Michigan Subcontractor Agreement for Security Services

Description

How to fill out Subcontractor Agreement For Security Services?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal template formats that you can download or print.

By utilizing the website, you can access numerous forms for business and personal purposes, categorized by regions, states, or keywords. You can find recent versions of forms like the Michigan Subcontractor Agreement for Security Services within moments.

If you have a current monthly membership, Log In to retrieve the Michigan Subcontractor Agreement for Security Services from the US Legal Forms archive. The Acquire button will be visible on every form you review. You can access all previously downloaded forms in the My documents tab of your account.

Process the purchase. Use your credit card or PayPal account to finalize the payment.

Select the file format and download the form to your device. Make modifications. Fill in, modify, and print or sign the downloaded Michigan Subcontractor Agreement for Security Services. Each template you add to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to evaluate the form's details.

- Read the form description to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the page to find a more suitable one.

- Once you are content with the form, confirm your choice by clicking the Buy now button.

- Select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Necessary paperwork for a subcontractor typically includes a subcontractor agreement, proof of insurance, and tax identification forms. Ensuring that all documentation is in order will streamline your business relationship and compliance. A well-crafted Michigan Subcontractor Agreement for Security Services acts as the cornerstone of this paperwork, setting clear terms for the work ahead.

tier subcontractor is one who works under a secondtier subcontractor, rather than directly for the primary contractor. This tiered structure can help distribute work effectively and allow for specialized services. However, it is crucial to understand the relationships and responsibilities outlined in your Michigan Subcontractor Agreement for Security Services.

