This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Maine Reservation of Additional Interests in Production

Description

How to fill out Reservation Of Additional Interests In Production?

Are you presently inside a situation in which you will need paperwork for possibly business or individual functions almost every day time? There are tons of lawful file templates accessible on the Internet, but discovering ones you can rely is not easy. US Legal Forms delivers a huge number of form templates, such as the Maine Reservation of Additional Interests in Production, which can be published to satisfy state and federal needs.

Should you be previously acquainted with US Legal Forms web site and also have a free account, just log in. Next, you can acquire the Maine Reservation of Additional Interests in Production format.

Unless you provide an profile and need to start using US Legal Forms, follow these steps:

- Find the form you will need and make sure it is for your proper metropolis/state.

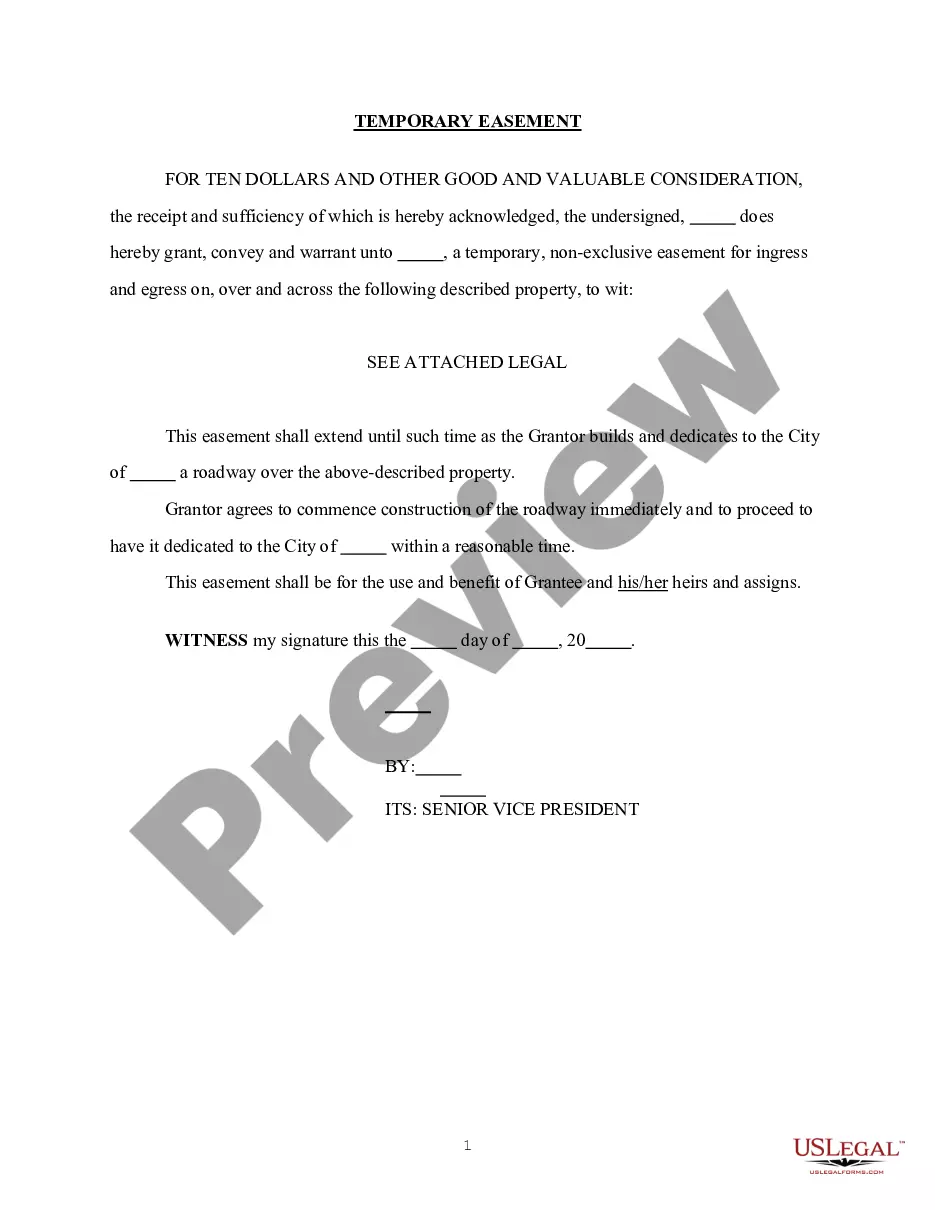

- Make use of the Review button to check the form.

- Browse the description to ensure that you have selected the correct form.

- When the form is not what you are looking for, make use of the Look for field to discover the form that fits your needs and needs.

- When you find the proper form, just click Get now.

- Select the pricing strategy you need, fill out the required info to make your money, and buy your order making use of your PayPal or Visa or Mastercard.

- Pick a handy data file structure and acquire your backup.

Get all the file templates you may have bought in the My Forms menu. You can obtain a extra backup of Maine Reservation of Additional Interests in Production at any time, if needed. Just click the required form to acquire or produce the file format.

Use US Legal Forms, the most comprehensive collection of lawful kinds, to save lots of efforts and stay away from mistakes. The support delivers expertly manufactured lawful file templates which can be used for an array of functions. Make a free account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

In Maine, you will normally be allowed a credit for sales or use tax paid in another state for tangible personal property used in Maine. The amount of the credit may not exceed the amount of the Maine tax. Lease and rent payments are not subject to sales and use tax when they are not considered to be purchases.

Maine Tax Rates, Collections, and Burdens Maine has a graduated individual income tax, with rates ranging from 5.80 percent to 7.15 percent. Maine also has a corporate income tax that ranges from 3.50 percent to 8.93 percent. Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes.

The personal exemption amount is $5,000. Standard deduction. The standard deduction amounts are as follows: single-$14,600; married filing jointly-$29,200; head-of-household-$21,900; and married filing separately-$14,600.

The tax rate is 9% on certain rentals of living quarters. The tax rate is 10% on short-term rentals of automobiles and on short-term rentals of pickup trucks and vans with a gross vehicle weight of less than 26,000 pounds when rented from a person primarily engaged in the short-term rental of automobiles. USE TAX.

Maine Income Tax Brackets for 2023 Here's how it breaks down for this individual: The first $24,500 of income is taxed at 5.80% ($1,421) The next portion of income from $24,500 to $58,050 is taxed at 6.75% ($2,265) Finally, the remaining income from $58,050 to $350,000 is taxed at 7.15% ($20,874)

The 2023 Maine personal exemption amount is $4,700 and the Maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns.

Standard deduction. The standard deduction amounts are as follows: single-$14,600; married filing jointly-$29,200; head-of-household-$21,900; and married filing separately-$14,600.

All short term rental owners or operators must register with the Maine Revenue Service and collect and remit Maine State Sales Tax. This amounts to 9% of the listing pricing including cleaning and guest fees and applies to casual rentals (fewer than 15 nights a year) as well as long term rentals (28 days or longer).