Michigan Sample Letter to State Tax Commission sending Payment

Description

How to fill out Sample Letter To State Tax Commission Sending Payment?

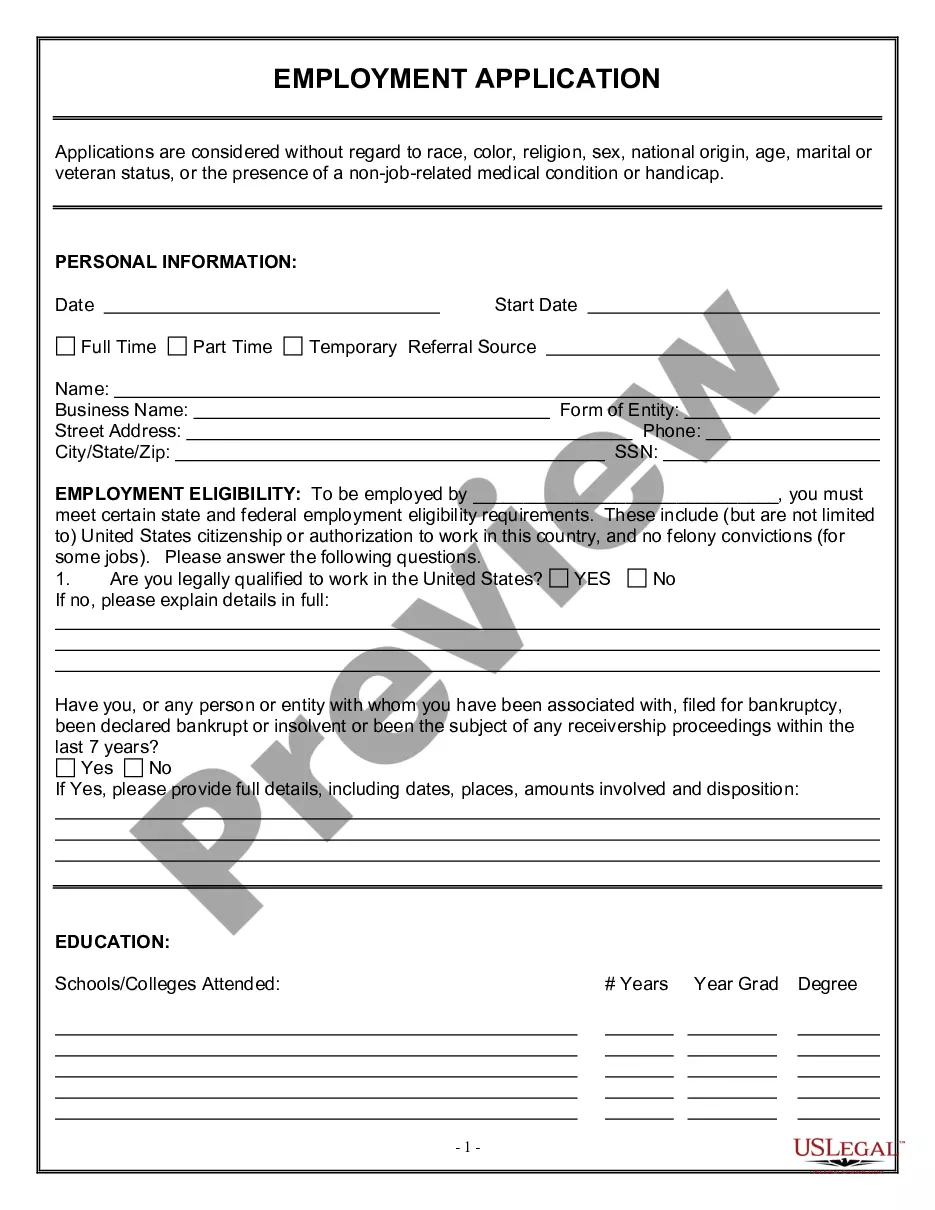

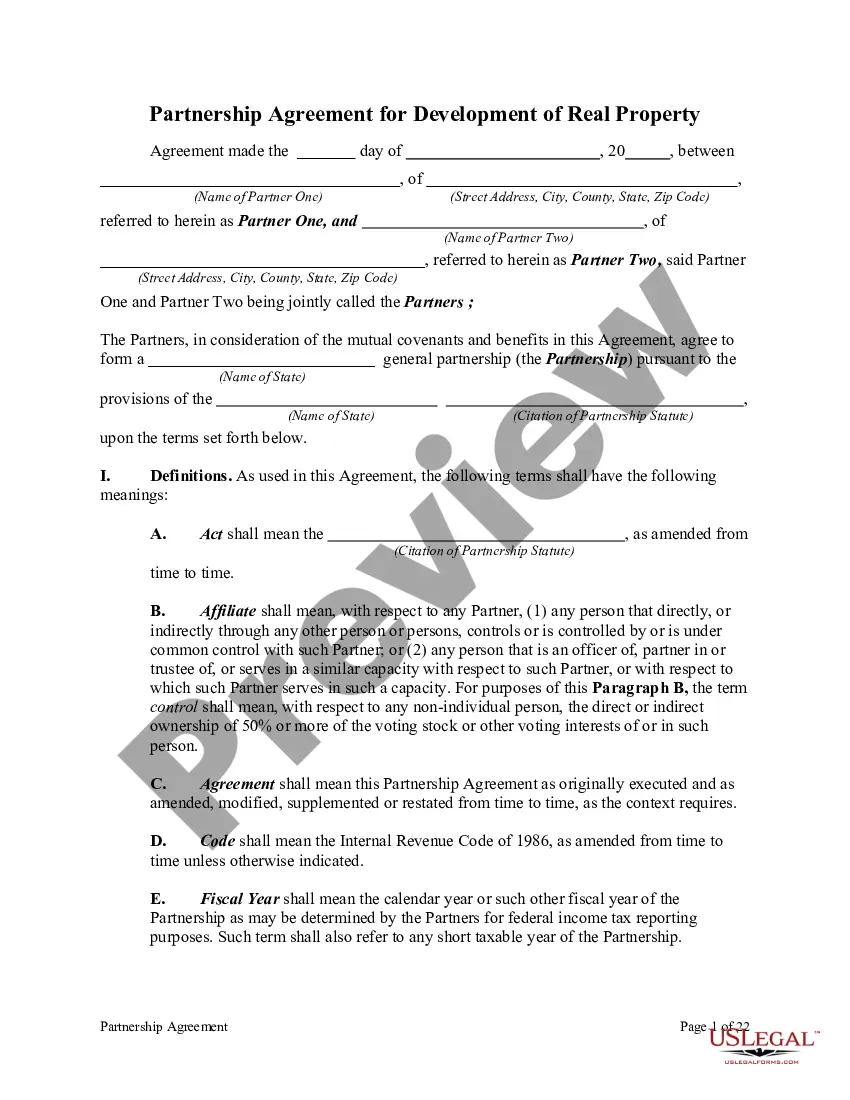

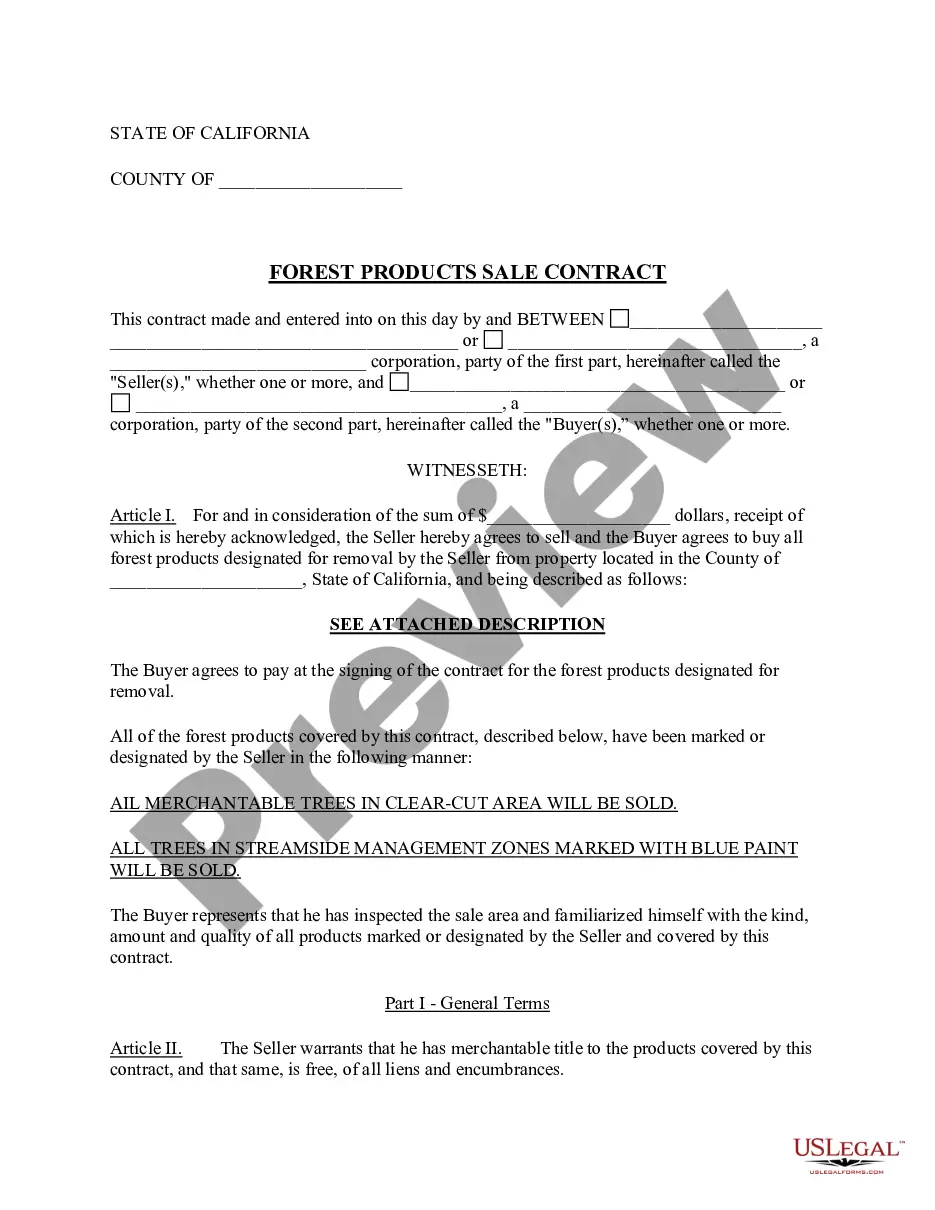

Have you ever been in a situation where you require documents for potential business or personal reasons almost every day? There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of form templates, including the Michigan Sample Letter to State Tax Commission for submitting Payment, that are designed to comply with both federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Michigan Sample Letter to State Tax Commission for sending Payment template.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Sample Letter to State Tax Commission for sending Payment at any time, if needed. Just select the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal templates, to save time and minimize errors. The service provides accurately crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- Obtain the form you require and ensure it is for the correct city/region.

- Use the Preview feature to review the document.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search feature to find the form that suits your needs and specifications.

