Florida Letter to Lienholder to Notify of Trust

Description

Definition and meaning

The Florida Letter to Lienholder to Notify of Trust is a formal document used to inform a lienholder that a property has been transferred into a trust. This letter is important as it updates the lienholder about the change in ownership and ensures that their records reflect the current status of the property.

A trust is a legal arrangement where a person (the trustor) transfers assets to a designated entity (the trustee) for the benefit of specified beneficiaries. This document specifically highlights the details of such a transfer, making it essential for maintaining clear communication between all parties involved.

How to complete a form

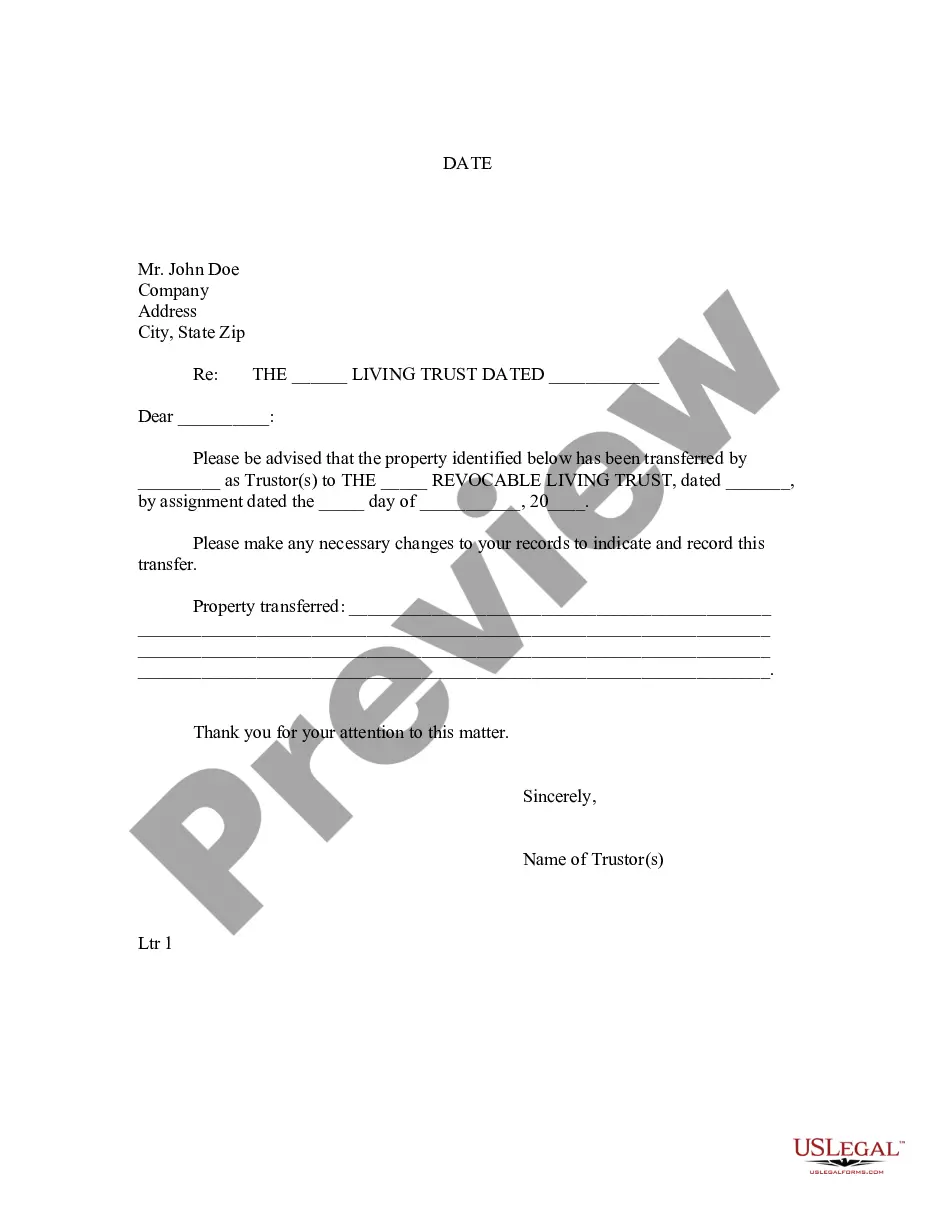

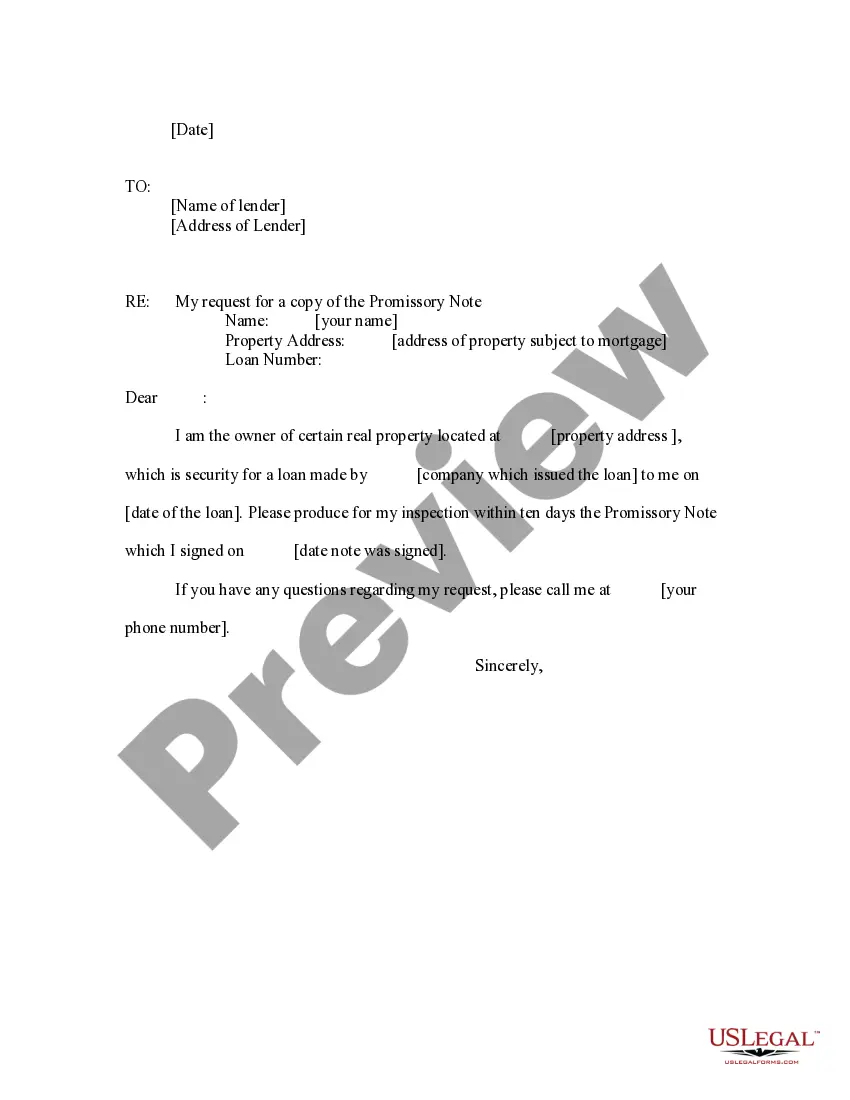

Completing the Florida Letter to Lienholder to Notify of Trust requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by entering the date at the top of the letter.

- Provide the lienholder's name, company, and address in the designated area.

- Clearly state the name of the trust and the date it was created.

- Include the name of the trustor(s) who transferred the property.

- List the property being transferred and include any necessary details, such as the address and legal description.

- Conclude the letter with a polite closing and the signatures of the trustor(s).

Who should use this form

This form is primarily intended for individuals who have recently established a trust and wish to notify lienholders of the transfer of property into that trust. It is beneficial for:

- Trustors who need to ensure their lienholders have up-to-date information regarding property ownership.

- Trustees managing property within the trust to maintain compliance and clear documentation.

