Maine Assignment of After Payout Interest

Description

How to fill out Assignment Of After Payout Interest?

US Legal Forms - among the largest libraries of authorized forms in America - provides a variety of authorized document templates you are able to down load or produce. Utilizing the site, you will get thousands of forms for enterprise and person purposes, sorted by categories, claims, or keywords and phrases.You will discover the newest variations of forms such as the Maine Assignment of After Payout Interest within minutes.

If you have a membership, log in and down load Maine Assignment of After Payout Interest from your US Legal Forms collection. The Obtain key can look on each kind you look at. You gain access to all in the past acquired forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, here are simple instructions to obtain started off:

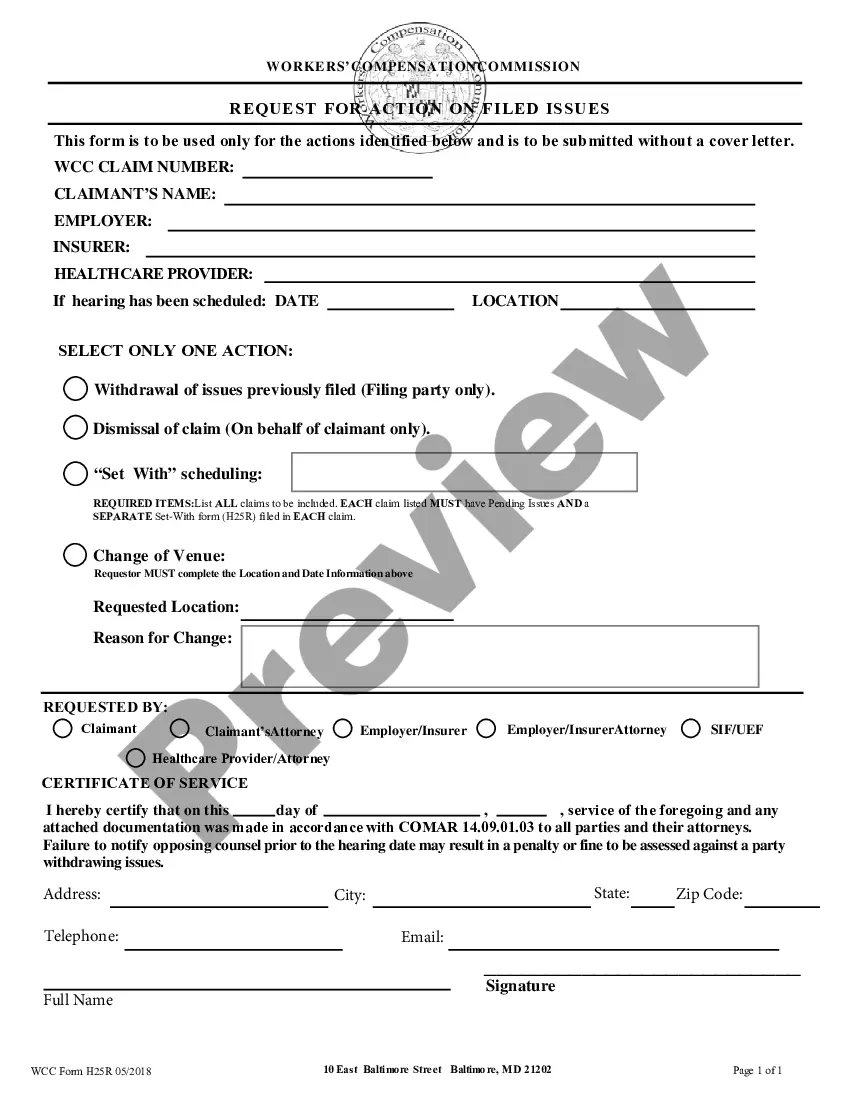

- Be sure to have picked the correct kind for your personal metropolis/county. Click the Preview key to analyze the form`s content. Browse the kind information to ensure that you have chosen the right kind.

- In the event the kind does not satisfy your needs, utilize the Research industry on top of the monitor to obtain the one that does.

- When you are satisfied with the shape, confirm your selection by visiting the Acquire now key. Then, opt for the prices strategy you want and supply your references to register for an bank account.

- Process the financial transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Find the formatting and down load the shape on the gadget.

- Make adjustments. Complete, revise and produce and indication the acquired Maine Assignment of After Payout Interest.

Every single format you included with your bank account does not have an expiry particular date and is yours forever. So, in order to down load or produce one more backup, just check out the My Forms portion and click on about the kind you want.

Obtain access to the Maine Assignment of After Payout Interest with US Legal Forms, the most substantial collection of authorized document templates. Use thousands of expert and status-certain templates that meet up with your business or person demands and needs.

Form popularity

FAQ

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

Maine resale certificates are only to be used when a purchaser intends to resell tangible property. A valid certificate must include the name and address of the purchaser. It should also include the purchaser's account ID or federal employer identification number (EIN).

1. What is Maine real estate withholding? Maine law requires, at the time of closing on total considerations of $100,000 or more, that every buyer of real property must withhold 2.5% of the consideration from any nonresident individual, estate, or business seller.

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.