Michigan Income Projections Statement

Description

As monthly projections are developed and entered into the income projections statement, they can serve as definite goals for controlling the business operation. As actual operating results become known each month, they should be recorded for comparison with the monthly projections. A completed income statement allows the owner/manager to compare actual figures with monthly projections and to take steps to correct any problems.

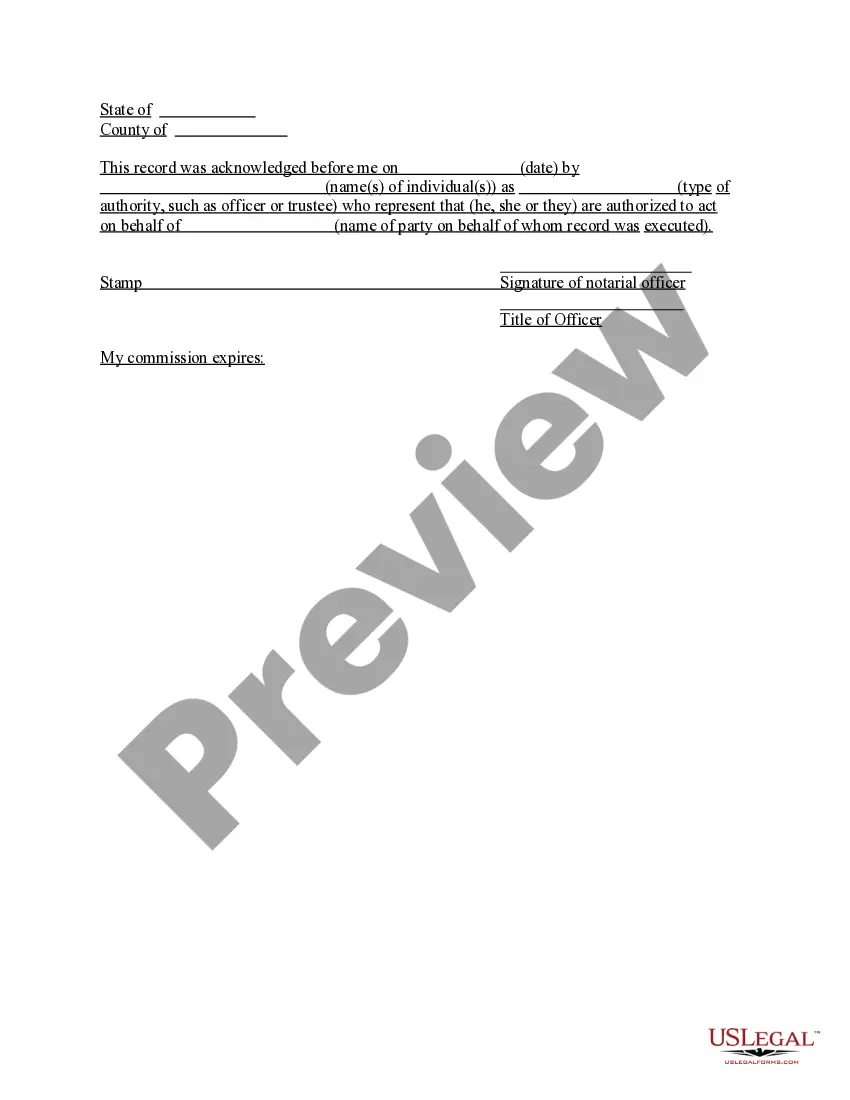

How to fill out Income Projections Statement?

It is feasible to spend numerous hours online trying to locate the legal document template that complies with the state and federal standards you will need.

US Legal Forms offers thousands of legal documents that can be evaluated by professionals.

You can indeed obtain or print the Michigan Income Projections Statement from your services.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can fill out, modify, print, or sign the Michigan Income Projections Statement.

- Every legal document template you purchase is your property permanently.

- To obtain another copy of an acquired form, go to the My documents tab and select the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

Michigan ranks as one of the larger economies in the United States, often landing within the top ten. The state's economic strength comes from a robust manufacturing base and a growing service sector. Evaluating the Michigan Income Projections Statement reveals critical trends that can guide economic strategies for future growth and stability.

The three states with the highest GDP are California, Texas, and New York, showcasing strong economic diversity and productivity. Each of these states leads in different sectors, which can provide valuable lessons for Michigan's growth strategies. Utilizing the Michigan Income Projections Statement allows stakeholders to identify key areas for improvement and investment.

California holds the title for the number one GDP in the United States, driven by its vast technology, entertainment, and agricultural sectors. This high GDP significantly influences national economic trends and serves as a benchmark for other states, including Michigan. The Michigan Income Projections Statement offers insights on how the state can position itself in comparison.

Michigan's GDP reflects the total economic output of the state, showcasing its diverse industries, including manufacturing, agriculture, and technology. With a current GDP that ranks among the top states in the U.S., Michigan demonstrates resilience and growth potential. Understanding the Michigan Income Projections Statement helps clarify how these dynamics impact future economic performance.

The economic outlook for Michigan in 2025 appears promising, with expectations of steady growth. Factors such as job creation and increased investment in infrastructure contribute to this optimism. By analyzing the Michigan Income Projections Statement, residents and businesses can better prepare for future economic shifts and opportunities.

The financial condition of Michigan is stable, characterized by a balance between revenue and expenditures. The state has made significant improvements in fiscal management, which supports long-term growth. As part of evaluating the Michigan Income Projections Statement, it is vital to consider various economic indicators that highlight potential changes in this condition.

Michigan Form 5081 is meant for individuals who are claiming a credit for taxes withheld from their income. If you expect to receive a refund due to overpayment of taxes, you should file this form. Incorporating your Michigan Income Projections Statement can help you assess if filing this form is beneficial for your tax situation.

Yes, you can file a tax extension online using approved e-filing software that supports Michigan forms. This method is user-friendly and allows for quick submission of your application. While you navigate the online process, consulting your Michigan Income Projections Statement will help ensure accuracy in your estimated tax payments.

To file Form 163 in Michigan, you need to complete it accurately and submit it, typically to address state income tax or credits depending on your financial situation. Make sure all income data aligns with your Michigan Income Projections Statement to avoid discrepancies. You can also opt for online platforms for guidance, making the form-filing process much simpler.

If you're filing a paper extension for Michigan taxes, you should mail your Form 4 to the address provided in the instructions specific to your situation. Usually, this is the Michigan Department of Treasury in Lansing. Always double-check the mailing address as it can change, and remember, managing your filing with the help of a Michigan Income Projections Statement can ease your tax season stress.