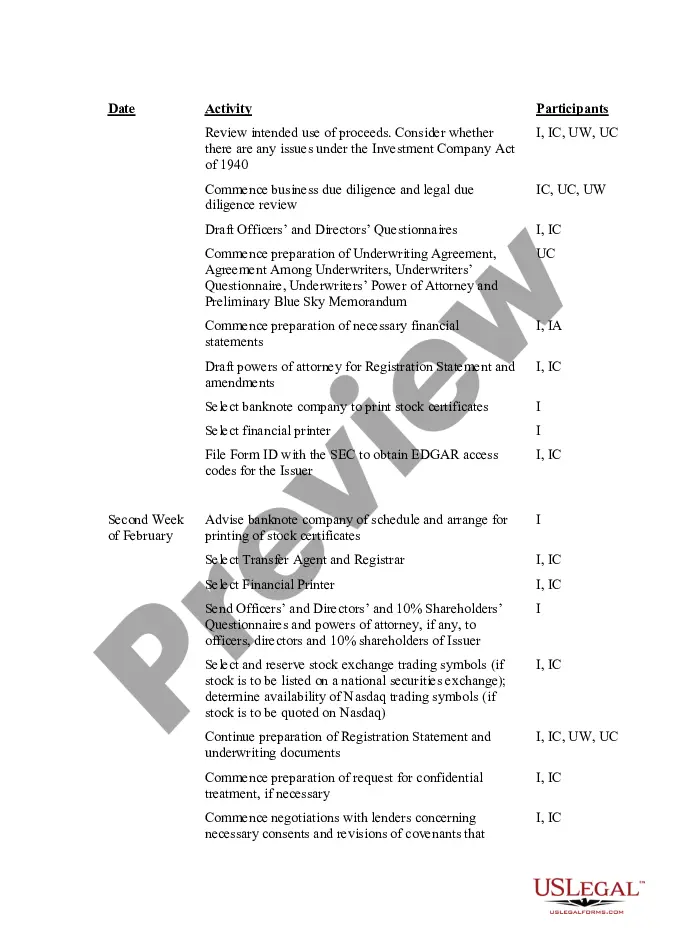

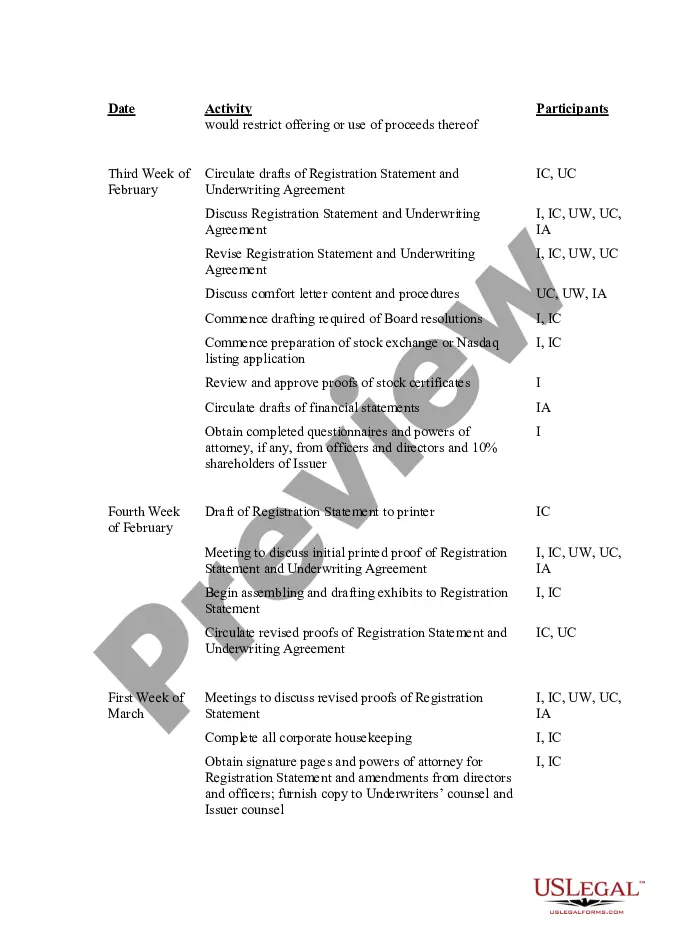

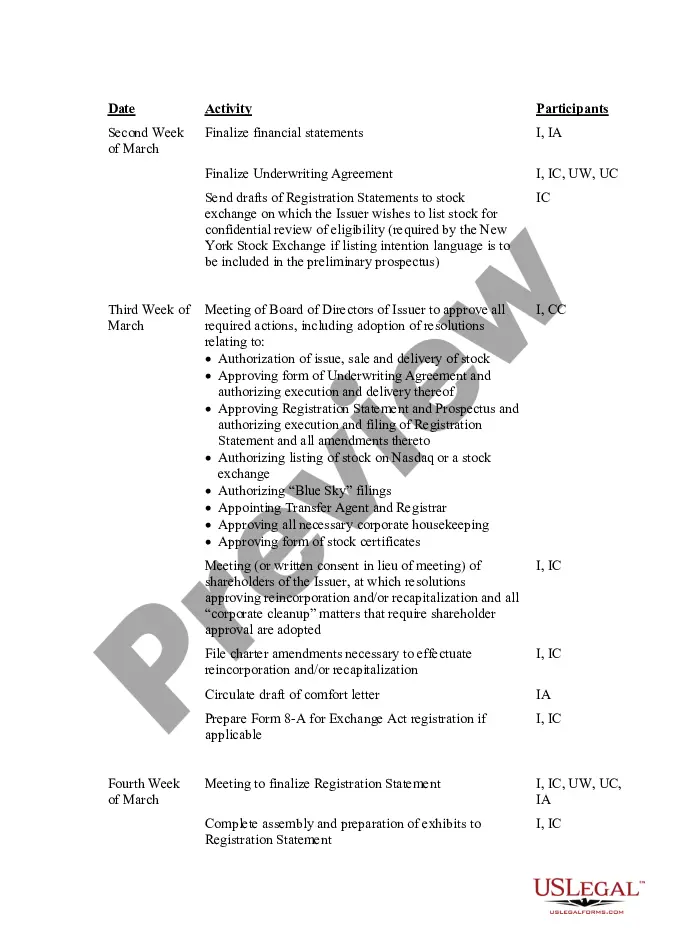

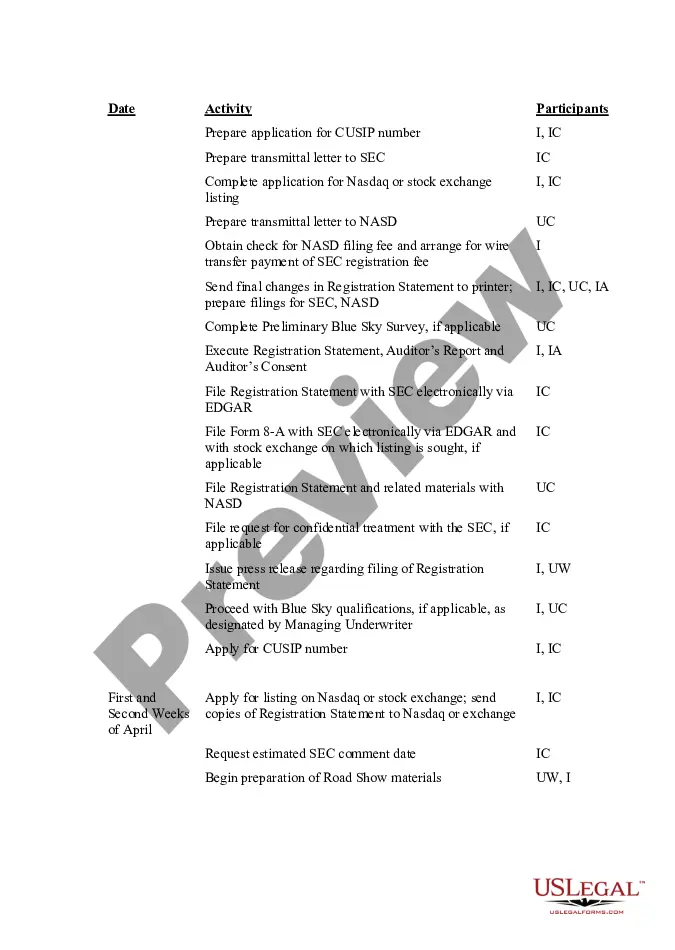

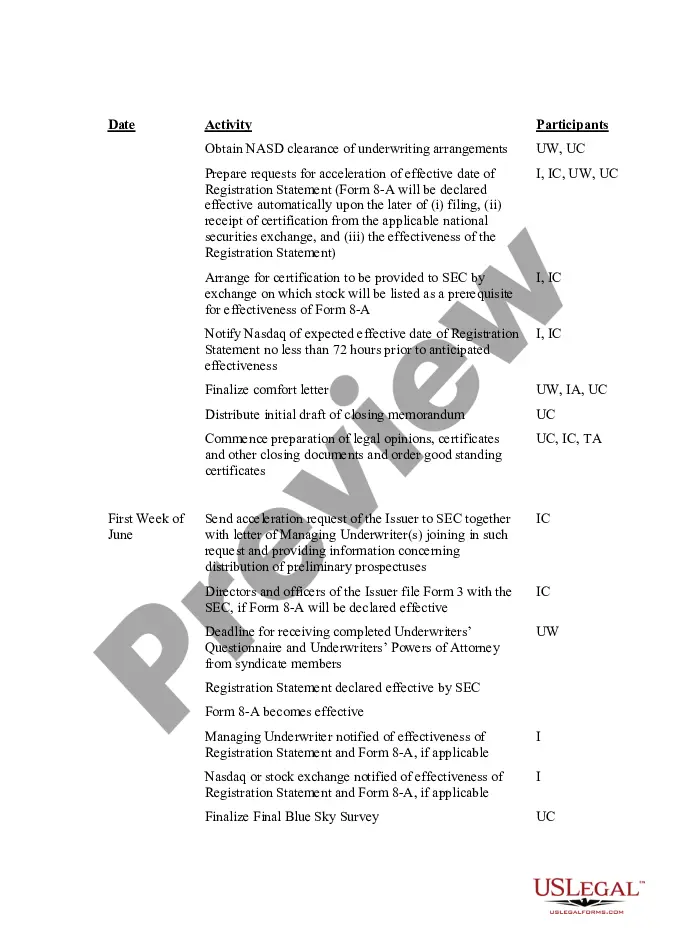

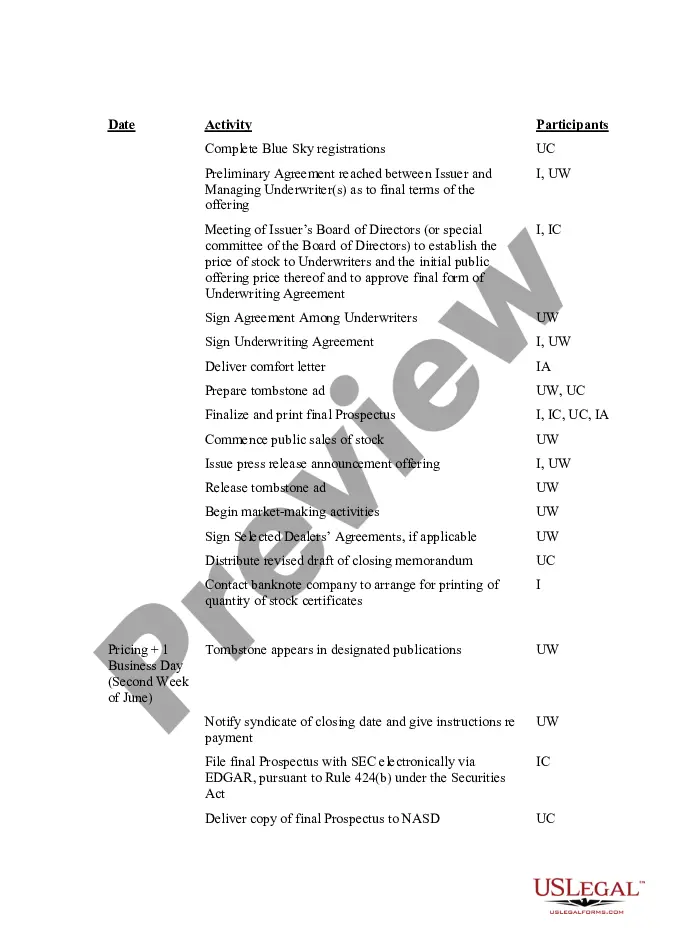

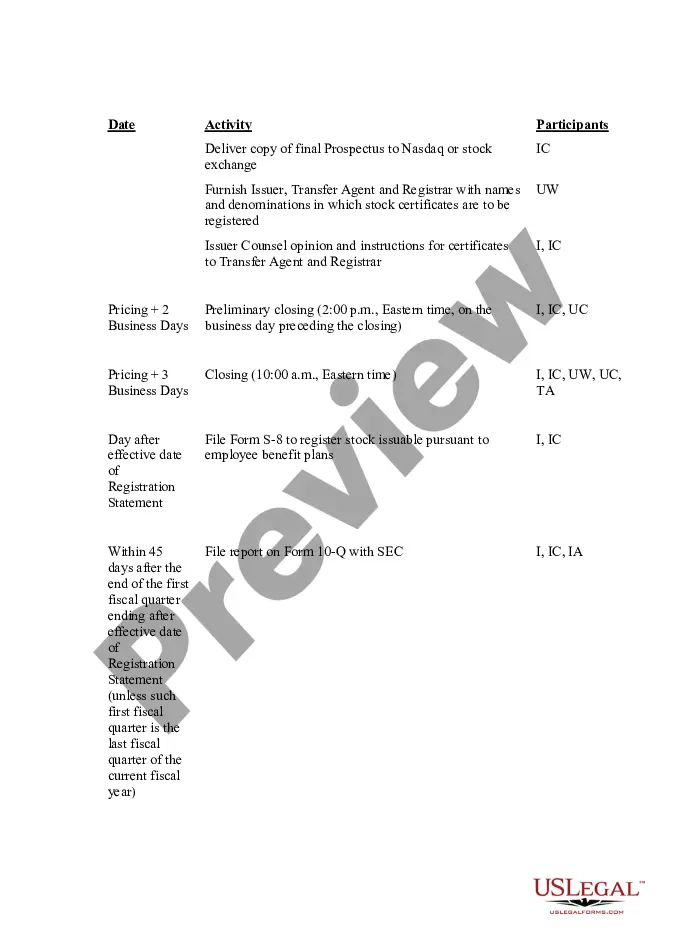

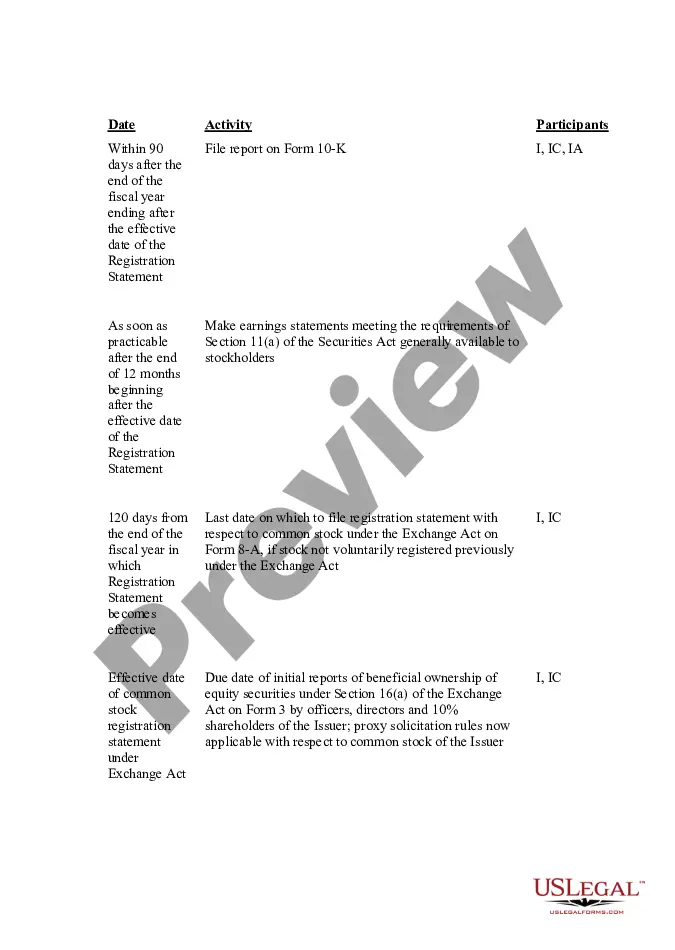

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Maine IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

Choosing the right lawful record design might be a have a problem. Naturally, there are a variety of web templates available online, but how do you get the lawful develop you need? Take advantage of the US Legal Forms web site. The services offers 1000s of web templates, such as the Maine IPO Time and Responsibility Schedule, which you can use for enterprise and private requirements. Every one of the varieties are checked out by professionals and fulfill federal and state needs.

