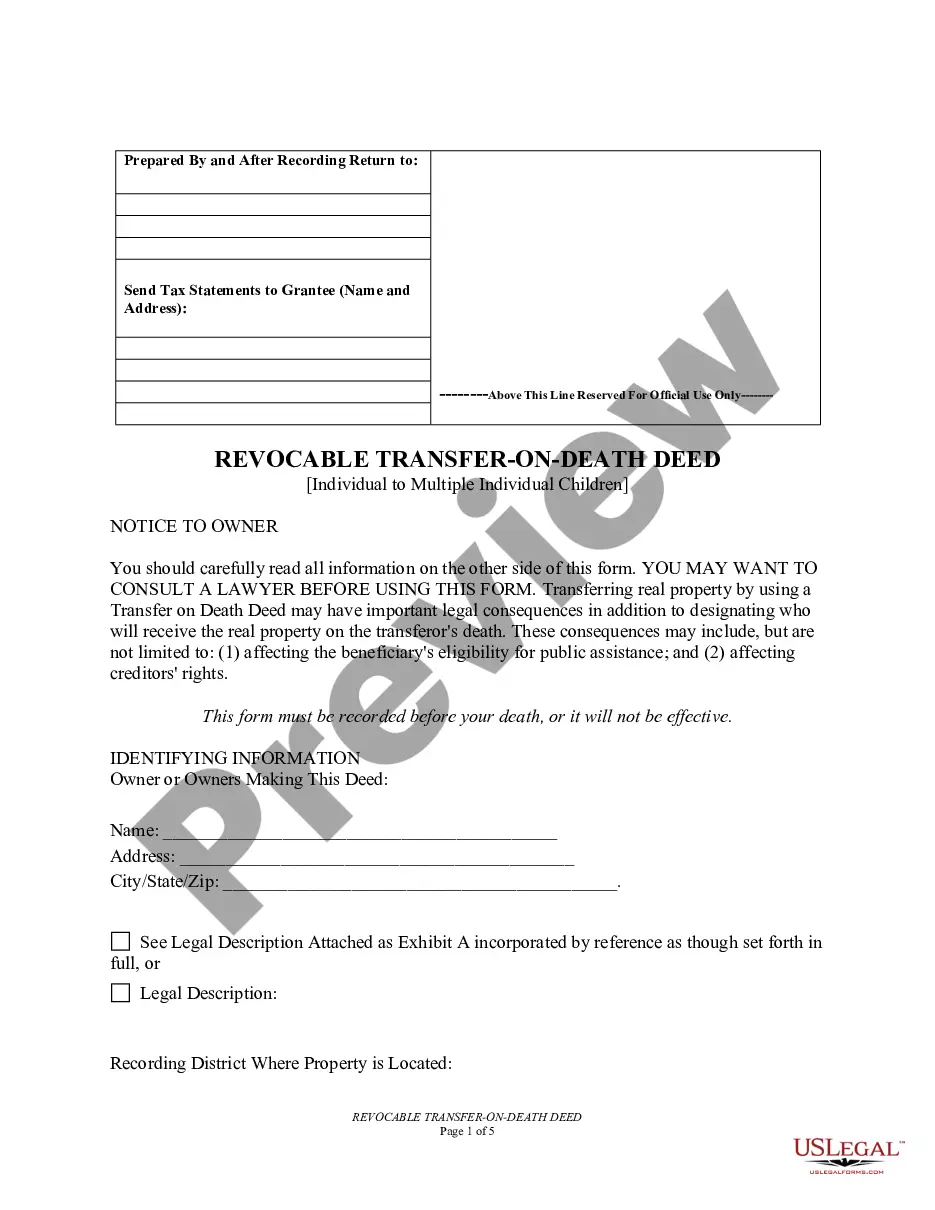

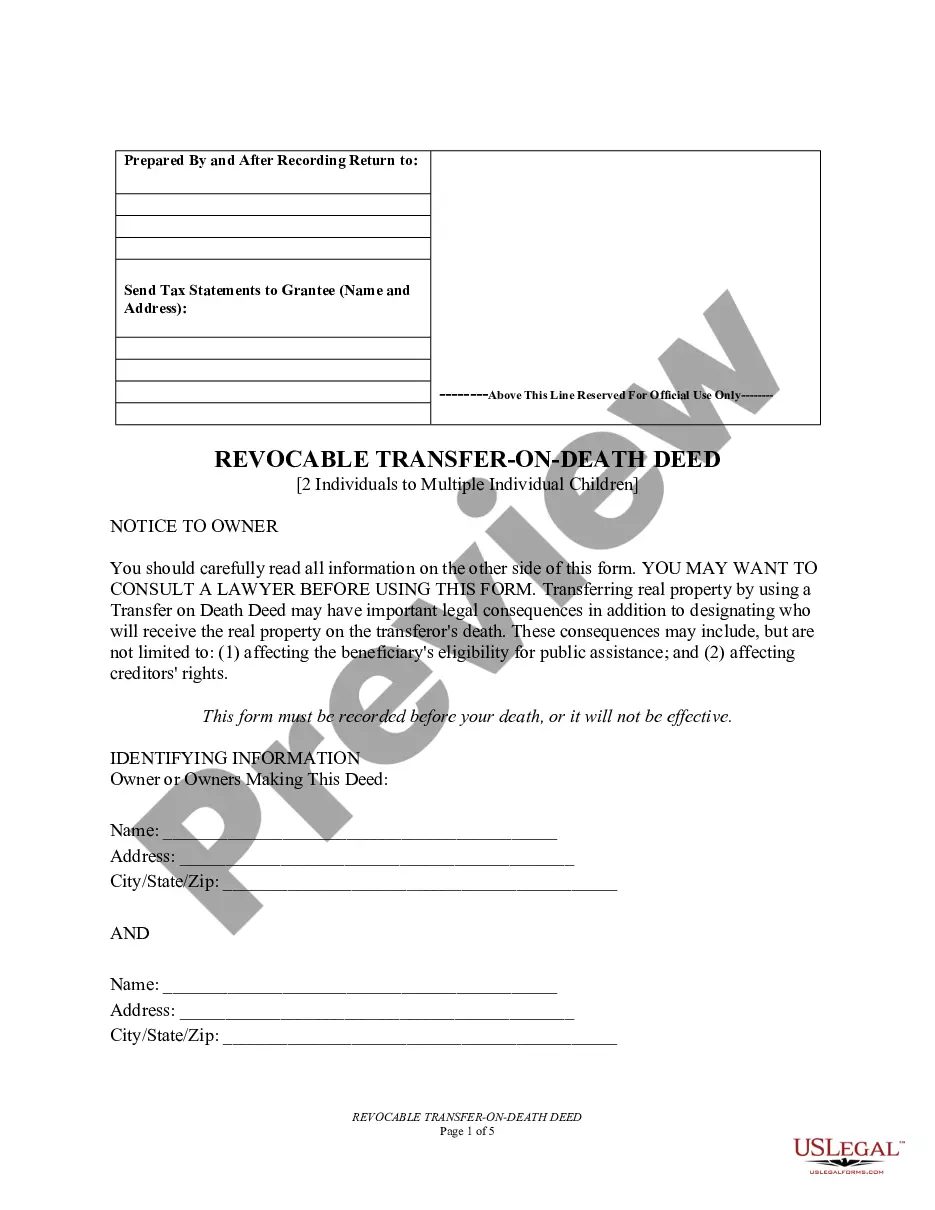

Maine Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals

Definition and meaning

The Maine Transfer on Death Deed, commonly referred to as a TOD deed, is a legal document that allows a property owner to transfer their real estate assets to one or more beneficiaries upon their death. This form eliminates the need for probate, meaning the property can directly pass to the designated beneficiaries without going through the lengthy legal process typically required when an individual dies.

How to complete a form

To successfully complete the Maine Transfer on Death Deed, follow these steps:

- Enter your name and address as the owner making the deed.

- Provide a detailed legal description of the property being transferred.

- Identify your primary beneficiary or beneficiaries by including their names and mailing addresses.

- Optionally, designate an alternate beneficiary in case the primary beneficiary does not survive you.

- Sign and date the deed in the appropriate section.

- Have the deed notarized as required by Maine law, ensuring its validity.

Who should use this form

This form is intended for any individual homeowner in Maine who wishes to ensure their property passes directly to chosen beneficiaries upon their death. It is particularly useful for individuals with a straightforward estate planning objective who want to avoid probate and streamline the transfer of their real estate assets to loved ones. If you have multiple beneficiaries or want to simplify the inheritance process, this deed may be ideal for you.

Legal use and context

The Maine Transfer on Death Deed is governed by specific state statutes, allowing property owners to maintain full control over the property during their lifetime. Only upon the owner's death does the deed take effect, allowing beneficiaries to inherit the property directly without the potential delays of probate. This deed is often utilized in estate planning to provide clarity and ease in property succession.

It is essential to understand the implications of this deed, as it may affect eligibility for certain public assistance programs and could influence creditors' rights against the property after the owner's passing.

Key components of the form

The Maine Transfer on Death Deed includes several critical components:

- Owner Information: The name and address of the individual creating the deed.

- Beneficiary Information: Details of the primary and optional alternate beneficiaries who will receive the property.

- Legal Description: An accurate description of the property to ensure clarity and avoid disputes.

- Transfer Clause: States the transfer of ownership upon the owner's death.

- Notarization: Requires a notary public to ensure the document's legal validity.

State-specific requirements

In Maine, the Transfer on Death Deed must be recorded in the appropriate county registry of deeds before the owner dies. Failure to record the deed could result in it being ineffective after the owner's death. Additionally, the deed must comply with the stipulations outlined in Maine Statute Title 18-C, Section 6-411, which details the legal framework for utilizing this form.

Common mistakes to avoid when using this form

To ensure the deed is valid and effective, avoid the following common mistakes:

- Failing to fully describe the property, which may lead to ambiguity.

- Not recording the deed in the designated county before the owner's death.

- Neglecting to get the deed notarized, which is crucial for legal recognition.

- Forgetting to designate alternate beneficiaries, which could complicate matters if the primary beneficiary does not survive.