Michigan Shipping and Order Form for Software Purchase

Description

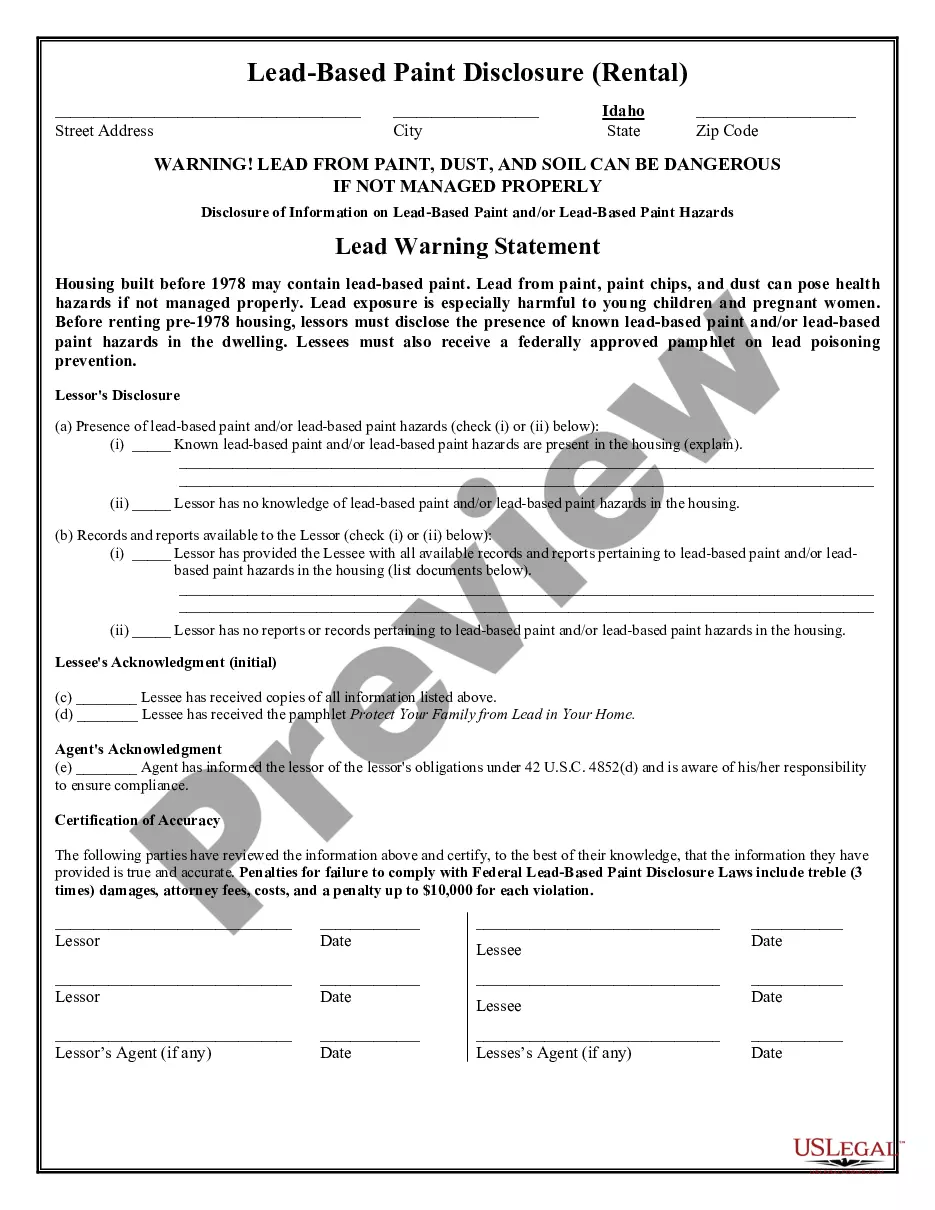

How to fill out Shipping And Order Form For Software Purchase?

You can spend countless hours online attempting to locate the legitimate form template that complies with the state and federal regulations you require.

US Legal Forms offers a vast array of legal documents that can be reviewed by specialists.

You can download or print the Michigan Shipping and Order Form for Software Purchase from my support.

If you need to find another version of the form, utilize the Search box to identify the template that meets your preferences and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, edit, print, or sign the Michigan Shipping and Order Form for Software Purchase.

- Every legal document template you obtain is yours indefinitely.

- To access another copy of the purchased form, go to the My documents section and click the respective option.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have chosen the correct form template for your desired state/city.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price (including shipping and handling charges) of their taxable retail sales to the State of Michigan.

For the most part, if you ship taxable items, then all shipping charges are taxable. And if you ship all non-taxable items in a parcel, then the shipping charges for that parcel are non-taxable.

What Services Are Subject To Use Tax? Most telecommunications, hotel/motel type accommodations, and industrial laundry services have been subject to Michigan use tax for many years. These services continue to be subject to the tax.

In Michigan, sales tax applies to delivery and installation charges applied before the transfer of ownership occurs. When delivery and installation occurs after ownership has transferred to the buyer, delivery and installation charges are exempt.

In Michigan, certain goods are subject to the 6% sales tax while certain services are subject to a 6% use tax that is imposed on the purchaser or consumer of services for the privilege of using that service in this State.

Goods that are subject to sales tax in Michigan include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.

Traditional Goods or Services Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.

A contractor incurs sales and use tax responsibilities as a consumer in the business of constructing, altering, repairing, or improving real estate for others. A. A contractor is required to pay sales or use tax on all items used to provide his or her service, including equipment, supplies, and materials.

Sales Tax. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price (including shipping and handling charges) of their taxable retail sales to the State of Michigan.

In the state of Michigan, services are not generally considered to be taxable.