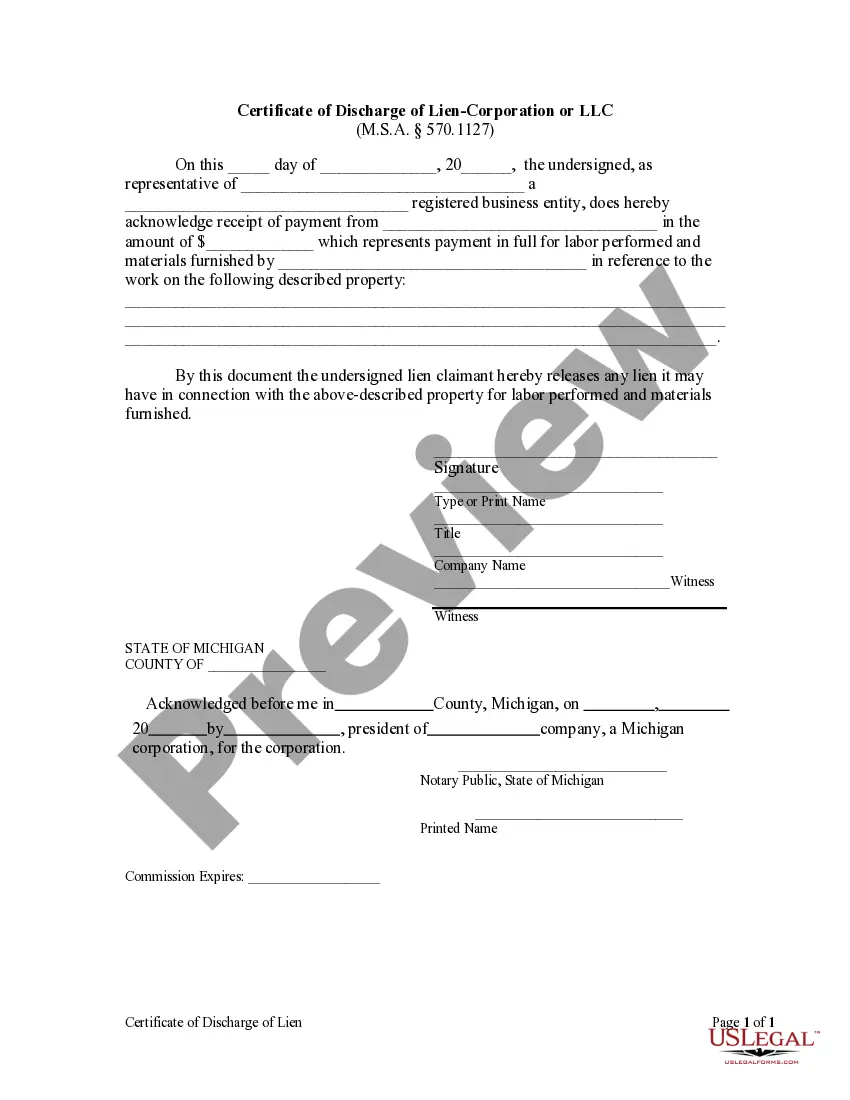

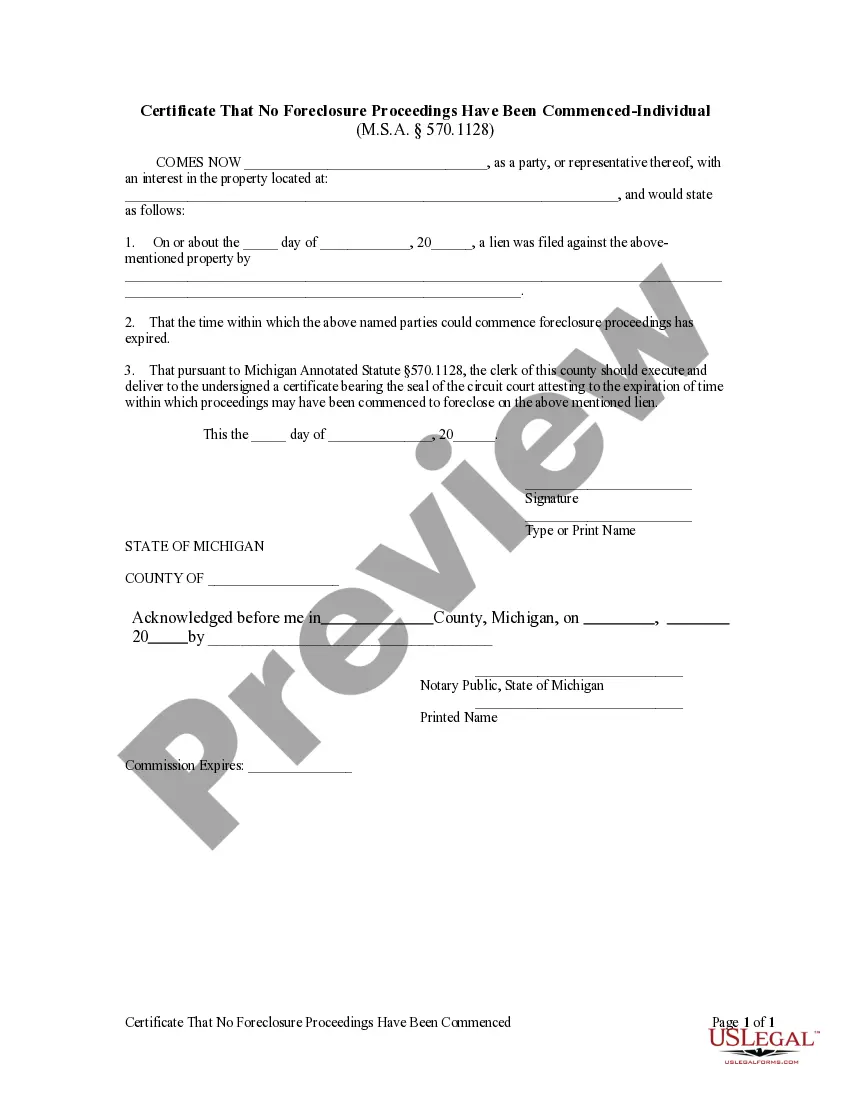

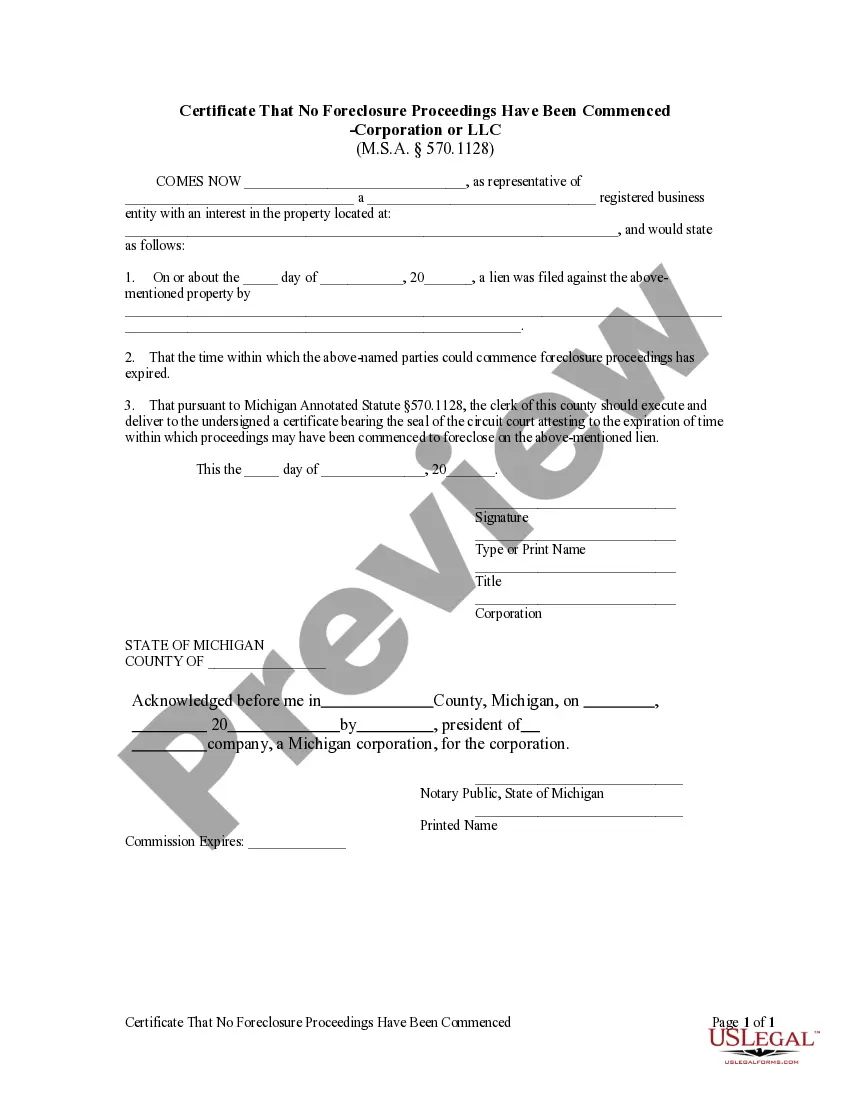

Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC

Description

How to fill out Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation Or LLC?

Obtain any template from 85,000 legal documents including Michigan Certificate That No Foreclosure Proceedings Have Been Initiated - Corporation or LLC online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. When you are on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow these steps: Check the specific state requirements for the Michigan Certificate That No Foreclosure Proceedings Have Been Initiated - Corporation or LLC you wish to utilize. Review the description and preview the sample. When you are confident the sample fits your needs, click on Buy Now. Select