- Individuals involved in estate planning who want to secure their assets for beneficiaries.

Key components of the form

The Florida Letter to Lienholder to Notify of Trust includes several key components that must be accurately filled out:

- Date: The date the letter is completed.

- Lienholder Information: Name, company, and address of the lienholder.

- Trust Information: Name of the trust and date it was established.

- Trustor(s) Information: Names of the individuals who established the trust.

- Property Details: Complete address and legal description of the property being transferred.

These elements are crucial for ensuring that the lienholder recognizes the trust as the new owner of the property.

Legal use and context

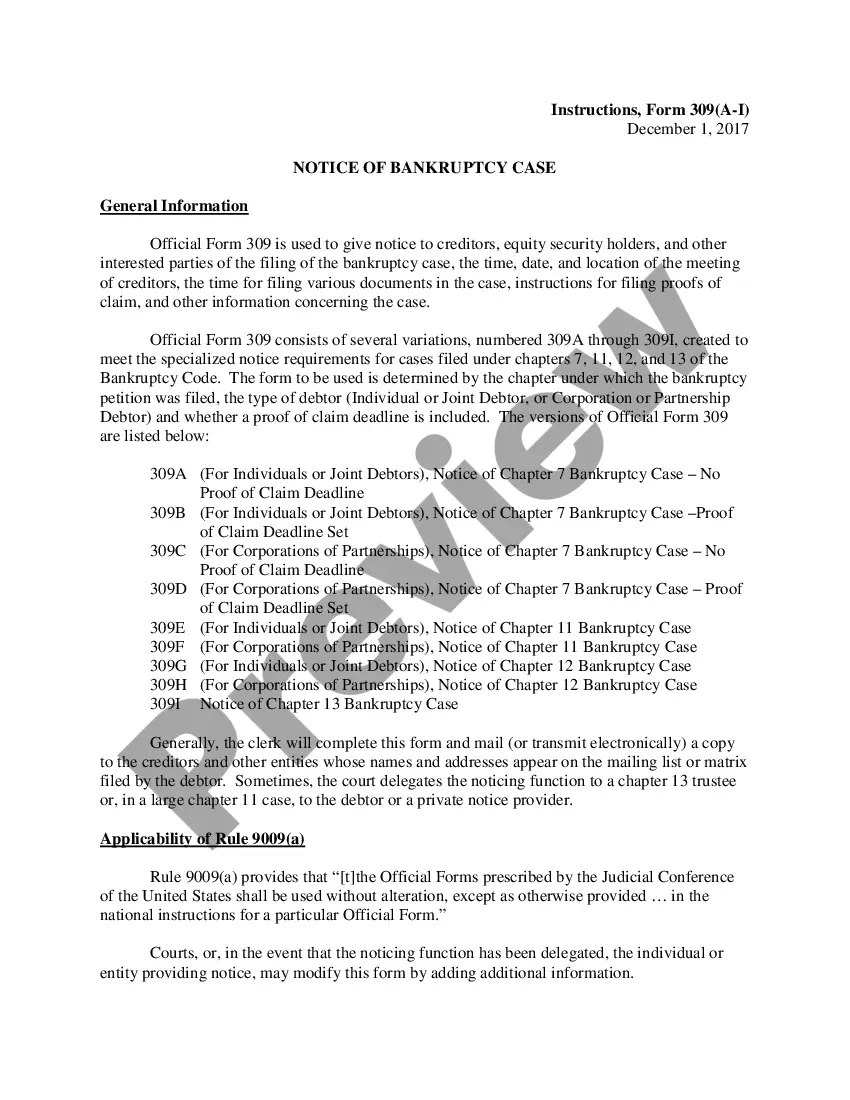

The Florida Letter to Lienholder to Notify of Trust is legally significant as it serves to officially document the transfer of property rights into a trust. This notification is essential for:

- Protecting the interests of both the trustor and the beneficiaries.

- Ensuring lienholders update their records to avoid any future disputes regarding property ownership.

- Providing a clear legal record of asset management and distribution under the terms of the trust.

