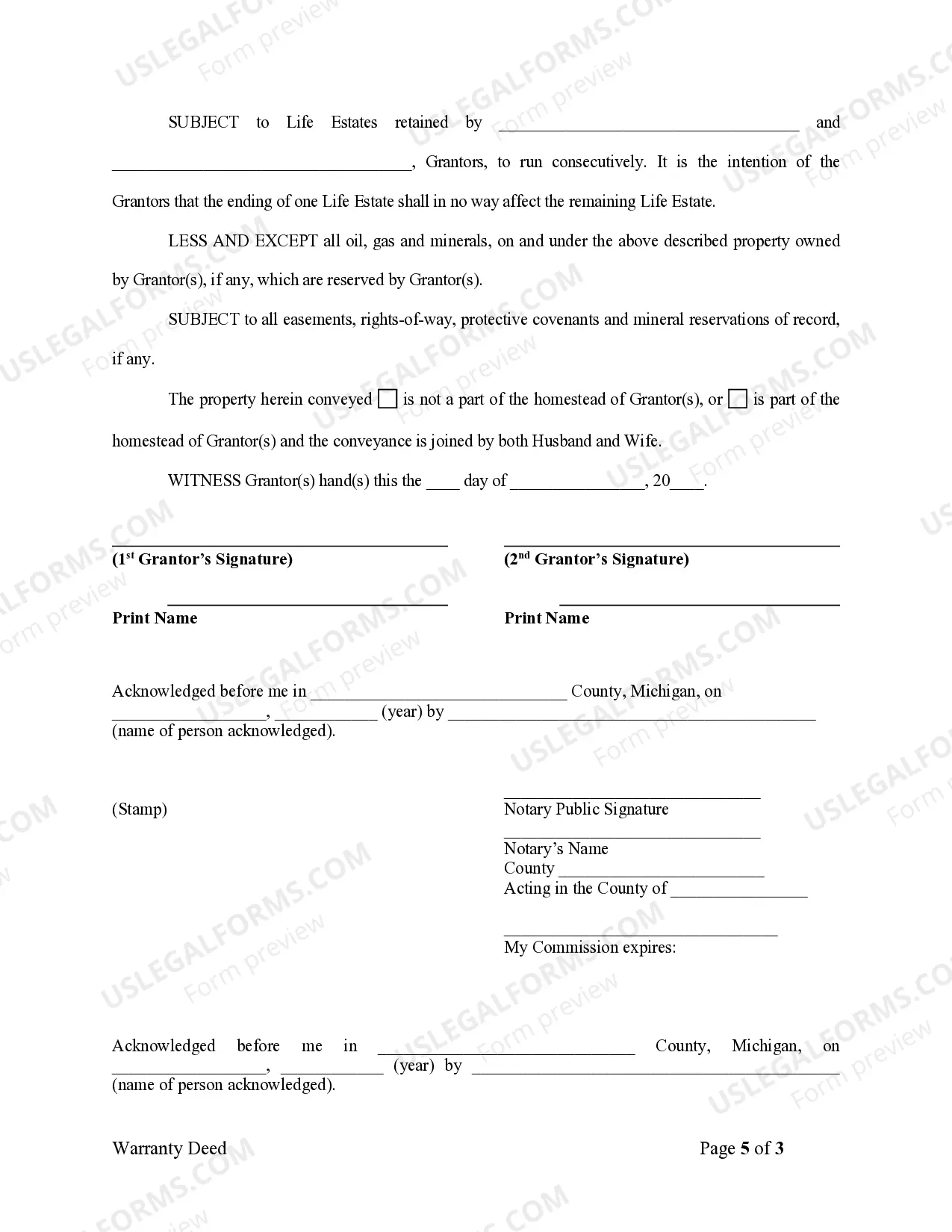

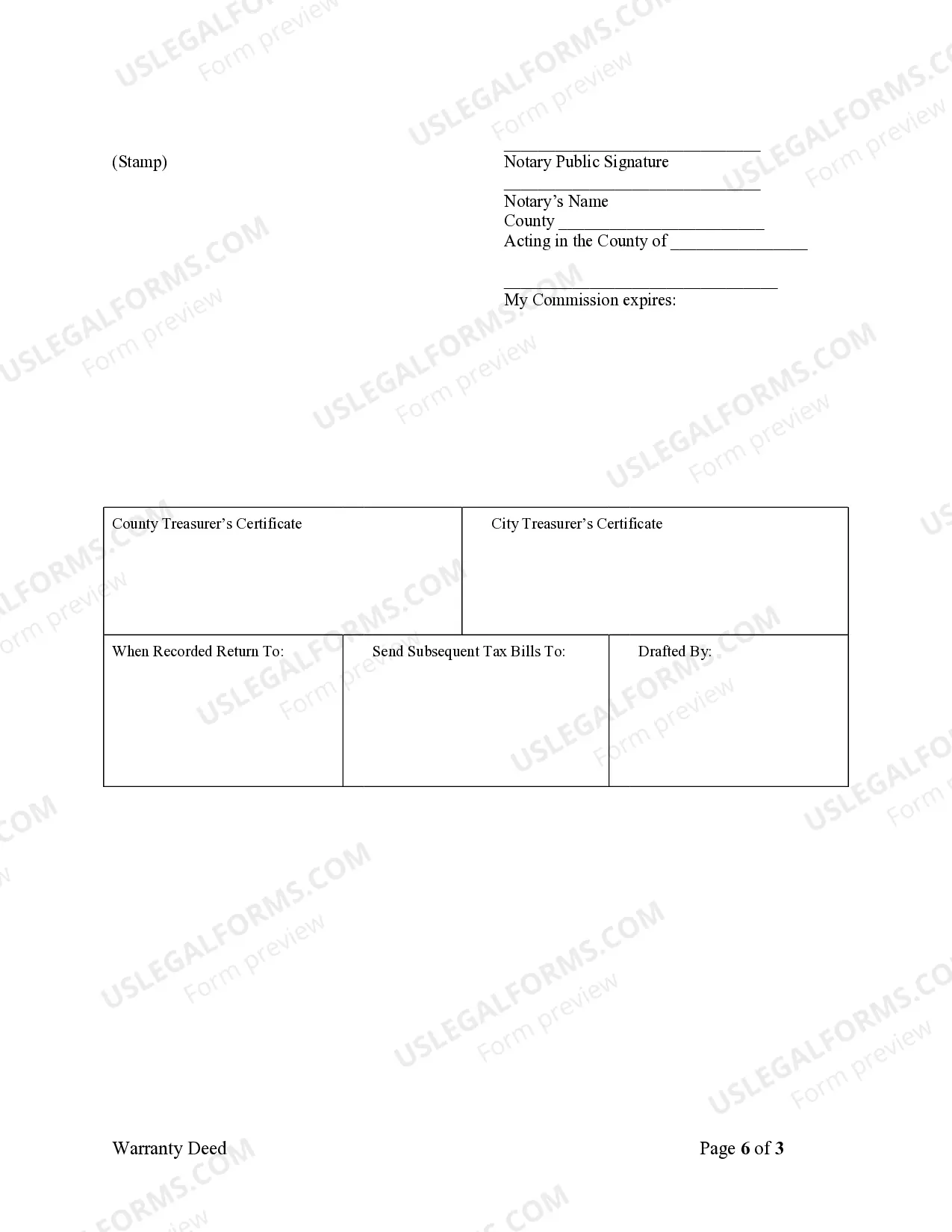

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed to Child - Reserving a Life Estate in the Parent(s), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. MI-021-77

Michigan Warranty Deed to Child Reserving a Life Estate in the Parents

Description

How to fill out Michigan Warranty Deed To Child Reserving A Life Estate In The Parents?

Obtain any type of 85,000 legal documents, including the Michigan Warranty Deed to Child Reserving a Life Estate in the Parents, online with US Legal Forms.

Each template is crafted and refreshed by attorneys licensed in the state.

If you possess a subscription, Log In. After reaching the form’s page, click the Download button and navigate to My documents to access it.

With US Legal Forms, you will always have rapid access to the right downloadable template. The platform organizes documents and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Michigan Warranty Deed to Child Reserving a Life Estate in the Parents quickly and conveniently.

- Review the state-specific criteria for the Michigan Warranty Deed to Child Reserving a Life Estate in the Parents you intend to utilize.

- Examine the description and preview the sample.

- Once you confirm the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that suits your financial situation.

- Establish a personal account.

- Make payment in one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Using a Lady Bird Deed in Michigan allows you to retain control of your property during your lifetime, meaning that you can still sell or mortgage your property at any time if you want.Once you pass, your tax basis in the property will step up to its value at death.

200bAlaska. Arizona. Arkansas. California. Colorado. District of Columbia. Hawaii. Illinois.

Michigan does not allow real estate to be transferred with transfer-on-death deeds. There is a type of deed available in Michigan known as an enhanced life estate deed, or Lady Bird deed, that functions like a transfer-on-death deed. This type of deed is not common.

A Michigan lady bird deed form allows a person to retain control over Michigan real estate during his or her life and automatically transfer the real estate at his or her death. The property transfer occurs automatically at the prior owner's death, avoiding probate.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.