a subscription plan that suits your finances. Create a personal account. Pay using one of two available methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable form is ready, print it or save it to your device.

With US Legal Forms, you will always have immediate access to the suitable downloadable template. The service will provide you access to forms and categorizes them to ease your search. Utilize US Legal Forms to secure your Michigan Certificate That No Foreclosure Proceedings Have Been Initiated - Corporation or LLC swiftly and effortlessly.

- Acquire any template from 85,000 legal documents including Michigan Certificate That No Foreclosure Proceedings Have Been Initiated - Corporation or LLC online with US Legal Forms.

- Every template is crafted and refreshed by state-certified legal experts.

- If you already possess a subscription, Log In.

- When you are on the form’s page, hit the Download button.

- Navigate to My documents to retrieve it.

- If you haven’t subscribed yet, follow these steps.

- Check the specific state requirements for the Michigan Certificate.

- Review the description and preview the sample.

- When you are confident the sample fits your needs, click on Buy Now.

Form popularity

FAQ

Forming an LLC in Michigan involves several key steps. First, you need to choose a name for your LLC that complies with state rules. After that, you will file Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs. Lastly, securing a Michigan Certificate That No Foreclosure Proceedings Have Been Commenced - Corporation or LLC can provide additional assurance of your LLC’s standing. Consider using resources like uslegalforms for guidance throughout this process.

