Michigan Agreement and Plan of Merger and Consolidation regarding banks

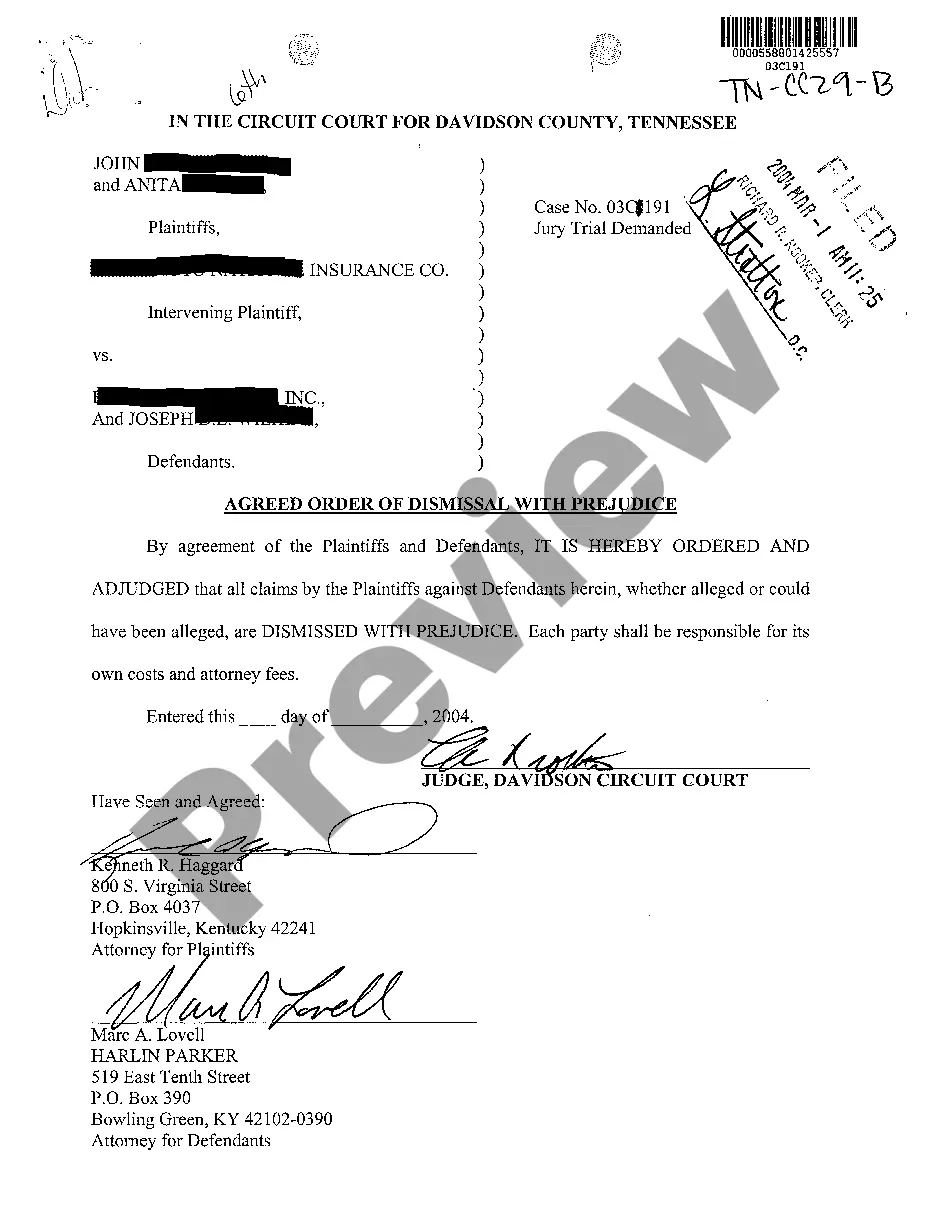

