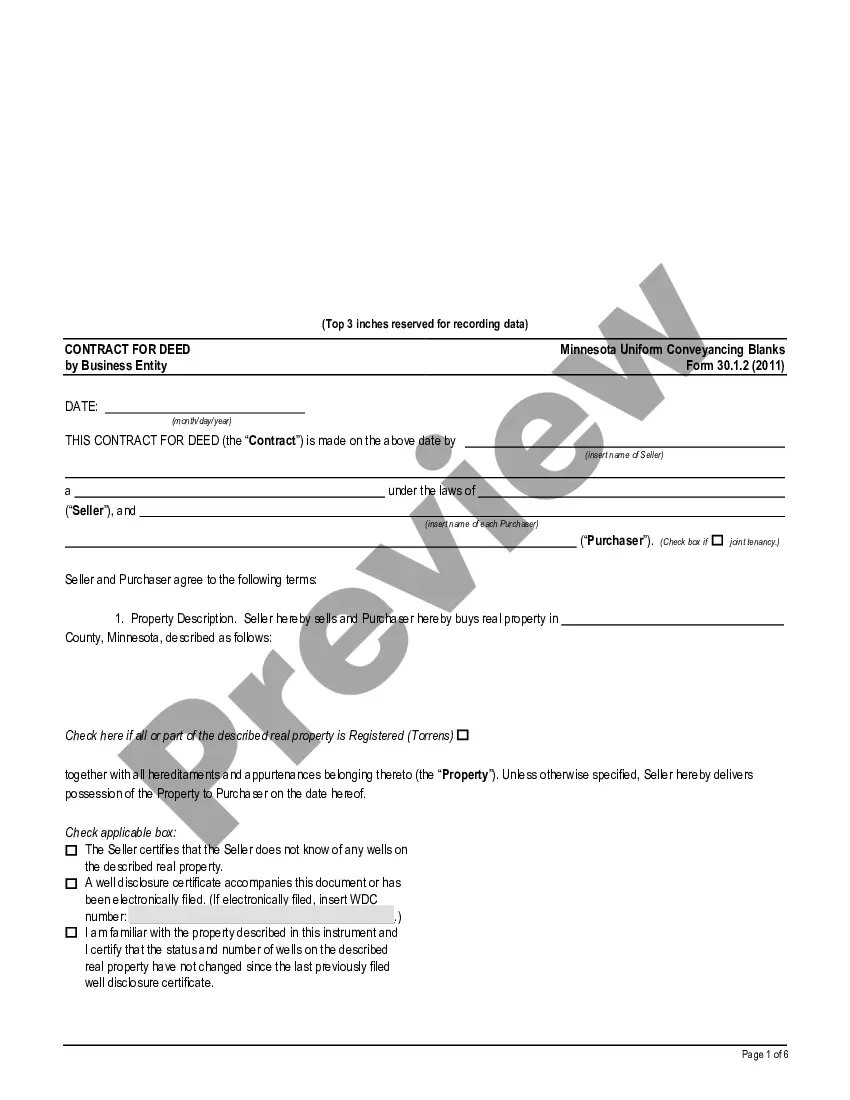

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1

Description

How to fill out Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1?

Have any form from 85,000 legal documents including Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1 on-line with US Legal Forms. Every template is prepared and updated by state-accredited lawyers.

If you already have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1 you want to use.

- Read description and preview the sample.

- When you are sure the template is what you need, just click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Minnesota Contract For Deed - Individual Seller - UCBC Form 30.1.1 fast and easy.

