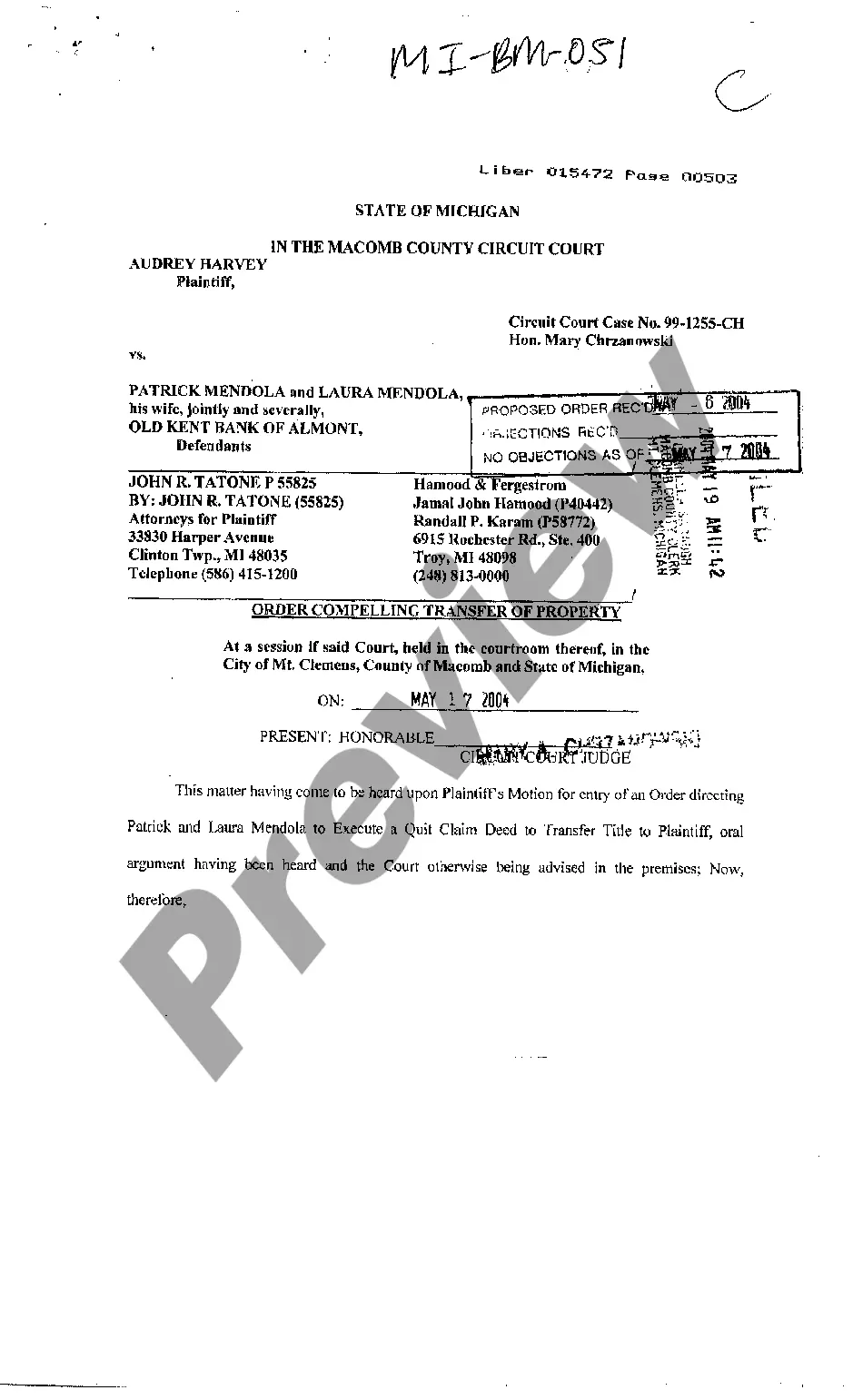

Michigan Order Compelling Transfer of Property

Description

How to fill out Michigan Order Compelling Transfer Of Property?

