Michigan Amendment to Living Trust

Description

Key Concepts & Definitions

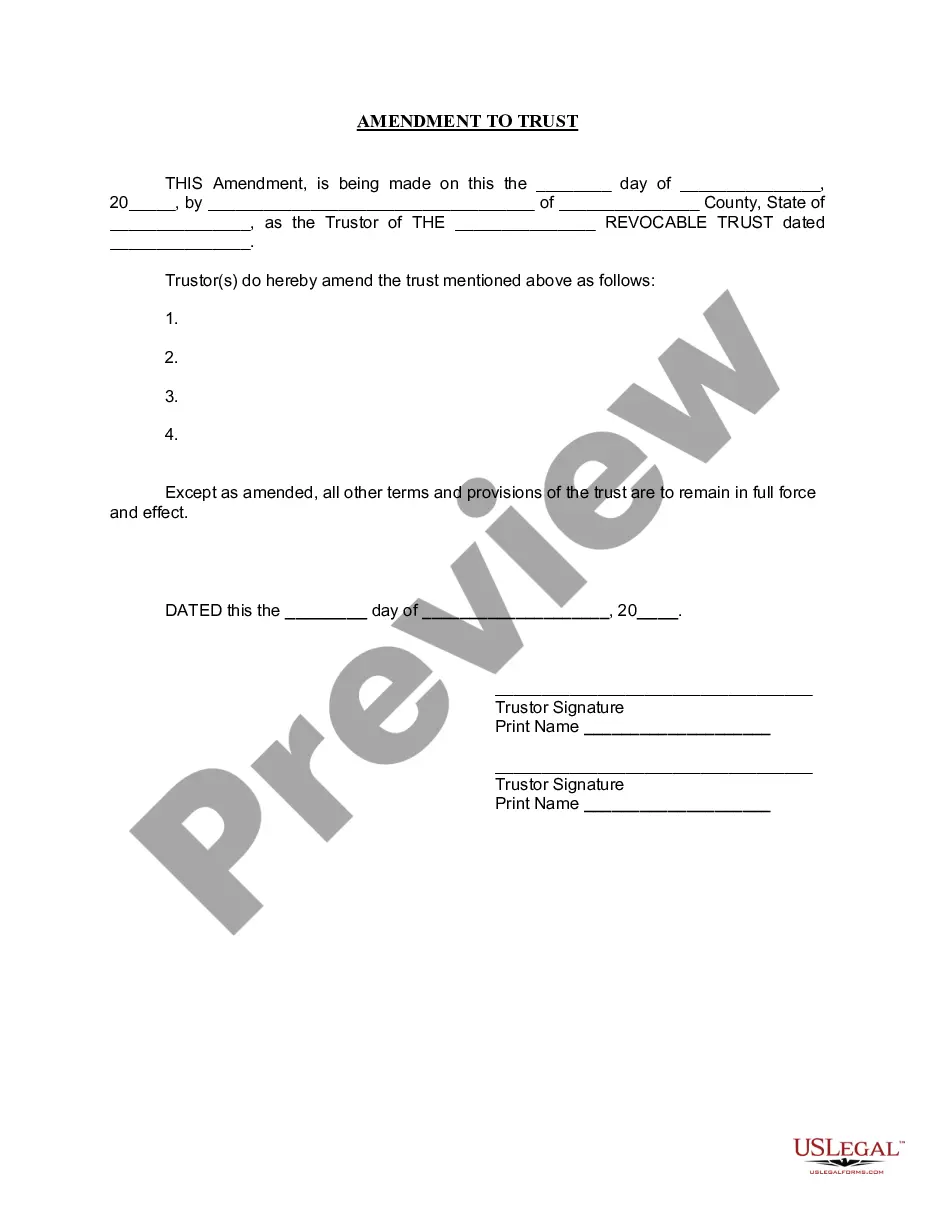

Amendment to Living Trust: An amendment to a living trust involves making changes to the provisions of an existing trust without revoking it. This procedure is typically used when minor changes are needed, such as adding or removing beneficiaries, changing trustees, or modifying the terms for distribution of assets.

Step-by-Step Guide to Amending a Living Trust

- Review the Original Trust Document: Start by reviewing the trust document to understand its terms and the provisions for amendments.

- Decide on the Changes: Clearly identify the changes that need to be made to the trust, ensuring they are consistent with legal requirements and the original intent of the trust.

- Draft the Amendment: Write the amendment, either on your own or with legal assistance. Make sure the language is clear and legally sound.

- Sign the Amendment: The trustor (or both trustors if a joint trust) must sign the amendment, usually in the presence of a notary public to ensure validity.

- Store the Amendment with the Trust Document: Keep the signed amendment with the original trust document to maintain a complete record of the trusts terms and modifications.

Risk Analysis

- Legal Disputes: Improperly drafted amendments can lead to disputes among beneficiaries, potentially resulting in legal challenges.

- Financial Implications: Changes in the distribution of assets might affect the financial stability of certain beneficiaries.

- Errors in Execution: The amendment might be considered invalid if not executed correctly, according to state laws.

Common Mistakes & How to Avoid Them

- Failing to Notarize: The amendment may be required to be notarized to be legitimate. Always check the local laws and ensure proper execution.

- Vague Wording: Vague or ambiguous language can cause interpretation issues. Use clear and precise language in amendments.

- Ignoring Spousal Rights: In some states, spousal consent may be required if the amendment affects the spouses interests. Ensure compliance with relevant state laws.

How to fill out Michigan Amendment To Living Trust?

Get any form from 85,000 legal documents including Michigan Amendment to Living Trust online with US Legal Forms. Every template is prepared and updated by state-certified lawyers.

If you have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Amendment to Living Trust you would like to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, just click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by credit card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable sample. The platform gives you access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Michigan Amendment to Living Trust fast and easy.

Form popularity

FAQ

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

Like a will, a living trust can be altered whenever you wish. One of the most attractive features of a revocable living trust is its flexibility: You can change its terms, or end it altogether, at any time. If you created a shared trust with your spouse, either of you can revoke it.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.