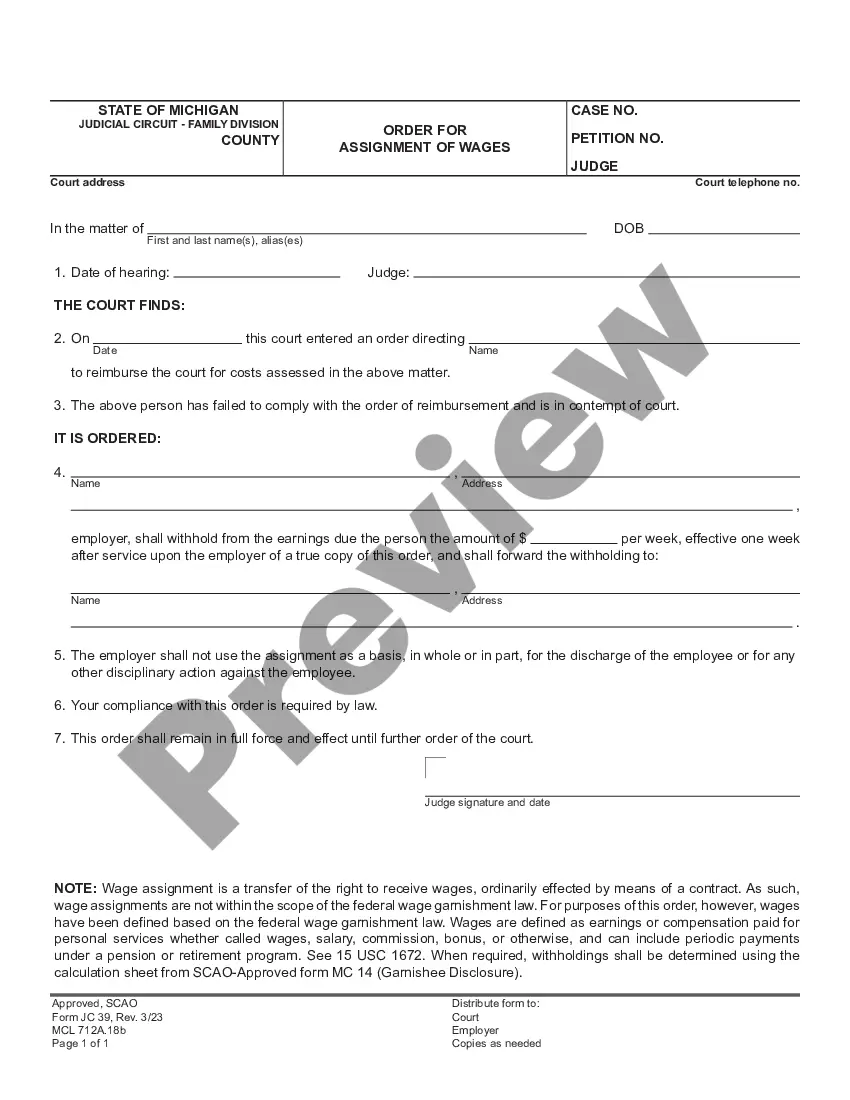

Michigan Order For Assignment of Wages (also known as wage assignment) is a court order that allows a creditor to collect on an unpaid debt, such as a loan or court judgment, by deducting money from the debtor’s wages. The creditor may file a request with the court to issue an Order For Assignment of Wages, which will direct the debtor’s employer to deduct the debt from the debtor’s wages and send it directly to the creditor. There are two types of Michigan Order For Assignment of Wages: voluntary and involuntary. Voluntary wage assignments are those where the debtor agrees to have money deducted from their wages and sent to the creditor. Involuntary wage assignments are those that are ordered by a court without the debtor’s permission. Both types of wage assignments are legally binding and must be followed by the debtor and the employer.

Michigan Order For Assignment of Wages

Description

Key Concepts & Definitions

Order for Assignment of Wages: This is a legal order whereby an employer is required to withhold a portion of an employee's earnings to pay off debts such as child support, consumer credit, or student loans. Wage Garnishments: This involves legally withholding part of an employee's wage for the payment of a debt. Wage Assignment: Voluntary agreements signed by the employee to direct a portion of their wages to creditors.

Step-by-Step Guide on Implementing Wage Garnishments

- Understand Legal Requirements: Employers must familiarize themselves with federal and state garnishment laws which dictate the allowable amount and types of earnings that can be garnished.

- Employer Notification: Upon receiving a wage garnishment order, employers are required to notify the employee. This process is regulated to ensure compliance with privacy standards.

