Maine Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest

Description

How to fill out Assignment Of Oil And Gas Leases Of All Interest, Reserving An Overriding Royalty Interest?

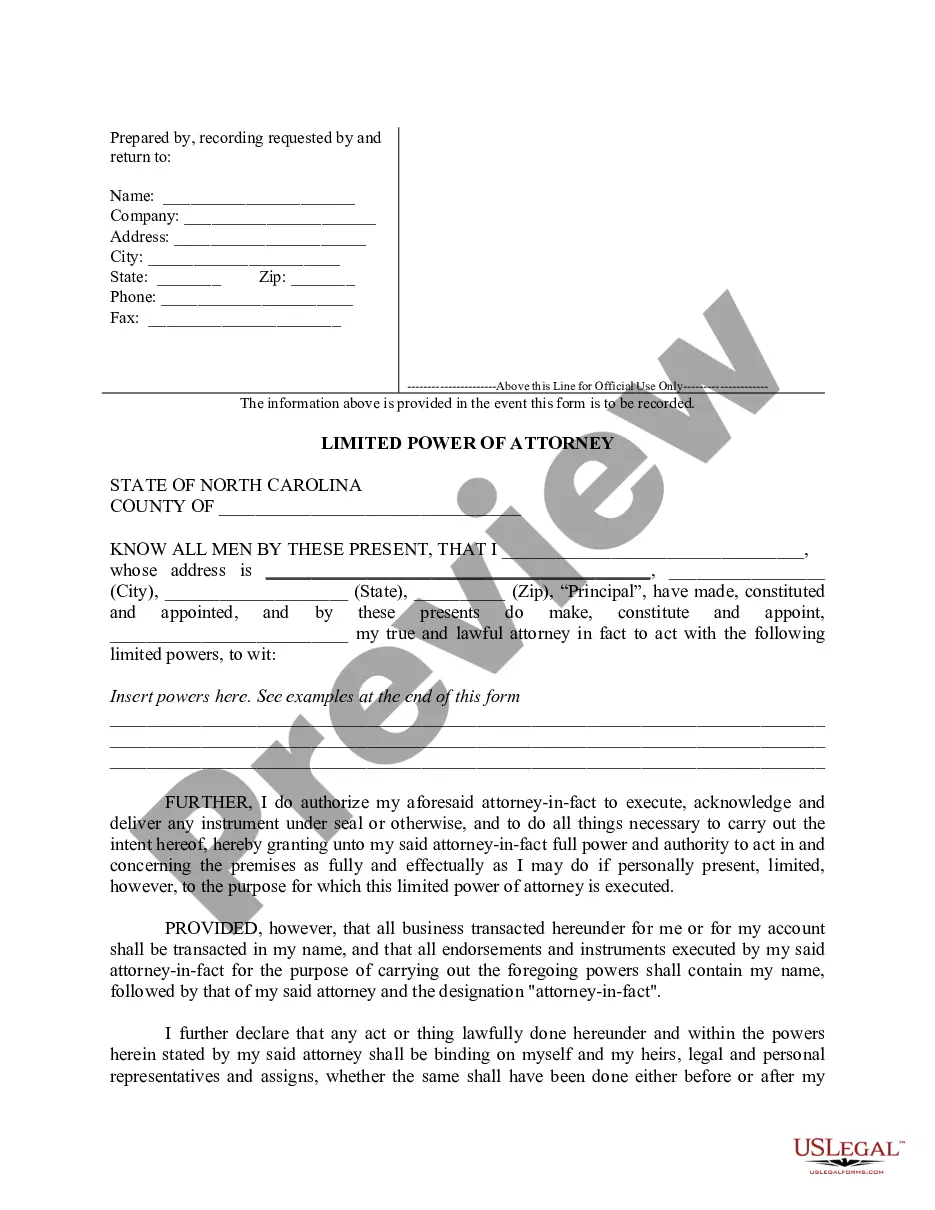

Discovering the right legal file web template can be quite a struggle. Needless to say, there are a variety of layouts available online, but how will you get the legal develop you require? Take advantage of the US Legal Forms web site. The services delivers thousands of layouts, like the Maine Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest, which can be used for enterprise and private demands. Every one of the types are checked by professionals and fulfill state and federal demands.

When you are already signed up, log in to your profile and then click the Download button to get the Maine Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest. Use your profile to look with the legal types you possess acquired earlier. Check out the My Forms tab of your respective profile and acquire one more version from the file you require.

