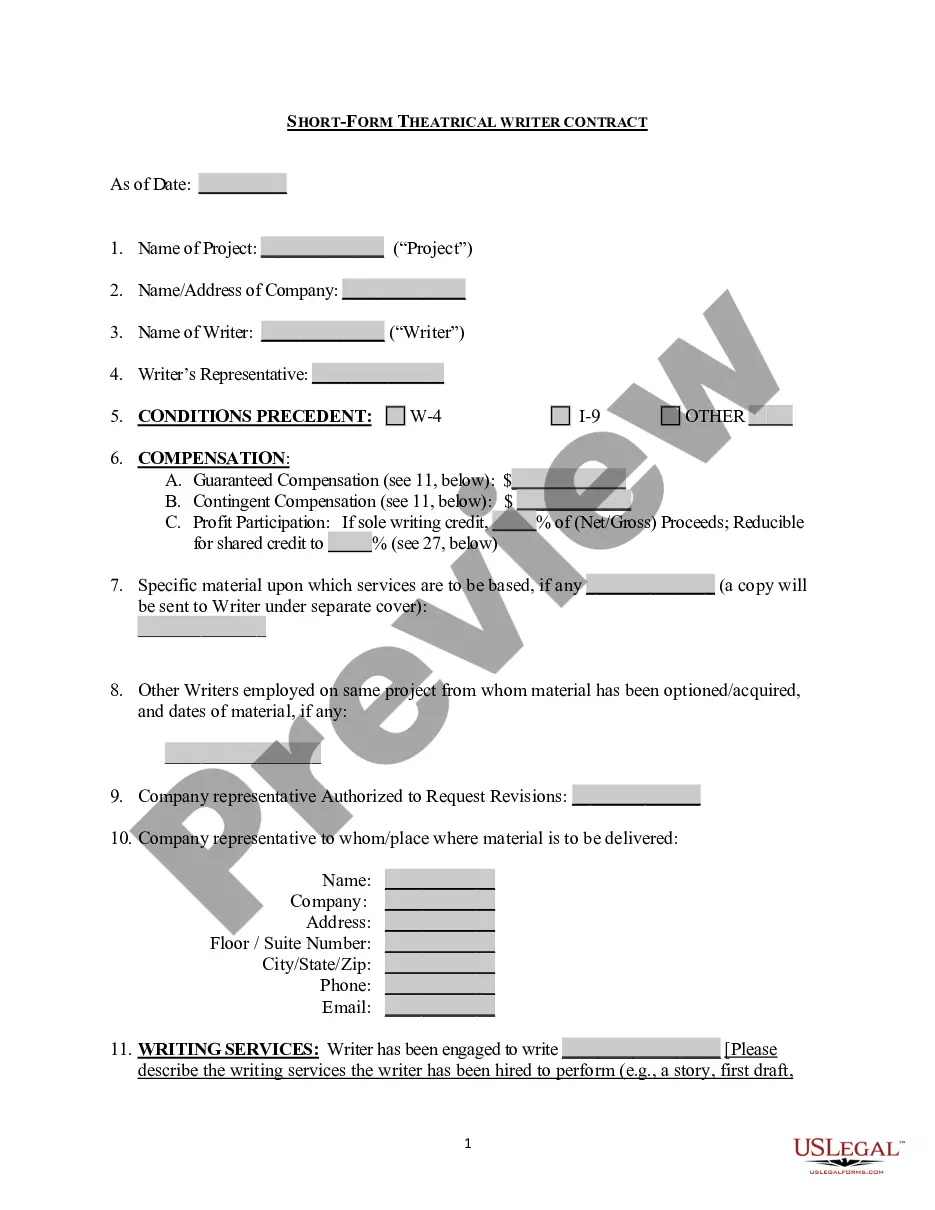

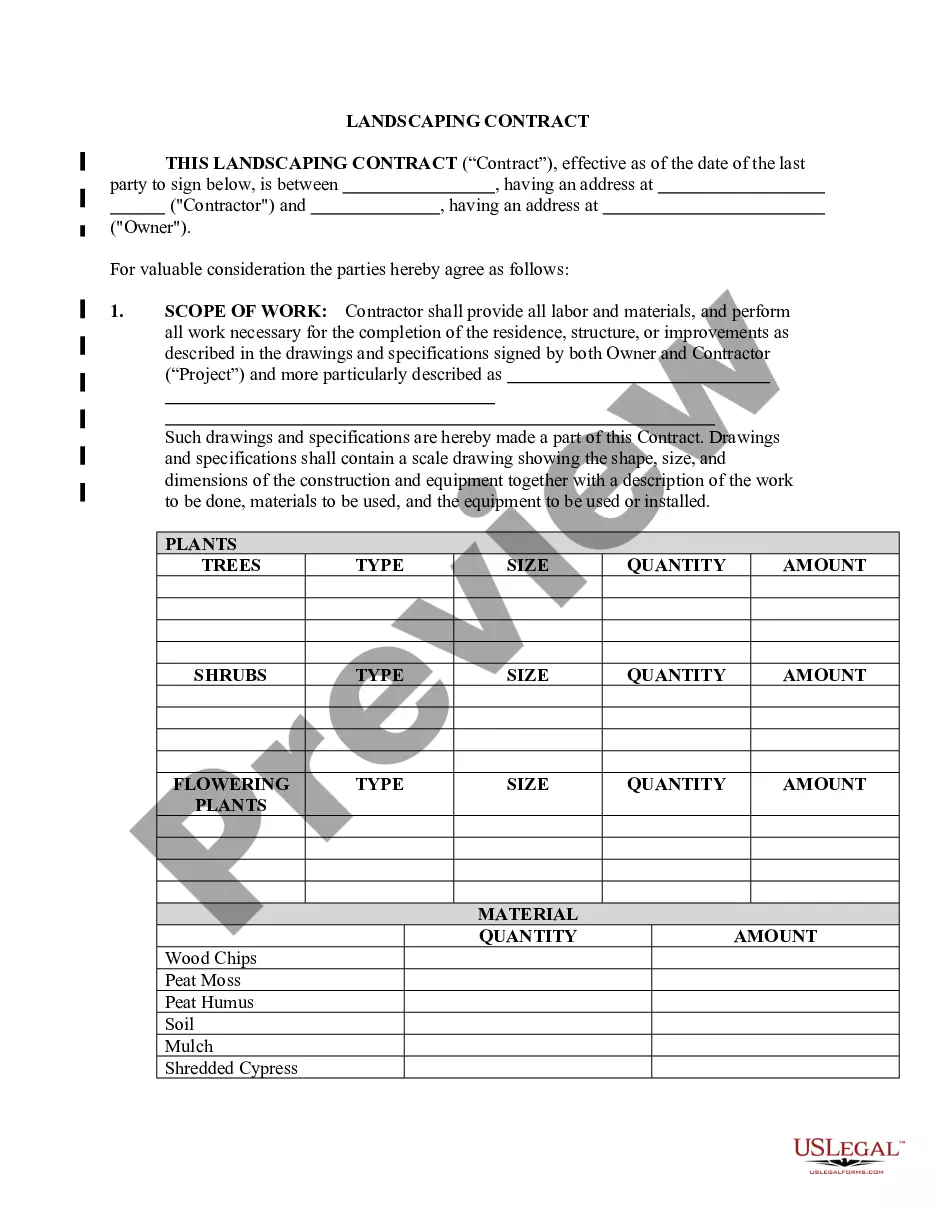

- Use the Preview button to examine the form.

- Check the description to confirm you have selected the correct document.

- If the form does not meet your expectations, utilize the Search bar to find the form that matches your needs.

Form popularity

FAQ

Filing Form 5081 online in Michigan can be done through the state’s official e-filing portal for tax documents. After accessing the portal, gather all necessary details related to your transactions, especially those involving Michigan Purchase Orders for Non Inventory Items. Follow the instructions carefully to ensure all information is submitted correctly, reducing the risk of processing delays.

In Michigan, items that are classified under certain categories, such as machinery used directly in processing, may be exempt from industrial processing tax. This also includes certain materials connected to the Michigan Purchase Order for Non Inventory Items when used in qualified production processes. It's essential to review the specific guidelines set by the Michigan Department of Treasury for a comprehensive understanding.

To file a claim of exemption in Michigan, you'll need to complete the appropriate exemption form, which may include Michigan Form 518. This process often centers around the specifics of your purchase, particularly if it involves a Michigan Purchase Order for Non Inventory Items. After filling out the form, submit it to the relevant authority to initiate the exemption claim.

Any business or individual who engages in taxable transactions in Michigan and seeks to claim a tax exemption must file Michigan Form 5081. This includes those who make purchases relevant to the Michigan Purchase Order for Non Inventory Items. Understanding if your transactions qualify for this form is critical for compliance with state tax regulations.

Yes, Michigan Form 807 can typically be e-filed, making it more convenient for businesses to submit their documentation electronically. This option allows for quicker processing, especially when dealing with transactions related to the Michigan Purchase Order for Non Inventory Items. Be sure to check the e-filing requirements on the state's official website to ensure compliance.

