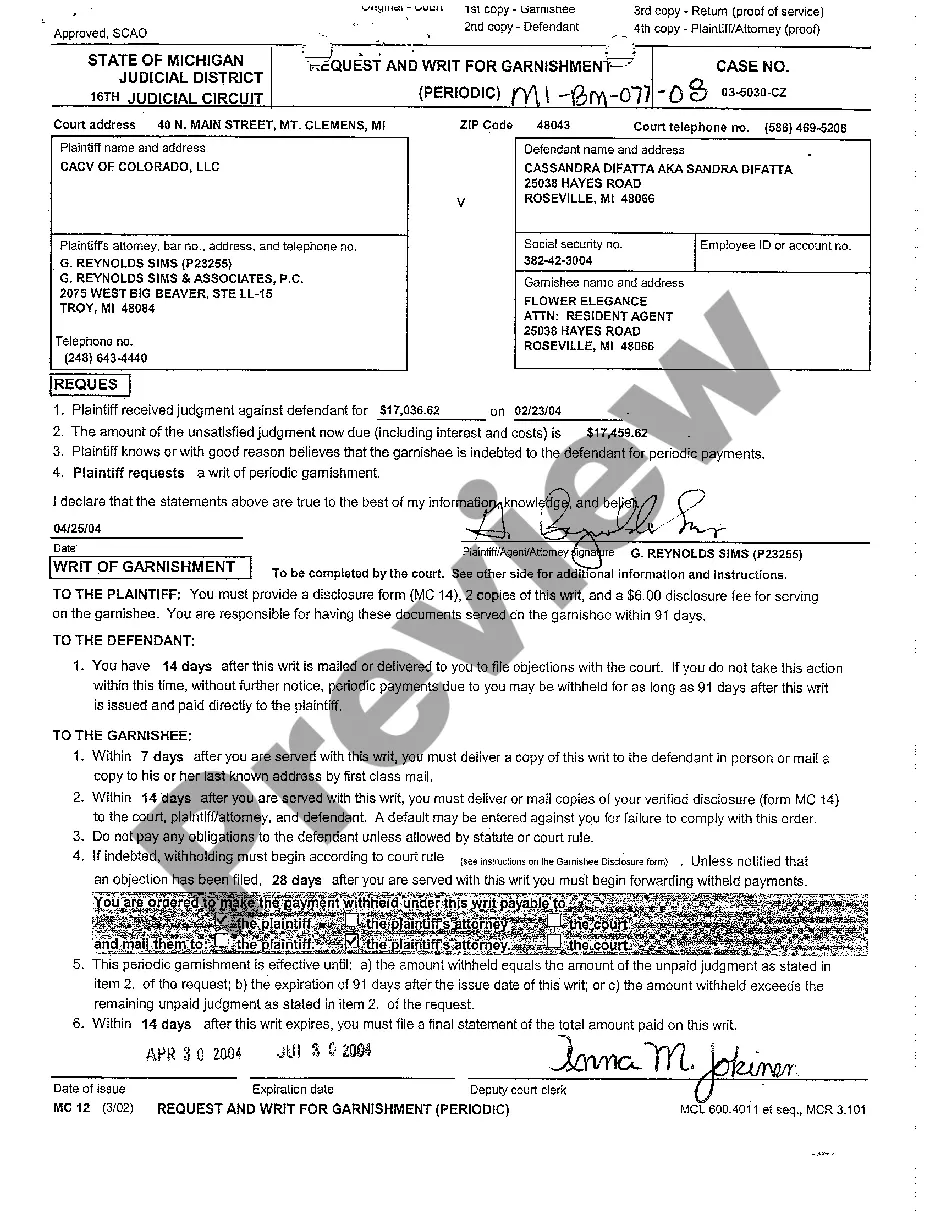

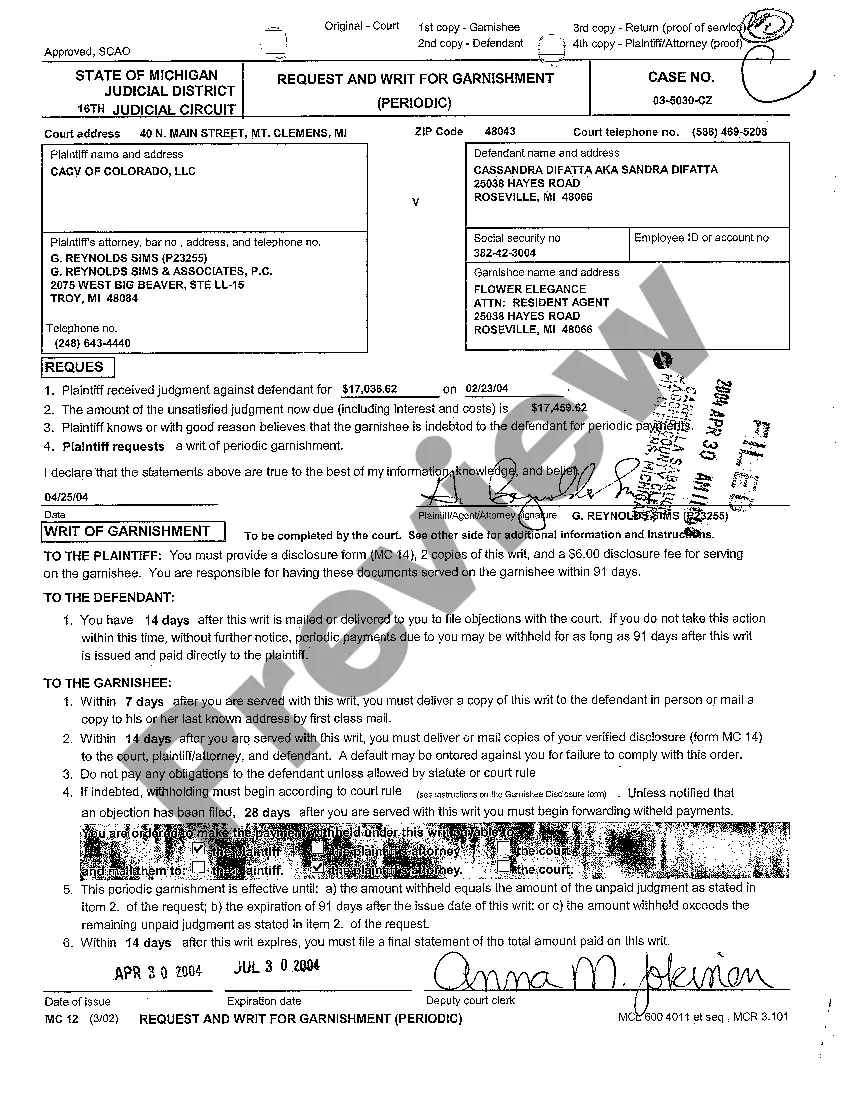

Michigan Request And Writ for Garnishment

Description

Form popularity

FAQ

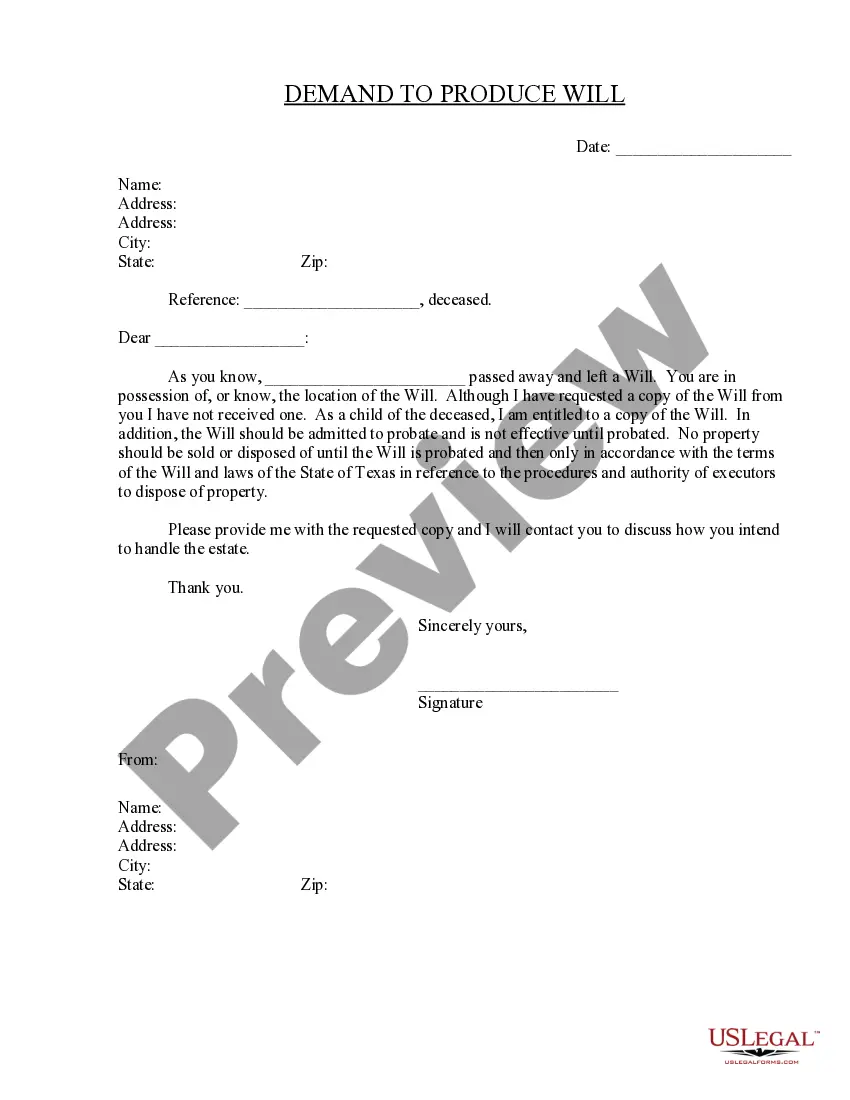

