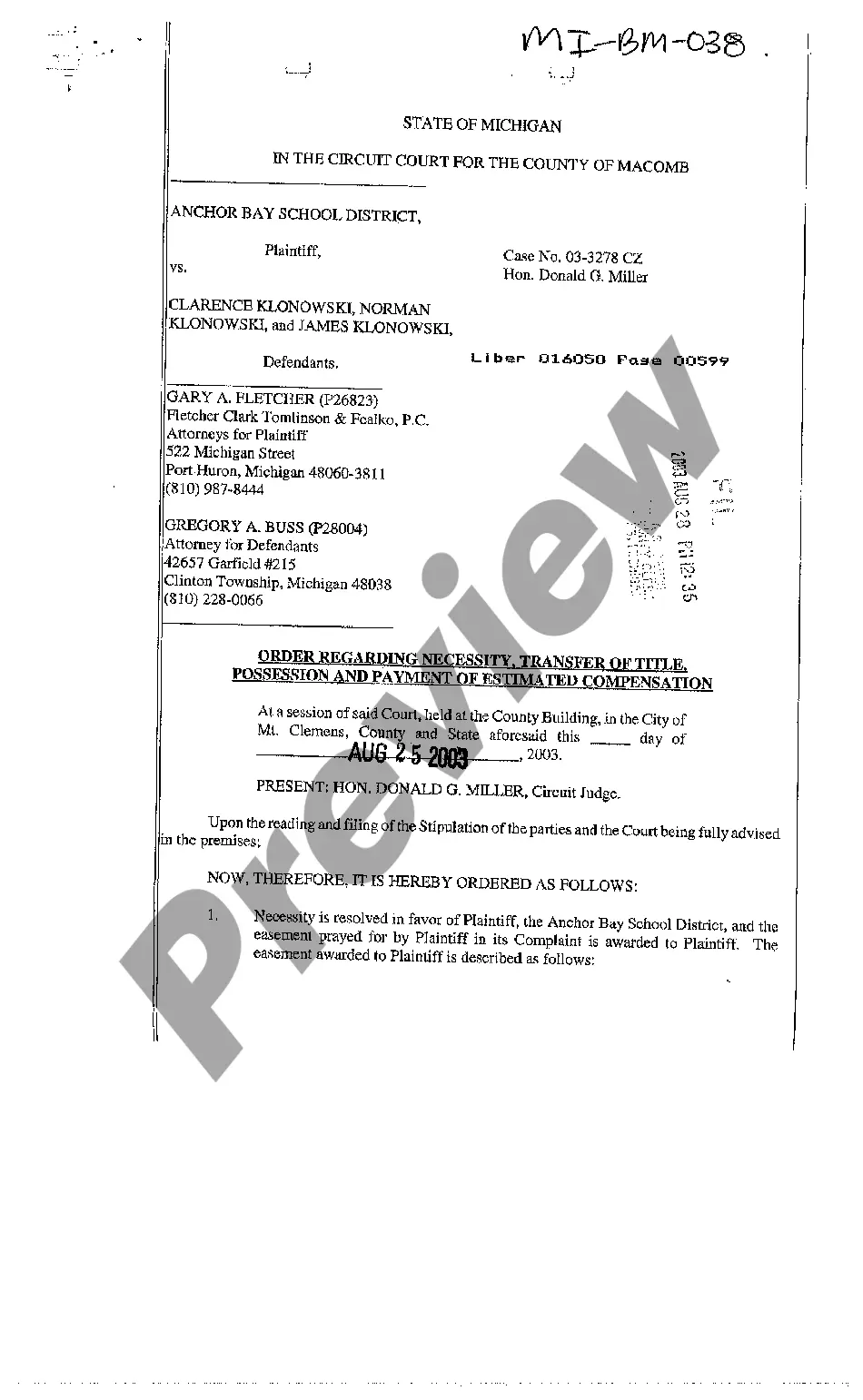

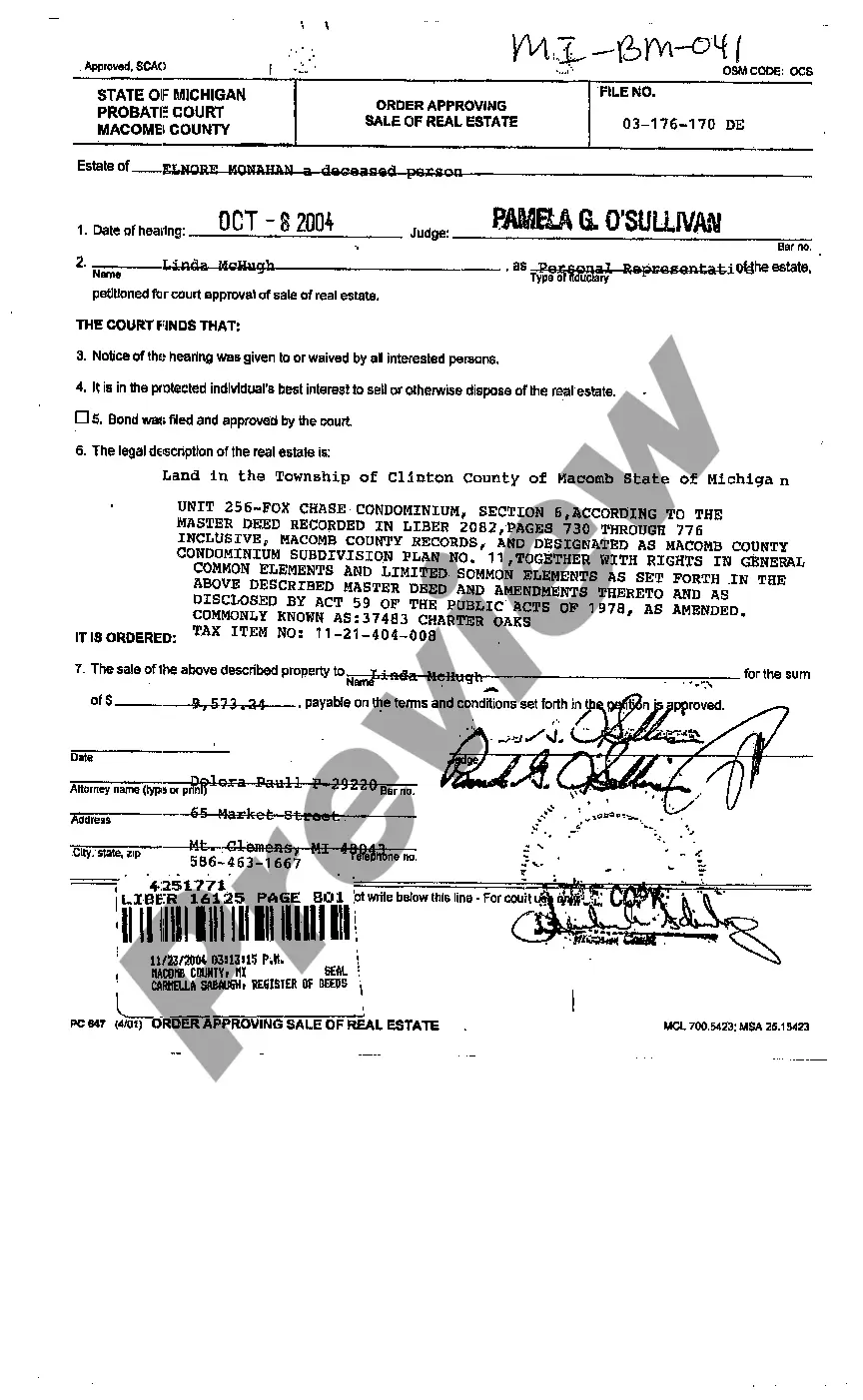

Michigan Order Authorizing Trustee to Sell Real Property

Description

How to fill out Michigan Order Authorizing Trustee To Sell Real Property?

Obtain any template from 85,000 legal documents including Michigan Order Authorizing Trustee to Sell Real Property online with US Legal Forms. Each template is crafted and revised by state-certified legal experts.

If you hold a subscription, sign in. Once on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, adhere to the guidelines listed below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The platform provides you with access to documents and categorizes them to enhance your search efficiency. Utilize US Legal Forms to obtain your Michigan Order Authorizing Trustee to Sell Real Property quickly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Order Authorizing Trustee to Sell Real Property you intend to utilize.

- Browse through the description and preview the template.

- Once you are confident that the sample meets your needs, click on Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Complete payment in one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two formats are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable form is downloaded, print it or store it on your device.

Form popularity

FAQ

In Michigan, a trustee generally has 63 days to notify beneficiaries after the trust becomes irrevocable. This ensures that beneficiaries are aware of their interests and rights within the trust. By providing a Michigan Order Authorizing Trustee to Sell Real Property, you can ensure efficient communication and management throughout the estate planning process.

When a deed of trust is created, the trustee holds the legal title to the property. This means the trustee has the right to manage the property according to the trust terms. If you opt for a Michigan Order Authorizing Trustee to Sell Real Property, this arrangement facilitates property management and helps ensure a smooth transaction process for all involved parties.

In Michigan, personal property that may be seized in a judgment includes assets such as bank accounts, vehicles, and other valuable items. However, certain exemptions apply, allowing individuals to keep essential goods, like basic household items. Understanding these laws is crucial, especially for those using Michigan Order Authorizing Trustee to Sell Real Property when dealing with judgments related to real estate.