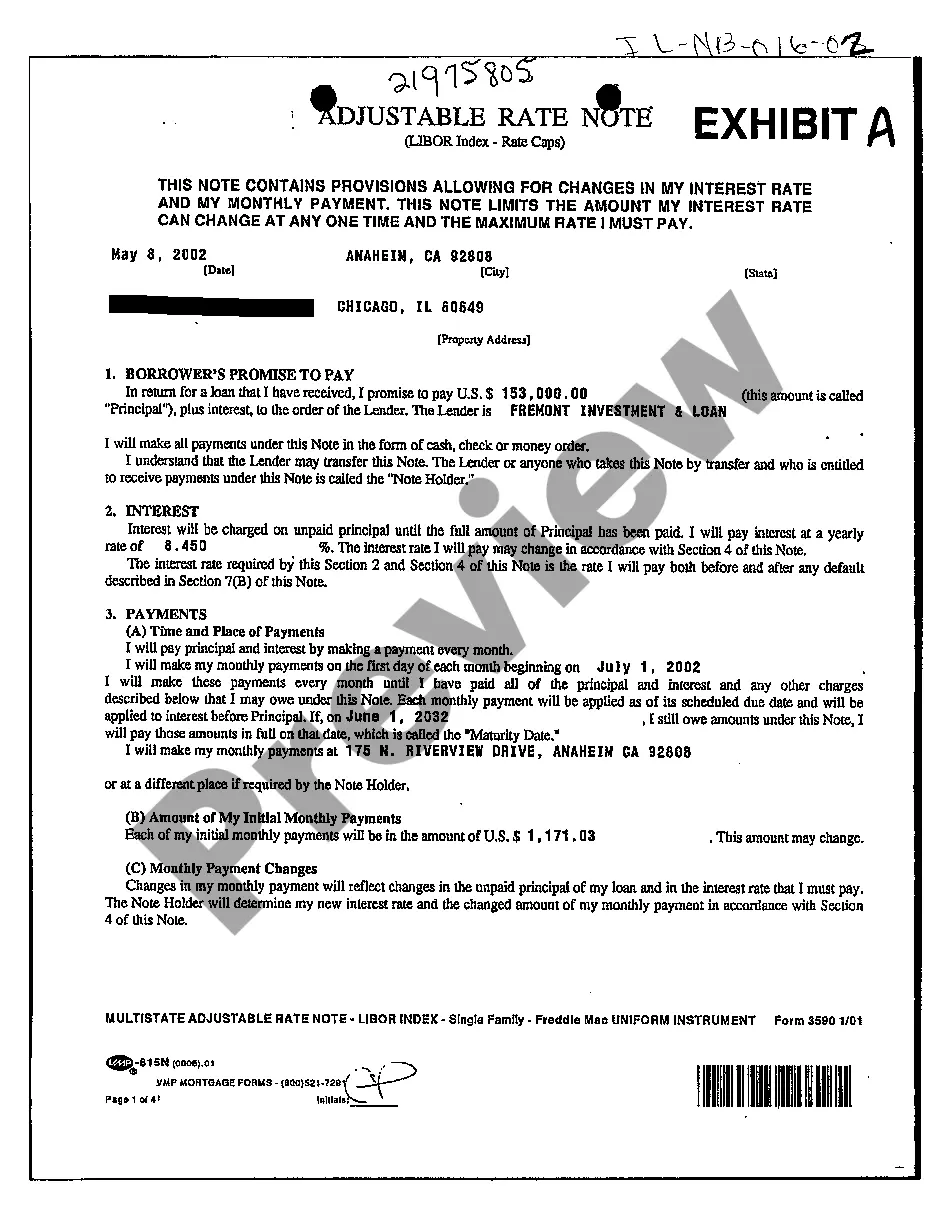

How Liens Work. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The property that is the subject of a lien cannot be sold by the owner without the consent of the lien holder.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

A lien is a legal right to claim a security interest in a property provided by the owner of the property to the creditor.The grantor (the owner of the property) is called the lienee while the party that receives the lien is referred to as the lienor or lien holder.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Non-consensual liens arise from statutory or common law. The most notable example is a tax lien, which is imposed by law against the property of a taxpayer. If a taxpayer fails to pay the taxes owed to the government, the tax agency can seize his or her real or personal property for the amount of the lien.

The lien gives the creditor an interest in your property so that it can get paid for the debt you owe. If you sell the property, the creditor will be paid first before you receive any proceeds from the sale. And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

The Indian Contract Act, 1872 classifies the Right of Lien into two types: Particular Lien and General Lien. Section 170 of the aforesaid Act gives the exact definition of Particular Lien which states that the Bailee is free to hold control of a precise property with position to the charge which is due.

A security interest or legal right acquired in one's property by a creditor. A lien generally stays in effect until the underlying obligation to the creditor is satisfied. If the underlying obligation is not satisfied, the creditor may be able to take possession of the property involved.