Michigan Agreement Adding Silent Partner to Existing Partnership

Description

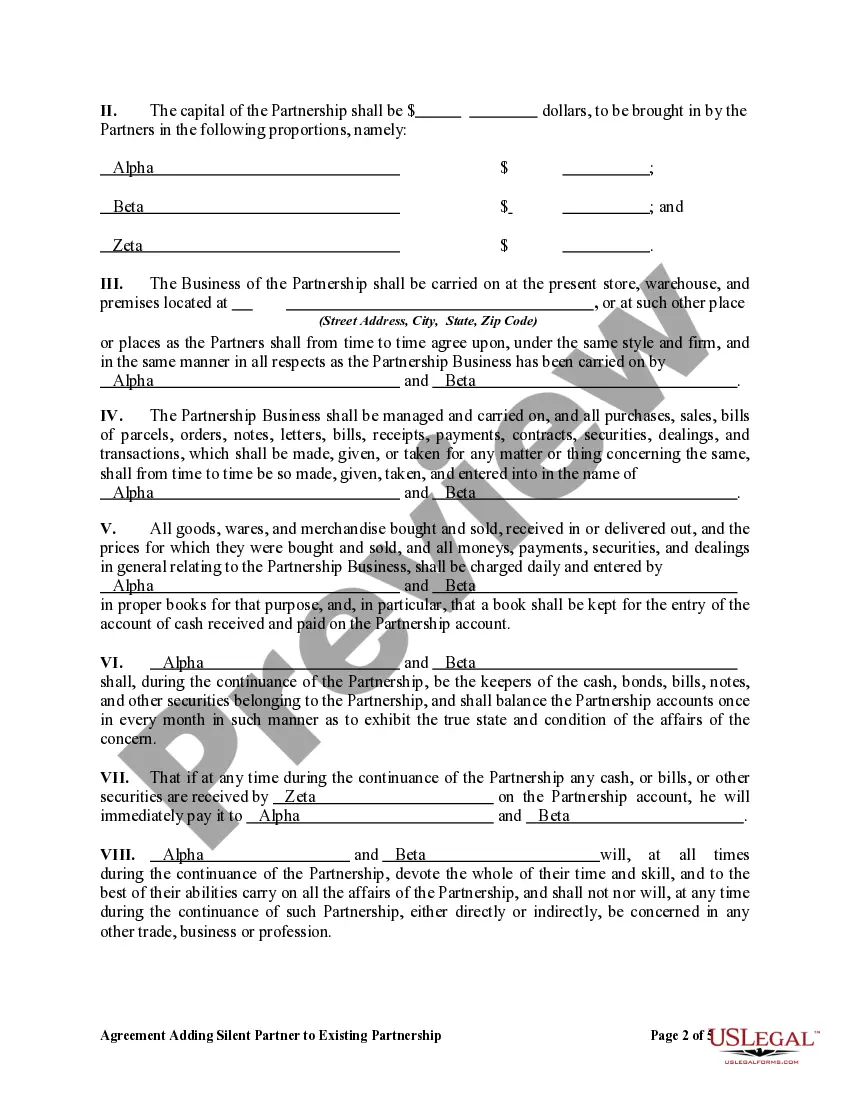

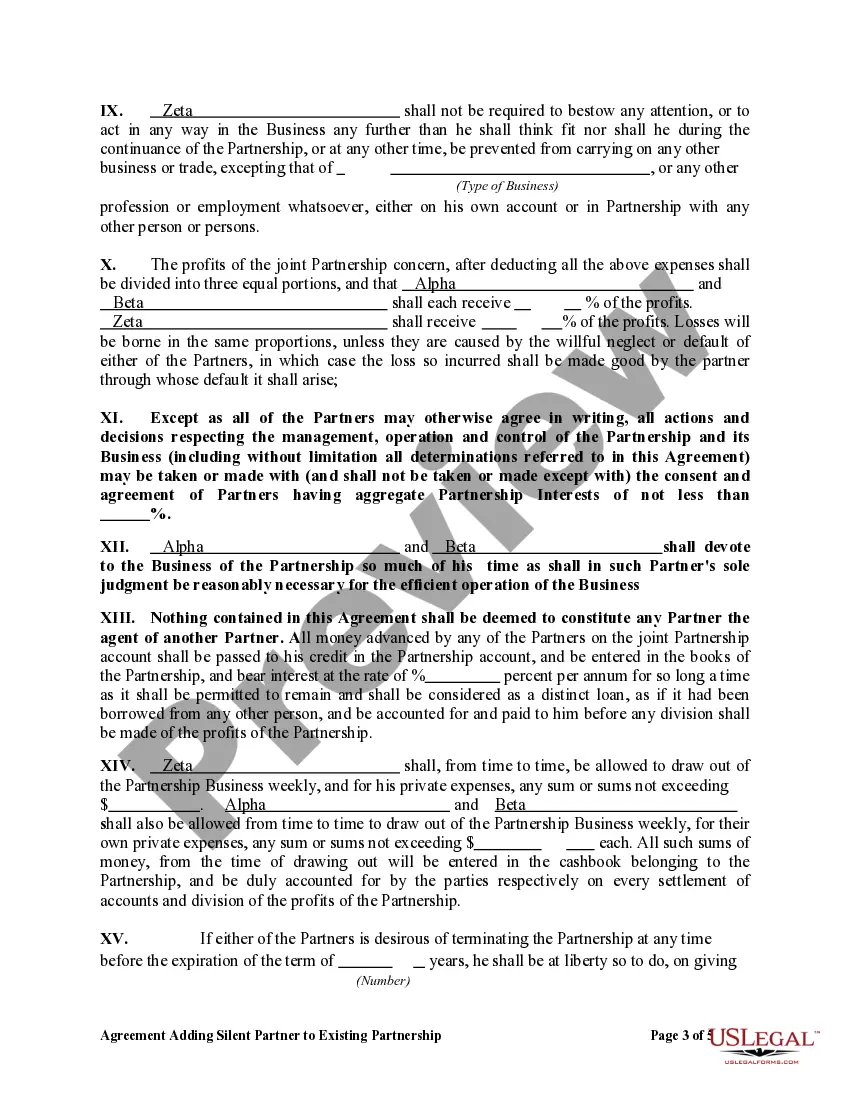

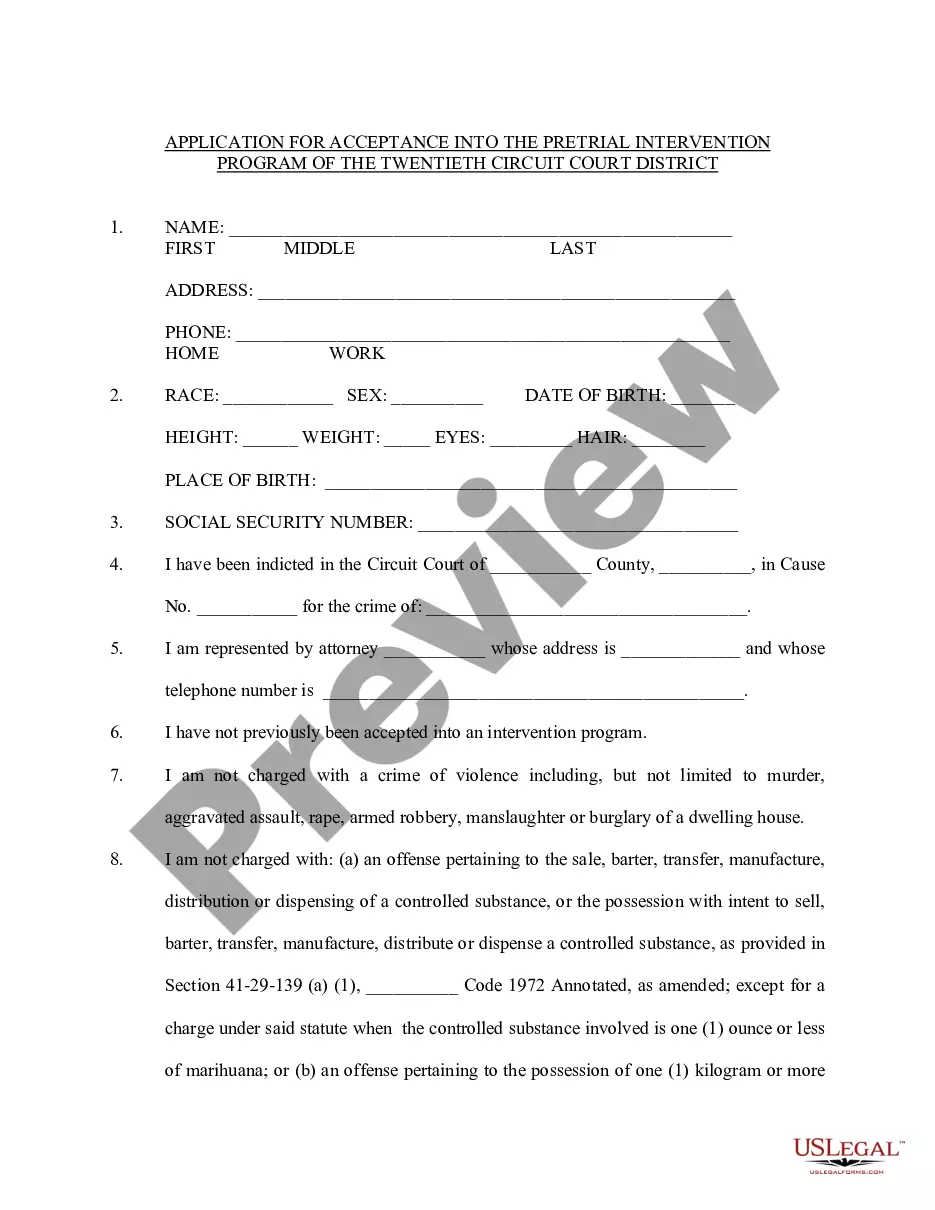

How to fill out Agreement Adding Silent Partner To Existing Partnership?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal document templates that you can download or print.

Using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Michigan Agreement Adding Silent Partner to Existing Partnership in just a few minutes.

If you already have a membership, Log In and retrieve the Michigan Agreement Adding Silent Partner to Existing Partnership from the US Legal Forms collection. The Download option will appear on every document you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the document to your device. Make modifications. Complete, edit, and print and sign the saved Michigan Agreement Adding Silent Partner to Existing Partnership. Every template you add to your account does not expire and is yours permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the document you need.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct document for your city/region.