Access any sample from 85,000 legal documents including Michigan Order Compelling Transfer of Property online with US Legal Forms. Each document is prepared and updated by state-certified attorneys.

If you already possess a subscription, Log In. Once on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow the guidelines outlined below.

With US Legal Forms, you will always have immediate access to the necessary downloadable document. The service will provide you with access to files and organizes them into categories to streamline your search. Utilize US Legal Forms to secure your Michigan Order Compelling Transfer of Property quickly and efficiently.

- Review the state-specific criteria for the Michigan Order Compelling Transfer of Property you intend to use.

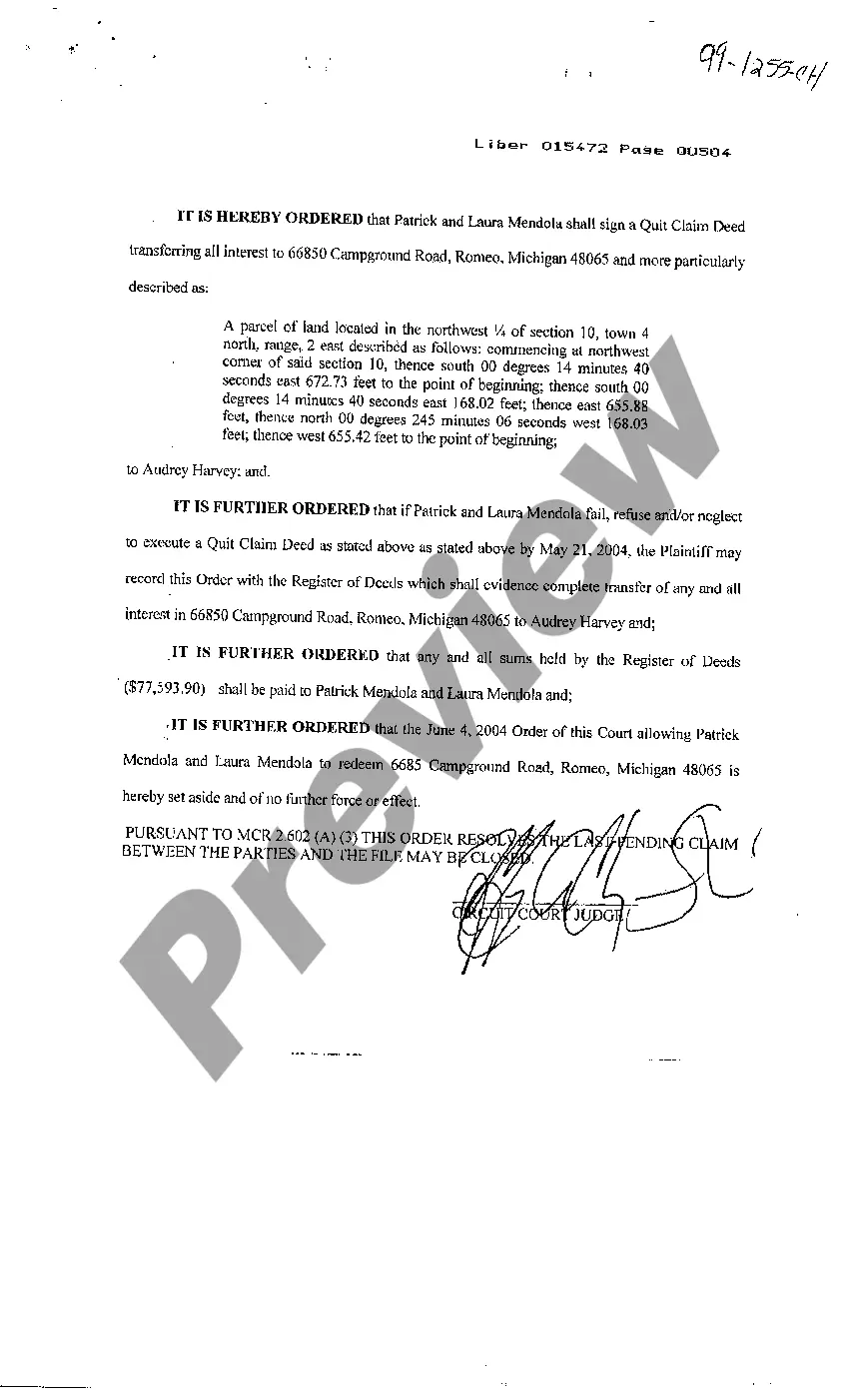

- Examine the description and preview the document.

- When you're certain the sample is what you require, simply click Buy Now.

- Choose a subscription plan that fits your financial needs.

- Establish a personal account.

- Complete payment using one of two convenient methods: credit card or PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable template is ready, print it or save it to your device.

Form popularity

FAQ

In Michigan, failing to comply with property transfer affidavit requirements can result in penalties, including fines. It is crucial to submit the affidavit correctly and within the designated time frame. If you face challenges with your property transfer affidavit or the Michigan Order Compelling Transfer of Property, consider using platforms like UsLegalForms, which can guide you through the process and help prevent penalties.

Yes, in Michigan, most affidavits must be notarized to be considered valid. This requirement adds a layer of authenticity and trustworthiness to the document. When preparing a property transfer affidavit related to a Michigan Order Compelling Transfer of Property, ensure you have it notarized to avoid potential legal issues.

You do not necessarily need a lawyer to transfer a deed in Michigan, as individuals can handle the process themselves. However, having legal guidance can prevent mistakes and ensure compliance with state laws, especially when dealing with a Michigan Order Compelling Transfer of Property. If you feel uncertain, consulting with a real estate attorney can provide clarity and confidence.