Transferring property after the death of a parent without a will can be complex, but it often involves intestate succession laws. In Michigan, the estate may go through probate, which can be lengthy and complicated. Utilizing a Michigan Order Authorizing Trustee to Sell Real Property can help facilitate the sale and transfer process efficiently, ensuring clear management of the estate's assets.

Certain assets typically cannot be held in a trust, such as retirement accounts with designated beneficiaries. Additionally, assets that legally require ownership to be held personally may not fit into a trust structure. However, real estate including a Michigan Order Authorizing Trustee to Sell Real Property can be included, which can streamline ownership transfer upon incapacity or death.

Yes, a trust can protect your home title by placing the property in the trust's name. This means that the property is managed by a trustee according to the terms of the trust. If you have a Michigan Order Authorizing Trustee to Sell Real Property, the trustee can effectively manage and sell the property if needed, providing additional security for your home title.

The two-year rule for trusts in Michigan pertains to the time frame in which a trust must be established regarding the assets transferred to it. If a grantor creates a trust and then transfers property, the transfer must occur within two years for certain tax advantages to apply. Understanding these regulations can prevent unexpected tax liabilities and help with estate planning.

After a death in Michigan, you must manage the decedent's estate, which often involves transferring property. If the deceased had a trust, you would generally follow the terms of that trust. If there is no trust, you may need to go through probate court to allocate the property according to the will or state laws.

While trusts themselves don't need to be filed, if you plan to use the trust for transferring property, you might need to prepare certain documents, like a Michigan Order Authorizing Trustee to Sell Real Property. It’s advisable to consult an attorney to ensure all necessary documents are in order. For many people, using services like UsLegalForms can simplify the process of creating and managing your trust.

You should file a property transfer affidavit with the county clerk's office where the property is located in Michigan. This affidavit should accompany the deed when transferring property ownership. Properly filing ensures you comply with state regulations and facilitates a smooth property transfer process.