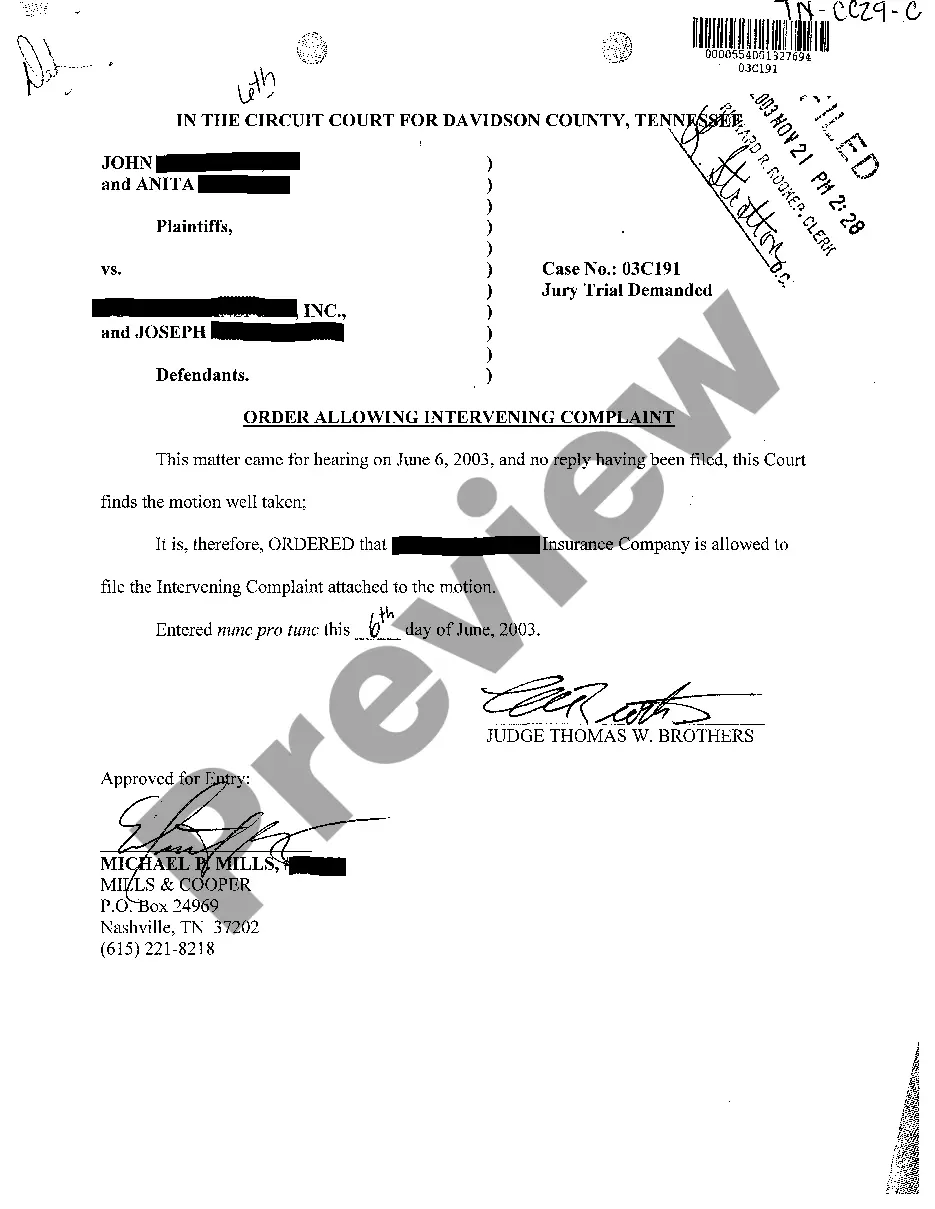

Description

How to fill out Michigan Agreement And Plan Of Merger And Consolidation Regarding Banks?

