Michigan Superior Improvement Form

Description

How to fill out Superior Improvement Form?

You can spend multiple hours online searching for the valid document template that satisfies the federal and state requirements you need.

US Legal Forms provides a vast array of valid forms that are vetted by professionals.

You can easily download or print the Michigan Superior Improvement Form from our service.

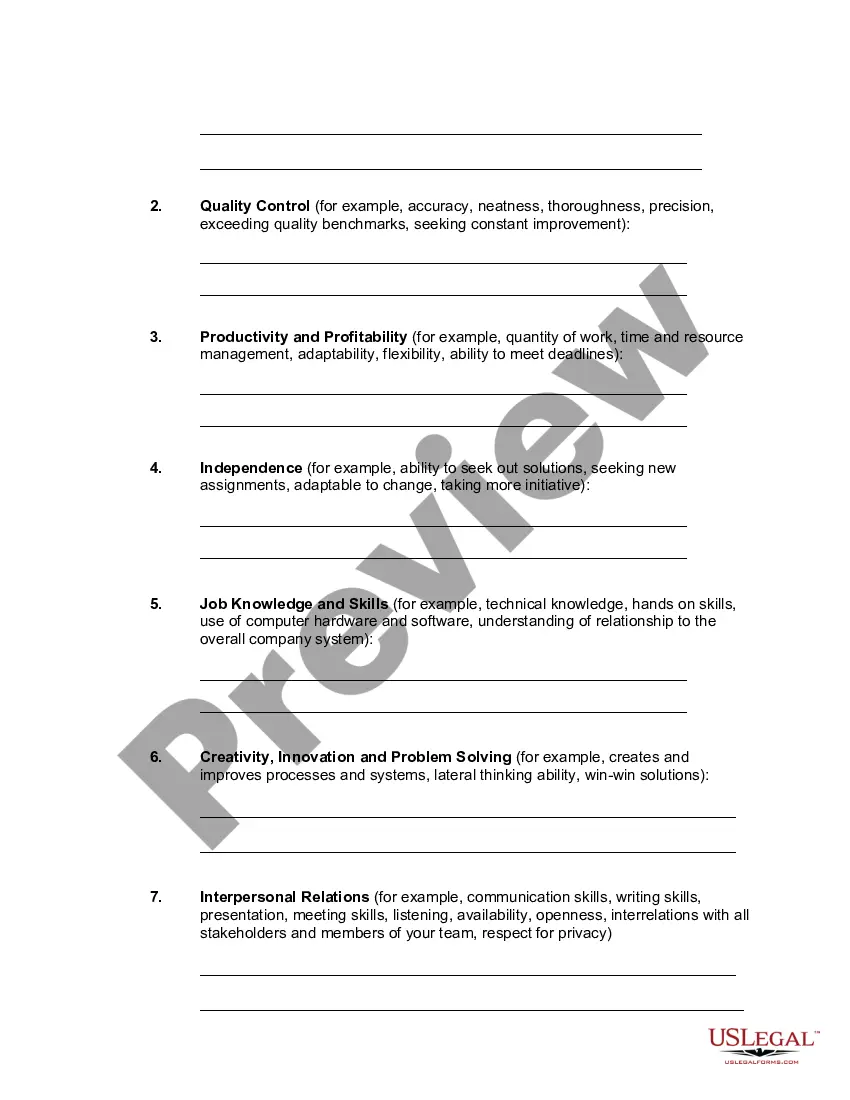

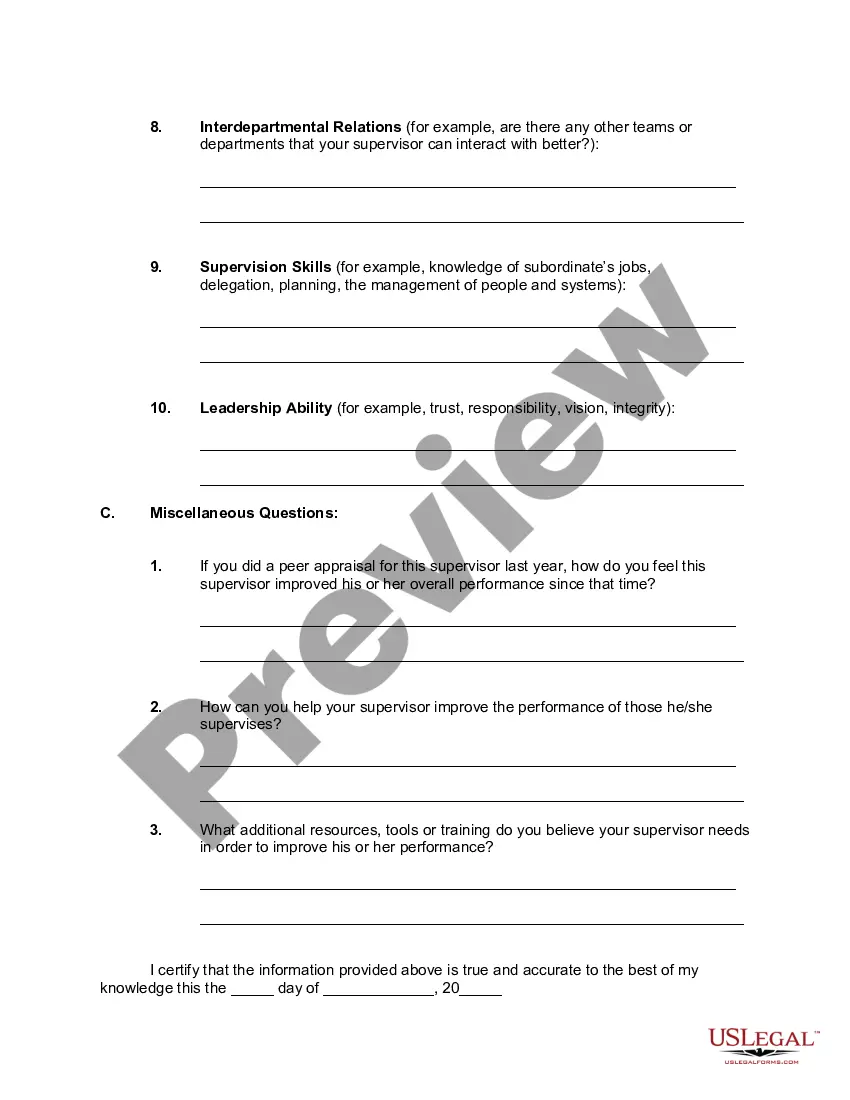

If available, take advantage of the Review option to look through the document template as well.

- If you have a US Legal Forms account, you can sign in and select the Download option.

- Then, you can complete, modify, print, or sign the Michigan Superior Improvement Form.

- Every valid document template you obtain is yours permanently.

- To acquire another copy of any purchased form, visit the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your region/city that you selected.

- Review the form description to confirm you have picked the appropriate form.

Form popularity

FAQ

Michigan form 5081 is necessary for businesses that withhold taxes from employee wages. If your business operates in Michigan and maintains payroll records, you are required to file this form regularly. By integrating the Michigan Superior Improvement Form, you can also document any improvements made to your business property during the process. Filing this form correctly ensures compliance and helps avoid unnecessary liabilities.

Michigan form 518, known as the Michigan Income Tax Exemption for Disabled Veterans, allows qualified veterans to claim certain tax exemptions. This form is vital for veterans seeking relief from property taxes due to their service-related disabilities. If you are eligible, using the Michigan Superior Improvement Form to report enhancements on your property may also provide additional tax benefits. Understanding your rights can lead to significant savings.

Michigan form 5076 is used for property owners to appeal their property tax assessment. This form helps you request a review of your property valuation, a critical step if you believe your taxes are unfair. By using the Michigan Superior Improvement Form alongside it, you can precisely articulate property improvements that may influence your assessment. A smooth appeal process can lead to a more favorable tax outcome.

Property tax assessment in Michigan determines the value of properties for taxation purposes. Local assessors evaluate various factors, including size, location, and improvements made, such as those documented with the Michigan Superior Improvement Form. A well-understood property assessment can ensure fair tax obligations and help property owners manage their finances effectively. If you disagree with your assessment, you can appeal it following local procedures.