When you are a fresh user of US Legal Forms, allow me to share basic instructions for you to follow:

- Very first, ensure you have selected the appropriate develop to your town/state. You may check out the shape using the Preview button and read the shape outline to guarantee it will be the best for you.

- If the develop will not fulfill your needs, utilize the Seach industry to discover the appropriate develop.

- Once you are certain the shape would work, click on the Buy now button to get the develop.

- Opt for the rates prepare you desire and enter the needed information and facts. Design your profile and pay money for an order using your PayPal profile or credit card.

- Select the document format and download the legal file web template to your device.

- Total, edit and produce and signal the attained Maine Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest.

US Legal Forms will be the most significant library of legal types in which you will find numerous file layouts. Take advantage of the service to download skillfully-created files that follow express demands.

Form popularity

FAQ

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Like Royalty Interest (RI), an ORRI ends when the oil and gas lease ends. ORRI and MI/RI (mineral/royalty) interests in the same tract of land may be valued differently. Unlike the mineral interest, which lasts in perpetuity, overriding royalties expire with the lease.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

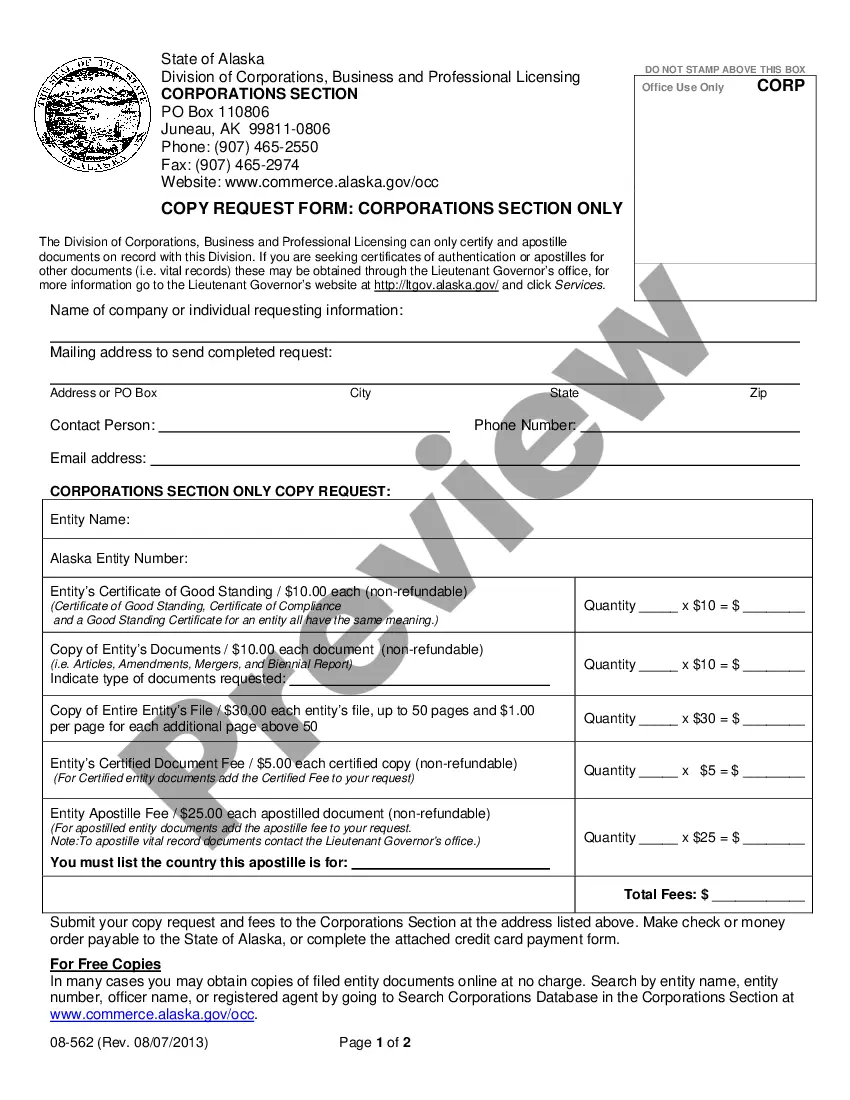

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Oil and gas royalties refer to the payments made to the owner of the mineral rights, which are the rights to extract oil and gas from the land. These royalties are typically a percentage of the revenue generated from the production and sale of the oil and gas extracted from the land.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.