Michigan Business Credit Application

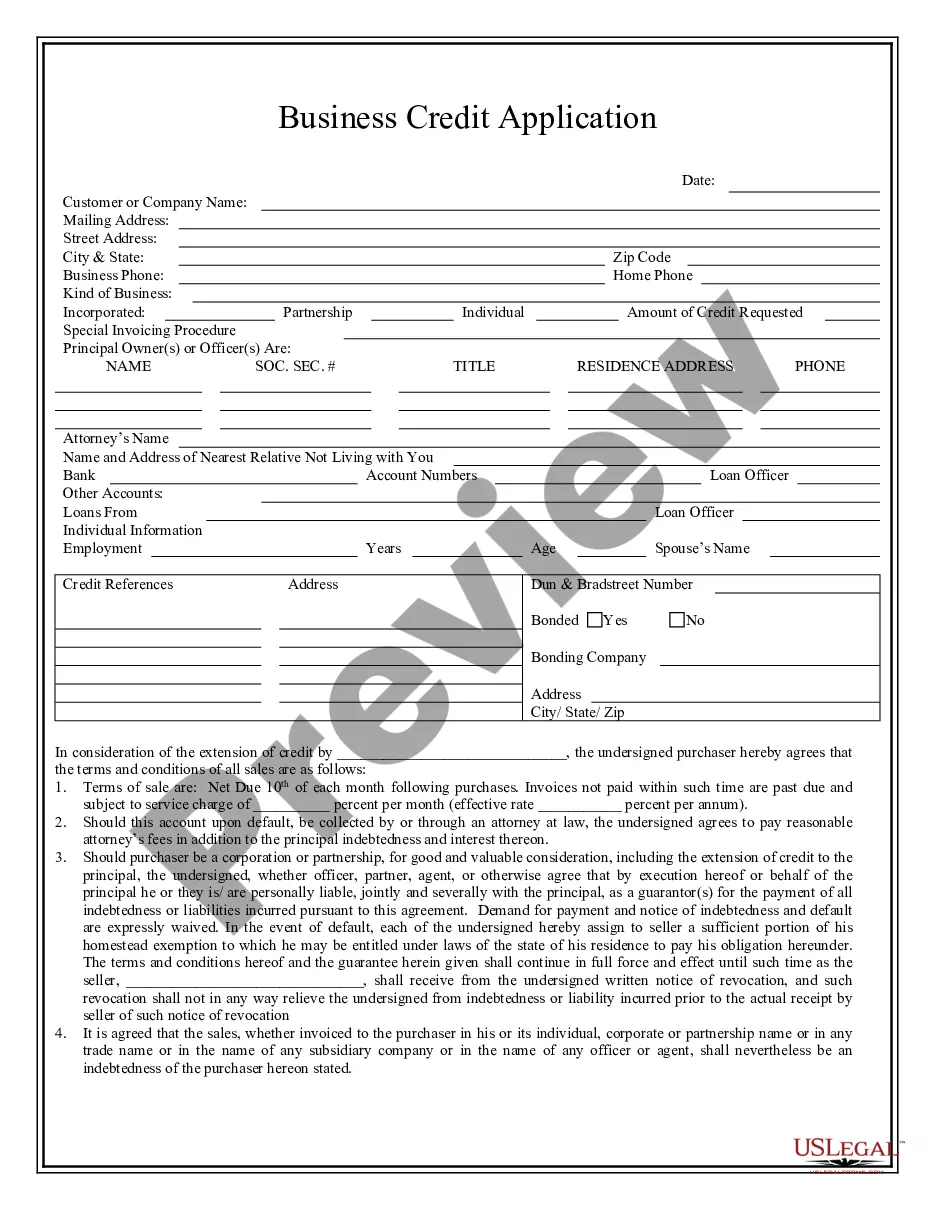

What is this form?

The Business Credit Application is a legal document used by individuals or businesses to request credit for purchases from a seller. This form outlines the terms of sale, payment obligations, and responsibilities in the event of default. Unlike other credit agreements, it specifically includes provisions for interest rates, waivers of warranties, and guarantees from corporate officers or partners, making it a vital tool in business transactions that involve credit sales.

Key components of this form

- Identification of the buyer and seller, including contact details.

