Maine Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

Have you found yourself in a situation where you require documentation for both business and personal purposes almost constantly.

There are numerous legal form templates available online, but obtaining reliable versions is not easy.

US Legal Forms offers a vast collection of form templates, such as the Maine Leased Personal Property Workform, which are designed to comply with state and federal regulations.

You can find all the form templates you have purchased in the My documents section.

You may retrieve another copy of the Maine Leased Personal Property Workform at any time if needed. Just click on the respective form to download or print the file template.

- If you are already acquainted with the US Legal Forms website and have created an account, simply Log In.

- Once logged in, you can download the Maine Leased Personal Property Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct area/region.

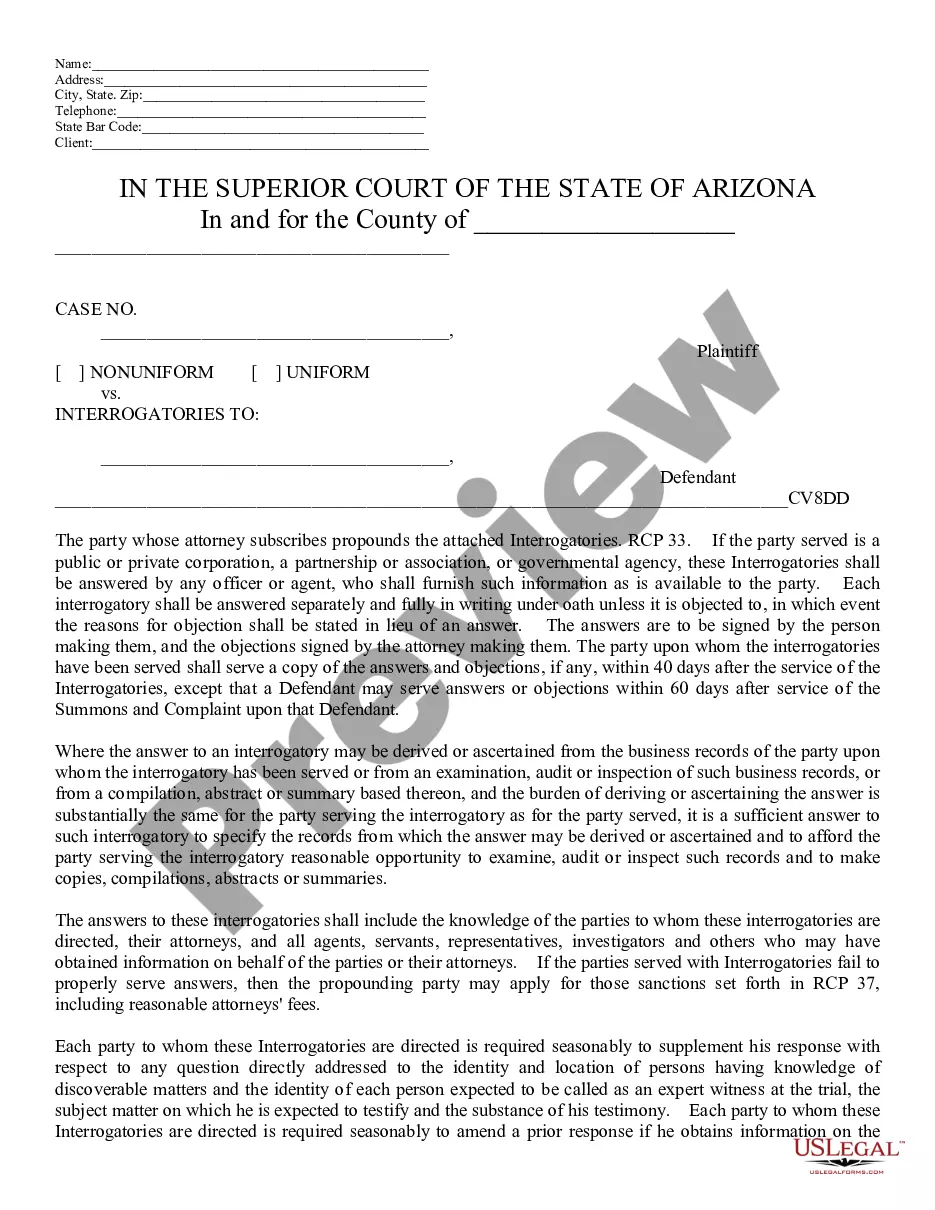

- Use the Preview button to review the form.

- Verify the details to confirm that you've selected the right form.

- If the form is not what you're looking for, use the Search field to locate the form that meets your requirements.

- Once you find the correct form, click Get Now.

- Select the payment plan you prefer, fill in the required information to set up your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To be considered a resident of Maine, you generally need to live in the state for a minimum of 183 days during the tax year. Residency has implications for your tax obligations and access to state services. If you have recently established residency and own leased personal property, consider how this affects your Maine Leased Personal Property Workform.

In Maine, tangible personal property includes items that can be touched and moved, such as furniture, appliances, and vehicles. This category excludes real estate and other intangible assets. It's important to accurately report tangible personal property on the Maine Leased Personal Property Workform to comply with state tax regulations.

Maine has introduced new rental laws focusing on tenant rights and rental agreements. These changes aim to improve transparency and protect both tenants and landlords. If you are managing leased personal property in Maine, familiarize yourself with these laws as they may impact how you complete your Maine Leased Personal Property Workform.

Wells Maine's 28 day rule pertains to the regulation of transient rentals. Under this rule, if you rent out a property for fewer than 28 days, different lodging laws apply. For those renting leased personal property in Maine, it’s crucial to adhere to these rules while filling out the Maine Leased Personal Property Workform to ensure compliance.

To order Maine income tax forms, visit the Maine Revenue Services website where you can access the necessary documents online. Additionally, you can find the Maine Leased Personal Property Workform among the available forms. If you prefer to receive a hard copy, you may also request forms by contacting the Maine Revenue Services directly.

Several states in the U.S. do not impose personal property taxes. Notable examples include Delaware, Montana, and New Hampshire. If you find tax obligations concerning leased items in states without such taxes, remember that the Maine Leased Personal Property Workform applies only in Maine.

Maine has a personal property tax system that targets specific assets, including machinery and equipment. If you engage in leasing personal property within the state, it is crucial to familiarize yourself with the taxes applicable to your situation. The Maine Leased Personal Property Workform is your resource for ensuring proper reporting and compliance.

Yes, leases are generally taxable in Maine. This includes both personal property and real estate leases. To navigate these regulations effectively, completing the Maine Leased Personal Property Workform can help you calculate and submit your tax responsibilities accurately and on time.

Yes, Maine imposes property tax on vehicles. This tax rate can vary by municipality and is typically based on the value of the vehicle. To ensure accurate assessment and payment, vehicle owners in Maine should use the Maine Leased Personal Property Workform if their vehicle is part of a leasing agreement.

The 28-day rule in Maine refers to the time frame for certain tax benefits. Specifically, it can relate to the taxation of leased personal property when frequently changing ownership within that period. Understanding this rule is crucial when filling out the Maine Leased Personal Property Workform to avoid any tax discrepancies.