Access a variety of 85,000 legitimate documents including the Michigan Agreement and Plan of Merger and Consolidation pertaining to banks online via US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you possess a subscription already, sign in. After navigating to the form’s page, click the Download button and proceed to My documents to gain access to it.

Should you not have a subscription yet, adhere to the steps outlined below.

With US Legal Forms, you will consistently have swift access to the appropriate downloadable template. The service offers you access to documents and categorizes them for easier navigation. Utilize US Legal Forms to acquire your Michigan Agreement and Plan of Merger and Consolidation regarding banks swiftly and effortlessly.

- Verify the specific state regulations for the Michigan Agreement and Plan of Merger and Consolidation related to banks that you intend to utilize.

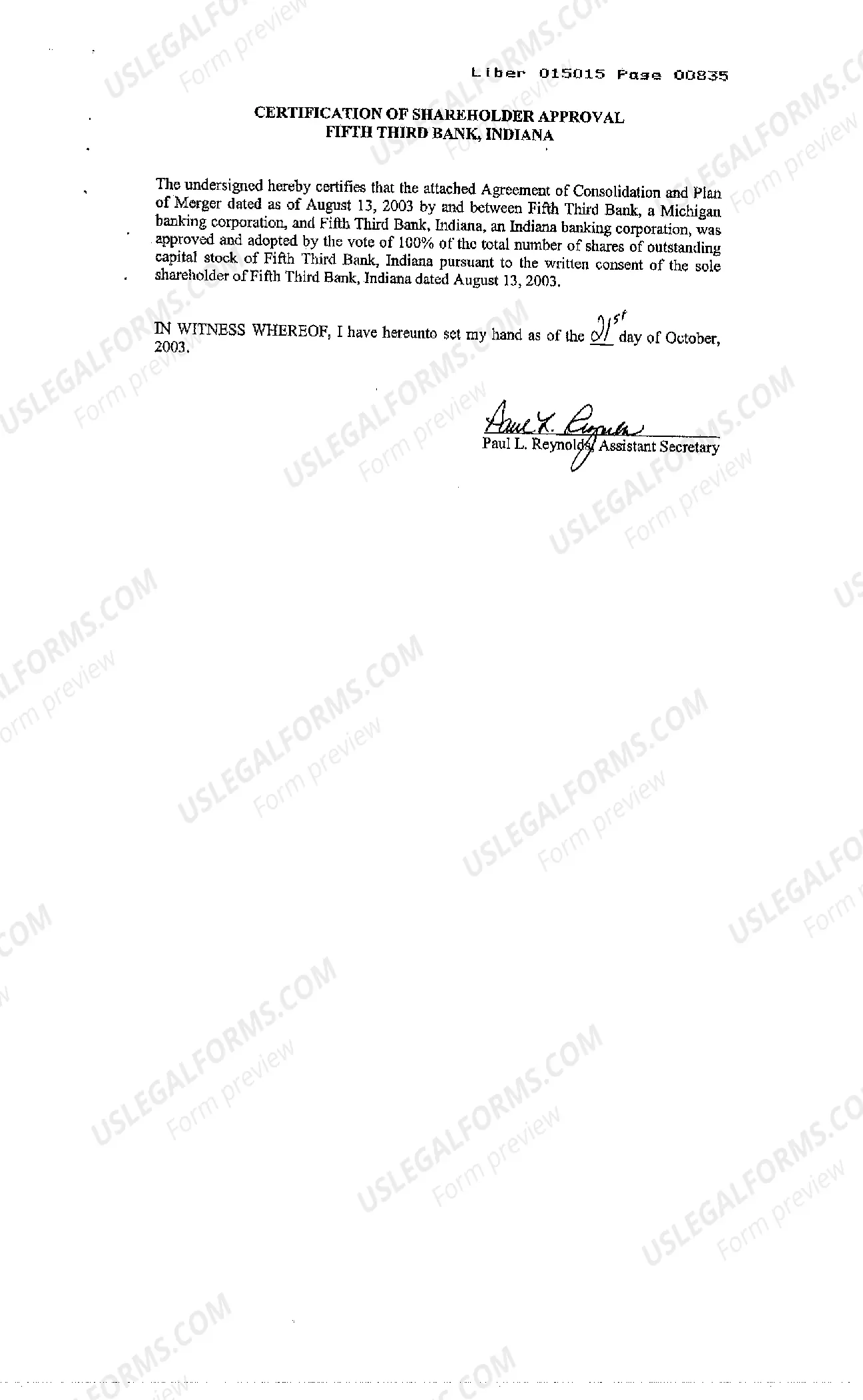

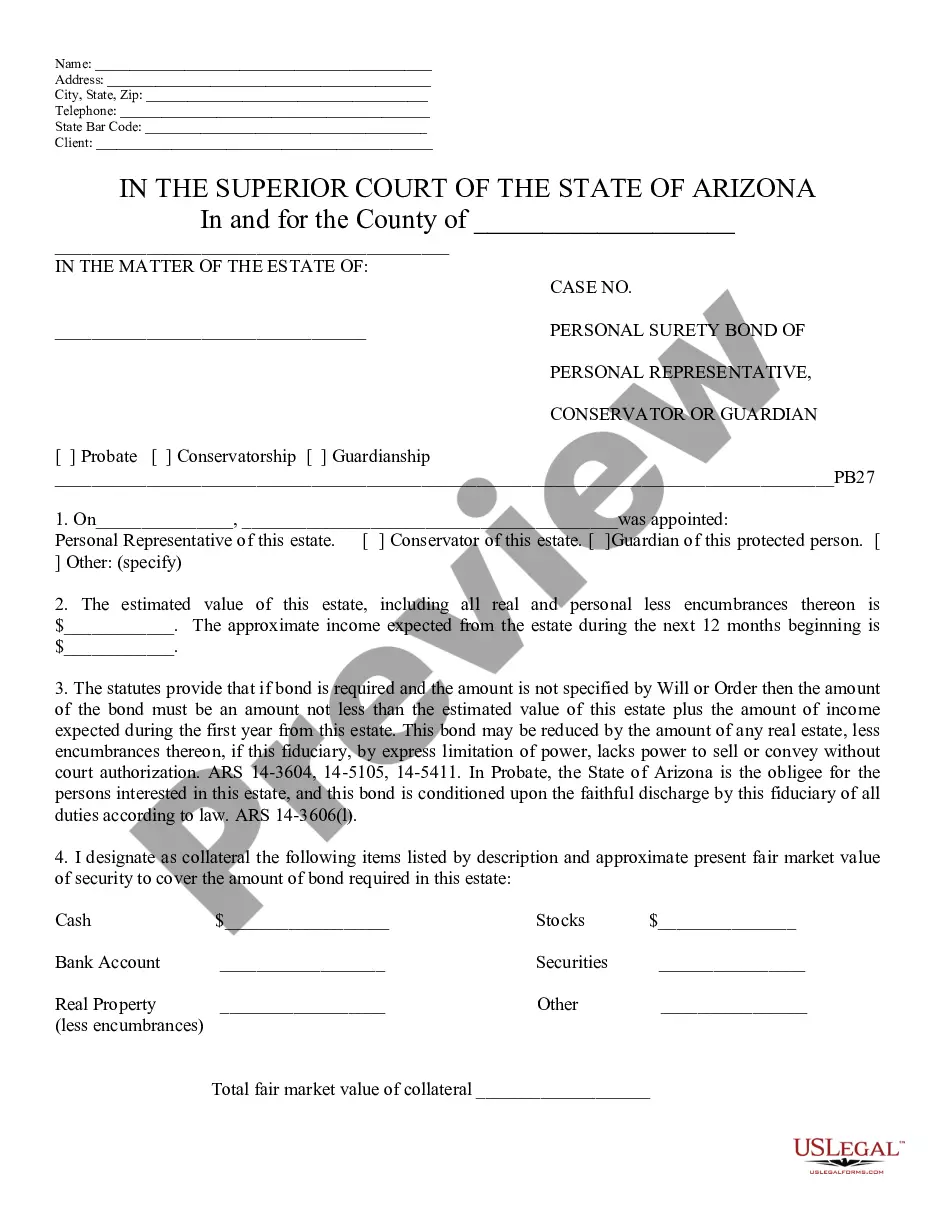

- Examine the description and view the sample.

