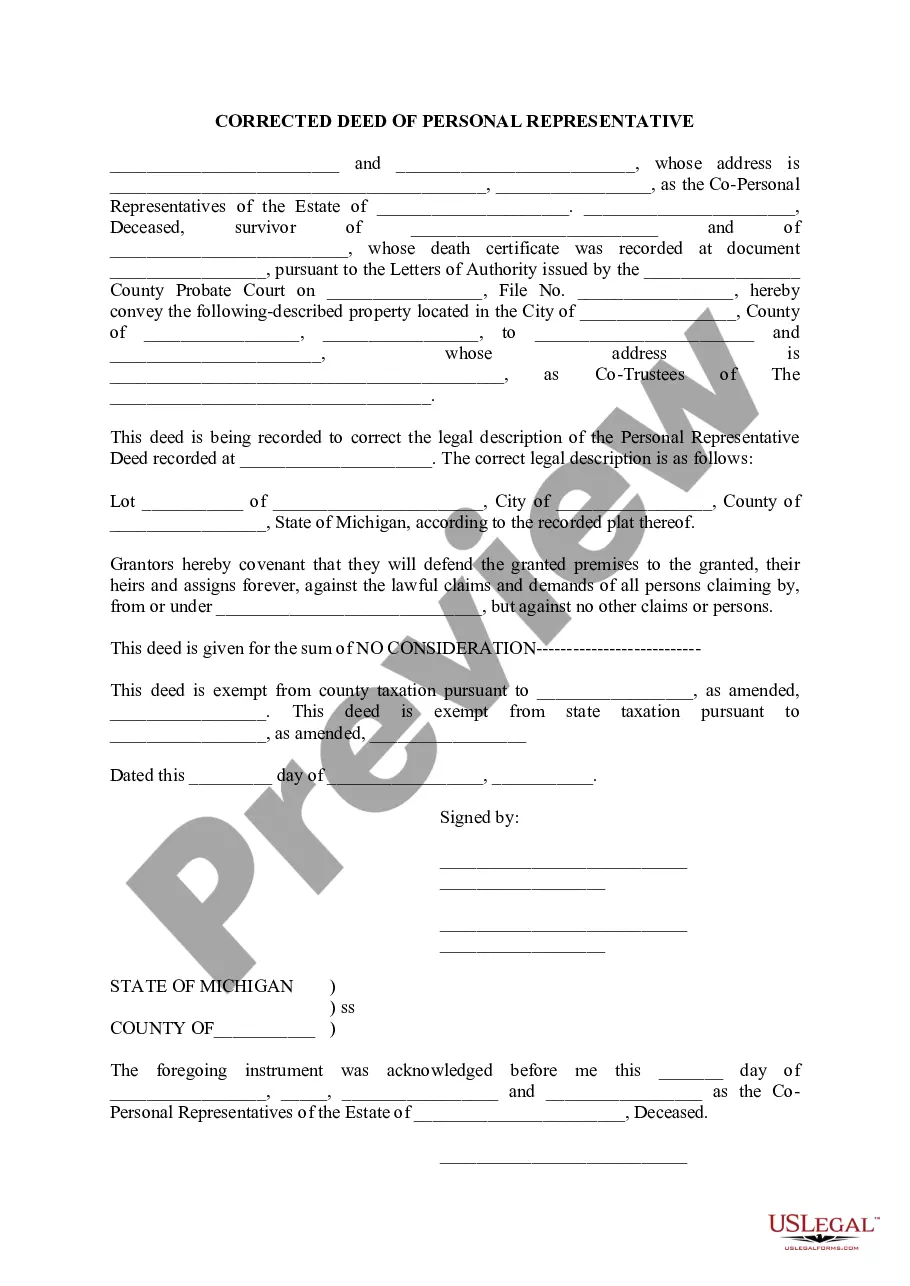

Michigan Corrected Deed of Personal Representative

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Corrected Deed of Personal Representative: A legal document issued by the personal representative of an estate to correct any errors present in a previously issued deed. This deed ensures that the property transfer reflects the accurate details as intended by the deceased's will or estate plan.

Step-by-Step Guide to Issuing a Corrected Deed

- Identify the Error: Review the original deed to pinpoint the exact inaccuracies that need correction.

- Consult with a Lawyer: Engage with an attorney who specializes in estate planning or real estate law to ensure the correction adheres to legal standards.

- Prepare the Corrected Deed: The personal representative should draft the corrected deed, including all accurate and corrected details.

- Signatures and Notarization: The deed must be signed by the personal representative and notarized to be legally valid.

- Record the Deed: File the corrected deed with the appropriate county recorder's office to make the correction official and part of the public record.

