Michigan Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

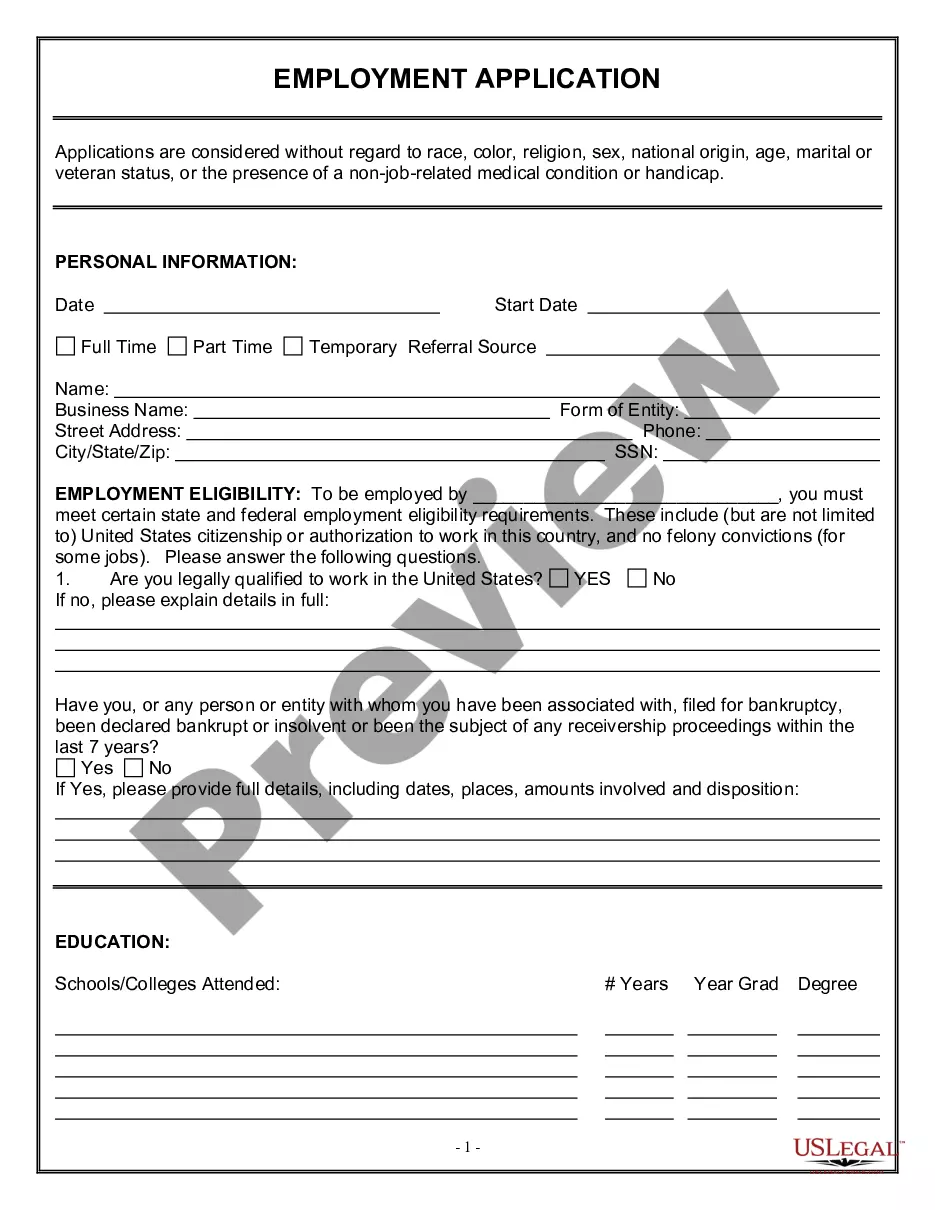

Finding the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Michigan Living Trust with Provisions for Disability, suitable for both business and personal purposes.