Income tax nexus in Michigan is established through various business activities and presence in the state. If your business has employees, property, or regularly sells goods in Michigan, you likely generate a nexus. This means you may need to file taxes, benefiting from using the Michigan Superior Improvement Form when claiming deductions for property upgrades. Understanding nexus helps you remain compliant and avoid penalties.

The Michigan 5080 form allows taxpayers to report property improvements and alterations for tax purposes. This form is essential to claim a Michigan Superior Improvement Form, ensuring you receive proper credit for your upgrades. By accurately completing this form, homeowners can effectively communicate property changes to local authorities. Keep in mind, proper documentation promotes transparency and may affect future property tax assessments.

Filing a certificate of dissolution in Michigan involves completing the necessary paperwork to officially dissolve your business entity. You may want to reference the Michigan Superior Improvement Form for guidance on filling out the required documents correctly. After preparing your forms, submit them to the Michigan Department of Licensing and Regulatory Affairs to finalize the dissolution process.

Legally closing your business in Michigan requires following a few essential steps, including notifying creditors, settling debts, and filing appropriate dissolution forms. One important form to consider is the Michigan Superior Improvement Form, which may assist in your closure process. Consult Michigan's business guidelines or seek legal advice to ensure all necessary obligations are met during your business termination.

To file form 163 in Michigan, begin by gathering relevant financial documents and information that reflect your business's tax situation. The Michigan Superior Improvement Form can assist in organizing this data effectively. Once your details are prepared, you can submit the form either electronically or in paper format, depending on your preference and the guidelines provided by the state.

Yes, you can file Michigan form 4 online through the Michigan Department of Treasury's website. Utilizing the Michigan Superior Improvement Form can help facilitate this online filing process by providing clear instructions on the required information. Ensure you have all necessary documents on hand to streamline your filing and avoid delays.