This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Maine Unsecured Installment Payment Promissory Note for Fixed Rate

Description

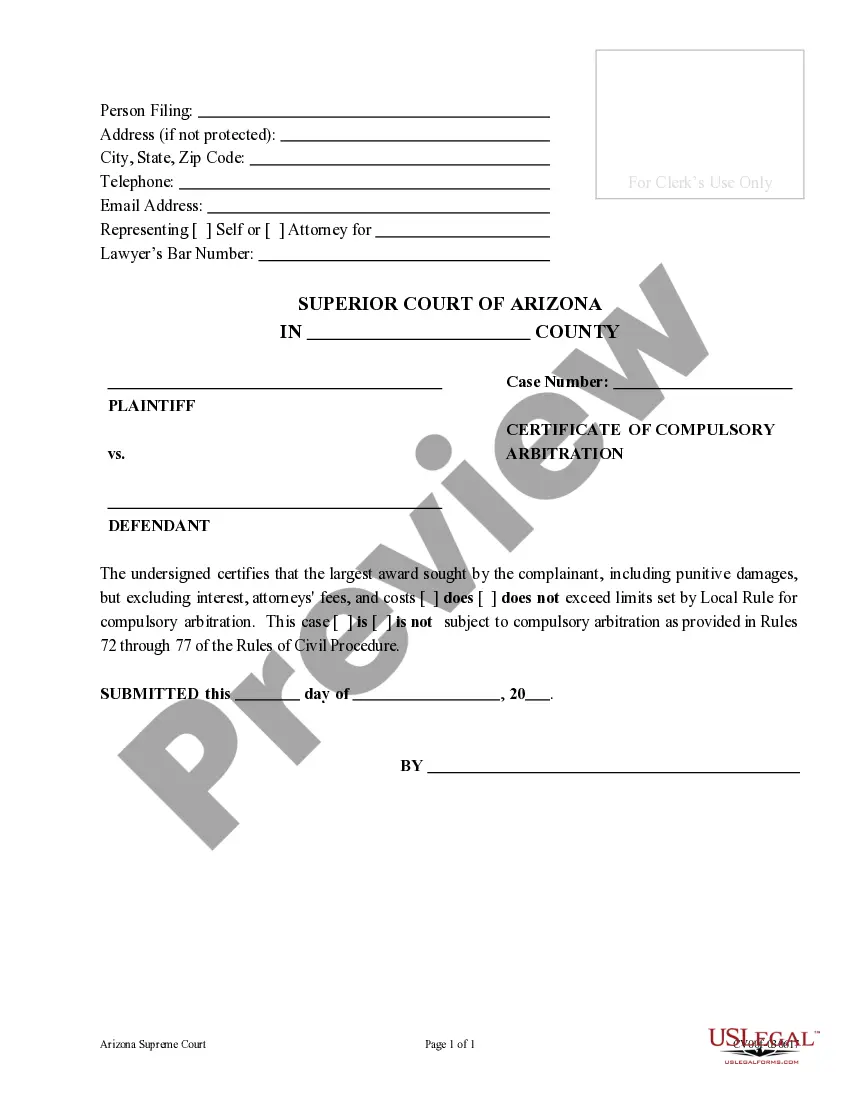

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or create. By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of documents such as the Maine Unsecured Installment Payment Promissory Note for Fixed Rate in just seconds. If you have a membership, Log In and download the Maine Unsecured Installment Payment Promissory Note for Fixed Rate from your US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple steps to help you get started: Ensure you have selected the correct form for your city/state. Click the Preview button to examine the form’s content. Review the form summary to confirm that you have chosen the right form. If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Access the Maine Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are satisfied with the form, affirm your choice by clicking on the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

- Make edits. Fill out, modify, and print and sign the saved Maine Unsecured Installment Payment Promissory Note for Fixed Rate.

- Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or create another copy, simply navigate to the My documents section and click on the form you need.

Form popularity

FAQ

A promissory note does not necessarily need to be notarized to be legally binding, but notarization can add an extra layer of security and credibility. It helps verify the identities of the parties involved and confirms that they agreed to the terms. If you want peace of mind, consider including notarization when creating a Maine Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms.

To write a legal IOU, include the names of the parties involved, the amount owed, and a clear statement confirming the debt. State the repayment terms, such as when and how the debt will be settled. For a more structured approach, explore templates available on US Legal Forms that can help you draft a Maine Unsecured Installment Payment Promissory Note for Fixed Rate.

To write a promissory note example, start by including the date, the names of the borrower and lender, and the amount borrowed. Clearly state the repayment terms, including the interest rate and payment schedule. An effective example might also specify what happens in case of default. For a user-friendly template, consider using US Legal Forms for a Maine Unsecured Installment Payment Promissory Note for Fixed Rate.

An unsecured promissory note means that it is not backed by collateral. This type of note relies solely on the borrower's promise to repay the debt. In the context of a Maine Unsecured Installment Payment Promissory Note for Fixed Rate, it is important to assess the borrower's creditworthiness before proceeding, as there is a higher risk for lenders.

Collecting on an unsecured promissory note involves several steps. First, you should communicate directly with the borrower to discuss the missed payments. If informal collection efforts are unsuccessful, you may need to consider legal action, which can include filing a lawsuit to enforce the terms of the Maine Unsecured Installment Payment Promissory Note for Fixed Rate.

A reasonable interest rate for a promissory note often depends on current market conditions and the creditworthiness of the borrower. For a Maine Unsecured Installment Payment Promissory Note for Fixed Rate, rates typically range between 5% to 10%. It’s essential to set a rate that is fair yet reflects the risk involved in the unsecured lending process.

To obtain a legal promissory note, you can utilize resources such as US Legal Forms, which provides templates specifically designed for Maine Unsecured Installment Payment Promissory Note for Fixed Rate. You need to fill out the necessary details, ensuring that the note complies with Maine state laws. Additionally, consider consulting with a legal professional to confirm the note's validity and enforceability.

A promissory note does not necessarily need to have an interest rate. However, including an interest rate can clarify the repayment terms for both parties involved. In the context of a Maine Unsecured Installment Payment Promissory Note for Fixed Rate, setting a fixed interest rate helps borrowers understand their financial obligations upfront. This clarity can prevent misunderstandings and foster trust between the lender and borrower.

A promissory note does not have to be secured; it can be either secured or unsecured. A Maine Unsecured Installment Payment Promissory Note for Fixed Rate provides flexibility for borrowers without requiring collateral. This option can be advantageous for those who lack assets to pledge. Always consider the implications of both types before proceeding.

Promissory notes do not necessarily need to be secured. A Maine Unsecured Installment Payment Promissory Note for Fixed Rate serves as an option for borrowers who prefer not to use collateral. However, it’s important to weigh the risks, as unsecured notes can lead to higher interest rates. Understanding both secured and unsecured options will help you make an informed decision.