Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor

Description

How to fill out Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust is not straightforward.

US Legal Forms provides a wide array of form templates, such as the Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/state.

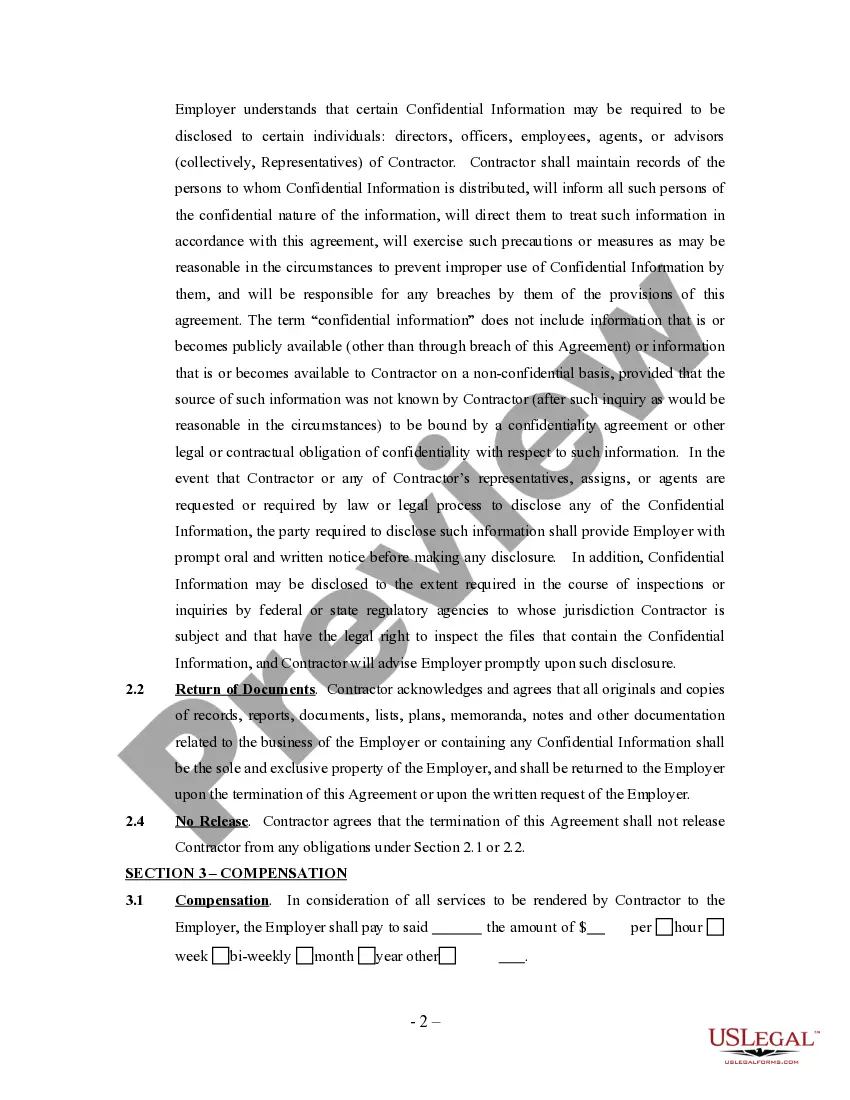

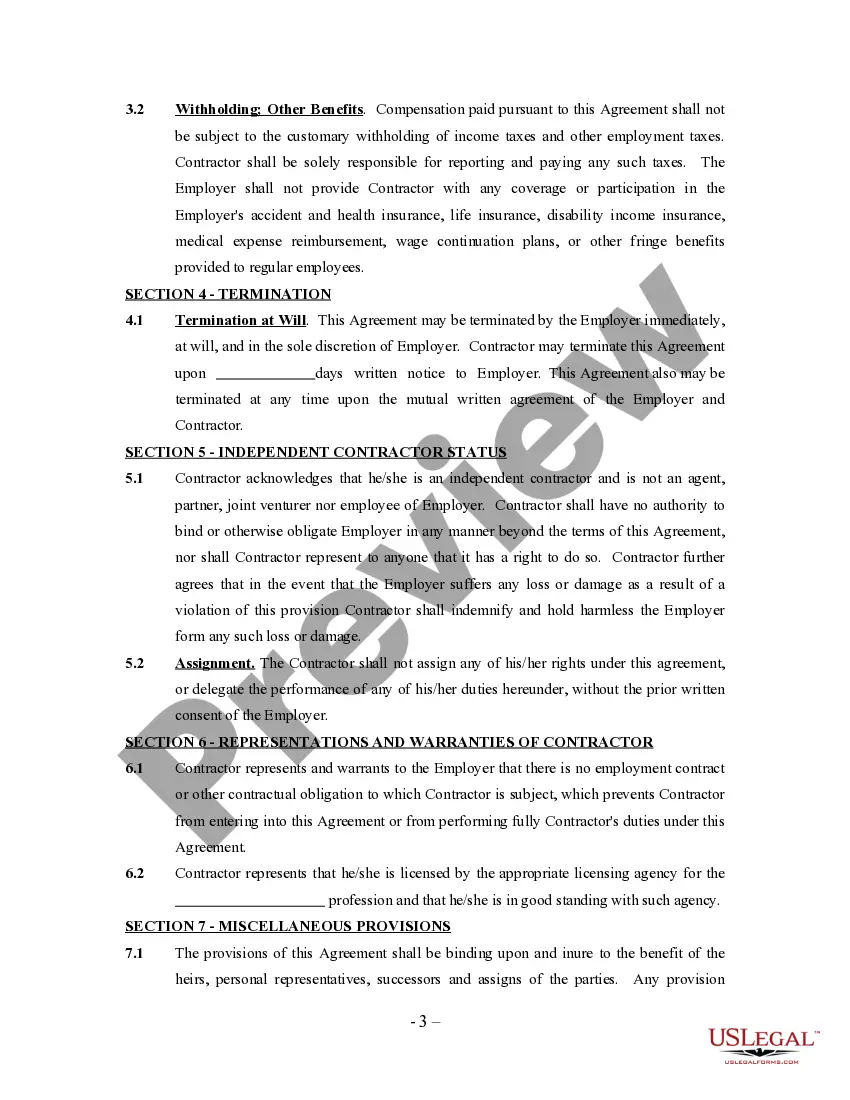

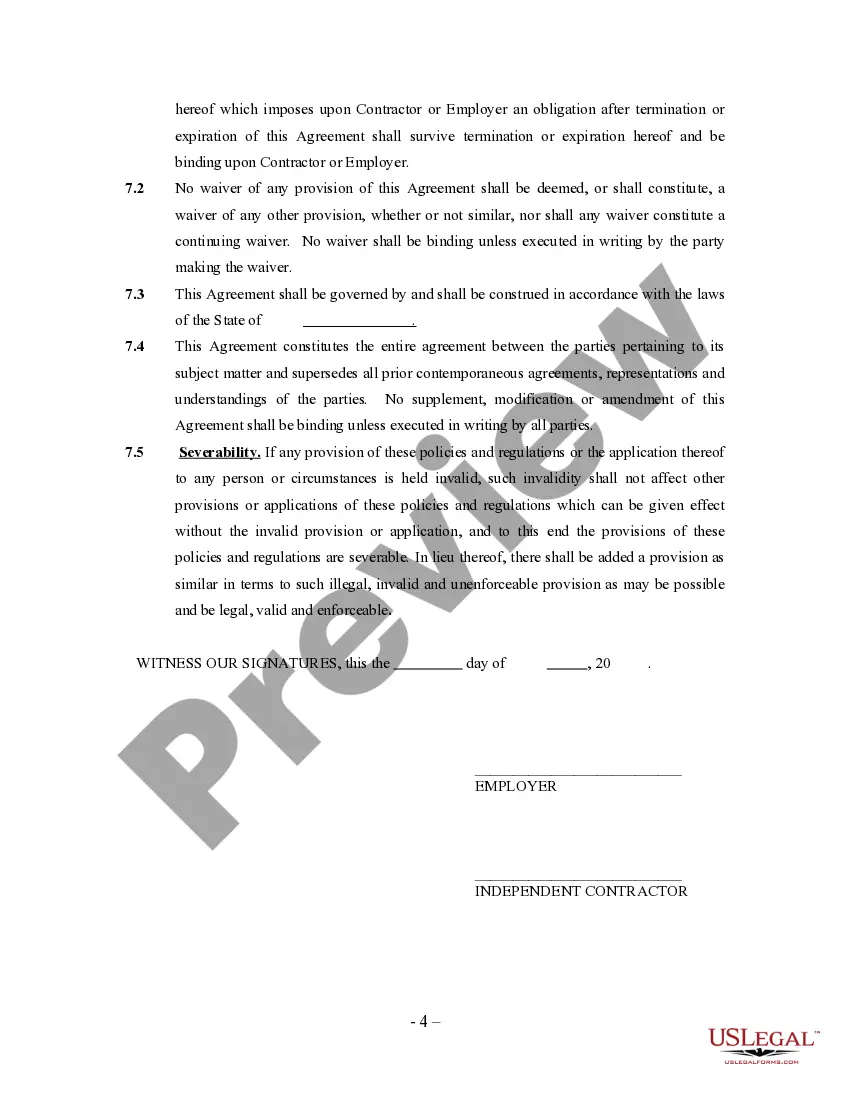

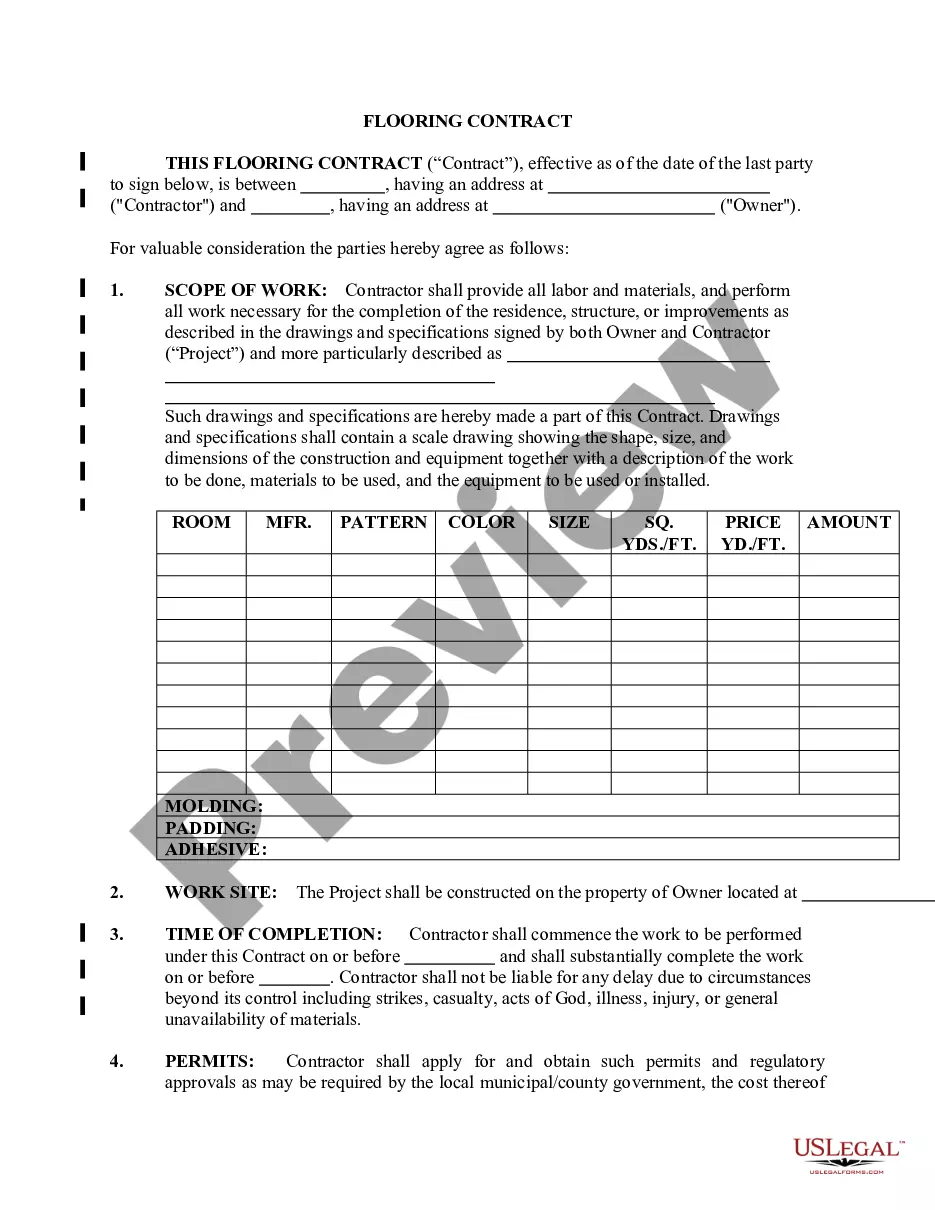

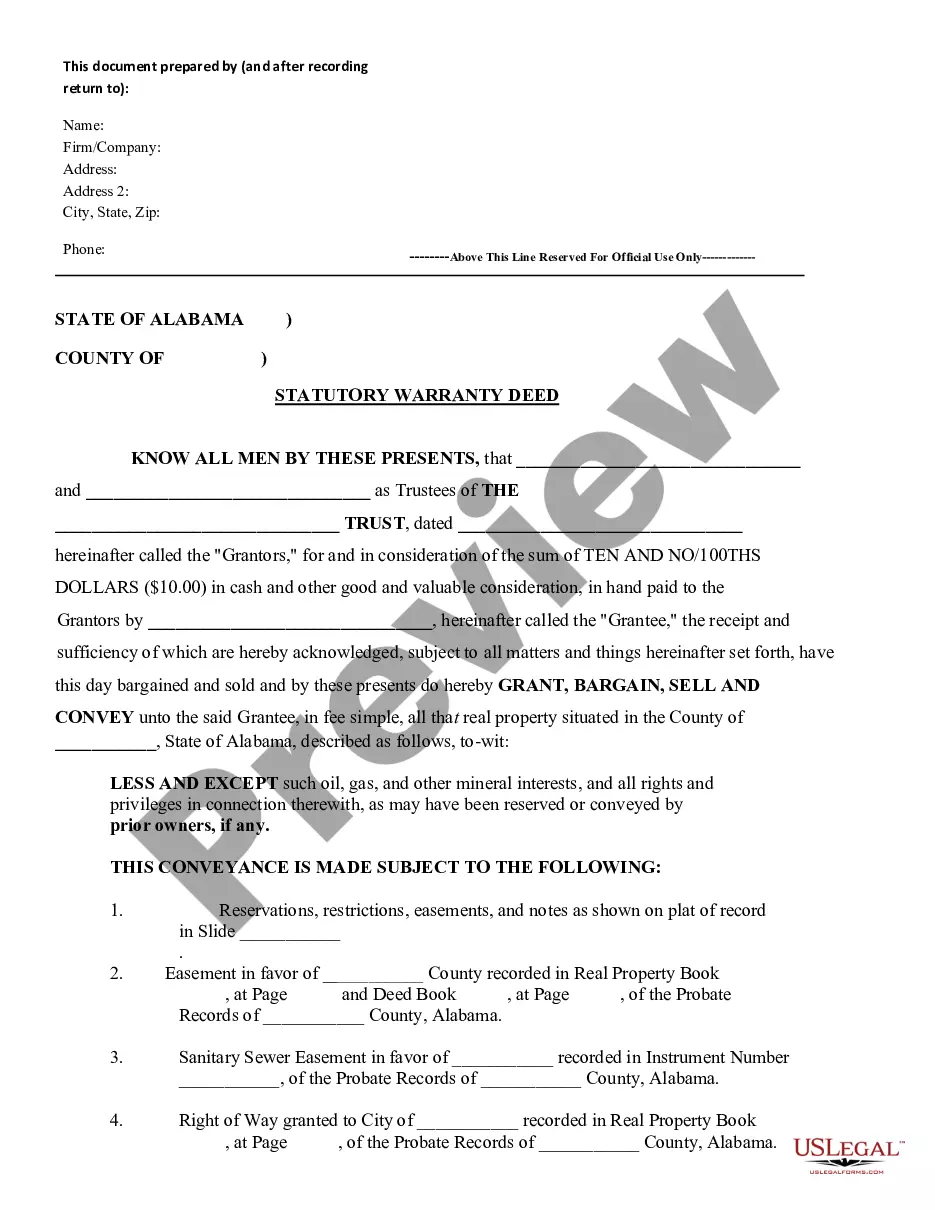

- Use the Preview button to review the document.

- Check the summary to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the document that fits your needs and requirements.

- Once you find the right form, click on Get now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor at any time, if needed. Just select the desired form to download or print the document template.

Form popularity

FAQ

