Michigan Shareholders Agreement - Short Form

Description

How to fill out Shareholders Agreement - Short Form?

Selecting the optimal legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how will you locate the legal format you need.

Utilize the US Legal Forms website.

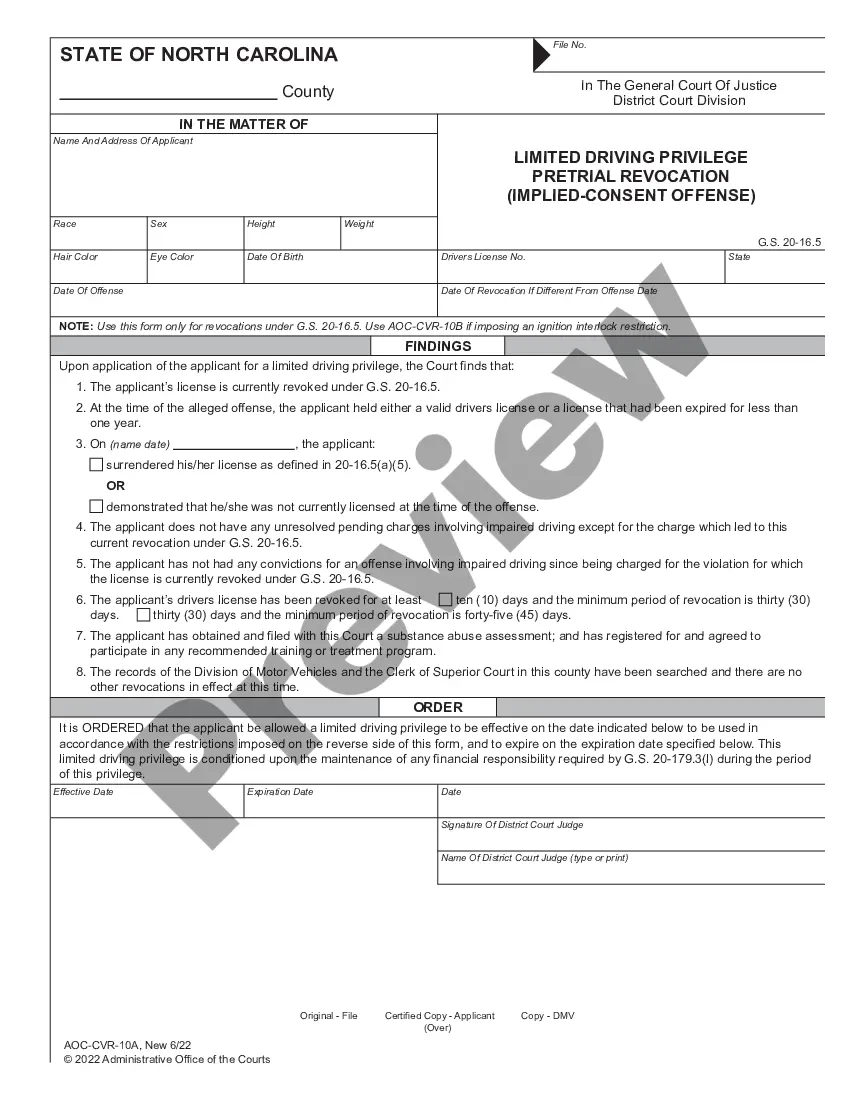

First, ensure you have selected the appropriate form for your jurisdiction. You can review the form using the Review button and check the form details to confirm it is the right one for you.

- The service provides thousands of templates, such as the Michigan Shareholders Agreement - Short Form, suitable for business and personal needs.

- All forms are evaluated by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Michigan Shareholders Agreement - Short Form.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

Form popularity

FAQ

The primary difference between an S Corp and a C Corp in Michigan lies in their taxation structure. An S Corp allows income to pass through to shareholders, avoiding double taxation, whereas a C Corp is taxed at both the corporate and personal levels. When forming your business structure, it's wise to consider a Michigan Shareholders Agreement - Short Form to facilitate any necessary agreements among shareholders regarding their interests.

To set up a shareholders agreement, gather the involved parties and discuss key aspects such as decision-making processes, roles, and profit distribution. Drafting a comprehensive document that outlines each shareholder's rights and obligations is crucial. Consider using a Michigan Shareholders Agreement - Short Form to streamline the process and ensure that all critical components are addressed efficiently.

There is no specific minimum income required for an S Corp in Michigan, but you need to generate enough profit to cover operating expenses and shareholder distributions. Generally, achieving a profit that allows for meaningful distributions is essential for tax benefits. Keep in mind that using a Michigan Shareholders Agreement - Short Form can help outline how income will be allocated among shareholders.

Filing an S Corp in Michigan begins with selecting a business name and completing the Articles of Incorporation. After that, you need to file Form 2553 with the IRS to elect S Corporation status. Utilizing a Michigan Shareholders Agreement - Short Form will help ensure that you are prepared for shareholder discussions and responsibilities from the very beginning.

An LLC, or Limited Liability Company, provides flexibility in management and tax treatment, while an S Corporation has stricter operational processes and taxation benefits. The key distinction lies in taxation, as an S Corp can avoid double taxation since profits pass directly to shareholders. To make informed choices about your business formation and a Michigan Shareholders Agreement - Short Form, understand these differences.