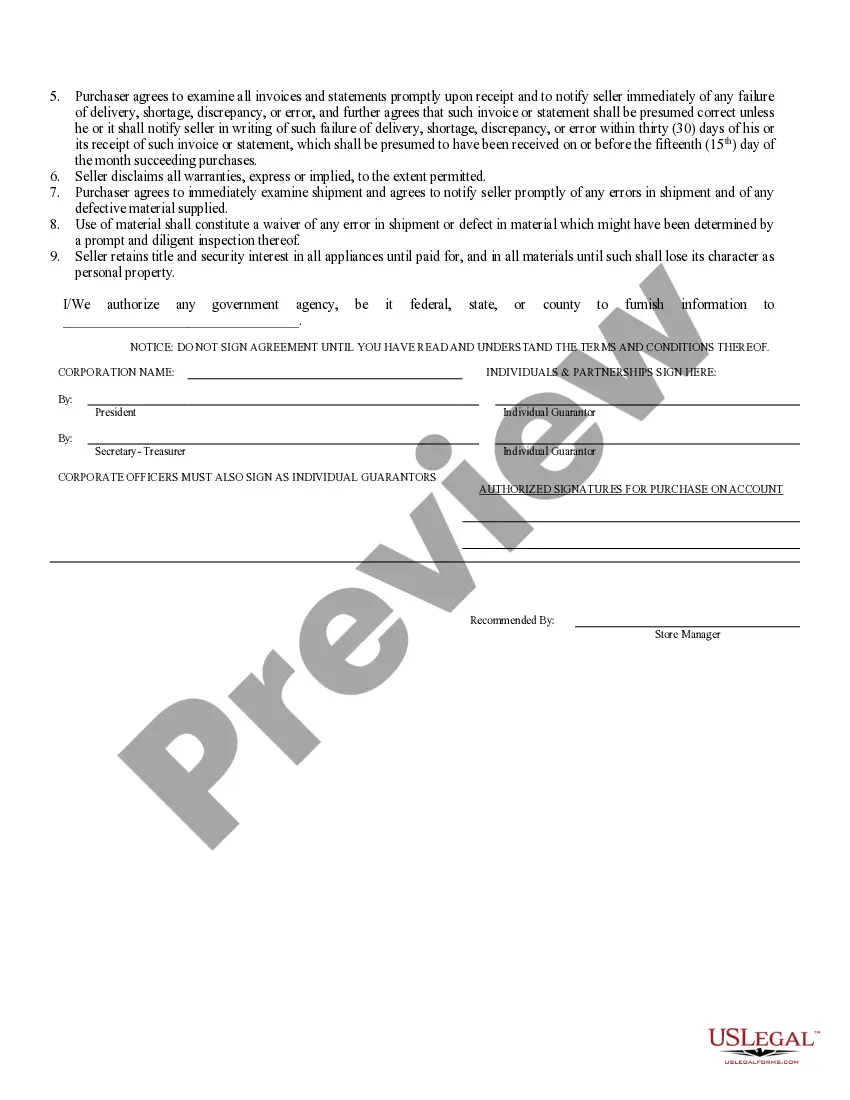

- Payment terms, including due dates and any applicable service charges for late payments.

- Provisions for default, including responsibilities for attorney fees.

- Waivers of warranties and disclaimers protecting the seller.

- Retention of title clause ensuring ownership remains with the seller until the purchase is fully paid.

- Authorization for the seller to obtain credit information from relevant agencies.

Common use cases

This form should be used when a buyer intends to purchase goods on credit from a seller. It is particularly useful for businesses that wish to establish credit terms with suppliers or vendors. Situations that may require this document include new business relationships, bulk purchases of merchandise, or any scenarios where immediate payment is not feasible but goods are needed for operations.

Intended users of this form

- Individual entrepreneurs seeking to purchase goods on credit.

- Corporations looking to establish credit terms with suppliers.

- Partnerships needing to secure credit for business operations.

- Anyone requiring additional credit for making substantial business purchases.

Completing this form step by step

- Identify both the seller and purchaser by entering their names and addresses at the top of the form.

- Specify the payment terms, including the due date and interest rate for late payments.

- Enter any details regarding default provisions, including fee amounts for collections.

- Have all relevant parties review and sign the document to confirm their acceptance of the terms.

- Provide authorization for the seller to obtain necessary credit information from agencies.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to read and understand all terms before signing the agreement.

- Not entering complete or accurate information for either party.

- Neglecting to have all required parties sign the document, including individual guarantors from corporations.

- Overlooking any deadlines for error reporting on invoices.

Advantages of online completion

- Convenient access to a legally vetted document tailored for your needs.

- Editable fields for easy customization to fit specific business arrangements.

- Instant availability for download, eliminating delays in obtaining a credit agreement.

Looking for another form?

Form popularity

FAQ

Check your credit scores. Know your annual income. Research available reward options. Understand the rates you'll be paying on your credit card debt. Know the eligibility requirements for the card you select. Apply for the business credit card.

Unlike banks, which operate for profit, credit unions are non-profit cooperatives.Credit unions offer many of the same financial services as banks, including business and personal checking and savings accounts, vehicle loans, personal and business credit cards, mortgages, and business loans.

Small business credit cards provide business owners with easy access to a revolving line of credit with a set credit limit in order to make purchases and withdraw cash. Like a consumer credit card, a small business credit card carries an interest charge if the balance is not repaid in full each billing cycle.

While you might think that your business is in the early days and you don't need a separate credit card, business credit cards can provide important benefits to your company, including rewards you can use for virtually free travel, expense management, and credit to grow your business.

On your business credit card application, your card issuer will request some information about your business financials, including your income and estimated monthly spend. (That's partly how they'll determine your eligibility for the card and, if so, the size of your credit line.)

When you apply for a business credit card especially if it's a small business card your application will likely hinge on your personal credit. This means that when you apply, the card issuer will run a hard check on your credit.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

Own or operate a business. Check your personal credit score. Determine whether you need cards for employees. Choose between rewards and 0% rates. Compare cards based on your intended usage. Apply for the best credit card for your business.

If you want a business credit card for a new enterprise, side hustle or startup, you don't have to wait to establish a business credit history before applying. If you have good credit represented by a credit score of 690 or above you can generally qualify based on your personal credit history.