Maine Appliance Refinish Services Contract - Self-Employed

Description

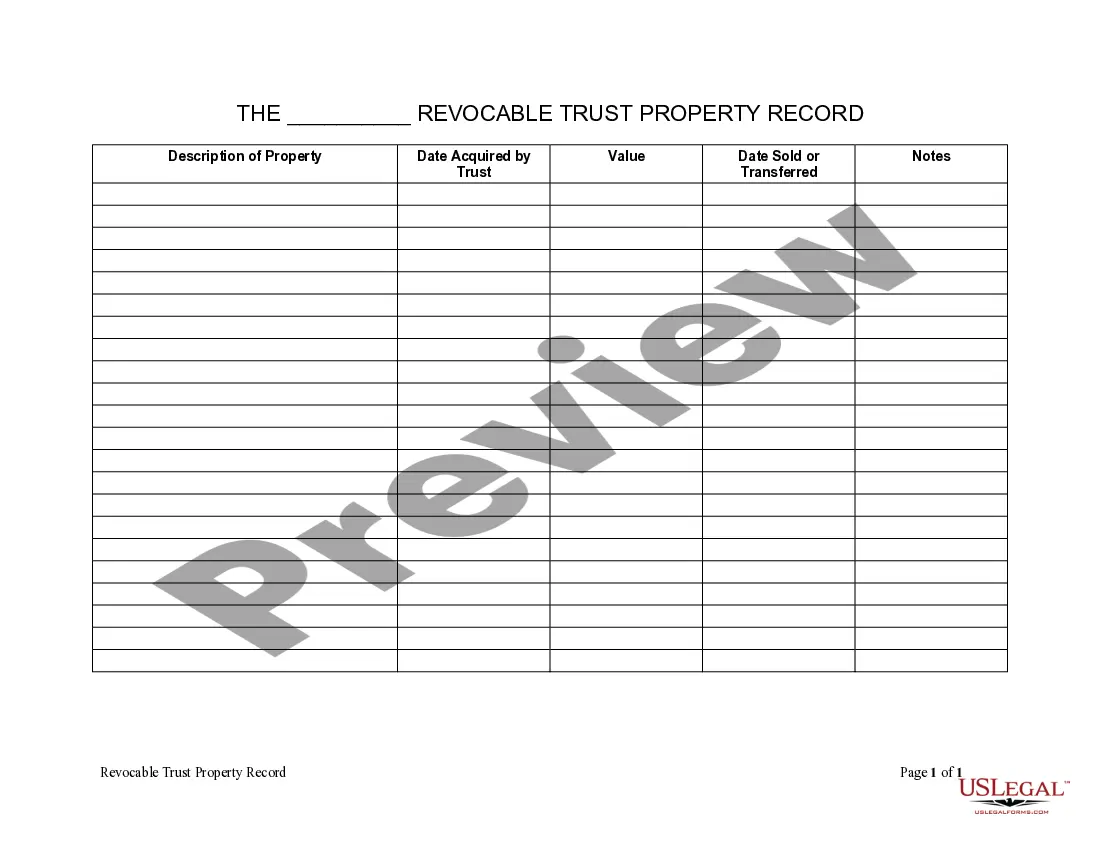

How to fill out Appliance Refinish Services Contract - Self-Employed?

If you need to thoroughly gather, download, or create official document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Maine Appliance Refinish Services Contract - Self-Employed in just a few clicks.

Every legal document format you obtain is yours permanently. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Complete and download, and print the Maine Appliance Refinish Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Maine Appliance Refinish Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Maine Appliance Refinish Services Contract - Self-Employed.

Form popularity

FAQ

The Maine service provider tax is a tax applied to certain types of services, specifically outlined by the state. While many services remain untaxed, specific categories may incur this tax, so it’s essential to review your services under a Maine Appliance Refinish Services Contract - Self-Employed. Consulting resources or professional services can clarify any uncertainties you may have.

The 183 day rule in Maine refers to the state’s guidelines for determining tax residency. If you spend more than 183 days in Maine during the tax year, you are generally considered a resident for tax purposes. Knowing your residency status is essential when operating under a Maine Appliance Refinish Services Contract - Self-Employed, as it affects your tax obligations.

Service tax applies to specific services provided, while sales tax is charged on the sale of tangible products. In Maine, you may encounter both depending on the nature of your business under a Maine Appliance Refinish Services Contract - Self-Employed. Understanding the distinction between these taxes is crucial for maintaining compliance with state tax laws.

As an independent contractor in Maine, you file your taxes using Schedule C to report income and expenses. You’ll also need to file a Form SE to calculate your self-employment tax. It's crucial to maintain accurate records of your income and expenses related to your Maine Appliance Refinish Services Contract – Self-Employed to ease the filing process.

Maine exempts various items from sales tax, including groceries, certain medical supplies, and some services like educational training. When engaged in a Maine Appliance Refinish Services Contract - Self-Employed, it's important to distinguish between taxable and non-taxable items to efficiently handle your business finances. Staying informed on exemptions will enhance your operational strategy.

The self-employment tax in Maine consists of Social Security and Medicare taxes for individuals who work for themselves. Currently, the self-employment tax rate is 15.3% on your net earnings. Ensure you calculate this tax while preparing your finances under a Maine Appliance Refinish Services Contract - Self-Employed to stay financially informed.

Service contracts in Maine may be subject to sales tax if they provide for the repair or maintenance of tangible personal property. However, contracts that solely cover services, like those executed under a Maine Appliance Refinish Services Contract - Self-Employed, generally do not incur sales tax. Keeping up with the latest Maine tax law helps you maintain compliance and avoid surprises.

In Maine, service labor is generally not taxable. However, if you provide a service as part of a sale of tangible goods, that service may become taxable. Therefore, if you're operating under a Maine Appliance Refinish Services Contract - Self-Employed, it's vital to understand the specific nature of your services to determine tax obligations.

To become a subcontractor in Maine, you should first understand the specific licenses and permits required for your trade. Next, connect with primary contractors who may need your services, and submit a formal proposal or bid. Familiarizing yourself with the terms of a Maine Appliance Refinish Services Contract - Self-Employed can also help you navigate the requirements successfully.

Proving independent contractor status involves compiling relevant documents that demonstrate your work arrangement. These may include a signed contract outlining your services, tax records reflecting your independent income, and invoices for completed jobs. These documents will support your position and are essential for compliance with the Maine Appliance Refinish Services Contract - Self-Employed.