This Account of Fiduciary is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Account of Fiduciary, Short Form

Description

How to fill out Michigan Account Of Fiduciary, Short Form?

Obtain any template from 85,000 legal documents including Michigan Account of Fiduciary online with US Legal Forms. Each template is created and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the guidelines below: Check the state-specific prerequisites for the Michigan Account of Fiduciary you need to utilize. Review the description and preview the template. When you are sure the sample meets your needs, simply click Buy Now. Choose a subscription plan that fits your financial situation. Create a personal account. Make payment in one of two suitable methods: by card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents section. After your reusable template is downloaded, print it or save it to your device.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample. The platform provides documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Michigan Account of Fiduciary swiftly and effortlessly.

- Obtain a template from a vast collection of legal documents.

- Log in if you are a subscriber.

- Access your forms easily after downloading.

- Check specific requirements for your document.

- Review the template description.

- Purchase once you are confident in your choice.

- Select a budget-friendly subscription plan.

- Create your personal account.

- Make payment using card or PayPal.

Form popularity

FAQ

Yes, in Michigan, an executor must provide an accounting to beneficiaries to ensure transparency and trust. This accounting includes a detailed report of all financial transactions, including income, expenses, and distributions made from the Michigan Account of Fiduciary, Short Form. Beneficiaries have the right to understand how the estate is managed, promoting a fair process. If you need assistance in organizing this accounting, US Legal Forms offers reliable resources and templates to simplify your tasks.

Yes, an estate account is indeed a type of fiduciary account. When managing the financial matters of an estate, an executor or administrator acts as a fiduciary, ensuring that all assets are handled according to the deceased's wishes. This involves opening a Michigan Account of Fiduciary, Short Form, which allows for proper management and distribution of estate funds. By using a fiduciary account, individuals can safeguard the interests of beneficiaries while adhering to legal guidelines.

To obtain letters of testamentary in Michigan, you need to file a petition with the probate court in the county where the deceased lived. This petition typically includes the will, a death certificate, and details about the estate's assets. After the court reviews your petition, it will issue the letters, granting you the authority to act on behalf of the estate. Using a Michigan Account of Fiduciary, Short Form can help streamline this process and provide guidance through the legal framework.

In Michigan, to use a small estate affidavit, the total value of the estate must be under $25,000, excluding real estate. You must be an heir or a representative of the deceased. The affidavit must be completed and notarized, stating the names of the heirs and the assets to be transferred. Utilizing a Michigan Account of Fiduciary, Short Form can simplify this process further, ensuring you meet all legal requirements efficiently.

Transferring property after death in Michigan involves several steps, typically starting with the probate process. You’ll need to file necessary documents, such as the Michigan Account of Fiduciary, Short Form, to manage the estate's assets. This procedure ensures that property is legally transferred to the rightful heirs. Utilizing resources like USLegalForms can provide you with the essential tools and templates to facilitate this transfer smoothly.

Fiduciary law in Michigan governs the responsibilities of individuals appointed to manage another person's financial matters. This area of law ensures that fiduciaries act in the best interest of the estate or trust they oversee. The Michigan Account of Fiduciary, Short Form, is a crucial tool for reporting financial transactions made on behalf of the estate. Understanding these laws can help you navigate the complexities of estate administration effectively.

