Michigan Software Maintenance and Technical Support Agreement

Description

How to fill out Software Maintenance And Technical Support Agreement?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

By using the website, you can discover thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can find the most recent documents such as the Michigan Software Maintenance and Technical Support Agreement in just a few minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your credentials to register for the account.

- If you already possess a subscription, Log In and retrieve the Michigan Software Maintenance and Technical Support Agreement from the US Legal Forms library.

- The Download button will appear on each form you examine.

- You can access all previously downloaded forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you've chosen the correct form for your location/state. Click the Preview button to review the form's content.

- Examine the form summary to confirm you've selected the appropriate form.

Form popularity

FAQ

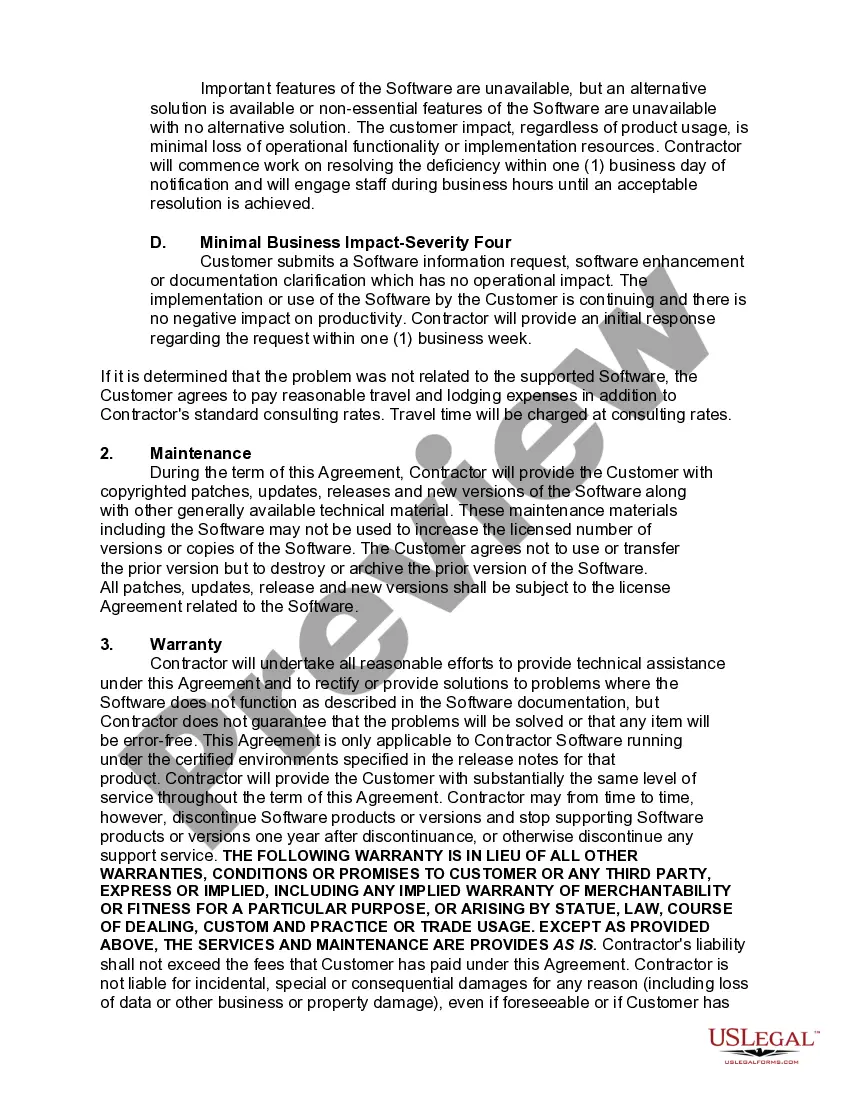

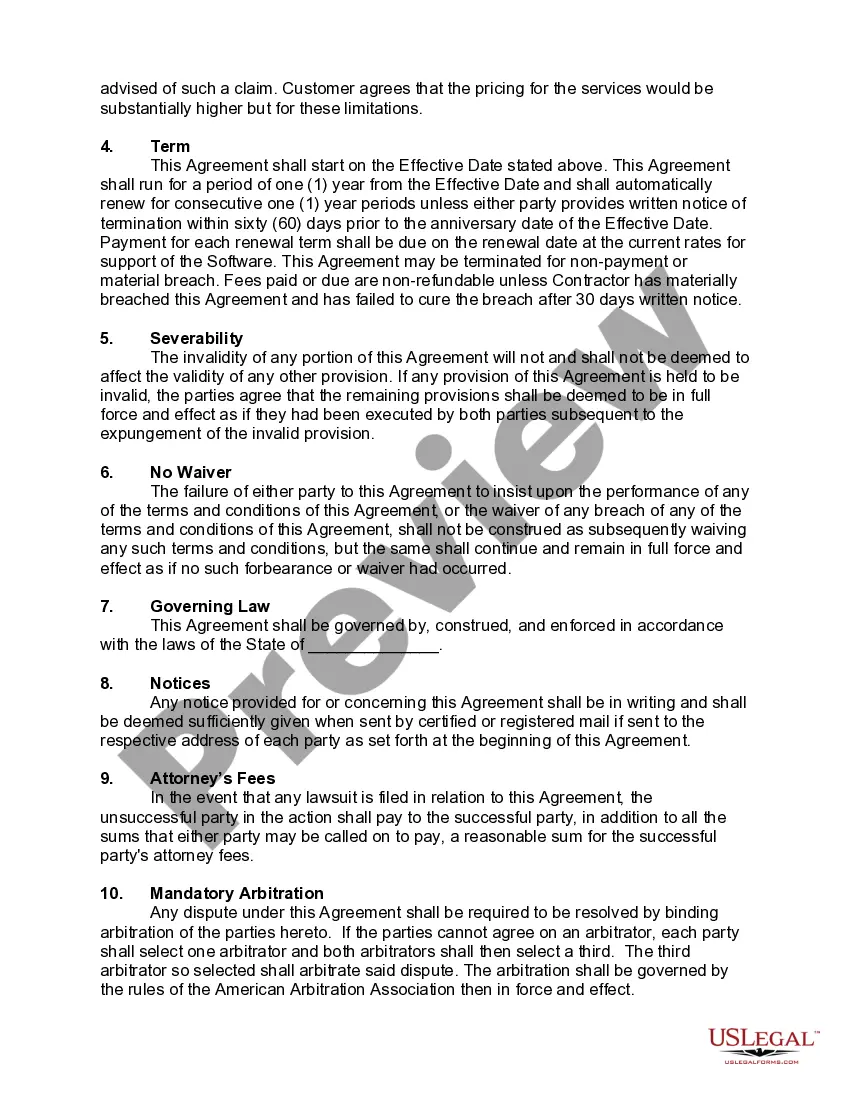

A maintenance contract typically includes scheduled maintenance, technical support, and necessary updates to the software. Additionally, it may outline response times for service requests and any costs associated with major upgrades. With a Michigan Software Maintenance and Technical Support Agreement, customers can establish a comprehensive plan for maintaining software performance, ultimately allowing for more efficient operations.

A software support agreement is a contract between a software provider and users, outlining the support services available. This includes troubleshooting, upgrades, and maintenance tasks designed to sustain product performance. A well-structured Michigan Software Maintenance and Technical Support Agreement can help establish clear expectations, ensuring clients receive reliable support when needed.

The four types of software maintenance are corrective, adaptive, perfective, and preventive maintenance. Corrective maintenance addresses bugs, while adaptive maintenance adjusts the software for changes in the environment. Perfective maintenance improves functionality, and preventive maintenance anticipates future issues. Understanding these types through your Michigan Software Maintenance and Technical Support Agreement can optimize your software's performance.

A software Annual Maintenance Contract (AMC) usually encompasses routine updates, technical support, and emergency fixes. This agreement provides peace of mind, knowing that issues will be addressed promptly under your Michigan Software Maintenance and Technical Support Agreement. By including AMC in your strategy, you can enhance your software's longevity and efficiency.

Software maintenance includes a variety of essential services to keep your applications running smoothly. Typically, it covers updates, bug fixes, and performance enhancements. With a Michigan Software Maintenance and Technical Support Agreement, you ensure ongoing support that addresses both minor and major updates, improving your software's reliability.

A software maintenance agreement typically includes terms regarding updates, bug fixes, technical support, and access to new software versions. It assures users that their systems will run smoothly and stay current with technology trends. When creating a Michigan Software Maintenance and Technical Support Agreement, be sure to detail all obligations, deliverables, and timeframes to benefit both parties.