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

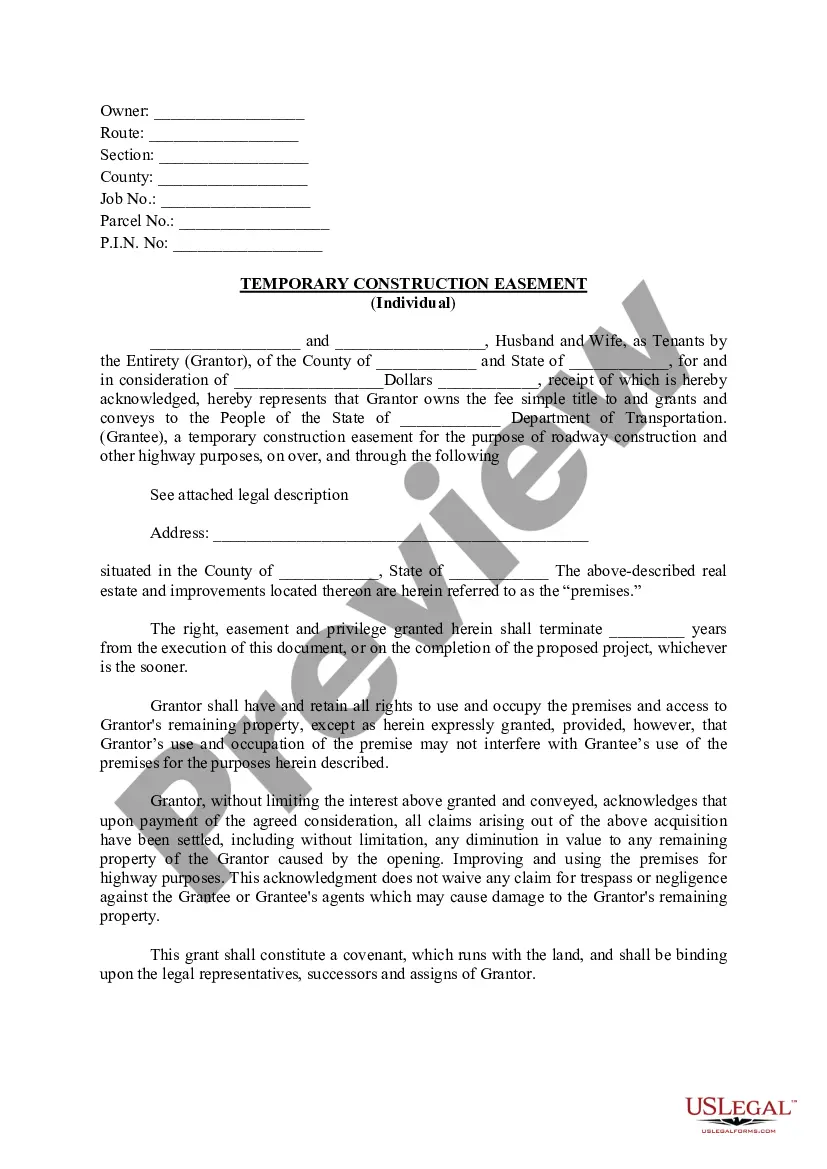

Requesting a GarnishmentTop Start a garnishment by filing a Request and Writ for Garnishment with the court that entered the judgment. The writ is a court order. It tells the garnishee to give you the money it holds for the debtor (like money in a bank account) or would have paid to the debtor (like a paycheck).