Risk Analysis

- Legal Risks: Improperly corrected deeds can lead to disputes among beneficiaries or claims against the estate.

- Financial Risks: Errors in the deed that are not corrected promptly may lead to financial losses, such as penalties or additional taxes.

- Reputation Risks: Mistakes in estate documentation can affect the personal representative's credibility and trustworthiness.

Common Mistakes & How to Avoid Them

- Overlooking Small Errors: Even minor mistakes in a deed can lead to significant legal problems. Always double-check the details before recording a deed.

- Delaying Corrections: Delay in addressing deed errors can complicate property transfers and estate settlements.

- DIY Approach: Drafting or correcting legal documents without professional advice can increase the likelihood of errors. Always consult with an estate or real estate lawyer.

Key Takeaways

A corrected deed of personal representative is crucial for ensuring that property is transferred correctly according to the deceased's wishes. Thoroughly review and seek legal counsel when dealing with property deeds to prevent potential legal issues.

How to fill out Michigan Corrected Deed Of Personal Representative?

Obtain any version from 85,000 legal documents like the Michigan Corrected Deed of Personal Representative online with US Legal Forms. Each template is created and refreshed by state-authorized legal experts.

If you hold a subscription, Log In. When you reach the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the procedures outlined below: Check the state-specific criteria for the Michigan Corrected Deed of Personal Representative you wish to utilize. Go through the description and preview the template. When you are certain the sample meets your requirements, click Buy Now. Select a subscription plan that fits your financial plan. Set up a personal account. Make payment in one of two suitable methods: by card or through PayPal. Choose a format to download the document in; two choices are available (PDF or Word). Download the document to the My documents tab. Once your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you will consistently have instant access to the relevant downloadable sample.

- The platform provides you with forms and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Michigan Corrected Deed of Personal Representative quickly and effortlessly.

Form popularity

FAQ

In Michigan, to qualify for a small estate affidavit, the total value of the deceased's assets must not exceed the small estate limit, which is currently $25,000. The affidavit must include the facts surrounding the estate's assets and beneficiaries. If you need assistance with these requirements or have questions about the Michigan Corrected Deed of Personal Representative, UsLegalForms can provide helpful resources.

A property transfer affidavit in Michigan is typically completed by the seller or the person transferring the property. This affidavit confirms the transfer details for taxation and property records purposes. If the transfer involves a Michigan Corrected Deed of Personal Representative, it ensures the proper legal procedures are followed for the estate.

To remove someone from a deed in Michigan, you must prepare a new deed that names the remaining owners. This process may involve completing a Michigan Corrected Deed of Personal Representative if the property is part of a deceased person's estate. After preparing the new deed, you must file it with the local register of deeds to officially document the change.

In 2025, the small estate limit in Michigan is likely to be set at $25,000. This amount allows individuals to bypass lengthy probate procedures for smaller estates. Utilizing a small estate affidavit can help streamline the process, relating to matters like the Michigan Corrected Deed of Personal Representative, when dealing with heirs.

Yes, a personal representative can sell property in Michigan as part of managing the estate. They must act within the scope of their authority as outlined in the will or by court order. Moreover, any proceeds from the sale may support the requirements of the Michigan Corrected Deed of Personal Representative, ensuring all transactions are executed properly.

In Michigan, a codicil does not have to be notarized but must be signed by the testator and witnessed by at least two individuals. This allows the codicil to amend the original will legally. However, having it notarized adds an extra layer of validation, which can ease the process when addressing matters such as a Michigan Corrected Deed of Personal Representative.

Form PC 598 is used in Michigan for the designation of a personal representative for the estate of a deceased individual. This form is essential for managing the estate and facilitating the transfer of assets, including any corrections, such as the Michigan Corrected Deed of Personal Representative. Ensuring the proper completion of this form helps avoid delays in the probate process.

After you file an affidavit of heirship in Michigan, the court recognizes the valid heirs of the deceased person. This document provides proof of who inherits the estate's property without going through probate. Additionally, it can streamline the process of transferring property titles, like the Michigan Corrected Deed of Personal Representative, to the rightful heirs.

To correct a warranty deed in Michigan, you will typically need to prepare a Michigan Corrected Deed of Personal Representative. This document should clearly disclose the changes or errors that need rectification. After drafting the corrected deed, you must have it executed according to state laws, then file it with the county clerk or register of deeds. Utilizing platforms like USLegalForms can streamline this process by providing templates and guidance to ensure compliance with legal requirements.

Amending a deed involves creating a new document that details the changes you wish to make. For a Michigan Corrected Deed of Personal Representative, you must include specific details of the property and the corrections needed. Once you've drafted the amended deed, you should have it signed and notarized before recording it with your local register of deeds office. This ensures that the corrections are legally recognized and enforceable.