Maine Operating Agreement of Minnesota Corn Processors, LLC

Description

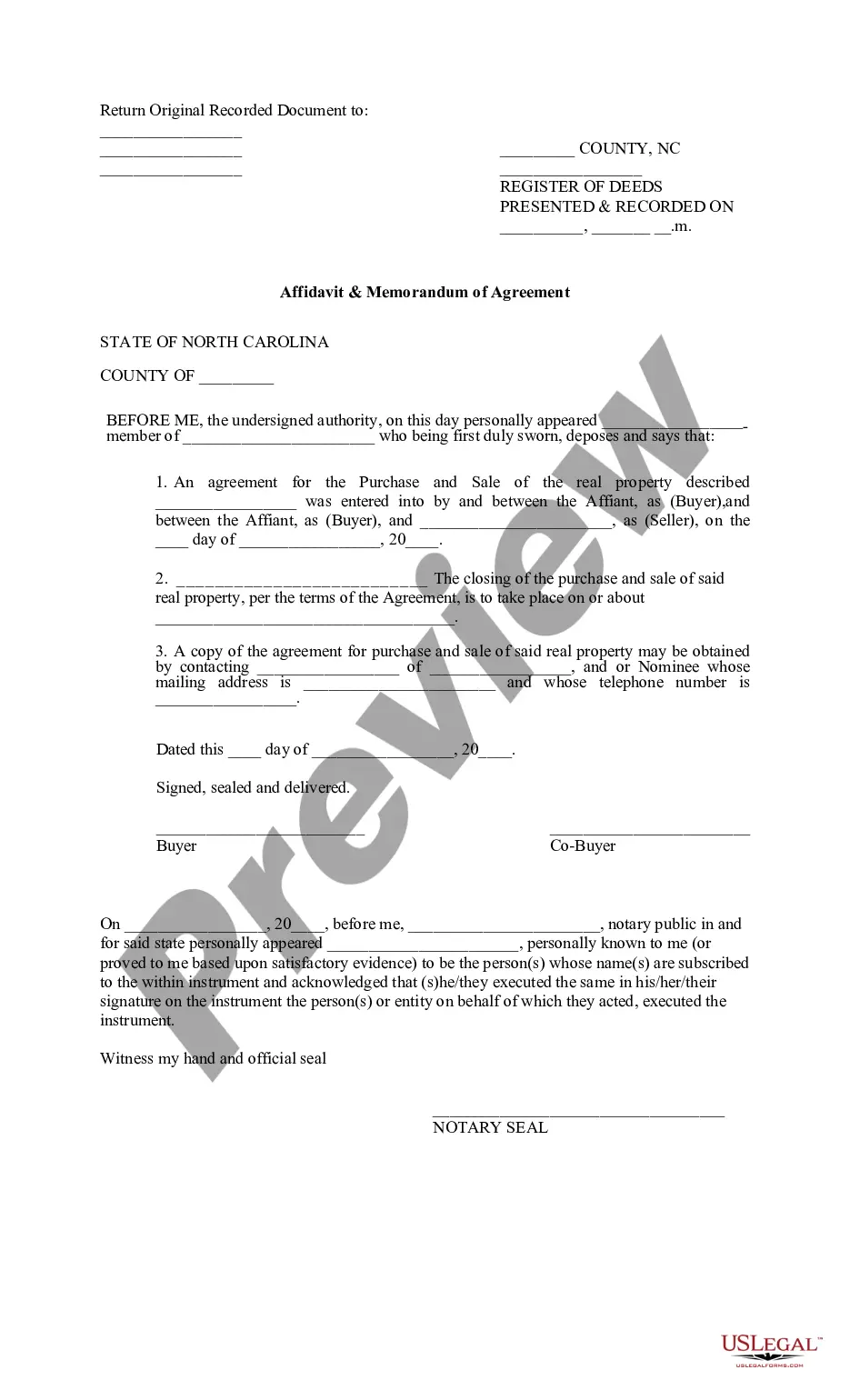

How to fill out Operating Agreement Of Minnesota Corn Processors, LLC?

Discovering the right lawful file web template might be a have difficulties. Naturally, there are plenty of themes accessible on the Internet, but how will you get the lawful kind you want? Utilize the US Legal Forms web site. The assistance offers a large number of themes, for example the Maine Operating Agreement of Minnesota Corn Processors, LLC, that you can use for company and personal needs. Each of the kinds are inspected by professionals and meet federal and state needs.

When you are previously authorized, log in in your account and click on the Obtain button to find the Maine Operating Agreement of Minnesota Corn Processors, LLC. Make use of your account to appear from the lawful kinds you might have acquired earlier. Visit the My Forms tab of your own account and have another copy in the file you want.

When you are a fresh consumer of US Legal Forms, here are straightforward recommendations that you should adhere to:

- Very first, be sure you have chosen the proper kind for your personal town/area. You may examine the form making use of the Review button and study the form information to make sure this is the best for you.

- In the event the kind is not going to meet your expectations, utilize the Seach area to obtain the appropriate kind.

- When you are certain the form is proper, click on the Buy now button to find the kind.

- Pick the pricing program you desire and enter in the necessary details. Create your account and pay for the order with your PayPal account or charge card.

- Select the submit file format and down load the lawful file web template in your system.

- Complete, change and print out and sign the obtained Maine Operating Agreement of Minnesota Corn Processors, LLC.

US Legal Forms is the greatest local library of lawful kinds for which you can discover numerous file themes. Utilize the service to down load expertly-made documents that adhere to state needs.

Form popularity

FAQ

Although most states do not require the creation of an operating agreement, it is nonetheless regarded as a critical document that should be included when forming a limited liability company. Once each member (owner) signs the document, it becomes a legally binding set of regulations that must be followed.

Your LLC is bound by the default rules of your state if you don't have an operating agreement in place. The default regulations in most state LLC statutes can be rewritten in the LLC's operating agreement. An operating agreement might spell out what will happen if you pass away or are unable to run the company.

This flexible business entity provides an affordable and easy way for business owners to protect their assets. Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business.

Under Connecticut law, an LLC is not required to have an operating agreement. In 2017, Connecticut enacted the Connecticut Uniform Limited Liability Company Act (?CULLCA?), which applies to all limited liability companies in Connecticut.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

An LLC classified as a partnership is subject to the Business Entity Tax of $250 provided it is required to file an annual report with the Connecticut Secretary of the State. An LLC classified as a corporation is not subject to the tax.

What To Include in a Single Member LLC Operating Agreement Name of LLC. Principal Place of Business. State of Organization/Formation. Registered Office and Agent. Operating the LLC in another state (Foreign LLC) Duration of LLC. Purpose of LLC. Powers of LLC.

Yes. Unlike most states?in which an operating agreement is encouraged but not required?Maine's statutes clearly state that ?a limited liability company agreement must be entered into or otherwise existing? before an LLC can be formed. (A ?company agreement? is the same thing as an operating agreement.)