- Once convinced the sample meets your needs, simply select Buy Now.

- Choose a subscription plan that aligns with your financial plan.

- Set up a personal account.

- Make a payment using one of two convenient methods: credit card or PayPal.

- Select a format to download the document in; you have two options (PDF or Word).

- Download the document to the My documents section.

- When your reusable template is ready, either print it out or save it to your device.

Form popularity

FAQ

A bank merger involves combining two financial institutions into a single entity, which can enhance operational efficiency and market reach. Initially, both banks negotiate terms based on the Michigan Agreement and Plan of Merger and Consolidation regarding banks. Once agreed, the merger goes through regulatory approvals, integrates assets and liabilities, and operational systems, ultimately aiming to create value for shareholders and customers.

The duration of a bank merger can vary depending on several factors, but typically it takes several months to complete. After the merger agreement is signed, both banks must undergo regulatory review under the Michigan Agreement and Plan of Merger and Consolidation regarding banks. Licenses may take time to secure, and thorough due diligence is essential to ensure a smooth transition.

In Michigan, you need to file your Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA). This is crucial for establishing your business entity and ensuring compliance with state regulations. You can file online or through traditional mail, and you'll want to be sure that your filing aligns with the Michigan Agreement and Plan of Merger and Consolidation regarding banks if your organization is involved in a merger.