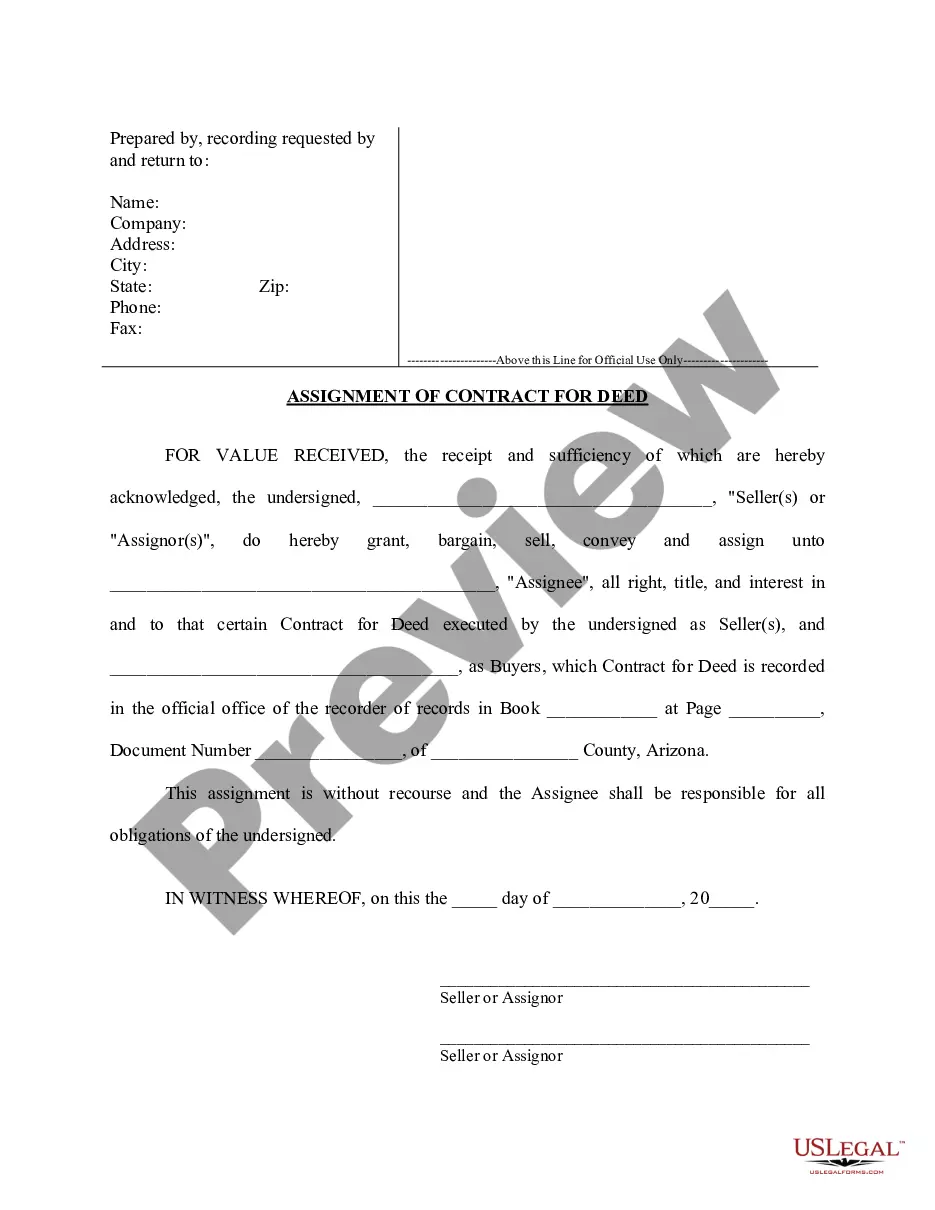

Form PC 598 in Michigan is a document used for filing an Account of Fiduciary, Short Form, with the probate court. This form helps fiduciaries, such as executors or trustees, present financial information regarding the estate. By completing this form accurately, you can help ensure that the estate administration process goes smoothly. Accessing form PC 598 through specialized platforms like USLegalForms can simplify the filing process for you.

Filing a small estate affidavit in Michigan involves completing the appropriate form based on the Michigan Account of Fiduciary, Short Form. This affidavit allows you to claim the deceased person's assets without going through a lengthy probate process. You must submit the completed affidavit to the probate court and provide necessary documentation, such as identification and proof of death. Once approved, you can access the assets outlined in the affidavit.

To file a claim against an estate in Michigan, start by preparing your documentation, including the Michigan Account of Fiduciary, Short Form. You must file your claim with the probate court overseeing the estate, typically within a specific timeframe set by law. Ensure you include all relevant details about your claim and any supporting evidence. After filing, attend any required hearings to present your case and resolve the issue.