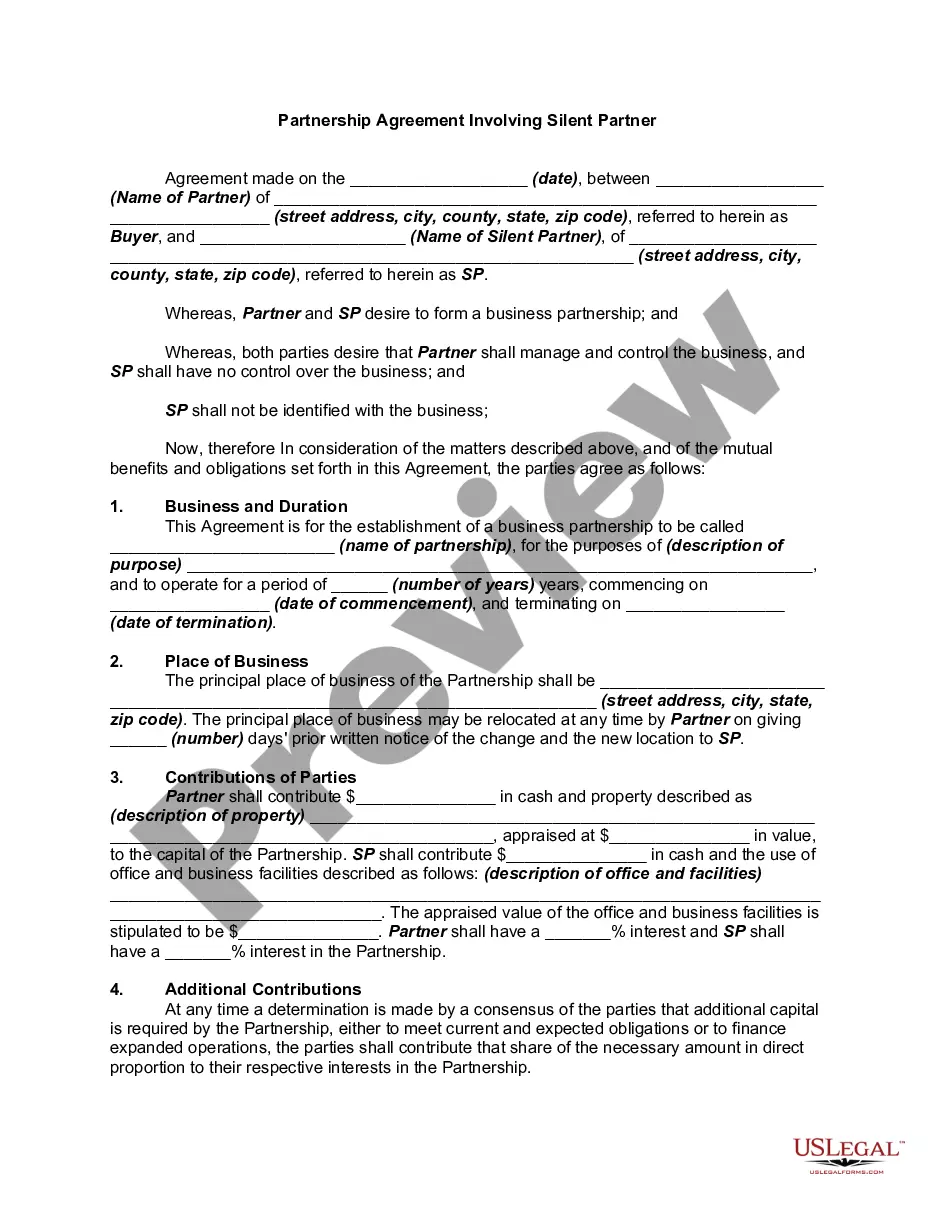

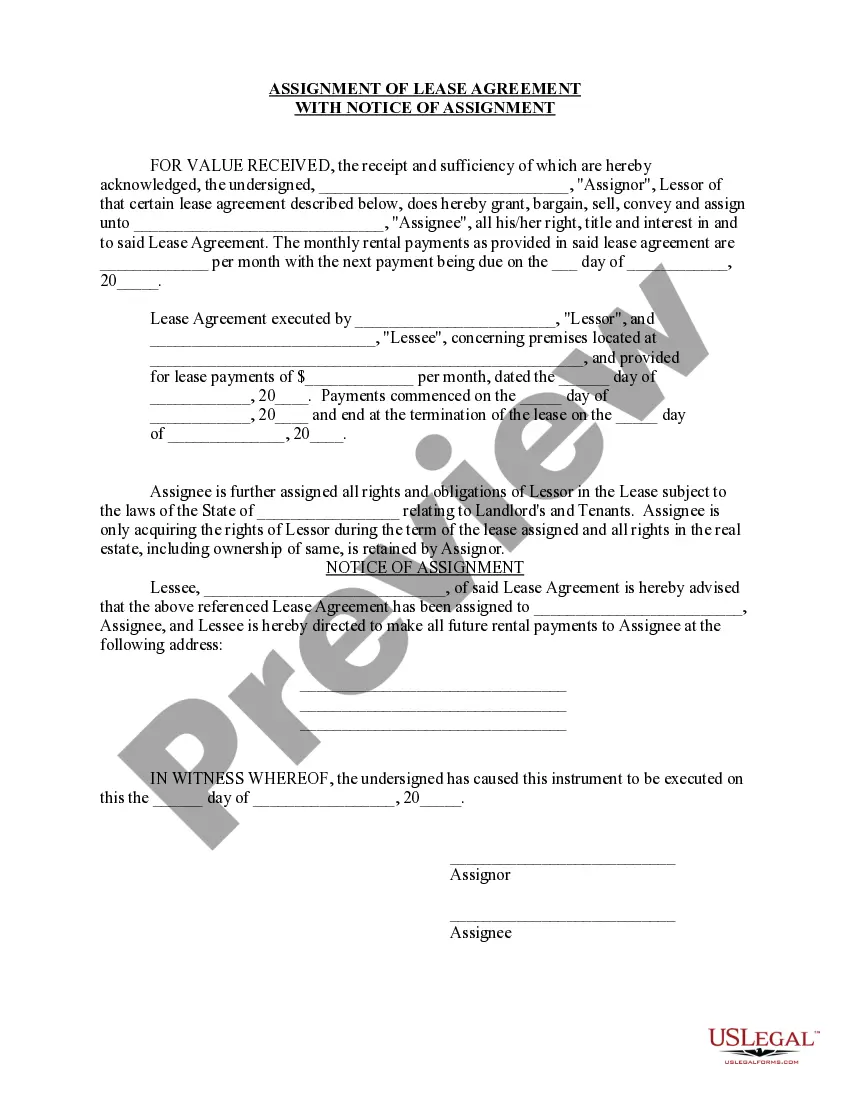

- Click the Review button to examine the document’s content.

- Check the document's description to ensure you've chosen the right one.

- If the document doesn’t meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy Now button. Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

