Maine Self-Employed Seasonal Picker Services Contract

Description

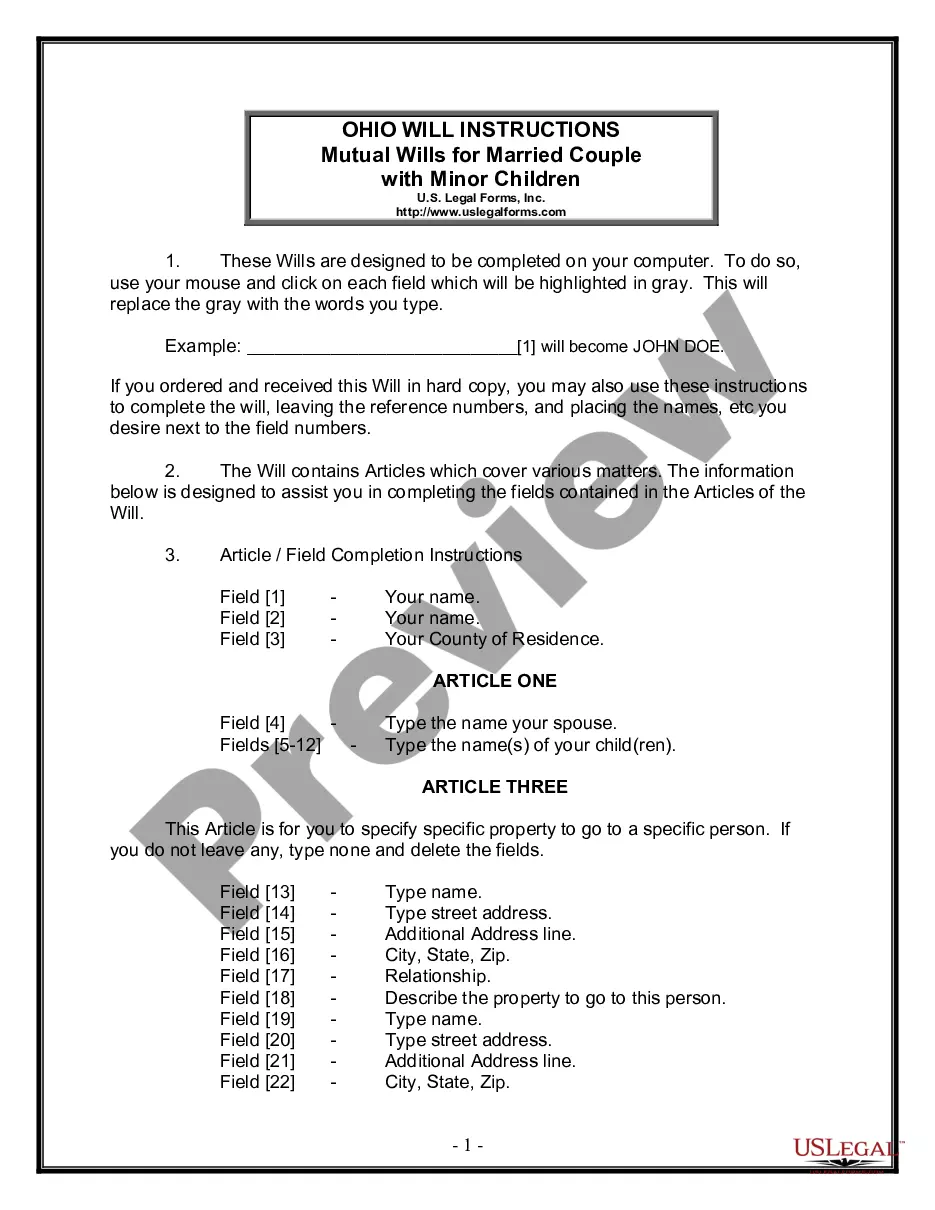

How to fill out Self-Employed Seasonal Picker Services Contract?

US Legal Forms - one of the largest collections of legal documents in the country - offers a broad selection of legal document templates that you can acquire or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest editions of forms such as the Maine Self-Employed Seasonal Picker Services Contract in just a few minutes.

If you already have an account, Log In and retrieve the Maine Self-Employed Seasonal Picker Services Contract from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your profile.

Select the format and download the form to your device.

Edit. Complete, modify, print, and sign the downloaded Maine Self-Employed Seasonal Picker Services Contract. Each document you add to your account has no expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Access the Maine Self-Employed Seasonal Picker Services Contract with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the form's details.

- Read the form description to confirm that you have selected the appropriate document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

To classify independent contractors, consider the level of control and independence in their work. Key factors include how much control you have over their tasks and whether they provide their own tools. For those entering a Maine Self-Employed Seasonal Picker Services Contract, accurate classification is crucial for compliance with tax and labor laws. You can use resources from Uslegalforms to help ensure proper classification and avoid legal pitfalls.

An independent contractor in Maine is an individual who provides services to clients without being tied to a single employer. They operate independently, often managing their own business, and are responsible for their own taxes and expenses. The Maine Self-Employed Seasonal Picker Services Contract serves as a beneficial tool for defining this relationship, ensuring both parties understand their rights and responsibilities.

The key factor distinguishing an employee from an independent contractor is the degree of control exercised by the employer. Employees work under the employer's direction, while independent contractors maintain control over how they complete their tasks. This distinction is vital when considering the Maine Self-Employed Seasonal Picker Services Contract, as it defines the nature of the working relationship.

To qualify as an independent contractor, a person must typically operate their own business, control their work schedule, and have the ability to offer services to multiple clients. The Maine Self-Employed Seasonal Picker Services Contract can help clarify these qualifications and ensure that both parties understand their roles. This structure supports the independence needed for a successful contracting relationship.

The terms 'contractor' and 'independent contractor' often refer to the same type of work arrangement, but 'independent contractor' emphasizes autonomy. A contractor may sometimes work under the direction of a company, whereas an independent contractor operates their own business. For those entering into a Maine Self-Employed Seasonal Picker Services Contract, understanding this distinction helps clarify roles and responsibilities.

To prove independent contractor status in Maine, you can provide evidence of your business operations, such as contracts, invoices, and client relationships. It is also helpful to demonstrate that you control your work schedule and methods. Utilizing the Maine Self-Employed Seasonal Picker Services Contract can provide a formal framework to establish and confirm your status.

In Maine, the primary difference lies in the level of control and independence in the work relationship. Employees typically receive benefits and have taxes withheld by their employer, while independent contractors like those under the Maine Self-Employed Seasonal Picker Services Contract manage their own business expenses and taxes. Understanding these distinctions can help you choose the right classification for your work.

In the context of the Maine Self-Employed Seasonal Picker Services Contract, both terms are often used interchangeably. However, 'independent contractor' emphasizes the nature of the work arrangement, highlighting the contractor's autonomy. Choosing the right term can depend on your specific situation, but clarity is key when entering into contracts.

Yes, independent contractors in the US typically need work authorization, especially if they are not US citizens or permanent residents. This usually involves obtaining the appropriate visa or work permit. For contractors focusing on the Maine Self-Employed Seasonal Picker Services Contract, ensuring proper authorization is critical to legal compliance and successful business operations.

The new federal rule on independent contractors clarifies the criteria used to determine whether a worker is truly independent or an employee. It emphasizes the importance of the worker's independence and the nature of the work relationship. Staying informed about these changes is vital, especially for those involved in the Maine Self-Employed Seasonal Picker Services Contract.