- Once you find the appropriate form, click Buy now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

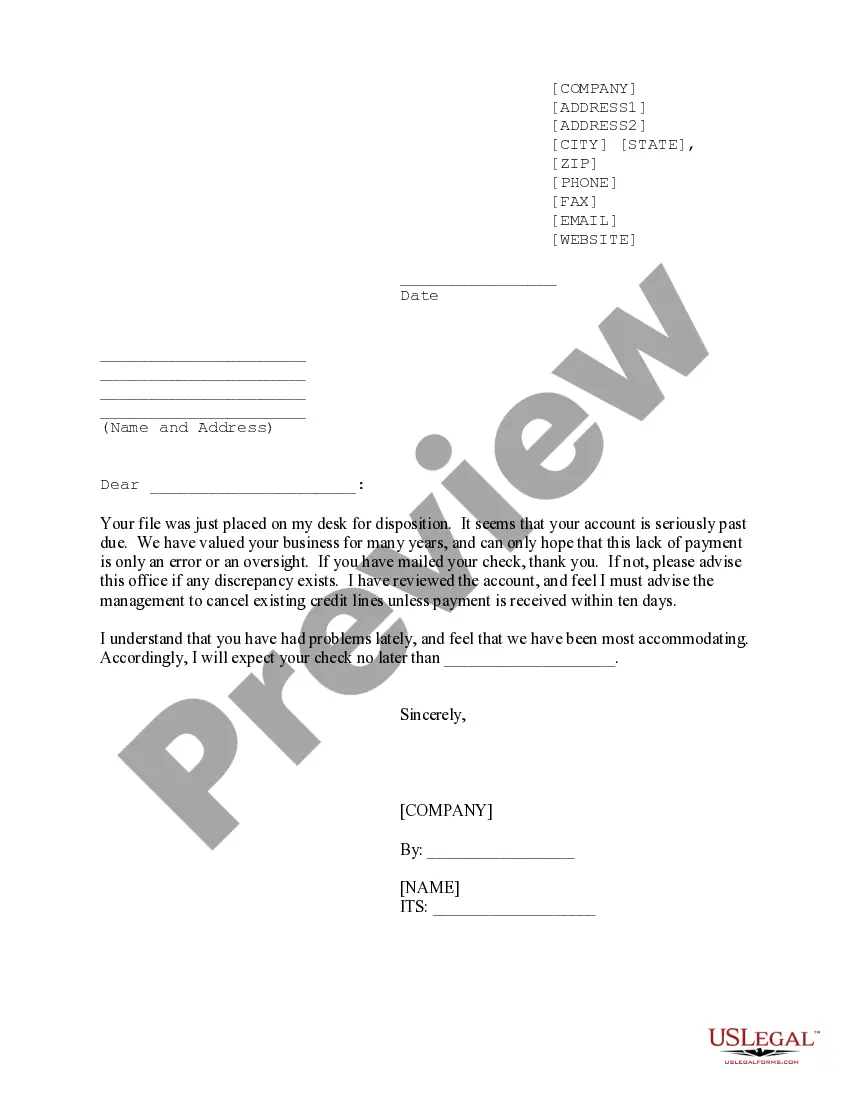

Prepare a cashier's check, personal check, or money order payable to State of Michigan. Include your name, last four digits of your Social Security number, and the invoice number on the remittance.

We will send a letter/notice if: You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity. We need additional information.

Make your check payable to the "State of Michigan". Always write your unique identifier or federal identification number on your check.

Payments can be made prior to receiving a Notice of Intent/Final Bill for Taxes Due by using the Michigan Individual Income Tax e-Payments system. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury, P.O. Box 30774, Lansing MI 48929.

All businesses are required to file an annual return each year. Remit withholding taxes on or before the same day as the federal payments regardless of the amount due. Payment must be made by EFT using an EFT Credit or EFT Debit payment method.

Payments can be made prior to receiving a Notice of Intent/Final Bill for Taxes Due by using the Michigan Individual Income Tax e-Payments system. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury, P.O. Box 30774, Lansing MI 48929.

Make a Payment Payments can be made via Michigan Treasury Online (MTO) using an e-check or credit card (fees are applicable). All cash payments for MRE must include form 5677 Marihuana Retailers Excise Tax Payment Voucher. All cash payments for SUW must include form 5094 Sales, Use and Withholding Payment Voucher.