When employing an independent contractor, essential paperwork includes a signed contract, tax forms, and W-9 documents. This documentation protects both parties by clearly defining expectations and responsibilities. Additionally, having an established Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor can help streamline your hiring process. It's advisable to consult templates available on US Legal Forms to ensure you have everything covered.

To fill out an independent contractor form, begin by gathering all relevant personal and business information. Next, provide details about the work you will be performing, including the project timeline and compensation. Make sure to review the form for accuracy before submission. Using US Legal Forms can help guide you through the steps, making your Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor complete and compliant.

Writing an independent contractor agreement begins with outlining the terms accurately. Include essential elements such as job description, payment details, and timelines. It's important to ensure both parties understand their rights and responsibilities. You can utilize templates on US Legal Forms to simplify this task and ensure you cover all necessary aspects tailored to a Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, deliverables, and deadlines. Additionally, specify payment terms and any required qualifications. Using a platform like US Legal Forms can streamline this process, ensuring you create a comprehensive Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor.

Yes, independent contractors file as self-employed individuals. This classification allows them to report their income directly to the IRS. To accurately fulfill this requirement, you should maintain thorough records of your earnings and expenses. Understanding your status as a self-employed individual is crucial for compliance with tax obligations.

The Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor is typically written by either the independent contractor or the hiring party. Both parties should collaborate to ensure all necessary terms are