Michigan Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible on the web, but how do you obtain the correct document you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Michigan Revocable Trust for Estate Planning, which can be used for both business and personal purposes.

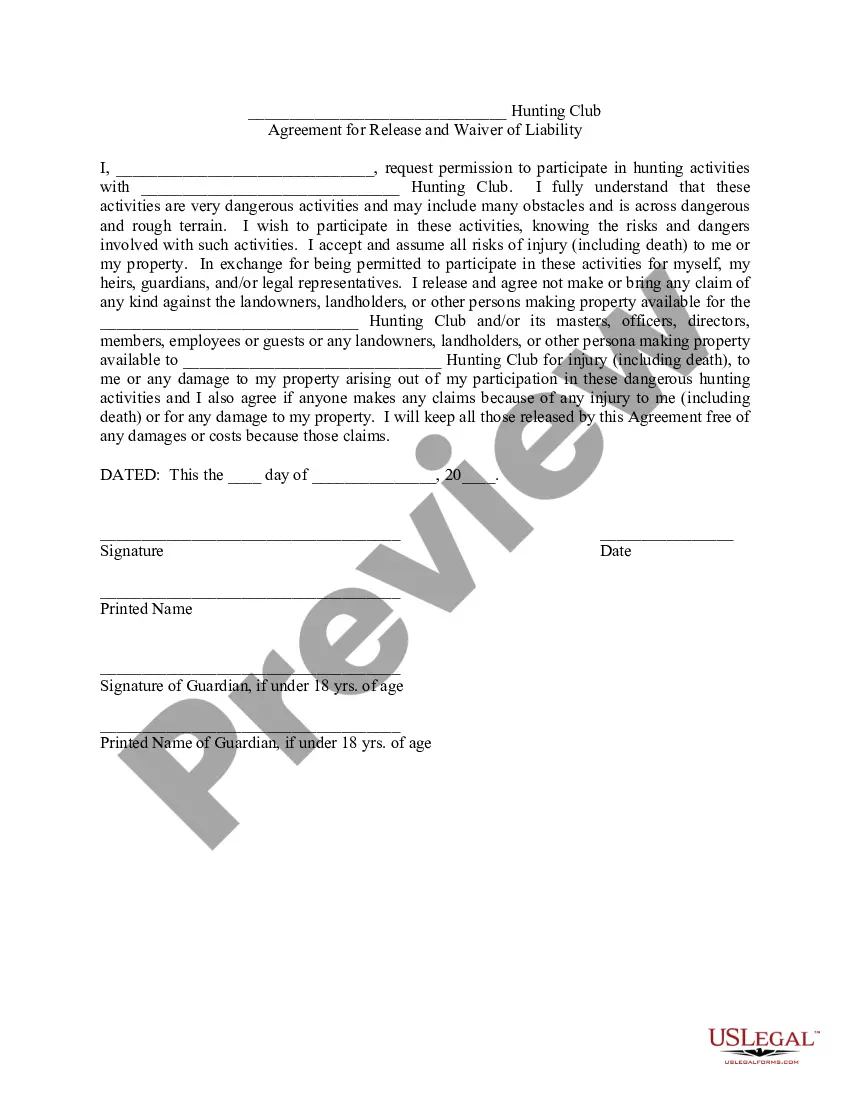

You can explore the form using the Preview button and review the form description to confirm it suits your needs.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Michigan Revocable Trust for Estate Planning.

- Use your account to look up the legal documents you have previously acquired.

- Navigate to the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

In Michigan, a trust does not legally require notarization, but having it notarized can help avoid disputes later. Notarization adds an extra layer of assurance regarding the validity of your Michigan Revocable Trust for Estate Planning. It can be beneficial if questions arise about your intentions or the authenticity of the document.

Setting up a revocable trust in Michigan involves compiling a list of your assets and drafting a trust document. You can create the document yourself or use legal services, such as those offered by uSlegalforms, to help ensure all legal requirements are met. Once the trust is created, the next critical step is to fund it by transferring your assets into the trust.

A trust does not need to be recorded in Michigan; it remains a private document. However, any real estate transferred to the trust will require a deed, which must be recorded. This feature of a Michigan Revocable Trust for Estate Planning helps maintain confidentiality while ensuring asset protection.

Trusts in Michigan are not filed with any government office. Instead, the trust document should be kept in a safe place, and its terms should be communicated to relevant parties, such as your beneficiaries or the trustee. A Michigan Revocable Trust for Estate Planning provides a straightforward way to manage your assets without the need for filing, allowing for a smoother transition of your estate.

One of the most significant mistakes parents make is failing to fund the trust properly. Simply creating a Michigan Revocable Trust for Estate Planning is not enough; you must transfer your assets into the trust to make it effective. Neglecting this step can lead to confusion and unwanted probate proceedings for your children.

Michigan law defines various types of trusts, including revocable and irrevocable trusts. A Michigan Revocable Trust for Estate Planning allows you to modify or revoke the trust during your lifetime. It is essential to understand the specific legal requirements and implications of each type to ensure your estate plan reflects your wishes.

Yes, a properly structured trust can help avoid the probate process in Michigan. When you place your assets in a Michigan Revocable Trust for Estate Planning, those assets typically pass directly to your beneficiaries upon your death, without the need for probate court proceedings. This not only saves time but also reduces associated costs and simplifies the transfer of your estate.

In Michigan, trusts are generally not recorded with the state. Instead, a trust operates privately and does not require registration. However, certain documents related to property transfers within a trust may need to be recorded. Using a Michigan Revocable Trust for Estate Planning allows you to maintain privacy while managing your assets effectively.

One downside of a Michigan Revocable Trust for Estate Planning is that it does not provide asset protection from creditors. While you can control your assets during your lifetime, they can still be accessed by creditors if you face financial issues. Additionally, a revocable trust may require ongoing management, including updating the trust as your assets or circumstances change. It is essential to understand these limitations when considering a Michigan Revocable Trust for your estate planning needs.

Certain assets typically cannot be placed in a revocable trust, such as retirement accounts like IRAs or 401(k)s, which have specific beneficiary designations. Additionally, assets that require transfer to title, like vehicles, may have their own rules. However, a Michigan Revocable Trust for Estate Planning can encompass various assets, such as real estate and bank accounts, giving you flexibility in your estate planning. Always consult with a professional to ensure proper asset placement.