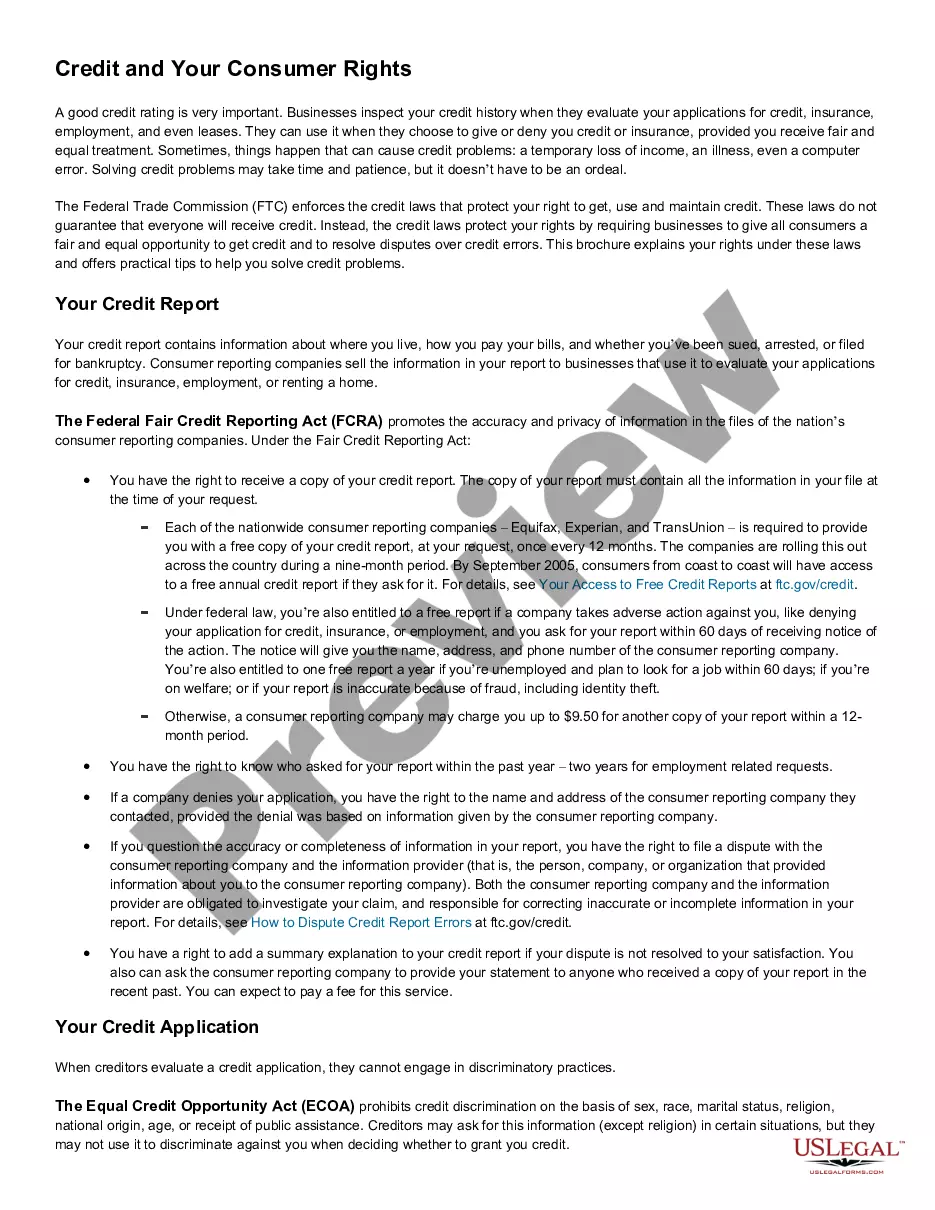

Maine A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

If you wish to comprehensive, acquire, or produce legitimate file templates, use US Legal Forms, the most important variety of legitimate types, that can be found on the Internet. Make use of the site`s easy and convenient look for to get the documents you require. Various templates for organization and specific functions are categorized by types and suggests, or keywords. Use US Legal Forms to get the Maine A Summary of Your Rights Under the Fair Credit Reporting Act in a handful of clicks.

If you are currently a US Legal Forms customer, log in for your accounts and click the Obtain key to obtain the Maine A Summary of Your Rights Under the Fair Credit Reporting Act. You can also gain access to types you earlier downloaded from the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that correct city/nation.

- Step 2. Use the Review method to look through the form`s content. Never forget to learn the outline.

- Step 3. If you are not satisfied with the develop, utilize the Research field towards the top of the display screen to find other variations of the legitimate develop design.

- Step 4. Once you have discovered the form you require, go through the Acquire now key. Choose the pricing prepare you prefer and put your qualifications to sign up for the accounts.

- Step 5. Approach the deal. You can utilize your charge card or PayPal accounts to finish the deal.

- Step 6. Choose the formatting of the legitimate develop and acquire it on your own product.

- Step 7. Comprehensive, edit and produce or indicator the Maine A Summary of Your Rights Under the Fair Credit Reporting Act.

Each legitimate file design you purchase is your own property forever. You may have acces to every single develop you downloaded in your acccount. Select the My Forms section and choose a develop to produce or acquire again.

Compete and acquire, and produce the Maine A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms. There are many specialist and state-particular types you can use for your personal organization or specific requirements.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Step 1: Before you take the adverse action, you must give the individual a pre-adverse action disclosure that includes a copy of the individual's consumer report and a copy of "A Summary of Your Rights Under the Fair Credit Reporting Act" - a document prescribed by the Federal Trade Commission.

Under the Fair Credit Reporting Act, you have a right to: You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request. Protected Access ? The act limits access to your file to those with a valid need.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Most Frequent Violations of the Fair Credit Reporting Act Reporting outdated information. Reporting false information. Accidentally mixing your files with another consumer. Failure to notify a creditor about a debt dispute. Failure to correct false information.

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free.

Candidate Rights Under FCRA The candidate may dispute the information provided by the consumer reporting agency. This action allows for the correction of misreported, outdated, or otherwise incorrect data.