included. Utilizing a platform like USLegalForms can simplify this process, offering customizable templates specifically designed for Maine's regulations. By using these resources, you can create a comprehensive agreement that meets everyone's needs and protects your interests.

Legal requirements for independent contractors vary by state, but generally include obtaining necessary licenses and ensuring tax obligations are met. In the context of a Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor, you must also adhere to local regulations governing freelance work. Having a contract in place can help clarify these obligations and protect your rights. Always consult with legal resources or platforms like US Legal Forms to stay compliant and informed.

Absolutely, a contract is highly recommended for independent contractors. A Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor governs the relationship between you and your client, ensuring mutual understanding. This legal document outlines payment details and project scope, which can prevent issues in the future. Utilizing US Legal Forms can provide you with easy access to contract templates tailored to your needs.

If you find yourself working without a contract, your rights can become blurred. In general, you may still have rights to payment for the services rendered, but proving the terms of your work could be challenging without documentation. A Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor can solidify your rights and clarify your position in any professional interaction. Always consider formalizing agreements to protect yourself.

Yes, having a contract is essential even if you are self-employed. A Maine Copy Editor And Proofreader Agreement - Self-Employed Independent Contractor can help outline your responsibilities and the expectations of your client. This document serves as a safeguard for both parties, promoting a smooth working relationship. It’s always best to formalize your agreements to avoid any uncertainties later on.