Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What this document covers

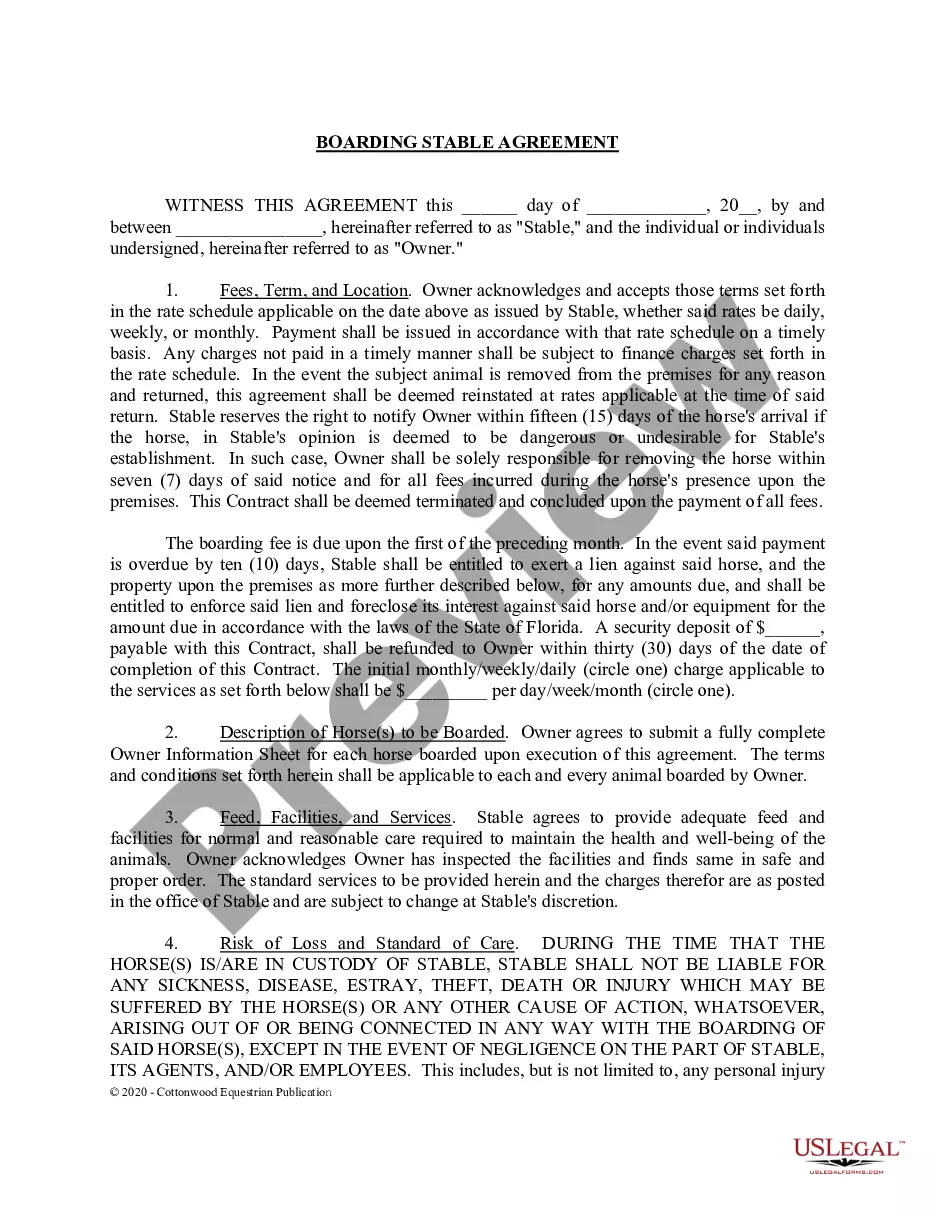

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property on behalf of an estate or trust. This form is distinct because it allows the grantor to sign and convey property ownership while acting in a fiduciary capacity, ensuring that real estate titles are legally and properly transferred. It is designed for individuals who are responsible for managing another person's assets or estate.