Should you be already signed up, log in to your accounts and then click the Download button to find the Maine IPO Time and Responsibility Schedule. Make use of your accounts to appear with the lawful varieties you have bought previously. Check out the My Forms tab of the accounts and get another version in the record you need.

Should you be a fresh user of US Legal Forms, allow me to share simple instructions that you should stick to:

- First, be sure you have selected the correct develop to your town/region. You can check out the shape while using Preview button and read the shape description to guarantee this is basically the right one for you.

- In the event the develop is not going to fulfill your requirements, take advantage of the Seach discipline to obtain the right develop.

- Once you are certain the shape would work, click the Acquire now button to find the develop.

- Select the prices plan you want and enter the necessary information. Create your accounts and buy the order using your PayPal accounts or credit card.

- Pick the document formatting and down load the lawful record design to your device.

- Complete, revise and print and signal the received Maine IPO Time and Responsibility Schedule.

US Legal Forms is the most significant catalogue of lawful varieties that you will find different record web templates. Take advantage of the company to down load appropriately-manufactured files that stick to condition needs.

Form popularity

FAQ

Preparation is the secret to success. The better prepared your company is, the more efficient and less costly the process can be. We recommend that an orderly plan be executed over a one- to two-year period. Choosing the appropriate structure for an IPO can provide substantial benefits.

What is the typical IPO timeline? While an IPO timeline can stretch across years, many professionals recommend you operate as a public company for one to two years before actually going public. There are about six key months during the IPO process.

Overview of the IPO Process. This guide will break down the steps involved in the process, which can take anywhere from six months to over a year to complete.

The typical timeframe for SEC review is between 90 to 150 days. Below, we shed some light on the SEC Staff's IPO review process and offer tips for effectively managing it.

What is the IPO process in India? Hire an investment banker. Prepare RHP and register with the SEBI. Application to a stock exchange. Go on a roadshow. Pricing the IPO. The IPO application is made available to the public.

For a company to issue an IPO, it should have : Positive Networth. Market capitalization of more than Rs 25 crores. Post Issue paid-up capital of more than Rs 10 crores.

IPO Process Timelines by Stages (Tentative) PhaseTimelineSEBI Approval4-8 weeksRHP Submission2-3 weeksIPO LaunchMinimum 3 daysAllotmentWithin 1 day of issue closure5 more rows

The timing of an IPO announcement will coincide with a company's regulatory filings for registering and issuing new shares. This can range from a matter of weeks to more than a year. Typically, however, investors will have around six months heads up based on a filing to IPO.