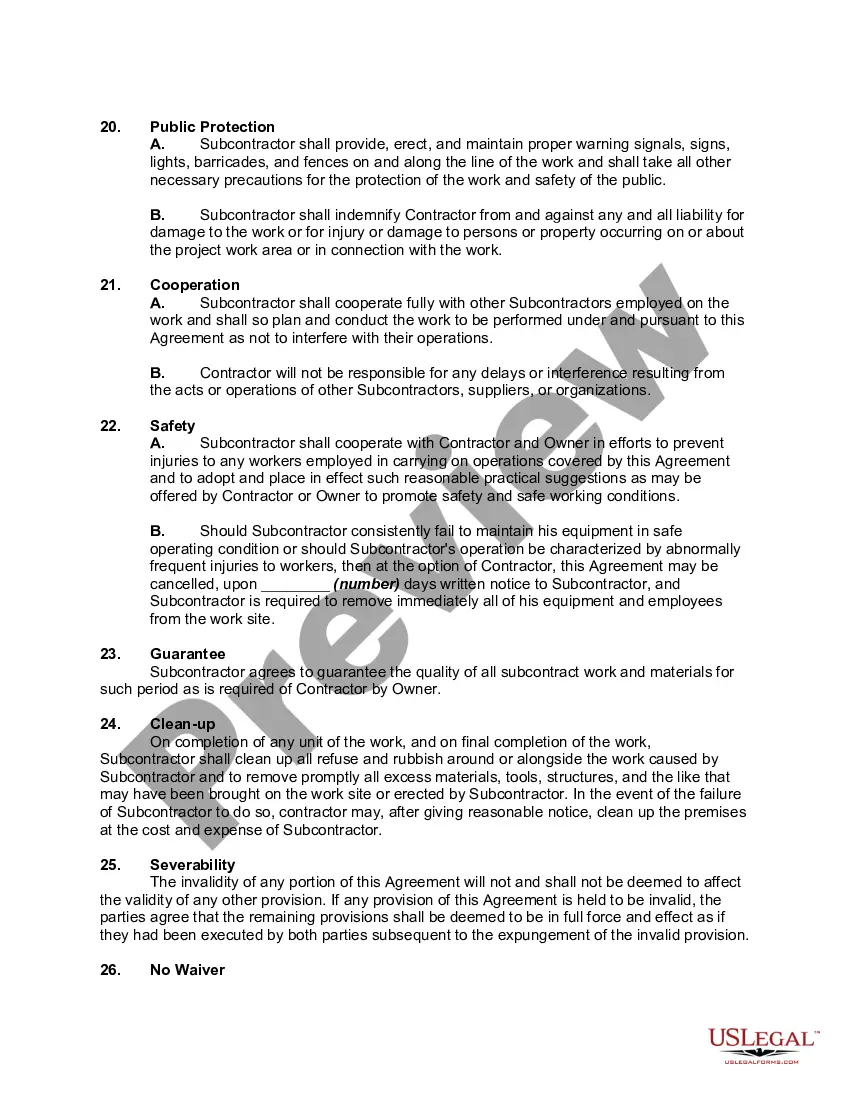

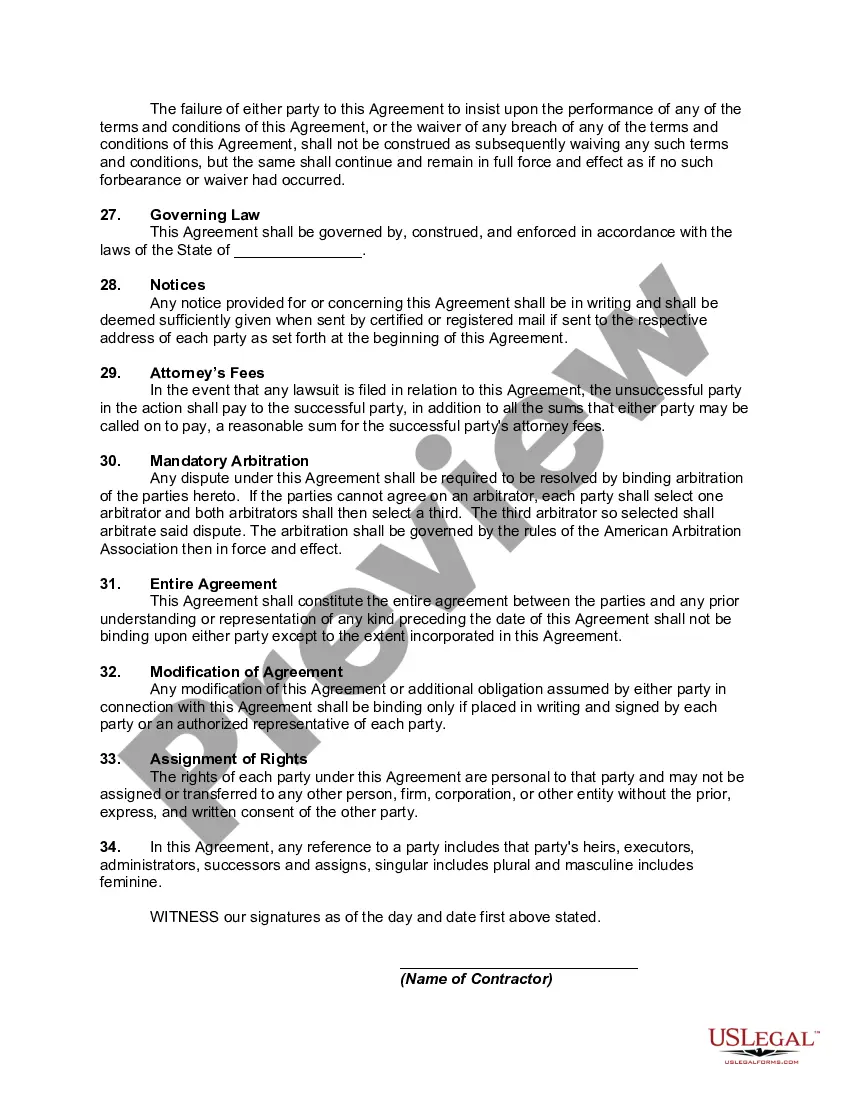

A subcontractor agreement should include essential details like project scope, payment terms, timelines, and legal obligations. Additionally, incorporating clauses for confidentiality and termination ensures that both parties understand their rights and responsibilities. Using a Michigan Subcontractor Agreement for Security Services provides a useful framework for these components.

Writing a contract for security services starts with clearly defining the scope of work, outlining responsibilities, and setting payment terms. Utilize a Michigan Subcontractor Agreement for Security Services to ensure you cover critical elements such as duration, confidentiality, and liability. This comprehensive approach protects both parties and aligns expectations.

There are three main types of subcontractors: general subcontractors, specialty subcontractors, and first-tier subcontractors. Each serves a distinct role, with general subcontractors overseeing the entire project, specialty subcontractors focusing on specific tasks, and first-tier subcontractors working directly with the primary contractor. Choosing the right type depends on your project's scope and needs.

The three primary factors that determine your status as a subcontractor include control, relationship, and the type of work performed. If the primary contractor has significant control over how you complete your tasks, it suggests subcontractor status. To clarify your relationship, consider a Michigan Subcontractor Agreement for Security Services that outlines duties and expectations clearly.

A subcontractor typically works under a primary contractor to fulfill specific project needs, while a 1099 independent contractor operates as a self-employed individual offering services directly to clients. In the context of a Michigan Subcontractor Agreement for Security Services, understanding this distinction helps you structure your business relationships effectively. Both roles are essential, but they involve different responsibilities and contractual obligations.

A subcontractor should fill out the Michigan Subcontractor Agreement for Security Services to establish the terms of their engagement. This agreement serves as a legally binding document that protects both parties' interests. Additionally, if working independently, a subcontractor may need to complete a W-9 form for tax purposes. Utilizing the right forms is essential for compliance and smooth business operations.

Subcontractors usually receive either a 1099-MISC or a 1099-NEC, depending on the nature of their services. If they provide non-employee compensation, they will receive a 1099-NEC. Alternatively, a 1099-MISC is issued for other types of payments. Knowing which form to expect can prepare subcontractors for their tax reporting responsibilities.

Contractors typically fill out Form W-9 when they begin working with subcontractors. This form provides necessary tax information, which is essential for accurate reporting. After the year-end, contractors will use this information to issue a 1099-MISC or 1099-NEC, depending on the work performed. Understanding this process helps contractors comply with IRS regulations.