Key parts of this document

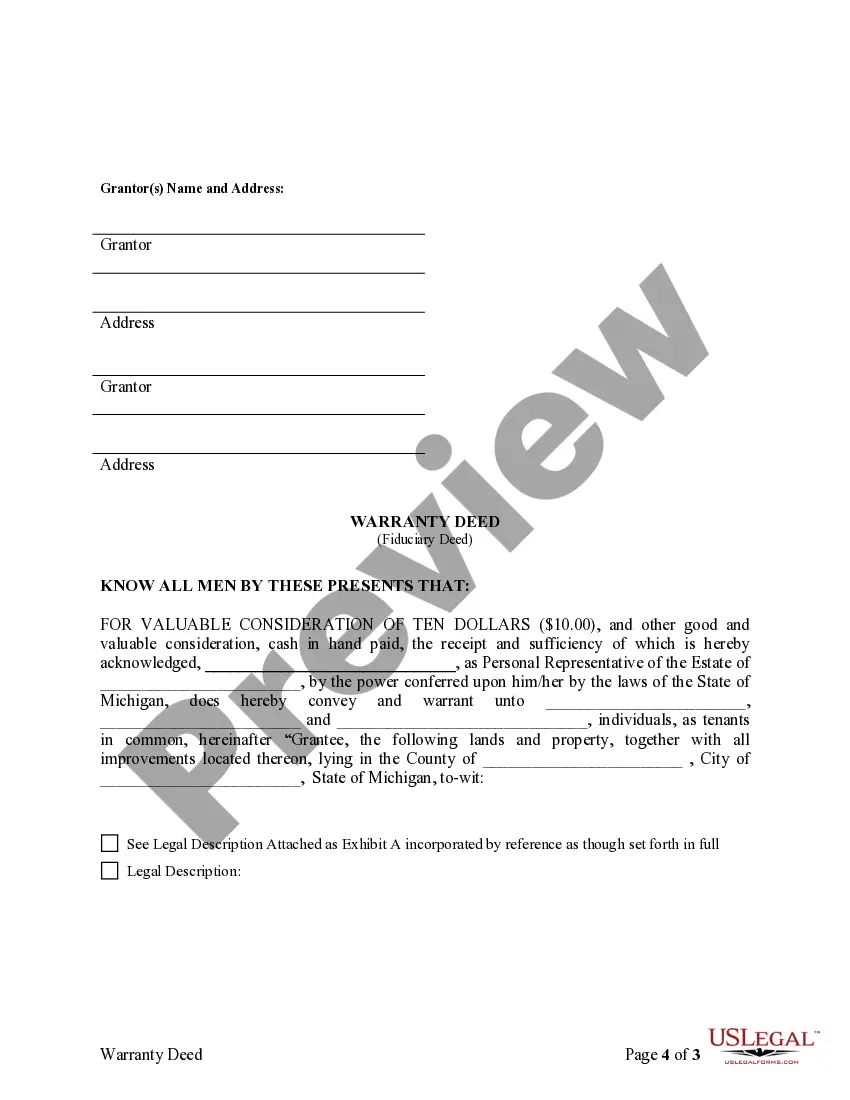

- Identification of the grantor as a fiduciary (e.g., executor, trustee).