Form popularity

FAQ

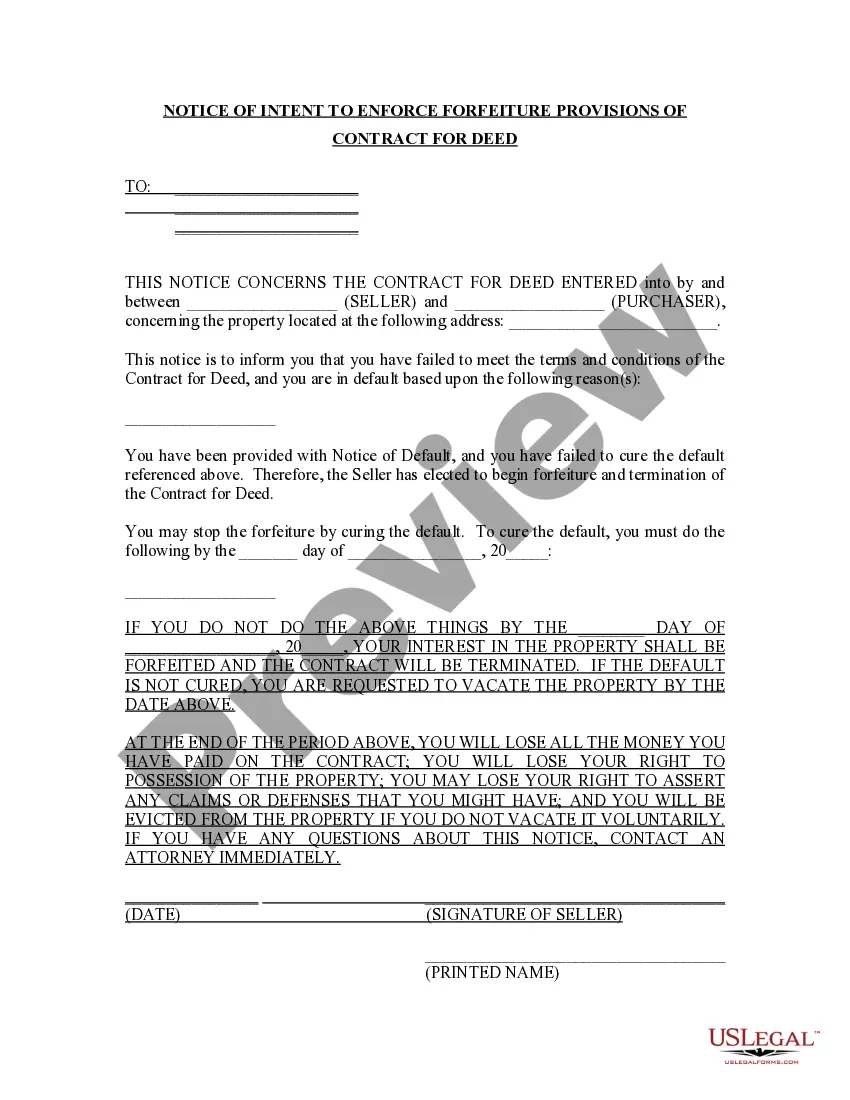

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

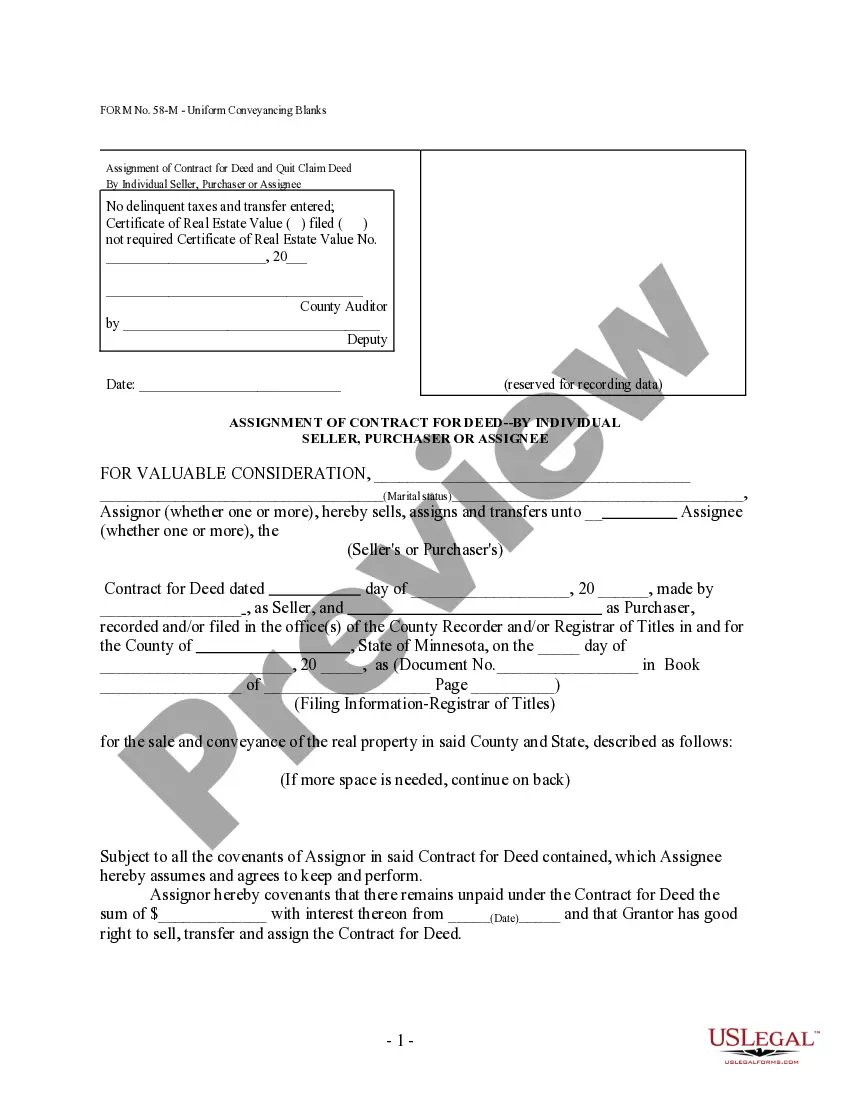

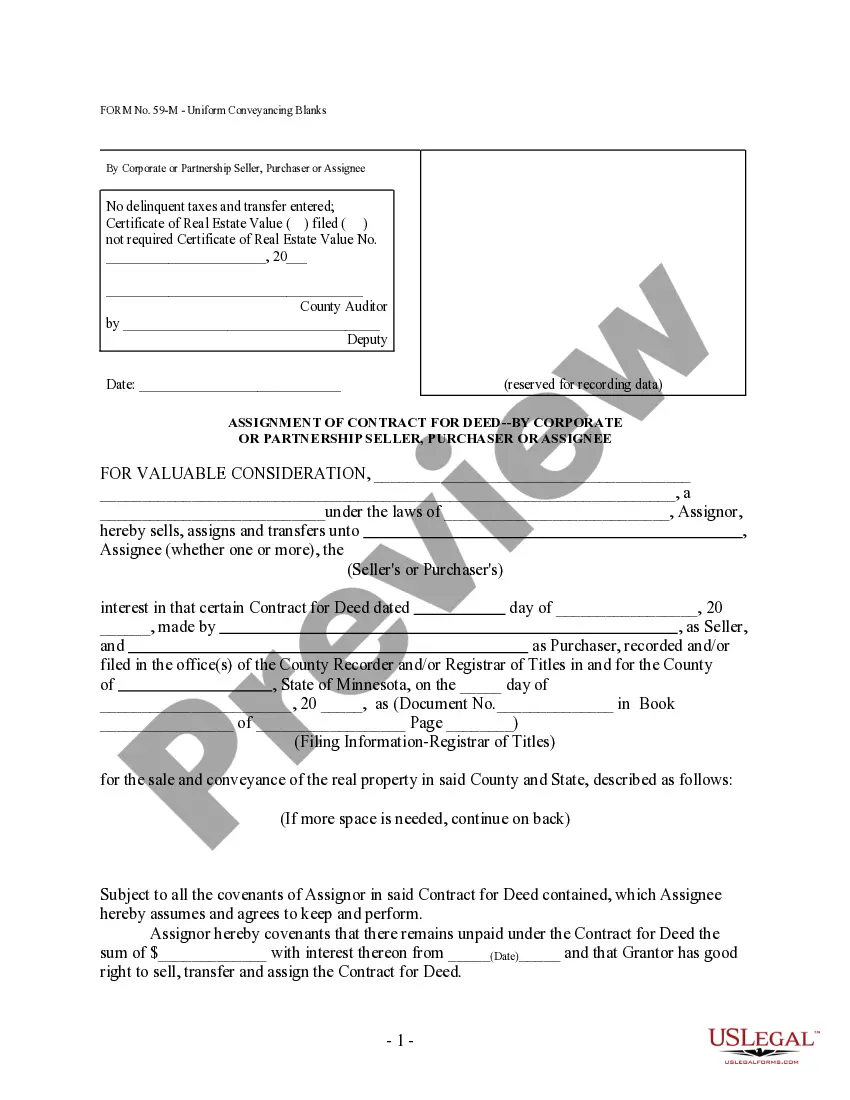

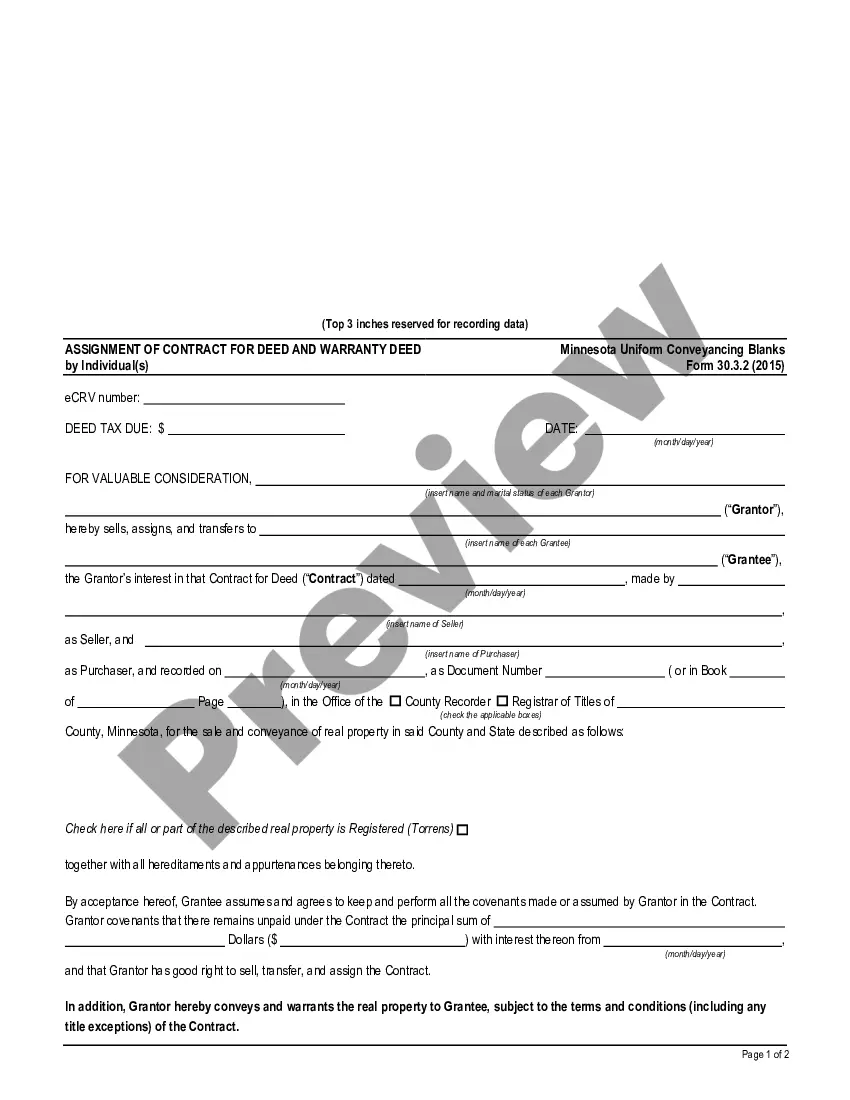

Under a contract for deed, the grantor retains the legal title to the real property until the purchase price is paid in full and the other terms of the contract are completed. Before a contract is paid off, the grantor (vendor) may choose to assign its contract rights to a third party.

Generally, the seller will look for a down payment anywhere from 10% to 20% of the purchase price. The interest on a contract for deed could be anywhere from 1% to 2.5% higher than the current market rate.

To cancel a contract for deed, it takes at least 60 days. You are required to personally serve a notice of cancellation on the buyer and then 60 days later (there are a few exceptions) the contract is terminated.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

The Difference Between Renting to Own and a Contract for Deed. Renting to own usually means renting now, with an option to buy later. When you make this kind of deal, you are still a tenant, and the seller is still a landlord, until the final purchase. A contract for deed is very different.