No, a property transfer affidavit and a deed are not the same. A property transfer affidavit is a document that provides information about a property transfer and is often used for tax purposes. In contrast, a deed is the legal instrument that transfers ownership of real estate. For matters relating to a Michigan Order Compelling Transfer of Property, it is essential to understand these distinctions.

Transferring a property deed in Michigan involves preparing a quitclaim deed or warranty deed, then recording it with the local county register of deeds. Make sure to complete the necessary documentation, including a property transfer affidavit, to accompany the deed. Once you file these documents, the transfer is officially recognized. For smoother execution, consider utilizing the US Legal platform, which provides comprehensive assistance for a Michigan Order Compelling Transfer of Property.

To file a property transfer affidavit in Michigan, you need to submit the form to your local county clerk's office. This affidavit is essential when transferring property, as it helps your local government assess property taxes accurately. After completing the form, ensure you submit it within 45 days after the transfer. For guidance on this process, you can explore the US Legal platform, which offers resources and templates for a Michigan Order Compelling Transfer of Property.

The best way to transfer property title between family members is often through a quitclaim deed or a warranty deed. These methods securely transfer ownership while minimizing complications. It is vital to ensure all documentation is correctly filled out and filed for your Michigan Order Compelling Transfer of Property, and resources such as US Legal Forms can provide templates and guidance to make the process easier.

To avoid stamp duty when transferring property in Michigan, you may look into specific exemptions that apply, such as gifts between family members. Additionally, you can structure the transfer in a way that qualifies for tax benefits. Consulting with a real estate attorney or using services like US Legal Forms can help clarify your options for a Michigan Order Compelling Transfer of Property, ensuring compliance while optimizing your savings.

In Michigan, the property transfer affidavit is typically filled out by the owner of the property. This document helps to report the transfer of property for tax purposes. If you are unsure about the completion process, you can seek assistance from a legal expert or use platforms like US Legal Forms to simplify the process. Ensuring this affidavit is correctly filed is crucial when handling a Michigan Order Compelling Transfer of Property.