Maine Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

Selecting the ideal legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, such as the Maine Equipment Lease Checklist, suitable for both business and personal needs.

If the form does not meet your requirements, utilize the Search field to find the correct form. Once you confirm the form is correct, click the Get now button to acquire it. Choose the pricing plan you prefer and provide the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Complete, revise, and print, then sign the downloaded Maine Equipment Lease Checklist. US Legal Forms is the largest collection of legal documents where you can find various template files. Use the service to obtain professionally crafted documents that meet state requirements.

- All the documents are reviewed by professionals and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Acquire button to obtain the Maine Equipment Lease Checklist.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, make sure you have chosen the appropriate form for your city/region. You can review the document using the Preview button and read the document summary to verify it is suitable for you.

Form popularity

FAQ

Maine sales tax exemptions include certain items such as food, clothing, and some medical devices. Additionally, specific industrial and manufacturing equipment may also qualify for exemptions. To determine what you can exclude, refer to the Maine Equipment Lease Checklist, which provides valuable information on exemptions and compliance.

The tax on rental cars in Maine is based on the total rental charges and includes both sales tax and vehicle use tax. Typically, the combined rate is around 9%, but it’s crucial to check for any additional local taxes that may apply. For insights into applicable charges, you might find our Maine Equipment Lease Checklist helpful when renting equipment or vehicles.

In Maine, equipment leases are generally subject to sales tax. However, the specifics can vary based on the type of equipment and the terms of the lease agreement. To ensure compliance and understand your obligations, it's wise to consult the Maine Equipment Lease Checklist. This checklist can help you navigate tax regulations effectively.

To account for leased equipment, you need to recognize the right-of-use asset and corresponding lease liability at the commencement date of the lease. This involves determining the lease term and the payments due, which can be complex. The Maine Equipment Lease Checklist simplifies this accounting process, guiding you through the essential steps for accurate financial reporting.

ASC 842 does apply to equipment leases, mandating that companies recognize leased assets and liabilities on their balance sheets. This standard was designed to provide a clearer picture of a company’s financial obligations. Following the Maine Equipment Lease Checklist can ensure that you are compliant with ASC 842 and accurately present your leased assets.

Yes, equipment leases fall under the ASC 842 standard, which requires lessees to report leased equipment on their balance sheets. This change aims to improve transparency in financial reporting. Leveraging the Maine Equipment Lease Checklist will help you understand how ASC 842 impacts your equipment leasing decisions.

Under ASC 842, leases are classified primarily as either operating leases or finance leases. Each classification has specific accounting implications that can influence how you report on leased assets. Utilizing the Maine Equipment Lease Checklist can guide you through these classifications and enhance your understanding.

Finding your lease information is straightforward if you keep organized records. You may start by reviewing your accounting documents or lease agreements for terms and conditions. Additionally, using the Maine Equipment Lease Checklist can help streamline this process and ensure you capture all relevant information.

Yes, leased equipment can be considered an asset, depending on the lease structure. If you are utilizing an equipment lease, it might be classified as a right-of-use asset on your balance sheet. This is significant in the context of the Maine Equipment Lease Checklist, as it can affect your financial reporting and operational strategies.

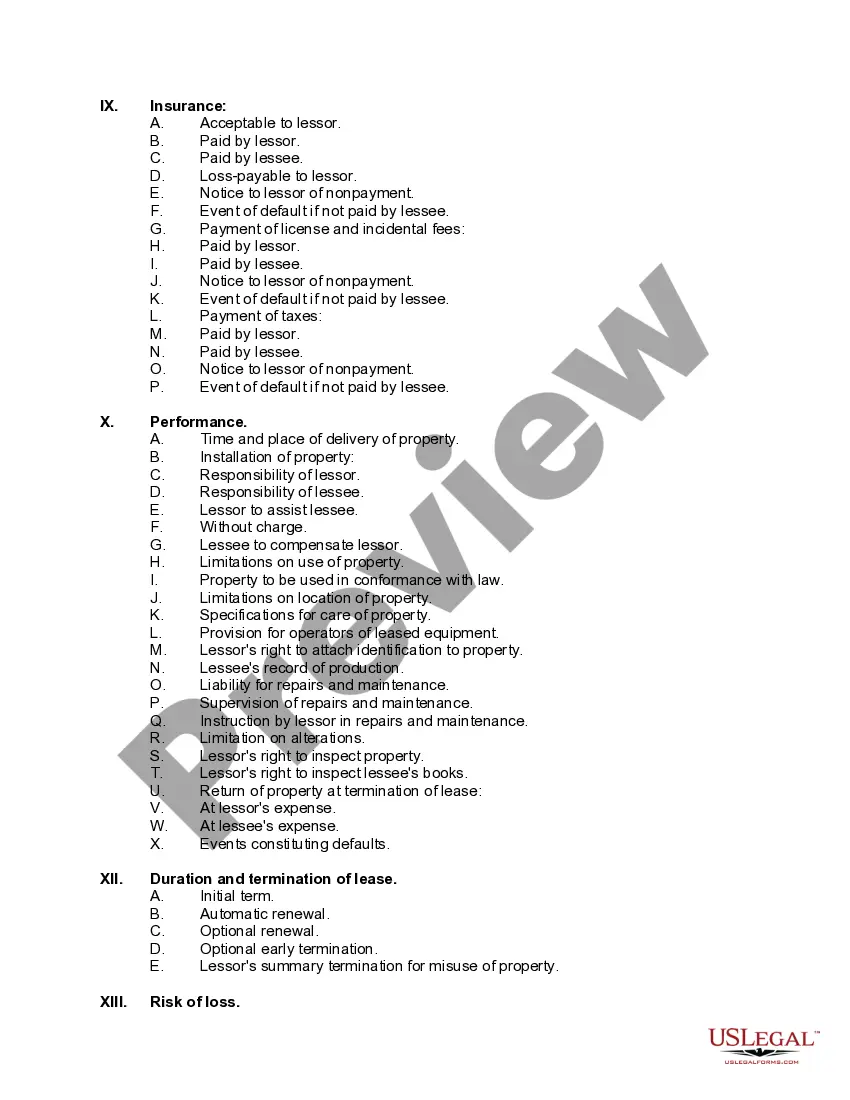

Filling out a commercial lease agreement involves providing vital information about the parties involved, the leased equipment, and the terms of agreement. Ensure clarity and accuracy in descriptions, payment details, and obligations. Leveraging a Maine Equipment Lease Checklist ensures nothing essential gets overlooked.