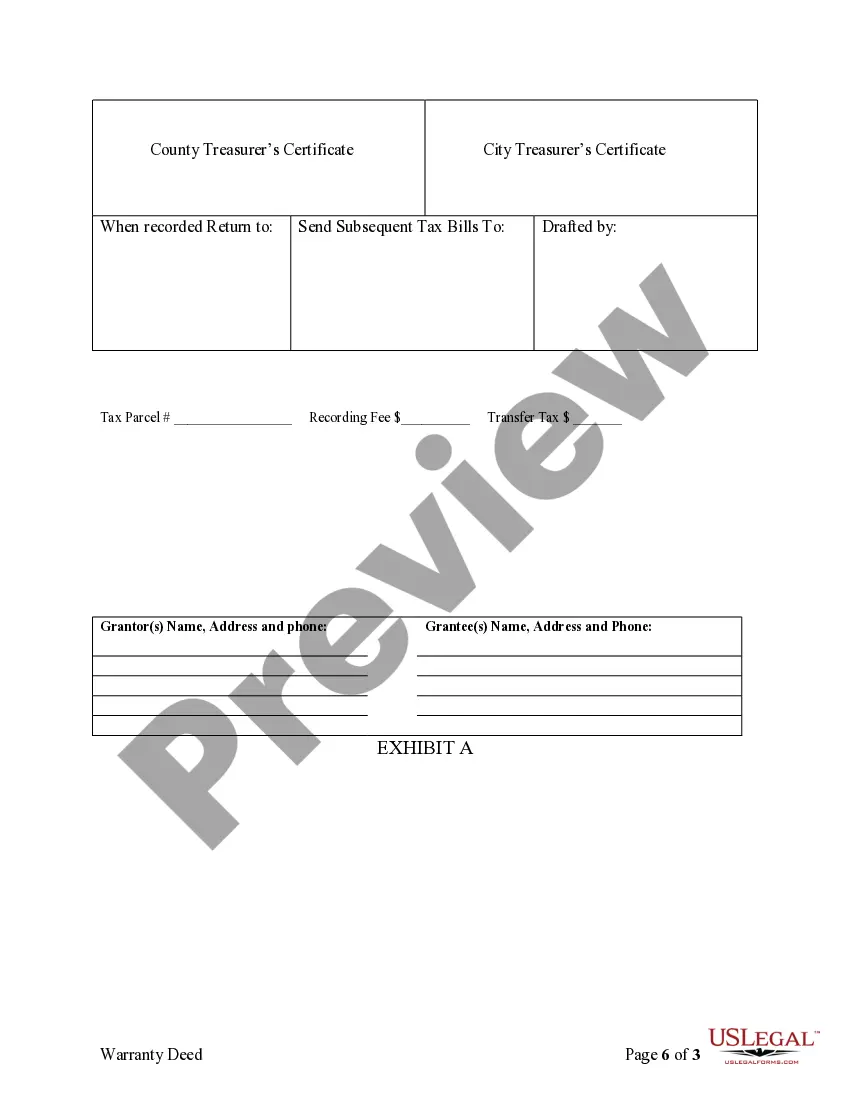

- Details about the property being transferred, including its legal description.

- Information on the beneficiaries receiving the property as tenants in common.

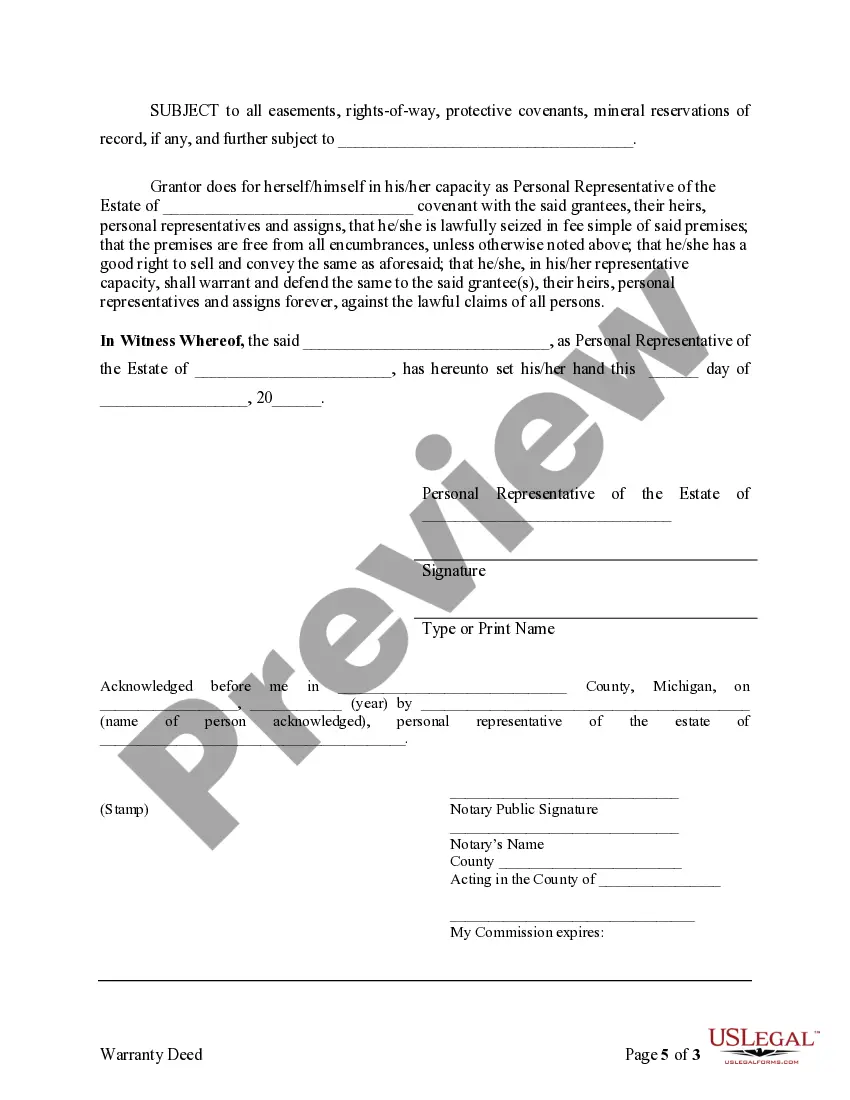

- Signatures of the grantor and a notary public for validation.

