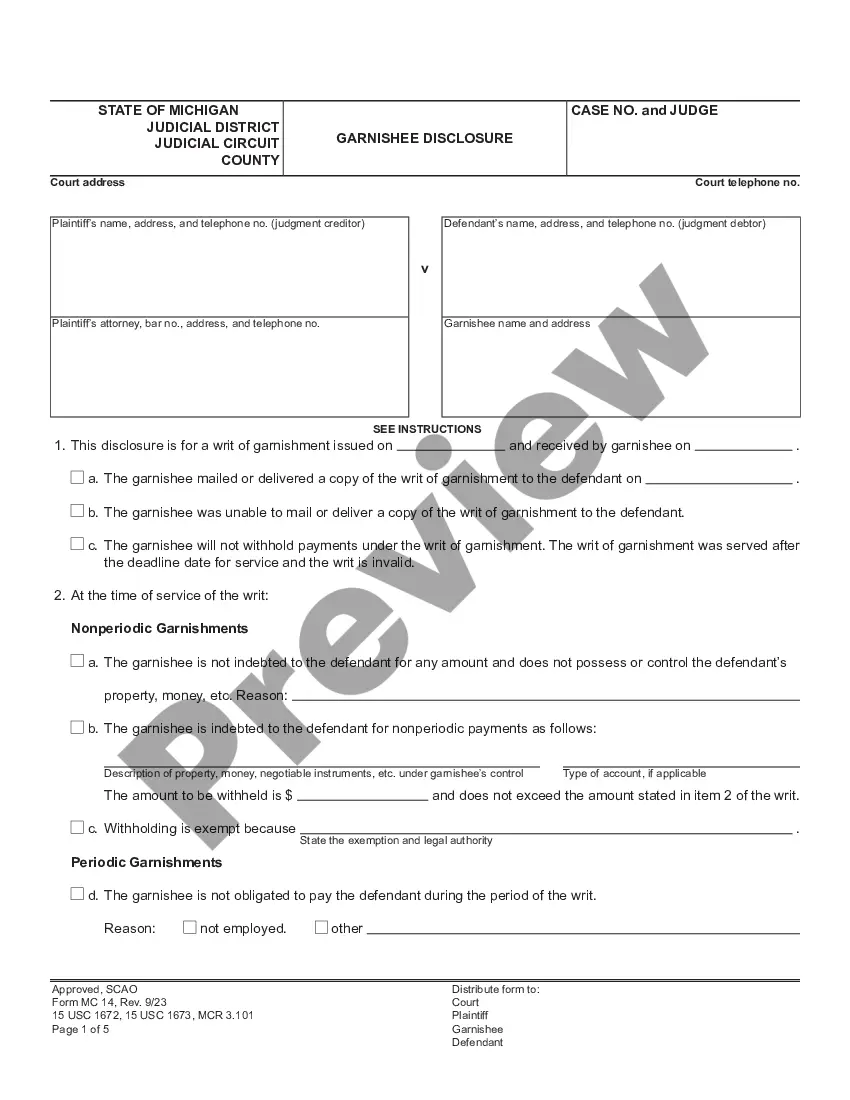

Michigan Garnishee Disclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Garnishee Disclosure?

How much time and resources do you generally allocate to composing official documents.

There’s a greater chance to acquire such forms than engaging legal professionals or spending countless hours searching the internet for an appropriate template.

Create an account and pay for your subscription. You can complete the transaction with your credit card or through PayPal - our service is completely secure for that.

Download your Michigan Garnishee Disclosure onto your device and complete it on a printed hard copy or electronically. Another advantage of our library is that you can access previously obtained documents that you securely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as you need. Save time and effort completing formal documents with US Legal Forms, one of the most reliable online solutions. Sign up with us today!

- US Legal Forms is the leading online repository that offers expertly crafted and validated state-specific legal documents for various purposes, such as the Michigan Garnishee Disclosure.

- To obtain and prepare a suitable Michigan Garnishee Disclosure template, follow these straightforward steps.

- Examine the form content to ensure it complies with your state’s requirements. To do this, review the form description or utilize the Preview option.

- If your legal template does not meet your requirements, locate another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Michigan Garnishee Disclosure. Otherwise, continue to the next steps.

- Click Buy now once you identify the correct blank. Choose the subscription plan that best fits your needs to access the complete services of our library.

Form popularity

FAQ

In Michigan, garnishment rules require careful adherence to legal procedures for both employers and creditors. When a creditor seeks to collect a debt through garnishment, they must first obtain a court order. The Michigan Garnishee Disclosure process ensures that garnishees, such as employers, report wage deductions accurately. Following these rules can help you avoid legal complications while effectively collecting owed debts.

To write a letter that stops wage garnishment, begin by clearly stating your intent to request a halt to the garnishment. Include your name, address, and any relevant case or file numbers to ensure identification. It's important to explain the circumstances that warrant this request, such as financial hardship or the resolution of the underlying debt. Additionally, refer to the Michigan Garnishee Disclosure guidelines, as they may provide specific requirements for your letter.

Typically, you receive a notification of garnishment through formal court documents sent to you via mail or sometimes through personal service. The notification detail the amount owed, the creditor’s name, and the action being taken against your income or account. It’s important to read this notice carefully to understand your rights and obligations. Using platforms like US Legal Forms can help you navigate the garnishment process effectively by providing templates and resources.

Garnishee disclosure in Michigan refers to the legal process where a creditor notifies a third party, such as a bank or employer, to withhold funds from a debtor’s account or wages. This disclosure must comply with Michigan laws to ensure proper notification and handling of the funds. It allows creditors to collect debts in a structured manner, while also providing debtors certain protections. Understanding Michigan garnishee disclosure is essential, whether you are a creditor seeking to recover funds or a debtor taking control of your financial situation.

Other Useful Information State Bar of Michigan ? Attorney listings.Michigan Courts Information Web Page. Internal Revenue Service (IRS) ? Phone 800-829-7650.To locate garnishment forms, contact State Court Administration, or the offices of a local court. Michigan Health Accounts (Medicaid)

In Michigan, a creditor can garnish whichever is less: up to 25% of your disposable earnings or. the amount of your disposable earnings that's more than 30 times the federal minimum wage, which is $217.50 (2021 figure).

Filing your Objection You can use the Do-It-Yourself Objection to Garnishment tool if you have a reason to object to the garnishment. There is no cost to file an objection to a garnishment. You must file your objection with the court within 14 days of getting the notice of garnishment to stop the garnishment.

The statement must include the names of the parties, the court in which the case is pending, the case number, the date of the statement, and the total amount withheld. The ?Final Statement on Garnishment of Periodic Payments? form (Form MC 48) can be used for this.

Writs for periodic garnishments do not expire. They are effective until the balance of the judgment, interest, and costs are paid.