- Payroll Adjustments: The employer's payroll accounting team must adjust the payroll system to deduct the required amount from the employee's paycheck until the debt is fully paid.

- Remit Payments: Collected amounts must be forwarded to the appropriate agency or creditor as directed by the order.

Risk Analysis of Wage Garnishment

- Legal Risks: Non-compliance with garnishment laws can lead to penalties, legal fees, and reputational damage.

- Financial Risks: Incorrect handling of garnishments can impact financial management due to possible errors in payroll processing and resource allocation.

- Employee Relations: Mishandling wage garnishments can result in strained relationships with employees, affecting team morale and productivity.

Pros & Cons of Wage Assignments

- Pros: Facilitates timely debt repayment, can be voluntary, and may involve less administrative strain than garnishments.

- Cons: Can impact an employees morale and financial stability if not managed with sensitivity. Potential legal complexities if revoked by the employee.

Best Practices in Handling Wage Garnishments

- Clear Communication: Regularly update and inform impacted employees about the status and details of the garnishment.

- Maintain Compliance: Continually review garnishment laws to ensure all practices are compliant with current regulations.

- Audit and Documentation: Conduct regular audits on the garnishment process and keep detailed records to protect against possible disputes or audits.

Common Mistakes & How to Avoid Them

- Ignoring Notices: Failing to act on garnishment notices can lead to penalties. Ensure that all notices are addressed promptly.

- Overlooking State Laws: Federal laws set the baseline for wage garnishments but always consider state-specific laws which may have stricter regulations.

- Inadequate Record Keeping: Maintain clear records of all garnishment activities to ensure compliance and resolve discrepancies efficiently.

FAQ

What is the maximum percentage that can be garnished from an employees wages? According to federal law, the lower of 25% of an employee's disposable earnings or the amount by which their weekly wages exceed 30 times the federal minimum wage can be garnished. Can an employee be fired for having a wage garnishment order? No, under the Consumer Credit Protection Act, an employer cannot dismiss an employee solely because of a single wage garnishment; however, this protection does not extend to multiple garnishments.

How to fill out Michigan Order For Assignment Of Wages?

If you're seeking a method to effectively prepare the Michigan Order For Assignment of Wages without employing a legal expert, then you're in the right place.

US Legal Forms has established itself as the most comprehensive and trustworthy library of official templates for every personal and business circumstance. Each document you find on our online service is crafted in accordance with federal and state laws, so you can be assured that your paperwork is accurate.

Another great aspect of US Legal Forms is that you will never misplace the documents you acquired - you can locate any of your downloaded forms in the My documents section of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or navigating through the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to find another template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are certain the paperwork meets all the standards.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The template will be available for download immediately after.

- Choose the format in which you wish to receive your Michigan Order For Assignment of Wages and download it by clicking the corresponding button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Form popularity

FAQ

To garnish someone's wages in Michigan, you must first obtain a Michigan Order For Assignment of Wages from the court. This process begins by filing a complaint to secure a judgment against the debtor. Once you have the judgment, you can request the order, which directs the employer to withhold a portion of the employee's wages. Utilizing a platform like US Legal Forms can help you navigate the legal paperwork and ensure compliance with Michigan laws.

