Maine Terms of advisory agreement

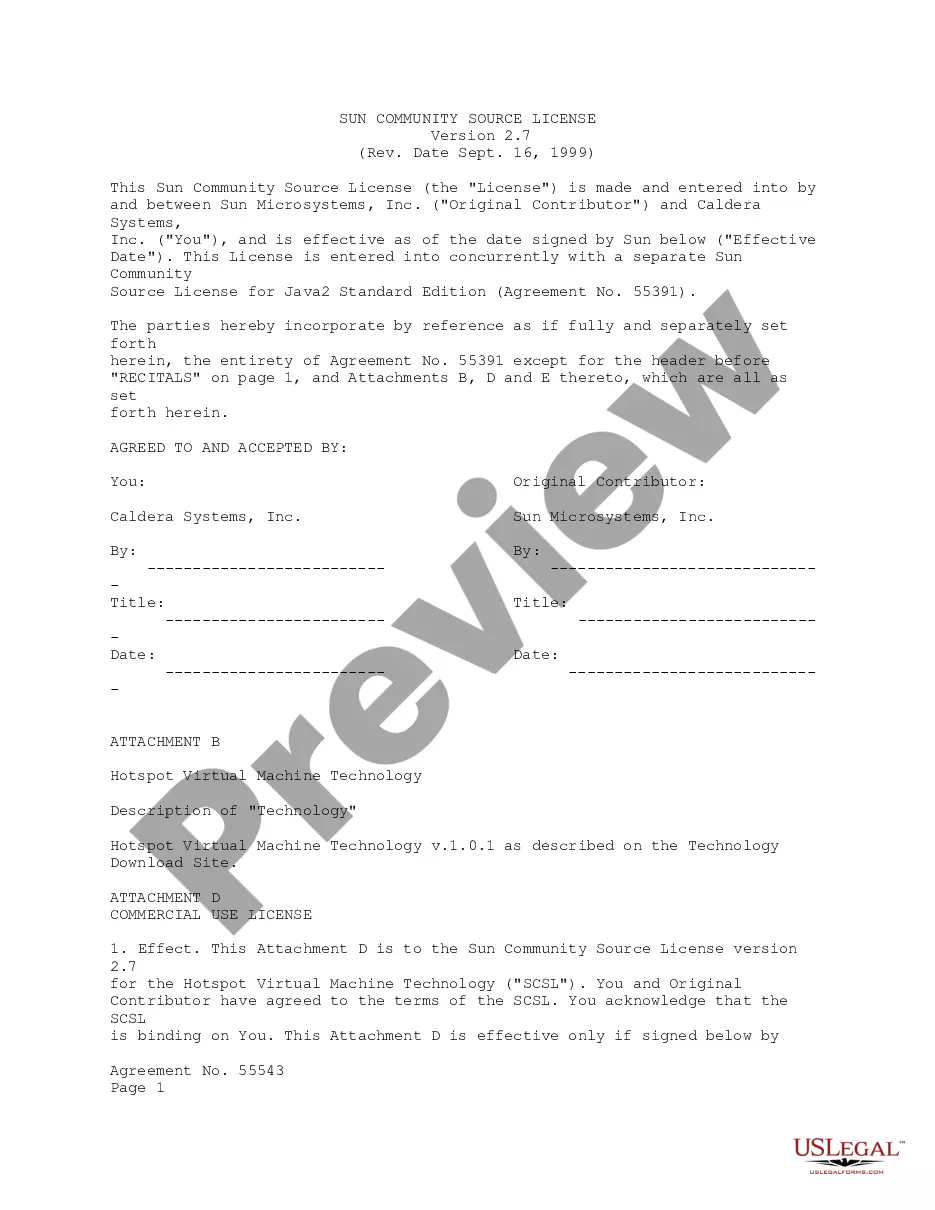

Description

How to fill out Terms Of Advisory Agreement?

If you need to complete, obtain, or print out legitimate record themes, use US Legal Forms, the greatest variety of legitimate types, that can be found on-line. Use the site`s basic and hassle-free lookup to obtain the paperwork you need. Various themes for organization and person functions are categorized by types and states, or keywords. Use US Legal Forms to obtain the Maine Terms of advisory agreement within a couple of mouse clicks.

Should you be currently a US Legal Forms consumer, log in for your profile and click the Down load key to obtain the Maine Terms of advisory agreement. You can also access types you in the past saved within the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for that correct metropolis/nation.

- Step 2. Make use of the Preview solution to examine the form`s articles. Never forget about to learn the information.

- Step 3. Should you be unhappy with all the kind, make use of the Lookup discipline towards the top of the screen to get other types of the legitimate kind design.

- Step 4. When you have found the shape you need, go through the Buy now key. Opt for the pricing strategy you favor and add your credentials to sign up to have an profile.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the structure of the legitimate kind and obtain it on your system.

- Step 7. Complete, modify and print out or signal the Maine Terms of advisory agreement.

Each and every legitimate record design you acquire is your own property permanently. You may have acces to each and every kind you saved inside your acccount. Go through the My Forms area and choose a kind to print out or obtain once again.

Compete and obtain, and print out the Maine Terms of advisory agreement with US Legal Forms. There are thousands of skilled and condition-specific types you may use to your organization or person needs.

Form popularity

FAQ

SEC Rule 204A-1 requires that access persons obtain the investment adviser's approval before they directly or indirectly acquire beneficial ownership in any securities in either an initial public offering ("IPO") or a limited offering.

Rule 205-3 exempts an investment adviser from the prohibition when the client is a ?qualified client,? which includes a client that meets an assets-under-management test or a net worth test under the rule.

Section 206(3) of the Investment Advisers Act of 1940 (the "Advisers Act") makes it unlawful for any investment adviser, directly or indirectly "acting as principal for his own account, knowingly to sell any security to or purchase any security from a client ?, without disclosing to such client in writing before the ...

Section 206(3) of the Investment Advisers Act of 1940 (the "Advisers Act") makes it unlawful for any investment adviser, directly or indirectly "acting as principal for his own account, knowingly to sell any security to or purchase any security from a client ?, without disclosing to such client in writing before the ...

Investment Advisers Act of 1940 This law regulates investment advisers. With certain exceptions, this Act requires that firms or sole practitioners compensated for advising others about securities investments must register with the SEC and conform to regulations designed to protect investors.

Rule 205-3 under the Advisers Act permits investment advisers to charge performance fees to clients with at least $500,000 under the adviser's management or with a net worth of more than $1,000,000.

Section 203A of the Investment Advisers Act of 1940 (the "Advisers Act") generally prohibits an investment adviser from registering with the Commission unless that adviser has more than $25 million of assets under management or is an adviser to a registered investment company.

Rule 204-3 under the Advisers Act, commonly referred to as the "brochure rule," generally requires every SEC-registered investment adviser to deliver to each client or prospective client a Form ADV Part 2A (brochure) and Part 2B (brochure supplement) describing the adviser's business practices, conflicts of interest ...