Michigan Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

Are you in a position where you require documents for various organizations or specific tasks almost every day? There is an abundance of legal document templates available online, but locating trustworthy ones is not easy.

US Legal Forms offers thousands of template variations, including the Michigan Revocable Trust for Minors, which can be generated to comply with both state and federal laws.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. Subsequently, you can download the Michigan Revocable Trust for Minors template.

- Obtain the template you need and ensure it's for the correct city/area.

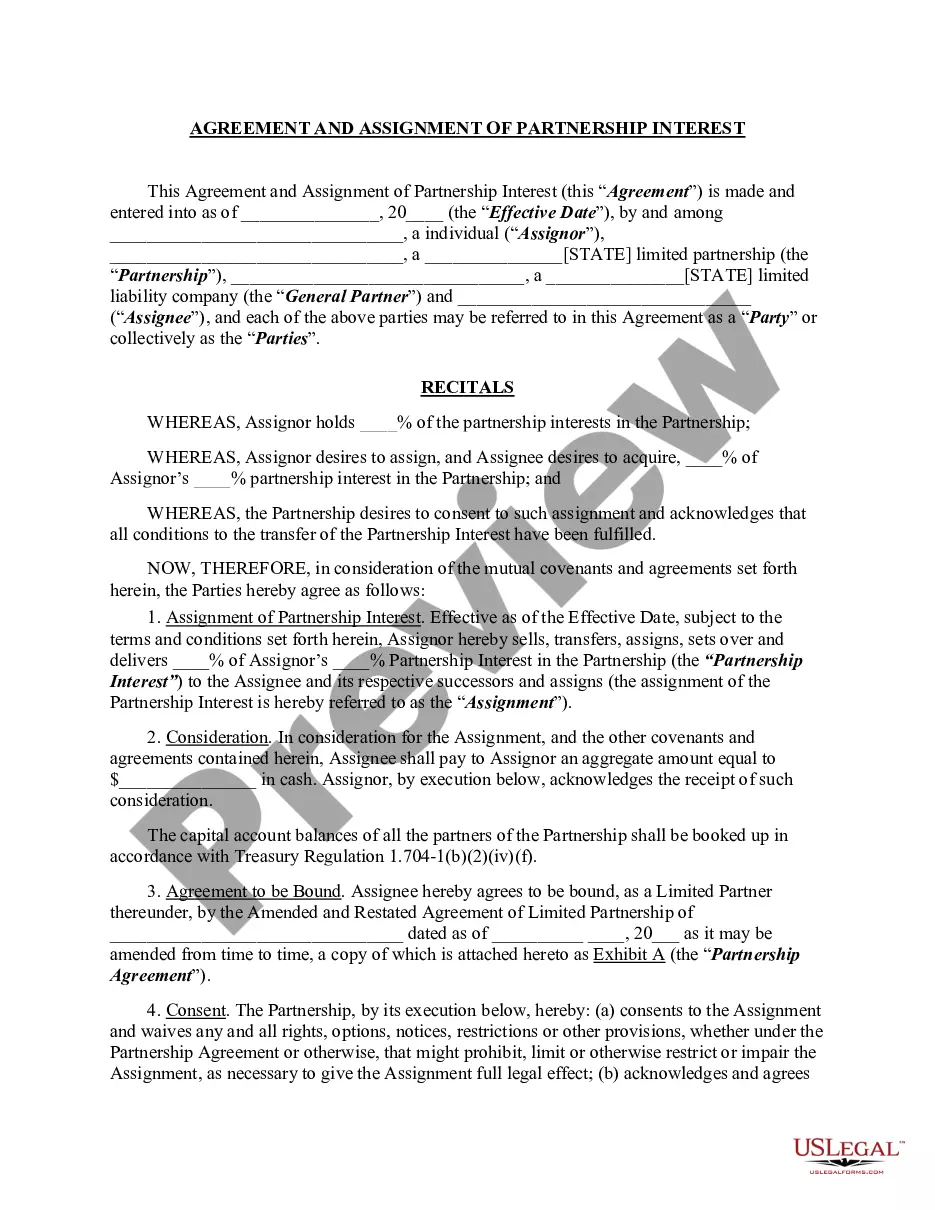

- Utilize the Review button to look over the document.

- Examine the description to confirm that you have chosen the correct version.

- If the document isn’t what you’re looking for, use the Search box to locate a template that meets your requirements.

- When you find the correct document, click Purchase now.

- Select the payment plan you wish, fill in the necessary information to create your account, and complete your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Michigan law recognizes various types of trusts, including a Michigan Revocable Trust for Minors. These trusts allow parents to manage assets for their children, providing a clear mechanism for asset distribution. It’s essential to understand Michigan probate laws and work with a legal expert to establish a trust that aligns with your goals.

Trusts, including the Michigan Revocable Trust for Minors, are not recorded like property deeds in Michigan. They remain private documents that you manage. This privacy protects your family's financial details while ensuring that your wishes are respected.

While a Michigan Revocable Trust for Minors does not need to be notarized to be valid, it is highly encouraged to have your trust documents notarized. Notarization can help prevent disputes regarding the authenticity of the trust. Additionally, some institutions may require notarized documents to accept them for asset management.

A trust, including a Michigan Revocable Trust for Minors, does not need to be recorded or filed with any state office. The trust operates privately, unlike a will that must go through probate. However, some financial institutions might require a copy to manage assets held in trust.

You do not need to file a Michigan Revocable Trust for Minors with the court. Instead, you can keep the trust documentation in a secure location, such as a safe deposit box or with your attorney. You may need to inform your trustee and beneficiaries about its existence and where to find it, ensuring your estate plan is clear.

One negative aspect of a trust, like a Michigan Revocable Trust for Minors, is the potential difficulty in making changes after its initial setup. Trusts can be more rigid compared to wills when it comes to modifications. Moreover, there might be legal fees and administrative costs associated with maintaining the trust. It's essential to understand these limitations while also recognizing the protective benefits a trust can offer.

Setting up a trust, including a Michigan Revocable Trust for Minors, can come with several pitfalls. One common issue is the complexity of managing the trust over time, especially as family dynamics change. Additionally, failing to fund the trust properly can render it ineffective in providing for your minors. To navigate these challenges, consider seeking guidance from the experts at uslegalforms who can help streamline the process.

A notable disadvantage of a family trust, such as a Michigan Revocable Trust for Minors, is the potential loss of control over assets. Once you place assets in the trust, you might feel less connected to those assets. Additionally, while family trusts provide benefits, they also require ongoing maintenance and management. It's crucial to weigh these factors against the long-term benefits of trust establishment.

One of the biggest mistakes parents make when establishing a Michigan Revocable Trust for Minors is failing to clearly outline the distribution terms. Parents might overlook detailed instructions on how and when the funds will benefit their children. This can lead to confusion and potential disputes among family members. By ensuring precise terms and conditions, you can prevent misunderstandings and secure your children's future.

Yes, you can write your own Michigan Revocable Trust for Minors. However, it is crucial to ensure that your trust meets all legal requirements to be valid and enforceable. Although DIY trust creation might seem straightforward, using a professional platform like US Legal Forms can simplify the process and save you from potential pitfalls. By utilizing their resources, you can create a comprehensive trust that secures your assets while effectively providing for your minors.