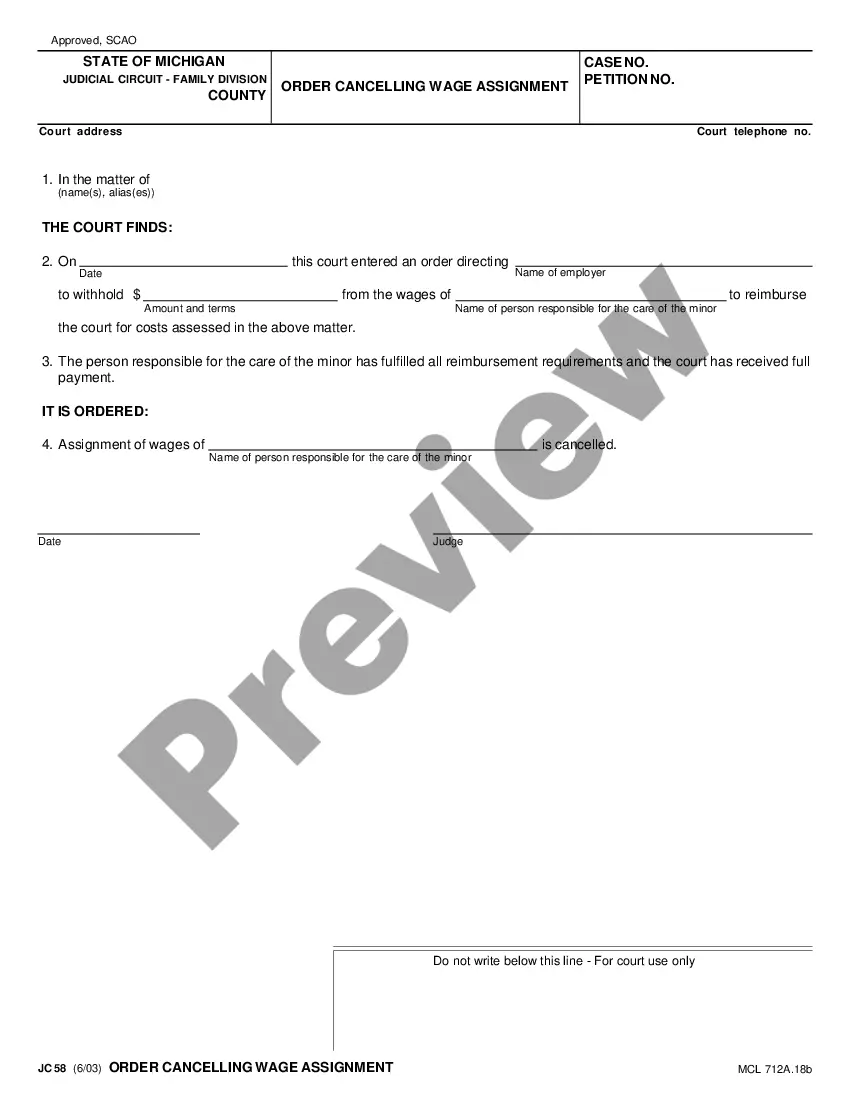

To write a revoke wage assignment letter, start by clearly stating your intent to revoke the Michigan Order For Assignment of Wages. Include your name, address, and any relevant account details to ensure the recipient understands your request. It is also important to mention the date of the original assignment and any necessary reference numbers. Finally, send the letter to your employer or the relevant agency, and consider using certified mail to confirm receipt.

Employers must comply with valid wage assignments, including those resulting from a Michigan Order For Assignment of Wages. Failure to comply can lead to legal repercussions for the employer. Understanding your rights and the obligations of your employer is vital. For more information and resources, consider exploring US Legal Forms, which can guide you through the compliance process.

Yes, employers in Michigan are required to honor voluntary wage assignments, including those established through the Michigan Order For Assignment of Wages. However, they must ensure the assignment complies with state laws. If you are unsure about the legality of your wage assignment, consult with a legal expert or use US Legal Forms for clarity and assistance.

Wages can typically be garnished in Michigan after a court has issued a judgment against you. There is no waiting period specified; garnishment can begin once the judgment is finalized. It’s important to stay informed about the timeline of the Michigan Order For Assignment of Wages. If you have concerns, US Legal Forms can help you understand your options.

In Michigan, wage garnishment limits depend on your disposable income and the type of debt. Generally, creditors can garnish up to 25% of your disposable earnings or the amount by which your weekly income exceeds 30 times the federal minimum wage, whichever is less. Understanding your rights under the Michigan Order For Assignment of Wages is crucial. US Legal Forms can provide templates and guidance to help you manage your garnishment situation.

To stop a wage assignment, you must file a request with the court that issued the Michigan Order For Assignment of Wages. It’s essential to provide valid reasons for your request, such as changes in your financial circumstances. Once the court approves your request, notify your employer to cease the wage assignment. For assistance, consider using US Legal Forms to navigate this process effectively.

To file a wage claim in Michigan, you need to gather necessary documentation and submit your claim to the Michigan Department of Labor and Economic Opportunity. This process often involves referencing a Michigan Order For Assignment of Wages if applicable. If you need assistance, platforms like uslegalforms can provide guidance and resources to navigate the filing process effectively.

Ignoring a wage garnishment order can lead to serious consequences, including continued deductions from your paycheck and potential legal action. A Michigan Order For Assignment of Wages is enforceable, and failure to comply may result in additional penalties. It is crucial to address any garnishment orders promptly to avoid further complications.

A notice of intent to assign wages is a formal notification sent to your employer about the upcoming wage assignment. This notice often accompanies a Michigan Order For Assignment of Wages and informs your employer of their obligations. Understanding this notice is essential for both employees and employers to ensure compliance.