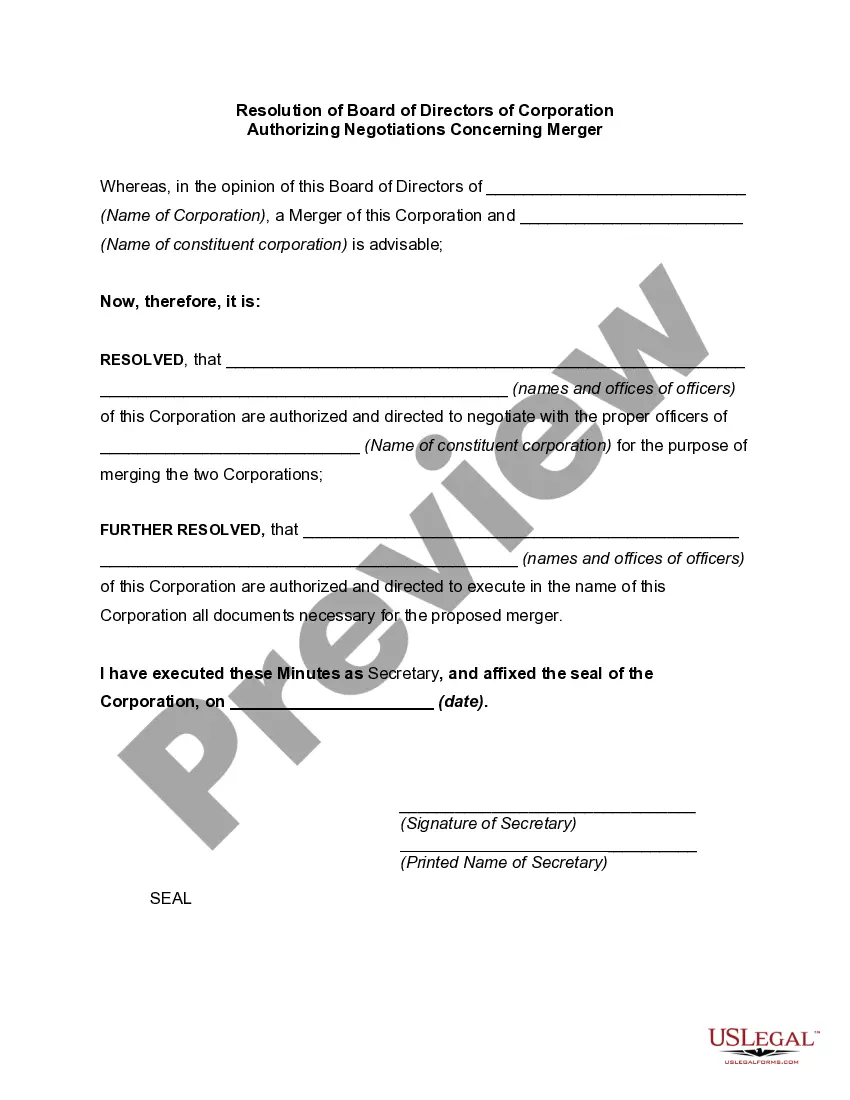

First, ensure that you have selected the correct form for your city/region. You can review the form using the Preview button and read the form details to ensure it is the right one for you.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Michigan Living Trust with Provisions for Disability.

- Use your account to browse the legal forms you have purchased previously.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions you should follow.

Form popularity

FAQ

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

Trusts considered to be qualified disability trusts are entitled to the same personal exemption allowed to all individual taxpayers when filing a tax return. The personal exemption in 2012 is $3,800.

Unlike SSI, there are no income or asset limits for SSDI eligibility. Instead, to qualify for SSDI, enrollees must have a sufficient work history (generally, 40 quarters) and meet the strict federal disability rules. SSA uses the same rules to determine disability for both the SSI and the SSDI programs.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

Using a will trust can help you to look after a disabled relative in the future so that it does not affect their benefits. If your loved one is vulnerable or lacks capacity, a will trust can also help: protect them from the risk of financial abuse. support them if they need someone to manage their money.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.