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

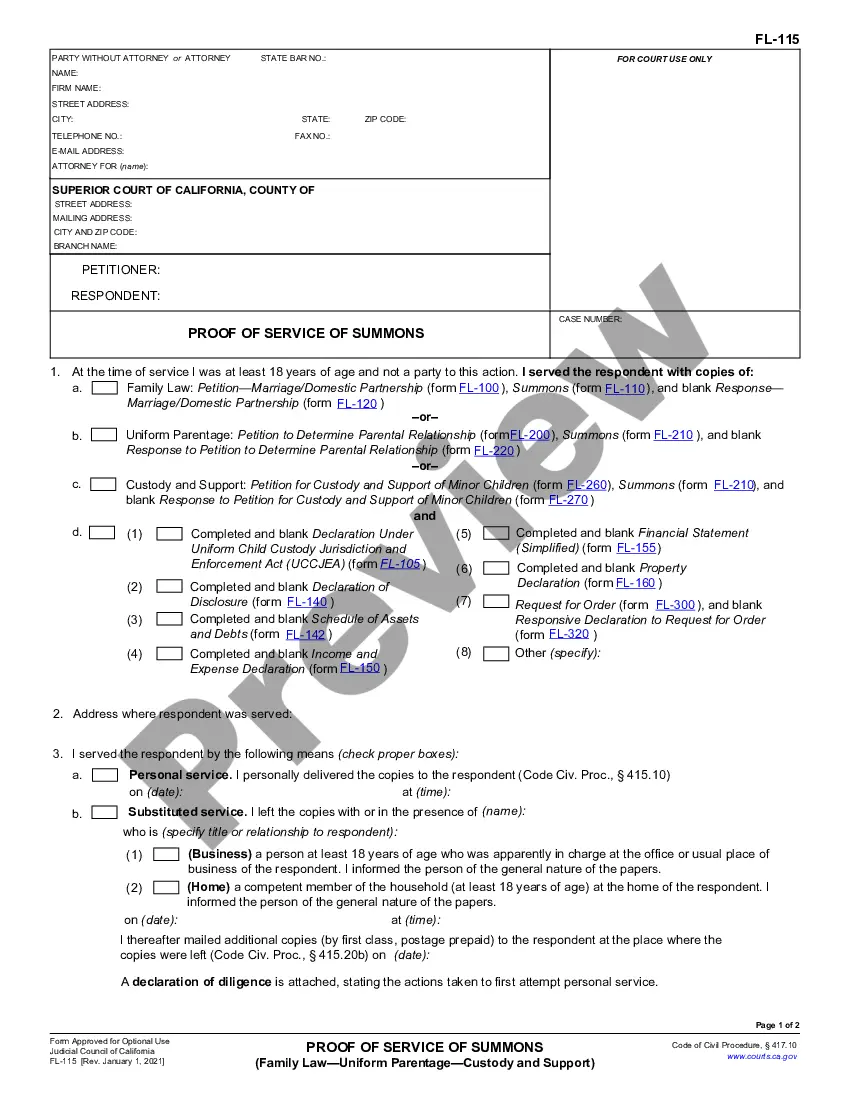

Limits on Wage Garnishments 25% of the debtor's disposable earnings (what's left after mandatory deductions), or the amount by which the debtor's wages exceed 30 times the minimum wage, whichever is lower.

Both the state of Michigan and the federal wage garnishment (or attachment) limits allow creditors who have sued you and obtained a money judgment to take 25% of your net wages (the amount left after subtracting required deductions).

In most cases, a creditor can't garnish your wages without first getting a money judgment against you.However, some creditorslike those you owe taxes, federal student loans, child support, or alimonydon't have to go through the court system to get a wage garnishment. Either way, you'll get notice of the garnishment.