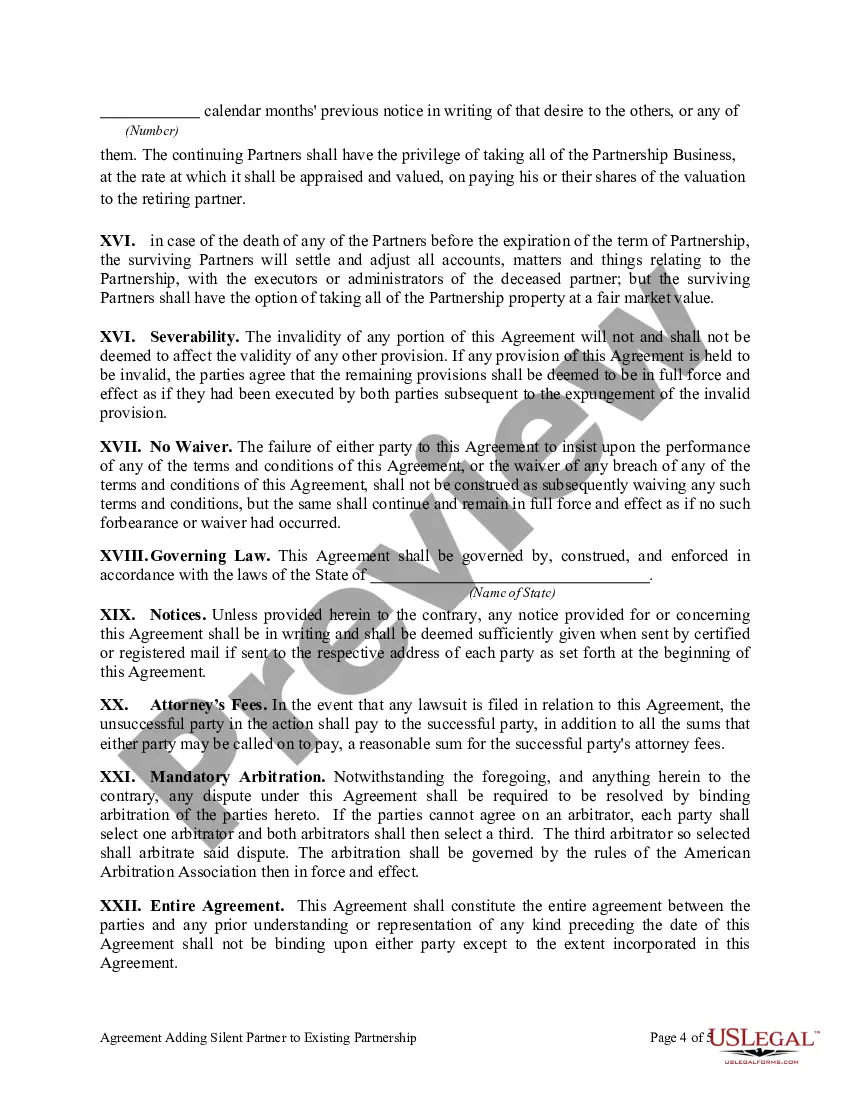

When a partnership deed is silent on key matters, it creates uncertainty regarding the management and operations of the partnership. This ambiguity can lead to conflicts, particularly regarding profit-sharing, decision-making, and partner roles. By implementing a Michigan Agreement Adding Silent Partner to Existing Partnership, partners can address these silent gaps, fostering a more harmonious and well-defined working relationship.

To resolve issues within a silent partnership deed, partners should hold discussions to clarify each one's expectations and obligations. If this proactive communication fails, they may need to draft an amended agreement to formalize their decisions. A Michigan Agreement Adding Silent Partner to Existing Partnership serves as an effective tool for documenting these changes and ensuring all partners are accountable.

If a partnership deed is silent on important matters, partners should first discuss and attempt to reach a mutual agreement. If consensus cannot be reached, it may be necessary to refer to state laws governing partnerships for guidance. Utilizing a Michigan Agreement Adding Silent Partner to Existing Partnership can prevent future misunderstandings and provide a structured approach for resolving any unaddressed issues.

When a partnership agreement is silent, it means that it does not address specific issues or scenarios that may arise during the partnership. This can lead to confusion or disputes among partners, as there are no agreed-upon guidelines in place. A Michigan Agreement Adding Silent Partner to Existing Partnership can help clarify these ambiguities, ensuring that all partners are on the same page regarding their roles and contributions.

To admit a new partner into an existing partnership, the current partners typically need to agree on the terms of the admission. This often involves amending the partnership agreement to include the new partner's rights and responsibilities. It is advisable to use a Michigan Agreement Adding Silent Partner to Existing Partnership template to ensure that all legal nuances are covered adequately. This document sets clear expectations and protects the interests of both existing and new partners.

Adding someone as a partner in an LLC requires an amendment to your operating agreement. A Michigan Agreement Adding Silent Partner to Existing Partnership is useful in detailing the new partner’s contributions and share of profits. Utilize tools like UsLegalForms to draft and execute this document correctly, ensuring compliance with state laws.

To add a business partner to your existing enterprise, you need to create a formal agreement that includes the new partner's roles and contributions. A Michigan Agreement Adding Silent Partner to Existing Partnership can facilitate this process by establishing clear terms. Consider using UsLegalForms to guide you through the necessary steps to make this transition smooth.

To add a partner to your existing company, start by reviewing your operating agreement or partnership contract. You should prepare a Michigan Agreement Adding Silent Partner to Existing Partnership to reflect the new partner’s involvement and contributions. This legal document serves to protect all parties and ensures clarity.

Yes, you can add a partner to your company, but the process depends on your current business agreements. Utilizing a Michigan Agreement Adding Silent Partner to Existing Partnership can clarify the roles, responsibilities, and profit-sharing. It is advisable to seek guidance from legal professionals or platforms like UsLegalForms to streamline the process.

To add a partner to your existing business, first review your business structure and existing partnership agreements. A Michigan Agreement Adding Silent Partner to Existing Partnership will help you outline the terms and contributions. Make sure to consult legal experts or tools like UsLegalForms to ensure all necessary procedures are followed.