- A statement of property transfer tax exemptions under Michigan law.

When to use this document

This Fiduciary Deed should be used when a fiduciary is required to transfer property ownership as part of settling an estate or managing a trust. Scenarios include transferring property after a person's death, conveying assets held in trust, or as part of a guardianship arrangement when a minor or incapacitated person is involved.

Who needs this form

This form is intended for the following individuals:

- Executors managing an estate after someone's death.

- Trustees responsible for transferring property from a trust.

- Administrators appointed by the court to handle estate management.

- Guardians or conservators acting on behalf of minors or incapacitated individuals.

- Any fiduciary with the legal authority to transfer property according to the specific estate plan or court appointment.

How to complete this form

- Identify the fiduciary role, including the full name and capacity (e.g., executor, trustee).

- Provide the accurate legal description of the property being conveyed.

- List the names of the individuals receiving the property as tenants in common.

- Complete the date and signature sections, ensuring the document is notarized.

- If applicable, fill out the Property Transfer Affidavit to comply with local regulations.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the accurate legal description of the property.

- Not getting the document notarized, which may invalidate the deed.

- Omitting required information about the grantor's fiduciary capacity.

- Not filing the necessary Property Transfer Affidavit within the required timeline.

Advantages of online completion

- Convenience of immediate access and download from anywhere.

- Editable fields allow for easy completion using a computer.

- Templates drafted by licensed attorneys ensure legal compliance.

- Secure storage of your completed forms for future reference.

Looking for another form?

Form popularity

FAQ

A trustees deed is typically used when a trustee transfers property held in trust to a beneficiary or another party. Utilizing a Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries ensures that the transaction is legally sound and recognized. This deed protects the interests of all parties involved during the property transfer. For assistance in drafting or understanding these documents, visit uslegalforms for reliable templates and information.

In Michigan, a trust does not need to be filed with the court, which simplifies the process for Executors, Trustees, Trustors, Administrators, and other Fiduciaries. However, having a Michigan Fiduciary Deed can provide clarity and ensure all parties understand their responsibilities. This deed can be beneficial when transferring property held in trust. For those seeking guidance, our platform offers resources to navigate these legal requirements smoothly.

A fiduciary deed in Michigan is a specific type of deed used by individuals acting in a fiduciary capacity to transfer property ownership. This deed is essential for Executors, Trustees, Trustors, Administrators, and other Fiduciaries to legally convey real estate, ensuring that the transfer is valid and recognized by law. Utilizing a Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries simplifies the process and protects all parties involved.

Fiduciary law in Michigan governs the actions and responsibilities of individuals acting on behalf of others, such as Executors, Trustees, and Administrators. This body of law mandates that fiduciaries act in the best interest of the beneficiaries and adhere to ethical standards in managing assets. Understanding Michigan's fiduciary law is essential for anyone involved in these roles, and resources like USLegalForms can provide the necessary forms and guidance to ensure compliance.

The primary purpose of a fiduciary deed is to facilitate the transfer of property by individuals acting in a fiduciary role, such as Executors, Trustees, Trustors, and Administrators. This deed provides a legal framework that ensures all parties involved acknowledge the transfer, protecting the interests of beneficiaries. By using a Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, you can streamline the process and ensure compliance with state laws.

While serving as a fiduciary can be rewarding, it also comes with responsibilities that may pose challenges. Fiduciaries may face personal liability if they fail to act in the best interests of beneficiaries, which can lead to legal complications. Additionally, managing assets and adhering to legal requirements can be time-consuming and demanding, making it crucial for fiduciaries to understand their duties and consider resources like USLegalForms for guidance.

A fiduciary deed is a legal document used by individuals acting in a fiduciary capacity, such as Executors, Trustees, Trustors, Administrators, and other Fiduciaries, to transfer property. In contrast, an executor deed specifically pertains to the actions of an executor managing an estate after a person's death. Both documents serve to convey title, but the fiduciary deed encompasses a broader range of fiduciary roles, making it more versatile in Michigan.

The ladybird deed, while useful, has several disadvantages when considering the Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. One key concern is that it does not avoid probate. As a result, property transferred through this deed may still be subject to the probate process. Additionally, if the grantor becomes incapacitated, the ladybird deed does not provide clear instructions for managing the property, which can complicate matters for fiduciaries. For those looking for a more straightforward solution, exploring the Michigan Fiduciary Deed options on the US Legal Forms platform might offer better clarity and control.