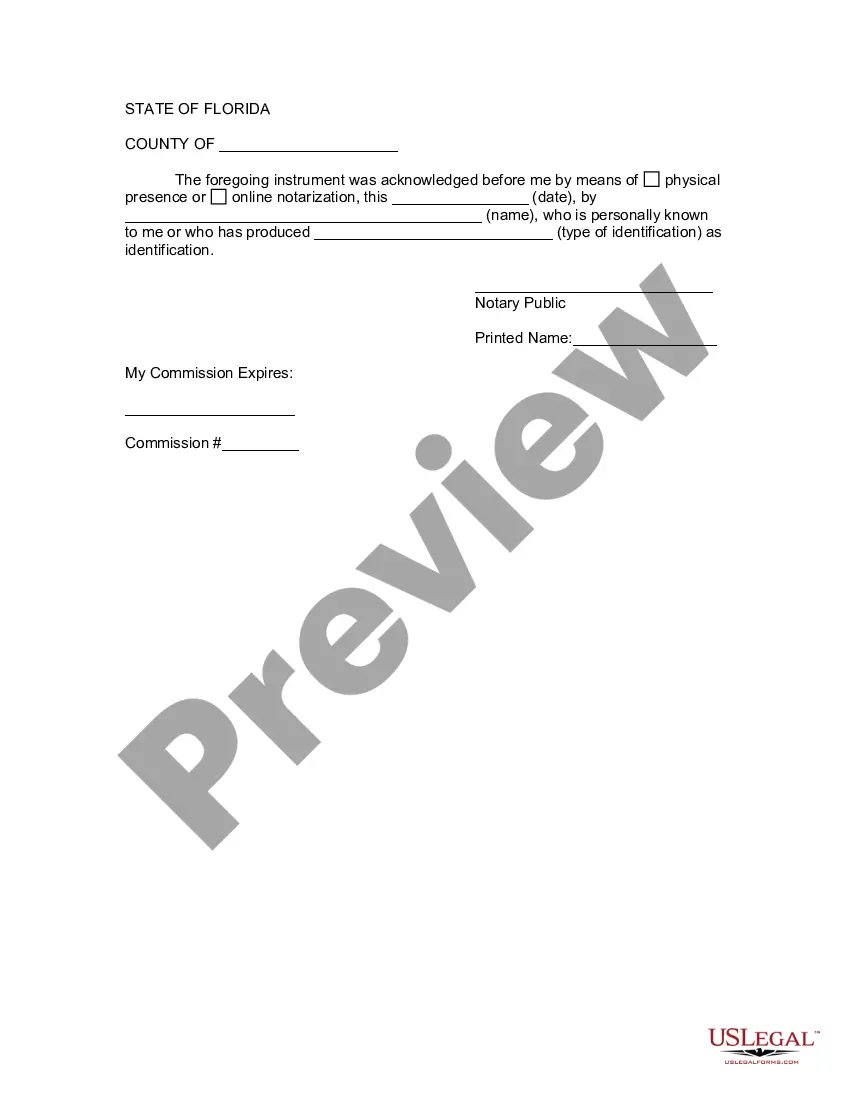

What to expect during notarization or witnessing

When the Florida Letter to Lienholder to Notify of Trust is prepared, it typically needs to be notarized to ensure its authenticity. Here’s what to expect during this process:

- Both trustor(s) must appear before a notary public.

- The notary will verify their identities through acceptable forms of identification.

- Once verified, the notary will witness the signing of the document.

- The notary will then affix their seal and signature, indicating that the document has been properly executed.

This process confirms the legitimacy of the document and protects all parties involved.

How to fill out Florida Letter To Lienholder To Notify Of Trust?

Gain access to one of the largest collections of legal documents.

US Legal Forms is truly a resource where you can discover any state-specific file in just a few clicks, even the Florida Letter to Lienholder to Notify of Trust templates.

No need to squander hours searching for a court-admissible document. Our certified experts ensure you obtain current papers every time.

After selecting a payment plan, establish your account. Process payment via card or PayPal. Download the template to your device by clicking Download. That’s it! You should submit the Florida Letter to Lienholder to Notify of Trust template and verify it. To confirm everything is accurate, contact your local legal advisor for help. Sign up and effortlessly browse through more than 85,000 valuable templates.