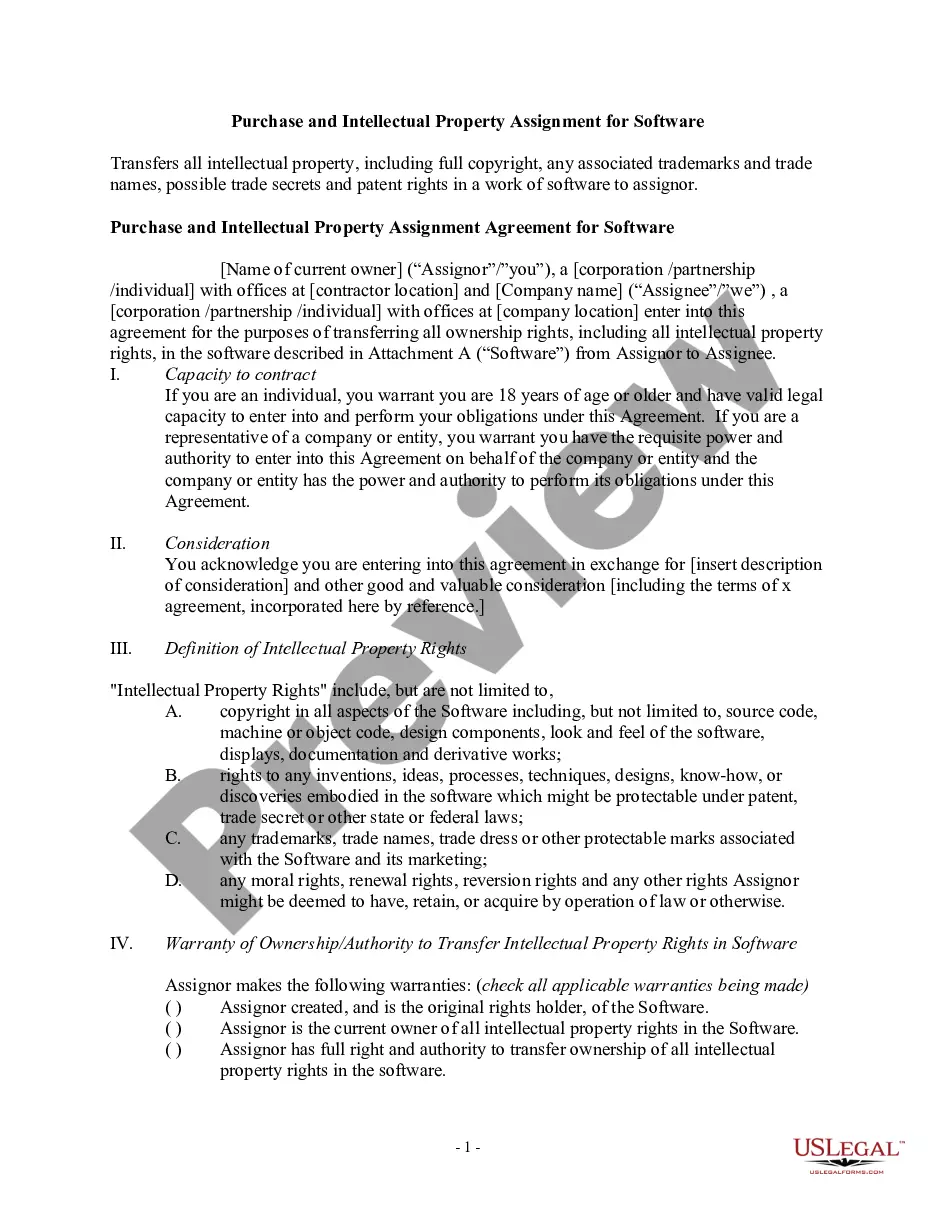

Writing a Michigan Shareholders Agreement - Short Form involves detailing key elements such as the purpose of the agreement, the roles of each shareholder, and decision-making processes. Start with an introduction that highlights the agreement's intent, followed by specific clauses covering management, profit distribution, and transfer of shares. To simplify this task, consider using the USLegalForms platform, which offers templates that guide you through each step of the writing process, ensuring comprehensive coverage of necessary topics.

To structure a Michigan Shareholders Agreement - Short Form, begin by outlining the essential terms, such as shareholder rights, obligations, and governance procedures. Clearly define how shares will be issued, transferred, and valued. Incorporate provisions for dispute resolution and exit strategies, ensuring all parties' interests are protected. Utilizing a structured format can streamline the process and make the document easier to understand.

The shareholder agreement document is a legally binding contract that delineates the roles, rights, and responsibilities of shareholders. A Michigan Shareholders Agreement - Short Form captures key elements like voting rights, dividend distribution, and procedures for resolving conflicts. Utilizing such a document allows businesses to establish a solid foundation for relationships among shareholders and creates transparency in governance.

The common abbreviation for shareholder agreement is SHA. In the context of a Michigan Shareholders Agreement - Short Form, using this abbreviation can help streamline discussions around legal documents. However, clarity is essential, so don’t hesitate to use the full term when necessary for comprehensive communication.

Another common name for a shareholder agreement is a stockholders agreement. Whether you refer to it as a Michigan Shareholders Agreement - Short Form or a stockholders agreement, its primary function remains the same: to outline the rights and obligations of shareholders in a clear and organized manner. This clarity can lead to more effective corporate governance.