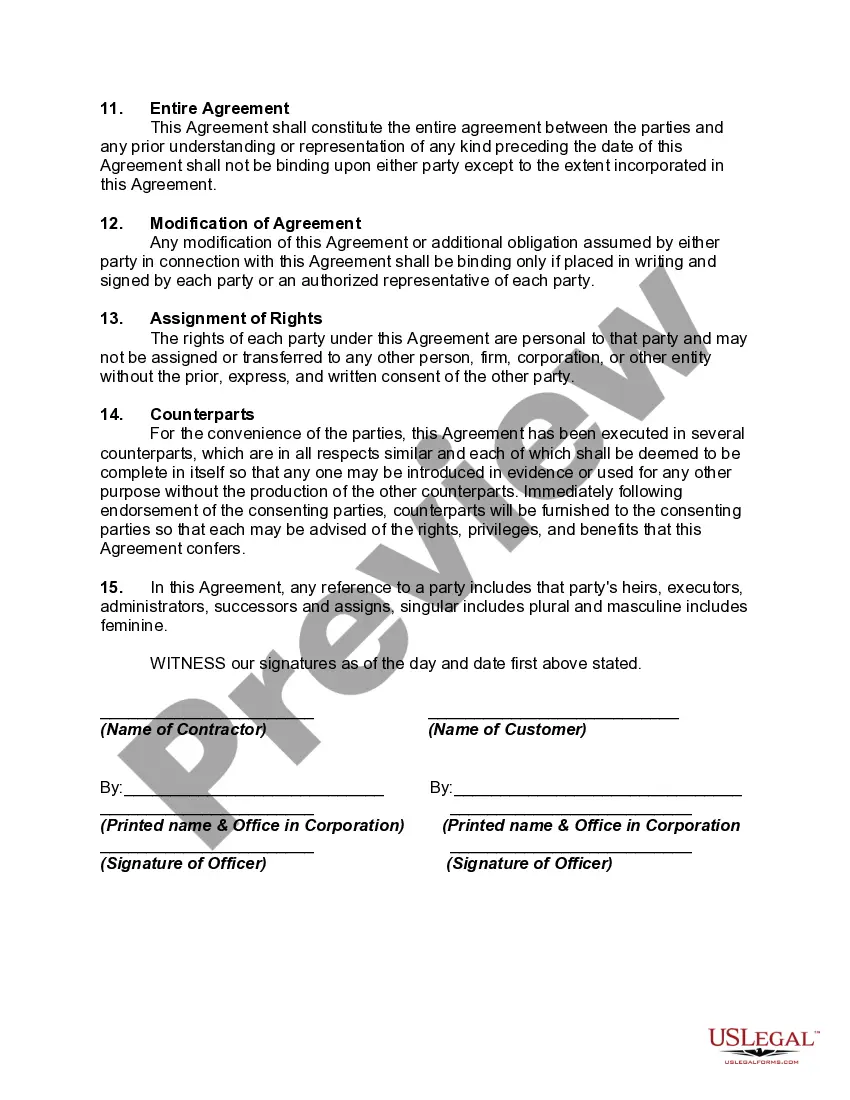

Service contracts can be taxable or exempt in Michigan, depending on the nature of the services provided. For instance, maintenance agreements involving software are often categorized in ways that can influence tax applicability. When drafting your Michigan Software Maintenance and Technical Support Agreement, it's vital to carefully outline the services covered to determine any potential tax obligations.

Engineering services in Michigan are generally not taxable. This means that if you are drafting a Michigan Software Maintenance and Technical Support Agreement that involves engineering consultation or services, you might not have to worry about sales tax. Nevertheless, ensure you clarify the scope of services and consult state regulations to know what nuances might affect your agreement.

In Michigan, professional services, including consulting and advisory services, are typically not subject to sales tax. However, some exceptions may apply depending on the nature of the service and how it relates to software agreements. If you plan to incorporate professional services within your Michigan Software Maintenance and Technical Support Agreement, understanding these tax implications will help you avoid unexpected expenses.

In Michigan, certain services are exempt from sales tax, including some software maintenance and technical support services. However, keep in mind that not all services within this area are exempt. It's essential to consult with a tax professional or refer to Michigan's Department of Treasury regulations for specific exemptions. Understanding these nuances can help you effectively draft your Michigan Software Maintenance and Technical Support Agreement.