To file Michigan Form 5081, begin by collecting the necessary information regarding the transaction and items involved. You will need to provide details about the Michigan Purchase Order for Non Inventory Items as well. Once completed, submit the form to the appropriate state department as outlined in the instructions, ensuring all information is clearly documented to facilitate a smooth process.

Michigan Form 518 is a tax exemption certificate used to claim a specific exemption from sales tax in Michigan. Often, businesses utilize this form when making purchases that qualify under the exemption criteria, particularly in relation to the Michigan Purchase Order for Non Inventory Items. It is essential to complete this form accurately to avoid any tax liabilities, ensuring compliance with Michigan tax laws.

To become tax exempt in Michigan, businesses must complete and submit form 3372, the Michigan Sales and Use Tax Exemption Certificate. This certificate identifies your exempt status for qualifying purchases. Leveraging a Michigan Purchase Order for Non Inventory Items simplifies the tracking of these purchases, ensuring compliance with tax regulations while maximizing your benefits.

In Michigan, certain items are exempt from sales tax, including some food items, prescription medicines, and specific agricultural supplies. Additionally, purchasing items through a Michigan Purchase Order for Non Inventory Items can help in managing your transactions while ensuring compliance. Always check the latest regulations or consult a tax professional to confirm specific exemptions.

The main difference between inventory and non-inventory items lies in their nature and usage. Inventory items are goods kept on hand for sale, while non-inventory items support business functions without being part of the product mix. Utilizing a Michigan Purchase Order for Non Inventory Items enables you to distinguish between these categories clearly and manage your resources more effectively.