US Legal Forms - one of several biggest libraries of lawful types in the United States - delivers an array of lawful file themes you may obtain or printing. Using the internet site, you may get a huge number of types for business and individual functions, categorized by groups, states, or search phrases.You will discover the latest models of types much like the Maine Guide to Complying with the Red Flags Rule under FCRA and FACTA in seconds.

If you already have a registration, log in and obtain Maine Guide to Complying with the Red Flags Rule under FCRA and FACTA through the US Legal Forms collection. The Download key can look on each and every type you view. You get access to all earlier acquired types in the My Forms tab of the profile.

In order to use US Legal Forms for the first time, here are straightforward guidelines to get you started off:

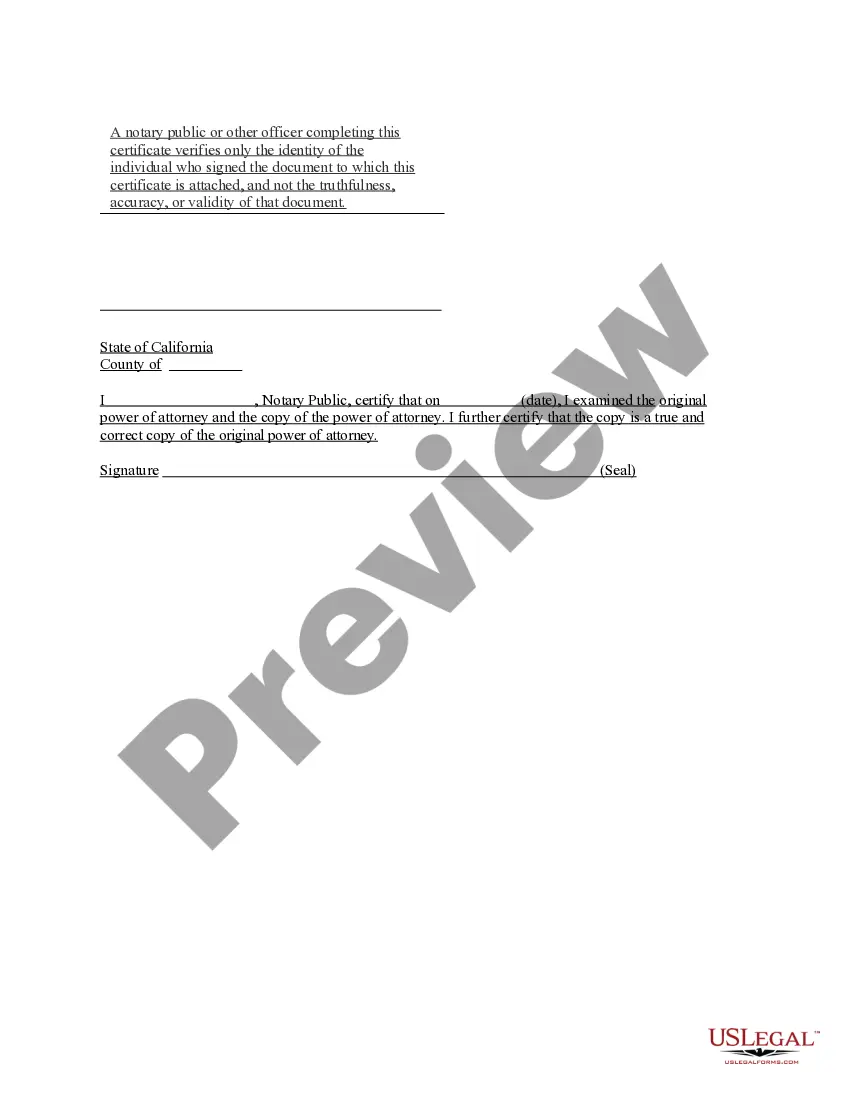

- Ensure you have selected the correct type for the metropolis/county. Click on the Preview key to examine the form`s information. Read the type outline to actually have selected the correct type.

- In case the type doesn`t suit your needs, take advantage of the Search field at the top of the monitor to find the one which does.

- When you are content with the shape, affirm your selection by visiting the Purchase now key. Then, select the pricing prepare you like and supply your qualifications to register for an profile.

- Method the financial transaction. Use your bank card or PayPal profile to finish the financial transaction.

- Pick the file format and obtain the shape in your system.

- Make changes. Load, edit and printing and signal the acquired Maine Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Every design you included with your bank account does not have an expiration particular date and is your own permanently. So, in order to obtain or printing yet another copy, just visit the My Forms area and click on around the type you will need.

Gain access to the Maine Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms, one of the most considerable collection of lawful file themes. Use a huge number of expert and status-specific themes that satisfy your business or individual needs and needs.