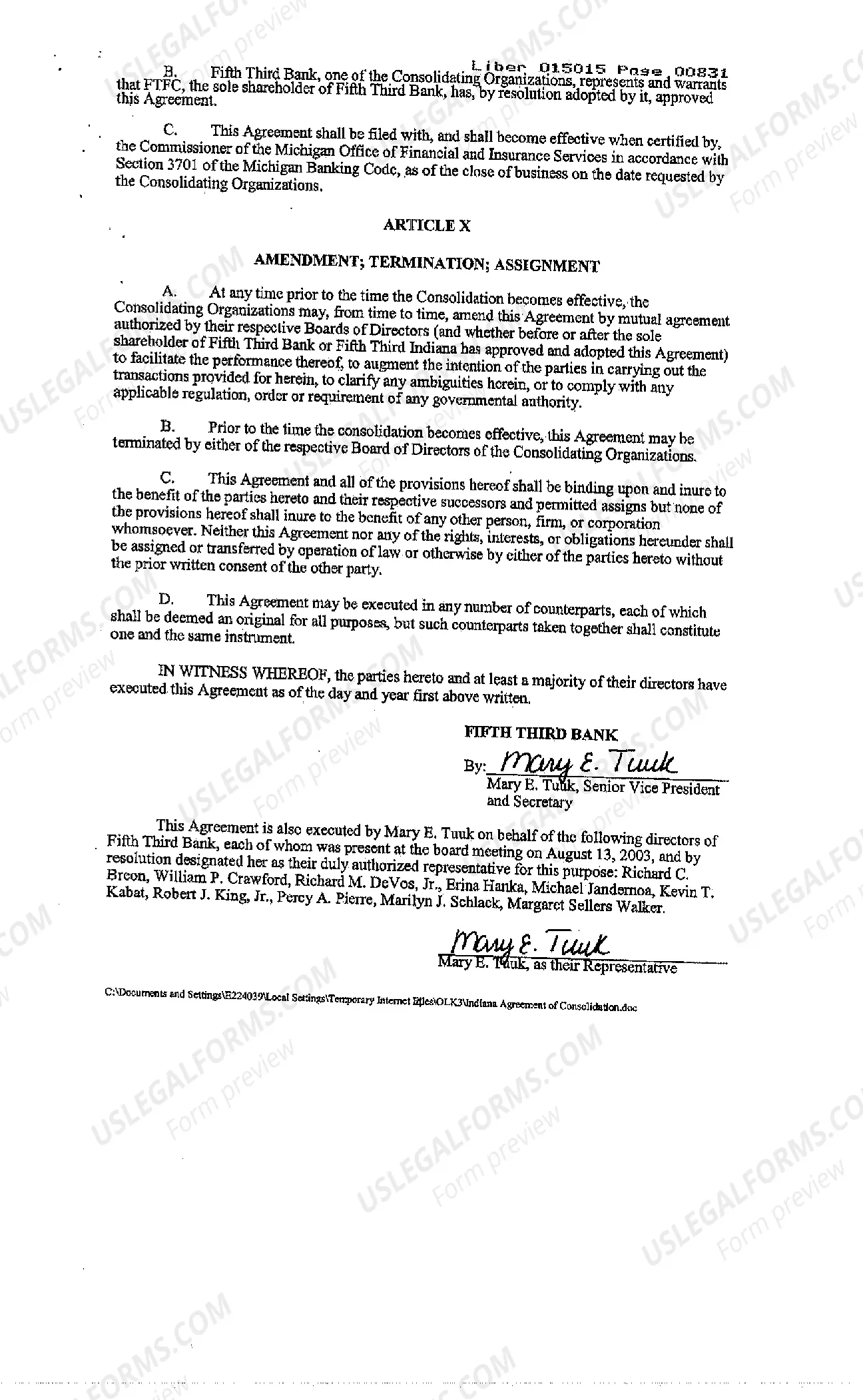

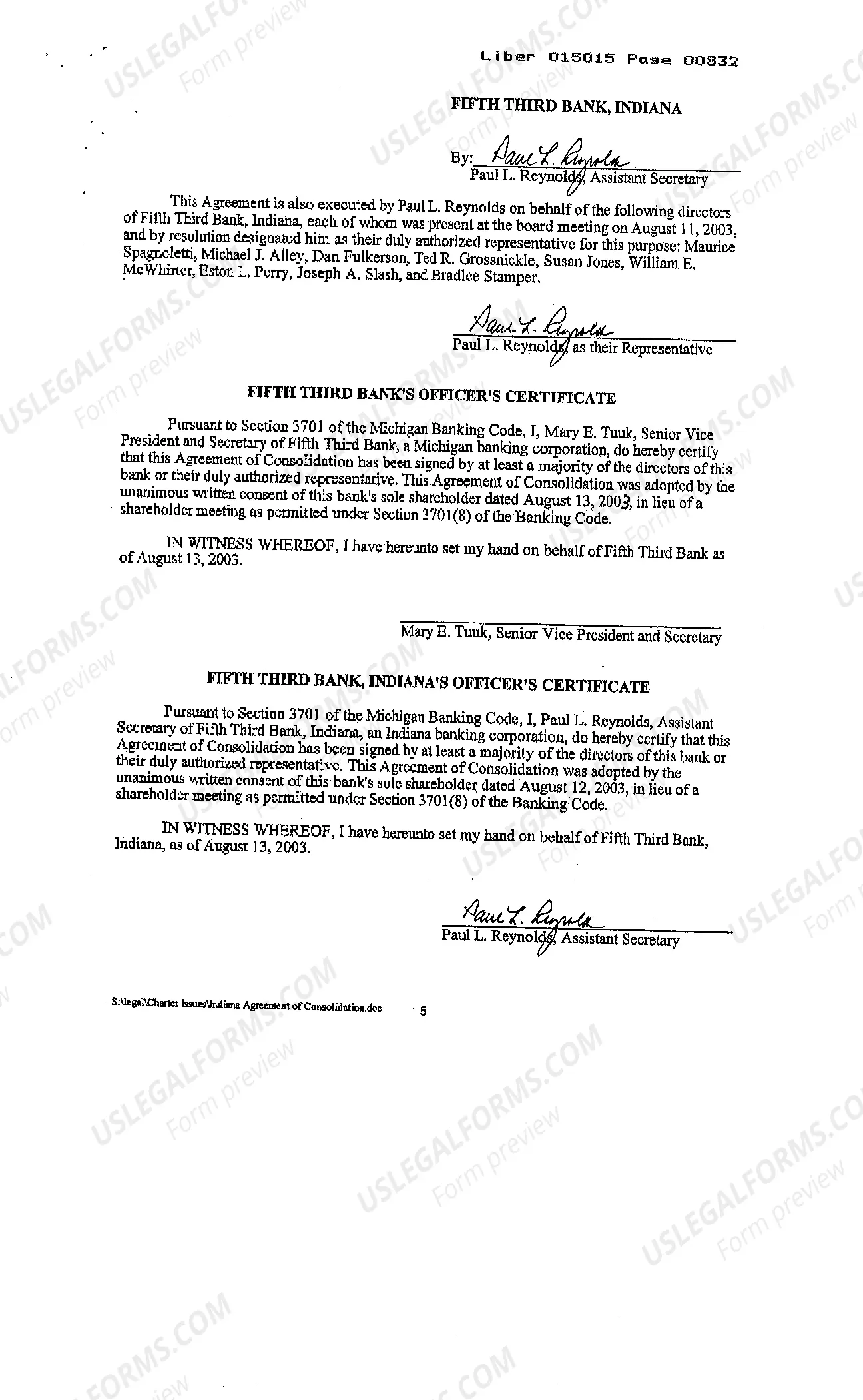

The procedure for a merger under the Michigan Agreement and Plan of Merger and Consolidation regarding banks typically involves several steps. First, the boards of directors for the merging banks must approve the merger agreement. Then, the banks must submit the necessary documentation, including the charter and bylaws, to the Michigan Department of Insurance and Financial Services for review and approval.

The impact of mergers on stocks can vary significantly depending on multiple factors, including market perceptions and the financial health of the entities involved. Generally, mergers can create opportunities for growth and increased market share, potentially leading to a rise in stock value. However, it’s essential to consider the specific details outlined in the Michigan Agreement and Plan of Merger and Consolidation regarding banks.

The plan of merger agreement describes how the merger will occur, including how assets, liabilities, and stock will be transferred. This legal document is crucial for banks as it clarifies the merging procedures and responsibilities of each party. Following the Michigan Agreement and Plan of Merger and Consolidation regarding banks will help ensure all regulatory requirements are met during this process.

An agreement and plan of merger is a comprehensive document that specifies the details of a merger, including the structure, rights, and obligations of the parties involved. This document is essential for guiding the merger process and must adhere to the Michigan Agreement and Plan of Merger and Consolidation regarding banks. It ensures that all parties understand their roles and the implications of the merger.

A merger agreement is a legal document that outlines the terms, conditions, and obligations of the parties involved in a merger deal. This agreement must be carefully crafted to ensure compliance with regulations, including the Michigan Agreement and Plan of Merger and Consolidation regarding banks. It serves as a roadmap for the merger process and details how assets and responsibilities will be handled.

Merger and consolidation refer to the processes through which two or more entities combine to form a new organization or to operate as a single entity. In banking, this often involves the consolidation of assets, liabilities, and operations to enhance efficiency. The Michigan Agreement and Plan of Merger and Consolidation regarding banks lays out the terms necessary for this process.

In the United States, a bank merger requires approval from several regulatory bodies, including state and federal agencies. The Office of the Comptroller of the Currency (OCC) and the Federal Reserve typically review these transactions. The Michigan Agreement and Plan of Merger and Consolidation regarding banks must satisfy all regulatory requirements to ensure a smooth transition.