Michigan Loan Agreement for Car

Description

How to fill out Loan Agreement For Car?

Are you inside a placement where you need files for sometimes organization or personal functions nearly every time? There are plenty of authorized record layouts accessible on the Internet, but discovering types you can depend on isn`t straightforward. US Legal Forms delivers thousands of develop layouts, just like the Michigan Loan Agreement for Car, that happen to be composed to satisfy state and federal needs.

Should you be presently informed about US Legal Forms web site and also have an account, basically log in. Following that, you are able to obtain the Michigan Loan Agreement for Car web template.

Should you not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is to the proper metropolis/region.

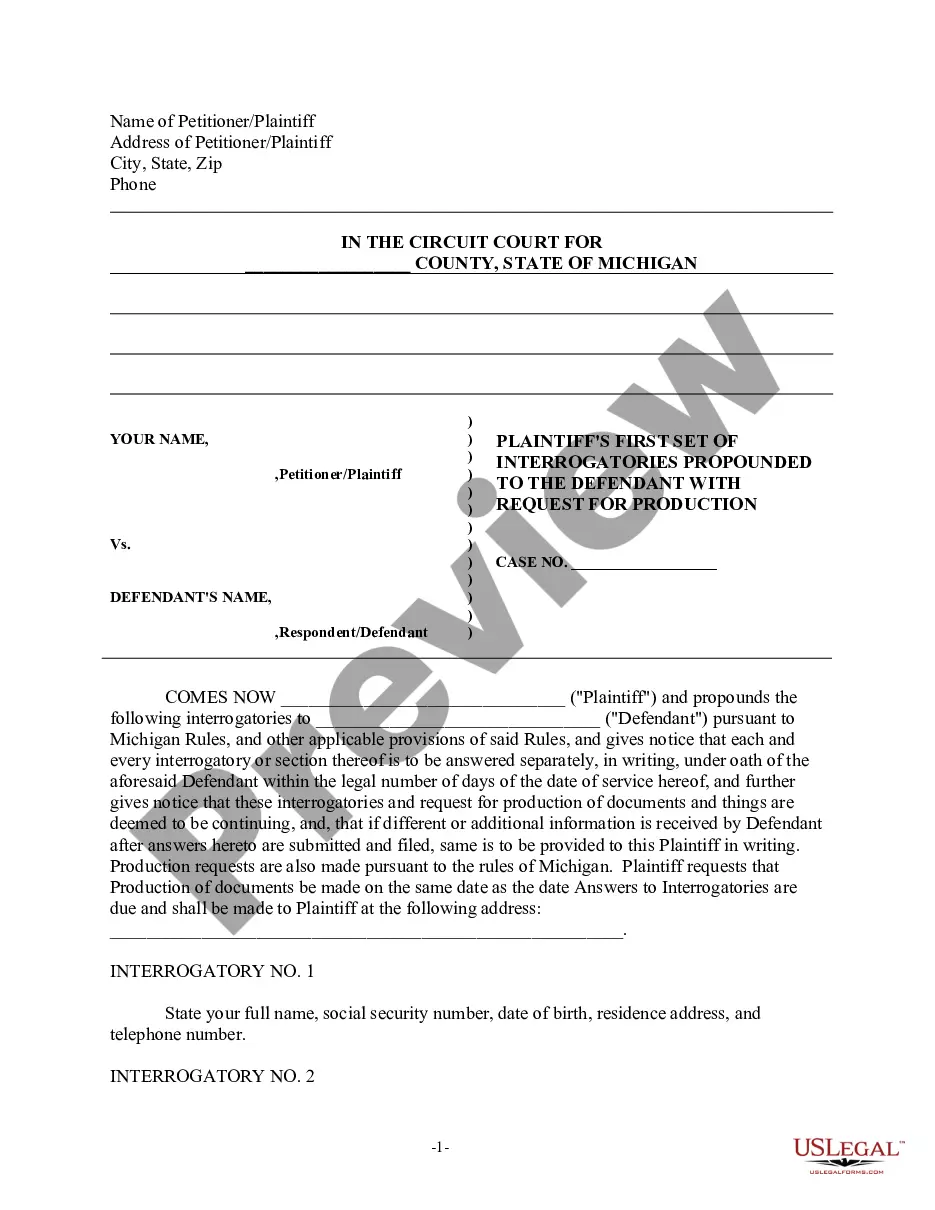

- Make use of the Review key to examine the shape.

- Browse the description to ensure that you have selected the appropriate develop.

- When the develop isn`t what you`re searching for, use the Research field to obtain the develop that meets your requirements and needs.

- Once you obtain the proper develop, click on Acquire now.

- Pick the prices prepare you would like, complete the necessary information to create your bank account, and pay for the order utilizing your PayPal or charge card.

- Choose a hassle-free data file file format and obtain your copy.

Find all the record layouts you possess purchased in the My Forms food selection. You can get a extra copy of Michigan Loan Agreement for Car whenever, if possible. Just click the required develop to obtain or produce the record web template.

Use US Legal Forms, by far the most considerable variety of authorized forms, in order to save time as well as steer clear of mistakes. The services delivers expertly produced authorized record layouts which you can use for a range of functions. Make an account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Required Documents for a Car Title Loan in Michigan Identification documents: For a lender to be able to verify your identity, you can provide documents such as a driver's license, state-issued ID, or a military ID. Reference documents: While not all lenders will require you to provide references, some will.

When financing a car, lenders require documentation that proves your identity, income, residency, and insurance coverage. You can also expect to provide your Social Security number and vehicle information.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

How To Get Out of My Car Loan: The Bottom Line. Turning to your lender is always the first step if you're having trouble with car payments. You can also get out of your car loan by refinancing to better terms, selling your car or turning it in to your lender through voluntary repossession.

How To Write a Loan Agreement Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate. ... Step 7 ? Include Late Fees (Optional)

How to Write Step 1 ? Vehicle Details. The following details will need to be entered to identify the vehicle that the borrower is purchasing: ... Step 2 ? Loan Amount. ... Step 3 ? The Parties. ... Step 4 ? Payment. ... Step 5 ? Interest. ... Step 6 ? Late Fees. ... Step 7 ? Collateral. ... Step 8 ? Governing Law.