- To utilize the forms library, choose a subscription plan and set up an account.

- If you have completed this step, just Log In and click Download.

- The Florida Letter to Lienholder to Notify of Trust template will be swiftly saved in the My documents section (a category for all forms you download on US Legal Forms).

- To create a new account, follow the brief steps outlined below.

- If you are planning to use a state-specific template, make sure to select the correct state.

- If feasible, review the description to understand all the details of the document.

- Utilize the Preview feature if it’s available to examine the document's content.

- If everything appears satisfactory, click Buy Now.

Form popularity

FAQ

A letter of intent to lien in Florida is a formal document that notifies the property owner and relevant parties of an impending lien against their property. This is particularly important when dealing with financial matters in trust, as a Florida Letter to Lienholder to Notify of Trust can clarify the trust’s interests in the property. The letter ensures that all parties understand their rights and responsibilities, promoting transparency and legal compliance. Utilizing resources like USLegalForms can assist you in drafting the necessary document.

In Florida, generally only the trustee and the beneficiaries are entitled to a copy of the trust document. If you need to notify a lienholder, a Florida Letter to Lienholder to Notify of Trust serves as an effective means to communicate important details without disclosing the entire document. This letter protects the trust's privacy while complying with legal obligations. It’s advisable to communicate with a legal professional for accurate guidance on trust access.

In Florida, a certificate of trust does not need to be recorded with the county clerk or any governmental body. However, having a Florida Letter to Lienholder to Notify of Trust can be essential when dealing with lienholders. This letter provides necessary information about the trust, ensuring that interested parties, like lienholders, are aware of the trust's existence and its terms. Always consult with a legal expert to understand specific requirements.

In Florida, there is no formal process to file a notice of trust, but you can provide a letter outlining the trust’s existence and details. This letter should include pertinent information about the trustee and the beneficiaries. Utilizing a Florida Letter to Lienholder to Notify of Trust can serve as this notice, ensuring that the lienholder is aware of the trust's terms and the authority of the trustee in any related transactions.

To file a lien on a vehicle in Florida, you must complete the necessary application form and submit it to your local tax collector’s office. You'll also need to provide any supporting documents, such as the vehicle title. Using a Florida Letter to Lienholder to Notify of Trust can be beneficial in ensuring all parties are informed about the lien, protecting your interests in the vehicle.

In Florida, you do not need to file a certificate of trust with the court; however, it is often advisable to create one for clarity. A certificate of trust provides proof of the existence of a trust and the authority of the trustee. When dealing with liens or ownership issues, such as with a Florida Letter to Lienholder to Notify of Trust, this document can streamline your processes by clarifying the trust’s terms to third parties.

A notice of trust in Florida serves to inform interested parties about the existence of a trust. This document helps clarify the intentions of the trust's creator and outlines the roles of the trustee and beneficiaries. It is essential for ensuring that lienholders and other stakeholders acknowledge the trust's terms. To learn more about how to create a Florida Letter to Lienholder to Notify of Trust, consider using UsLegalForms as a reliable resource.

The timeframe to release a lien on a car in Florida can vary. Once the lienholder processes your request and submits the lien release, you may receive it within a week, depending on their internal procedures. To streamline this process, consider sending a Florida Letter to Lienholder to Notify of Trust. This could ensure timely communication and may speed up the necessary paperwork.

Removing a lienholder from a title in Florida involves securing a lien release from that lienholder. After obtaining this release, present it to the Florida Department of Highway Safety and Motor Vehicles along with your application for title transfer. Using a Florida Letter to Lienholder to Notify of Trust can expedite this process by ensuring that all parties are aware of their interests. This clarity helps avoid any potential complications.

To remove a lien from a car title in Florida, you typically need to obtain a lien release from the lienholder. Once you have this document, you can file it with the Florida Department of Highway Safety and Motor Vehicles. If you are unsure about the process, consider using a Florida Letter to Lienholder to Notify of Trust, which can help establish clarity in ownership and facilitate communication with relevant parties.